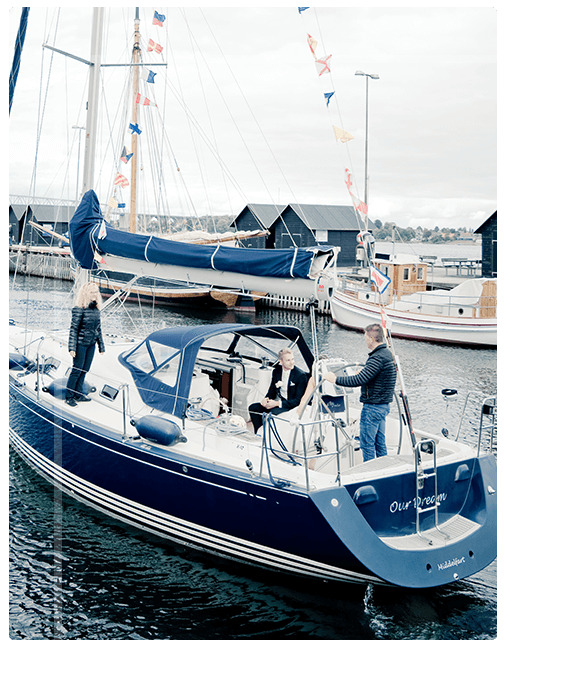

Hello! We Are Seafarer Marine

Charting Your Course

From local charter vessels to luxury yachts and package policy solutions for marinas, our experienced team will help you navigate policy terms and conditions to ensure you have the right coverages for your marine insurance needs.

Our Products and Coverages

Lobster Boats

Charter Boats

Ocean Cargos

From local charter vessels to luxury yachts and package policy solutions for marinas, we got you covered.

In addition to our underwriting expertise, we offer full-service solutions from billing and policy issuance to claims handling and loss control.

All backed by the financial strength of a leading insurance carrier with “A+” ratings from AM Best, S&P and Moody.

COMMITTED TO THE WELFARE OF YOUR SEAFARERS AND THEIR FAMILIES

MLC 2006 COMPLIANT BENEFITS INSURANCE FOR YOUR SEAFARERS

Seafarers deserve the same care and concern, the same right to benefits, the same access to the best medical treatment, the same security expected and enjoyed by those who work ashore. This is the vision that has inspired Crewsure.

For too long the tough life of the seafarer has gone unnoticed, but that has now changed. Legislation is bringing reform and improvements to working conditions, and Crewsure offers a product for this moment. Crewsure Marine is a single insurance policy embracing today’s needs and benefits; personal to the seafarer, yet paid by the employer. At last a seafarer’s insurance can match that of the shoreside employee.

From the outset collaboration with the Maritime Community has been fundamental to Crewsure’s development. Discussion with representatives of both employers and employees has engendered enthusiasm and support, and the collegiate approach will continue to underpin Crewsure’s future growth.

We have developed Insurance products that recognise the needs, concerns and differing legal requirements of seafarers and have sought to distinguish between those who serve the commercial shipping community and those aboard yachts.

W hat we D o

CREWSURE MARINE

Crewsure Marine is designed to meet the requirements imposed by MLC 2006 to provide ships' crew personalised medical benefits, injury cover, death in service, sick pay, loss of baggage and repatriation. For the owner, it also provides crew replacement cover and can be extended to include unpaid wages from abandonment.

CREWSURE YACHTS

Crewsure Yachts is designed to meet the requirements of the Maritime Labour Convention and to provide Yacht crew essential coverage:including Medical Expenses and Repatriation - Personal Accident - Death in Service - Personal Effects - Crew Replacement.

CREWSURE PROTECT

Crewsure Protect is designed to protect both yacht and marine crew against wrongful detention, kidnap, extortion, terrorism or violent crime.

CREWSURE FINANCIAL

Crewsure Financial provides the MLC requisite certificate confirming that all crew will receive unpaid wages and repatriation home with cover extended to provide a daily living allowance, medical and injury cover whilst awaiting repatriation home.

CREWSURE FAMILY

Crewsure Family is designed to enhance cover provided under Crewsure Marine to extend medical benefits to the crew’s families living in their home country.

L atest N ews

Unhappiness Grows

The Mission to Seafarers has published the latest Seafarer Happiness Index.....

Action on Seafarer Wellbeing

Reported today in Splash 'Pragmatic action on seafarer wellbeing crucial...'

Riding a Bevy of Black Swans

Steven Jones has written an interesting article in the Daily Splash today:

Crewsure News

The following attachment is an email we recently received from Mayf...

WYCC INSURANCE

Protect you everywhere and all along your life

Healthcare plans for Seafarers

For all crew members and their families

Medical Insurance for Globetrotters

Cover you and your family

Shipping Industry

Our solutions whatever the nationalities

RETIREMENT PLAN

Designed for the maritime industry and expatriates

Be prepared for all the risks of your life

WYCC Insurance provides cover for Seafarers in Yachting, Cruising, Shipping industry and for Expatriates or shore based personnel. WYCC Insurance benefits are compliant with the applicable law (MLC, Flag, CBA), local law and employers’ wishes (SEA). Only one name for employee benefits all around the world whatever the nationality, fiscal residence, vessel’s flag and employer location.

Single & Family Plan

Medical expenses in-patient

Medical expenses out-patient

Vision Care

Dental care

Repatriation

Permanent & Temporary Disability

Loss of Life

Legal Protection

Life Investment

Retirement Plan

Our health services according to your needs

WYCC Insurance in numbers

Years experience

Local brokers and managers around the world

Countries covered in our medical network

More information just one click away

See our solutions or contact us with the links below

OUR SOLUTIONS

Discover the product that’s right for you in just a few clicks!

WYCC PLATFORM

An innovative online system which manage list of employees, turnover and benefits

We are here to help you 24/7

Made by La Confection - Web Agency Lille

Privacy Overview

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

Marine Insurance and its Importance for Seafarers

Marine insurance is an essential aspect of the maritime industry that provides financial protection to seafarers, ship owners, and their families. Seafarers are constantly exposed to the dangers of the sea, and their job demands them to be away from their families for extended periods. With this in mind, it is imperative that they have proper marine insurance coverage that provides adequate protection to their families in the event of an unfortunate incident.

The Importance of Marine Insurance

Marine insurance is important for several reasons. Firstly, it provides financial protection to seafarers and their families. Seafarers are constantly exposed to the dangers of the sea, and their families face financial difficulties in the event of death, injury, or illness. With proper marine insurance coverage, families can be financially secure even in the absence of their loved ones.

Secondly, marine insurance provides peace of mind to the seafarers. Seafarers have a dangerous job, and the peace of mind that comes with knowing their families will be taken care of in the event of an unfortunate incident is invaluable. The knowledge that their families will not face financial difficulties even if they are no longer around is a major factor in the well-being of seafarers.

Lastly, marine insurance is a requirement of the maritime industry. Many countries require seafarers to have proper marine insurance coverage before they can work at sea. This ensures that the families of the seafarers will be taken care of in the event of an unfortunate incident.

Examples of Losses & Accidents that Marine Insurance can Protect Seafarers

- Cargo damage: Marine insurance can provide coverage for damages or losses of cargo during transport. For example, if a ship encounters rough weather and some cargo is damaged or lost, the marine insurance policy can cover the cost of repairing or replacing the cargo.

- Hull damage: A collision with another vessel or underwater obstacle can cause damage to the ship's hull. Marine insurance can provide coverage for the cost of repairs to the ship's hull and other equipment.

- Liability claims: If a seafarer is involved in an accident that causes injury or property damage to a third party, they may be held liable for the damages. Marine insurance can provide coverage for these liability claims and the associated legal expenses.

- Personal injury: Seafarers are at risk of accidents while working on board, such as falls or accidents during cargo handling. If a seafarer is injured while working, marine insurance can cover the cost of medical expenses and provide disability benefits.

- Collision: Ships can collide with other vessels, piers, or underwater obstacles. In the event of a collision, marine insurance can cover the cost of repairs to the ship's hull and equipment.

- Natural disasters: Seafarers are at risk of natural disasters, such as storms, hurricanes, and tsunamis, which can cause significant damage to the ship and cargo. Marine insurance can provide coverage for the cost of repairs or replacement of damaged parts or cargo.

Benefits of Marine Insurance for Seafarers

In short, it's designed to cover risks faced by seafarers, including natural disasters, piracy, collision, cargo damage, and personal injury.

A. Financial protection against losses

One of the primary benefits of marine insurance for seafarers is financial protection against losses. Seafarers work in a high-risk environment, and accidents and losses can happen at any time. Without insurance coverage, the cost of repairs, replacement, or legal liabilities can be substantial and potentially devastating. Marine insurance provides financial protection against such losses, ensuring that seafarers can continue their work without worrying about the financial consequences.

B. Peace of mind and security

Another benefit of marine insurance for seafarers is peace of mind and security. Working at sea can be stressful and challenging, and the risks involved can create anxiety and uncertainty. Having insurance coverage provides seafarers with a sense of security and reassurance, knowing that they are protected against potential losses. It allows seafarers to focus on their work and perform their duties without distractions.

C. Compliance with international regulations

Marine insurance is also essential for seafarers to comply with international regulations. Most countries require ships to have insurance coverage before they can enter their ports. This requirement is enforced to ensure that ships and their crew members are financially protected against potential losses and liabilities. Without insurance coverage, ships may be denied entry into ports, resulting in delays, fines, and other consequences.

It is essential for shipowners and seafarers to choose the right insurance policy that suits their needs and provides adequate financial protection in case of losses. With the right insurance coverage, seafarers can perform their duties with confidence and security, knowing that they are protected against potential risks and liabilities.

Family of Seafarers Insurance

Marine insurance is not limited to only the protection of the seafarers and their ships. It also includes coverage for the families of the seafarers. Family of Seafarers Insurance is a unique type of insurance policy that provides financial protection to the families of seafarers in the event of their death, injury, or illness while on duty. This insurance policy is designed to provide financial security to the families of seafarers, who often face financial difficulties in their absence.

Insurance Cover for Seamen Families - Overview

The insurance cover for seamen families is a critical aspect of marine insurance that provides peace of mind to the seafarers. The coverage of the insurance policy usually includes a lump sum payment in the event of death, injury, or illness. The payment is made directly to the family of the seafarer and can be used to pay off any outstanding debts, provide for the education of children, or any other financial obligations.

In addition, the insurance policy may also include coverage for repatriation expenses, which include the cost of transporting the body of the deceased seafarer back to their home country. The policy may also cover the cost of transportation for the family to visit the seafarer in case of injury or illness.

Insurance Cover for Seamen Families - Examples

For example, if a seafarer is injured or becomes ill while at sea, the cost of medical treatment and repatriation can be substantial. Marine insurance coverage for the families of seafarers can help to cover these costs, providing the financial support that is essential in such circumstances. In the event of the seafarer's death, the insurance can provide financial compensation to the family, ensuring that they are not left in financial hardship.

Another important aspect of marine insurance coverage for the families of seafarers is the protection it offers against the risk of abandonment. This is a real and ongoing concern for seafarers and their families, as shipping companies sometimes face financial difficulties and may abandon their vessels and crew. This can result in significant financial losses for the seafarers and their families, as well as putting their safety and well-being at risk. Marine insurance coverage for the families of seafarers can help to mitigate these risks, offering protection against financial losses and ensuring that the seafarers and their families are not left in a vulnerable position.

In addition to providing protection against the financial and practical risks that families of seafarers face, marine insurance coverage for the families of seafarers can also offer emotional support. This is important, as the life of a seafarer can be stressful and lonely, with long periods at sea and limited contact with their loved ones. The insurance can provide access to counseling and support services, which can help the families of seafarers to cope with the emotional and psychological stress that they may experience.

In conclusion, marine insurance coverage for the families of seafarers is an increasingly important aspect of seafarers' welfare, offering peace of mind and protection against the many risks they face. With the maritime industry being vital to the global economy, it is essential that the families of seafarers are given the protection and support they need, as well as being recognized for the sacrifices that they make in supporting their loved ones. By focusing on marine insurance, family of seafarers insurance, and insurance cover for seamen families, the maritime industry can help to provide the security and peace of mind that families of seafarers need and deserve.

Related posts

Inland marine insurance – what is it & top 5 reasons you need it, top 3 factors that affect tanker insurance cost, most popular, ordinary seaman duties and responsibilities.

Third Officer Duties and Responsibilities on a Cargo Ship

Engine Cadet Salary: What to Expect in the Marine Industry

Marine Chief Cook Salary: What You Need to Know

3rd Engineer Salary: An Overview of Earnings in the Maritime Industry

Search When autocomplete results are available use up and down arrows to review and enter to select.

Choose the plan that meets your needs and spend more time enjoying your international experience not worrying about your insurance coverage.

- Customer Stories

- Resume Quote / Application

What type of coverage do you need?

- Vacation / Holiday

- Visitor / Immigrant

- Student / Scholar

- Employer / Business Traveler

- Expat / Global Citizen

- Mission / Social Good

- Marine Captain / Crew

- Flights / Airfare

- Cruises / Excursions

Travel Medical Insurance

Temporary coverage for accidents, sicknesses, & emergency evacuations when visiting or traveling outside of your home country.

Popular Plans

International health insurance.

Annually renewable international private medical insurance coverage for expats and global citizens living or working internationally.

Travel Insurance

Coverage designed to protect you from financial losses should your trip be delayed, interrupted, or cancelled.

Enterprise Services

Meet your duty of care obligations with confidence, knowing your travelers are safe, healthy, and connected wherever they may be in the world.

What type of organization do you represent?

- Corporations

- Insurance Companies

- Educational Institutions

- Mission Organizations

- Maritime Industries

- Government Agencies

- Non-Profit Organizations

Medical & Travel Assistance

Your travelers can access 24/7 global support should they need medical attention, travel assistance, or medical transport services.

Global Workers' Compensation Case Management

Rest assured knowing you have an experienced team who is committed to reducing your costs, moving your files forward, and serving as an international resource for all your work injury claims.

Security Assistance Services

Keep your travelers safe, no matter where they are, with real-time alerts and intelligence on safety, health, political, and other global risks.

Insurance Administrative Services

You’ll have experts to guide you through all things related to your health care plan needs, from enrollment to claim reimbursement.

Marine Crew Insurance Plans

Health insurance options for yacht crews & captains.

A s a professional marine crew member, you know that finding adequate medical coverage can be a challenge. The unique demands of your profession often can prevent you from getting the inclusive international health care plan you need and deserve.

IMG understands your challenges and healthcare needs, at sea and in port. We're proud to provide comprehensive and portable marine crew insurance plans designed specifically for professional yacht and marine crew. The plans provide coverage 24 hours a day, and you have the freedom to choose any doctor or hospital for treatment around the world.

We go a step further than your vessel's required Protection and Indemnity insurance by offering 24/7 emergency medical and travel assistance to crew members, exemplary claims handling and customer service, assistance finding treatment facilities and coordination of emergency medical evacuations. Explore IMG's medical insurance for crew members below.

Popular Plans For Marine Captains & Crews

Global Medical Insurance

Annually renewable worldwide medical insurance program for individuals and families

- Long-term (1+ year) worldwide medical insurance for individuals and families

- Annually renewable medical coverage

- Deductible options from $100 to $25,000

- Maximum limit options from $1,000,000 to $8,000,000

Summary of Benefits

Subject to deductible and coinsurance unless otherwise noted

*Teleconsultations will not support a diagnosis for Mental or Nervous Disorders. Coverage for a Teleconsultation is not a determination that any specific condition discussed, raised or identified during such Consultation is covered under this insurance. We reserve the right to decline future claims relating to or arising from any condition discussed, raised or identified during a Teleconsultation where the illness or injury is directly or indirectly related to any Pre-existing Condition or is otherwise excluded under this Policy.

**If applicants can verify their prior health insurance, with no significant break in coverage (63 days), IMG may accept this as Creditable Coverage and provide a pre-existing conditions waiver (final decision is subject to Underwriters approval). Creditable Coverage is defined as a group health plan provided by a U.S. employer or Health Insurance Issuer, individual major medical health insurance provided by a Health Insurance Issuer, or other Public Health Plan (any health plan established or maintained by a State or the U.S. government).

International Marine Medical Insurance

- Worldwide group coverage for professional marine crew

- $5,000,000 maximum benefit per insured person per period of coverage

- Primary to the vessel's Protection and Indemnity insurance (P&I)

- Coverage for individuals and dependents

- Optional Sports Expansion add-on coverage available

Medical Benefits Summary

*Coverage for Remote Mental Health Service is not a determination that any specific condition discussed, raised or identified during such consultation is covered under this insurance. The Company reserves the right to decline future claims relating to or arising from any condition, raised, or identified during a Remote Mental Health Service consultation where the illness or injury is directly related to any pre-existing condition or is otherwise excluded under this Certificate of Insurance.

**Teleconsultations will not support a diagnosis for Mental or Nervous Disorders. Coverage for a Teleconsultation is not a determination that any specific condition discussed, raised or identified during such Consultation is covered under this insurance. We reserve the right to decline future claims relating to or arising from any condition discussed, raised or identified during a Teleconsultation where the illness or injury is directly or indirectly related to any Pre-existing Condition or is otherwise excluded under this Certificate of Insurance.

Dental Benefits Summary

- Prescriptions $3,000 and higher will require Universal RX (URX) to obtain prior authorization from the Company

- Enroll via the provider’s website: www.expatps.com

- Email (scan prescription): [email protected]

- Fax: +1.540.777.7184

- Phone number: +1.540.777.1450

- Email: [email protected]

Platinum Dental Benefits Summary

Give us a call, have any questions we’re here to help you, 866-263-0669, recent blog articles, flying during the coronavirus pandemic — what to expect now and in the future.

Taking flights right now is still possible, and my experience will likely be a look into the future for when travel restrictions begin to relax.

Frequently Asked Questions

With an international health plan from IMG, you have medical coverage worldwide. Our plans give you the freedom to choose your own health care provider wherever you are in the world.To view IMG's exclusive provider list, visit the Find A Doctor page in the myIMG member area.

Insurance prices are regulated by the government - you won't find a better price on IMG insurance plans anywhere else.

If you are applying for coverage under the Patriot series of plans, IMG will process your application and send your ID card and other documents within one business day. If you are applying for coverage under the Global or Group series, IMG will process your application within three to four business days following the receipt of all required information, and your materials will be forwarded the same day coverage is approved. Every attempt will be made to process your application timely. The specific time frame depends largely on the type of coverage for which you are applying.

This is not an offer to enter into an insurance contract. This is only a summary and shall not bind the company or require the company to offer or write any insurance at any particular rate or to any particular group or individual. The information on this page does and will not affect, modify or supersede in any way the policy, certificate of insurance and governing policy documents (together the "Insurance Contract"). The actual rates and benefits are governed by the Insurance Contract and nothing else. Benefits are subject to exclusions and limitations.

Global Resources. Local Care.

Languages spoken in-house, countries where members are served, insurance plans to fit your needs, employees & growing, doctors & hospitals in our global database, request information, to request more information, please fill out the form below. after you submit the form, we will have an img representative contact you., contact information, company information, how can we help.

Thank you for your submission! A representative will be with you shortly.

Select your language, headquarters, send a message.

If you need to send personal information such as medical records, payment information, etc., please use our Secure Message Center .

Thank you for your message! We'll be in touch shortly.

Crewselect contact info, brandon merideth.

Account Executive / Group Development

International Medical Group®

2960 N. Meridian St.

Indianapolis, IN 46208 USA

Phone: +1.317.833.1807

Email: [email protected]

Yacht & Superyacht insurance

I want to insure this yacht sailing yacht superyacht yacht.

With more than 10,000 models listed, find your ship and complete her dedicated form.

Ship not found? Click here

More than 10 000 yachts listed by name, builder and model premium & conditions displayed on line full transparency

COMPETITIVE PREMIUM & CONDITIONS

Exclusives rates and conditions the best rates and conditions on yacht insurance market

WORLDWIDE NETWORK

Worldwide cover more than 40 underwriters and brokers partners

crew HEALTH insurance

We offer a real social protection dedicated to seafarers. We are in compliance with :

– THE MLC 2006 – The FRENCH DECREE concerning the affiliation to a social protection for French resident seamen working on ships flying a foreign flag.

In order to offer you the insurance that best suits the characteristics of your vessel but also your navigation areas, we will compare and analyze all forms of insurance and the particular conditions of the best underwriters.

Yachting Insurance means better guarantees while enjoying better rates and renewal conditions.

We take care of all the cancellation procedures and the signing of the new contract!

ANTIBES OFFICE 45 avenue Pasteur F- 06600 Antibes

Tel : +33 (0) 4 69 96 94 00 Email : [email protected]

Merry Christmas and Happy Sailing 2024!

Dear sea enthusiasts and insured. As the year-end festivities wrap us in their magic, we want to extend our most sincere wishes to you. May

Meet us – Yacht Show Cannes

Meet us at the Cannes Yachting Festival Guillaume and Shayne are happy to meet you at during the Cannes boat Show between the 12 and

FRENCH DECREE SEAFARER

FRENCH DECREE (20 OCTOBER 2017)FOR CREW WORKING ON YACHT WITH OFFSHORE FLAG The decree of March 8, 2017 was amended on October 20, 2017 to come

We wish you a Happy New Year 2018 ! WHAT’S NEW FOR 2018 ? We have recently opened a new office near PORT VAUBAN in Antibes at 16 boulevard

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

Insurance for Seafarers

Welcome to your haven: tailored vul insurance for seafarers.

Welcome aboard to www.seafarerinsurance.com , where navigating through the complex waters of insurance for seafarers is made simple. As we chart our course towards 2024 and look towards the horizon of 2025, the need for comprehensive and adaptable insurance solutions for those who make their living at sea has never been more apparent. This platform is your compass in the vast ocean of insurance options, designed to guide you towards securing VUL insurance that meets the unique demands of seafaring life.

Embarking on Your Journey with Confidence

Finding cheap insurance that doesn’t compromise on coverage is crucial for seafarers, whose professions expose them to unique risks and challenges. Whether you’re a seasoned captain or a deckhand embarking on your first voyage, our mission is to guide you to insurance solutions that offer both value and peace of mind. With VUL insurance, you’re not just protecting your financial future but also investing in it, combining life insurance with the potential for cash value growth based on market performance.

Navigating Through Insurance Quotes

Setting sail into the world of insurance quotes can seem daunting, like charting through uncharted waters. However, comparing insurance quotes is a critical step in finding the VUL policy that best suits your seafaring lifestyle. It’s about more than just the premiums; it’s understanding the coverage, the investment options, and how each policy can be tailored to your needs. Our platform serves as your sextant, simplifying this process and enabling you to navigate these waters with clarity.

Discovering the Best Insurance Near Me

The quest for “insurance near me” is about more than convenience; it’s about finding personalized guidance and support. Regardless of where your home port is, connecting with the right insurance provider is key. We highlight local insurance experts who specialize in serving the seafaring community, ensuring that you have access to the best insurance solutions, no matter where you are docked.

A Comparative Voyage Among Top Insurance Providers

In the vast sea of insurance providers, finding the best insurance for seafarers requires more than just a glance at the surface. It’s about who offers comprehensive coverage, flexible investment options, and understands the unique needs of life at sea. As we journey through 2024 and beyond, we aim to provide you with the tools to compare top insurance providers effectively, spotlighting those who stand out for their commitment to serving the seafaring community.

Anticipating the Future: Insurance in 2024 and 2025

The tides of VUL insurance for seafarers are ever-changing, influenced by global economic currents, maritime laws, and the evolving needs of maritime professionals. Staying ahead of these changes is crucial to ensure your VUL policy remains a steadfast guardian of your financial wellbeing. We pledge to be your lighthouse, offering insights into the future of seafarer insurance, ensuring your decisions are informed and future-proof.

Setting Sail with Assurance

At www.seafarerinsurance.com , we are more than just a repository of information; we are your navigator in the journey toward securing the right VUL insurance. In a sea filled with complex jargon and intricate policy details, our purpose is to demystify, to clarify, and to empower. Making informed VUL insurance choices is a significant endeavor, one that should be undertaken with knowledge, insight, and the support of experts. We are here to illuminate your path, providing the guidance needed to navigate these decisions with confidence.

Embarking on Your VUL Insurance Exploration

As you dive deeper into our site, you will discover a wealth of resources designed to assist you in the intricate process of selecting the right VUL insurance for seafarers. From expert insights on finding cost-effective insurance without sacrificing coverage to comprehensive guides on how to effectively compare insurance policies, our platform is your anchor in the complex world of seafarer insurance.

We invite you to set sail, to explore, and ultimately, to make choices that ensure your financial security and prosperity, today and in the years to come. Welcome to a journey of discovery, where informed decisions lead to financial stability and peace of mind. Welcome to www.seafarerinsurance.com – your guiding star in the world of VUL insurance for seafarers in 2024 and beyond.

How VUL insurance helps Filipino Seafarers in Supporting their Families

VUL insurance, or Variable Universal Life insurance, is a popular insurance product that has been gaining traction among Filipino seafarers. This type of insurance policy is designed to offer both protection and investment benefits to the policyholder, making it a great option for Filipino seafarers who are looking to support their families back home. In this article, we will explore how VUL insurance helps Filipino seafarers in different scenarios.

Sending Kids to School: One of the main reasons why Filipino seafarers work overseas is to provide a better life for their families, including giving their children a good education. With VUL insurance, the policyholder can ensure that their children’s future is secure, even if something unexpected happens to the policyholder. The death benefit from the insurance policy can be used to pay for their children’s education, allowing them to continue their studies without worrying about financial difficulties.

Funding a Long-Term Goal of Acquiring New Property or Another Car: VUL insurance also allows the policyholder to accumulate wealth through its investment component. Over time, the policyholder’s premium payments can grow into a substantial sum, which can then be used to fund long-term goals, such as acquiring new property or a new car. This can provide peace of mind to the policyholder, knowing that they can achieve their dreams of providing a better life for their family, even if they are away from home.

In the Case the Seafarer Becomes Critically Ill: Unfortunately, illnesses can happen at any time, and a seafarer who is critically ill will need to be taken care of. With VUL insurance, the policyholder can use the living benefit feature to pay for their medical expenses, making sure they receive the best care possible. This can alleviate the financial burden on the family and allow them to focus on their loved one’s recovery.

In the Case the Seafarer Needs Long Hospitalization: In the event that the policyholder needs to be hospitalized for an extended period, VUL insurance can provide financial support to cover their hospital expenses. This can help reduce the stress and anxiety of the policyholder and their family, knowing that they will not be burdened by huge medical bills.

In the Case of Permanent Disability of the Seafarer, Making Him No Longer Fit to Work Onboard: In some cases, a seafarer may become permanently disabled and unable to work onboard. This can have a significant impact on their income and ability to support their family. VUL insurance provides a disability benefit that can help cover the loss of income, ensuring that the policyholder and their family are still taken care of even if the policyholder is no longer able to work.

In the Event of the Insured Seafarer’s Death: Lastly, in the event of the policyholder’s death, VUL insurance provides a death benefit to their beneficiaries. This can help provide financial stability for the policyholder’s family, even in their absence. This benefit can be used to cover the policyholder’s final expenses, pay off debts, or fund long-term goals, such as education or property acquisition.

In conclusion, VUL insurance is a great option for Filipino seafarers who are looking to support their families back home. With its combination of protection and investment benefits, VUL insurance can provide peace of mind and financial stability for Filipino seafarers and their families, even in the face of unexpected events. –

VUL Insurance

Variable Universal Life (VUL) insurance is a type of life insurance policy that provides both death benefit protection and tax-advantaged investment opportunities. Unlike traditional life insurance policies that offer a fixed death benefit and a fixed premium, VUL policies allow policyholders to allocate a portion of their premiums into a variety of investment options, such as stocks, bonds, and mutual funds.

VUL policies are essentially a combination of life insurance and an investment account. Policyholders can choose how their premium dollars are invested and have the potential to earn a higher return on their investment than they would with a traditional life insurance policy. However, it is important to note that the investment options offered in a VUL policy are not guaranteed and the value of the policy may fluctuate based on the performance of the underlying investments.

One of the main advantages of a VUL policy is the flexibility it provides in terms of premium payments and death benefits. Policyholders can choose to pay higher premiums in order to build up their investment account, or they can pay lower premiums and accept a lower death benefit. Additionally, VUL policies often offer the option to make changes to the death benefit or investment allocation without having to go through underwriting again.

Another advantage of VUL policies is that they offer tax-deferred growth of the investment account. Policyholders do not have to pay taxes on any investment gains until they withdraw the funds, at which point they are taxed as ordinary income. Additionally, if the policyholder dies, the death benefit is paid tax-free to the beneficiaries.

It is important to carefully consider the potential risks and benefits of a VUL policy before purchasing one. As with any investment, there is always the risk of loss, and the value of the policy may fluctuate based on the performance of the underlying investments. Policyholders should also be aware that the cost of insurance in a VUL policy may increase over time, which can impact the overall return on investment.

In conclusion, Variable Universal Life insurance can provide policyholders with a flexible combination of life insurance protection and investment opportunities. While it is important to understand the potential risks and benefits before purchasing a VUL policy, it can be a valuable tool for individuals looking for a way to build wealth and provide for their beneficiaries in the event of their death.

The Role That VUL Insurance Plays in the Development of Families

Variable Universal Life (VUL) insurance is a type of life insurance policy that provides death benefit protection and investment options to families. The flexible structure and potential for cash value growth of VUL policies make them an attractive option for growing families, as they can provide financial support in a variety of different scenarios, including sending kids to school, funding the acquisition of new property, covering costs associated with critical illness or long hospitalization, permanent disability, and the death of the insured.

In terms of sending kids to school, the accumulated cash value of a VUL policy can be used to pay for education expenses, either by taking a loan from the policy or by surrendering it. This can provide families with a source of funds that can be used to help ensure their children receive a quality education. Additionally, if the policyholder has a long-term goal of acquiring new property, the cash value of the VUL policy can also be used as a source of funds for that purpose, either by taking a loan or by surrendering the policy.

In case of critical illness or long hospitalization resulting from an accident, the policy’s accelerated death benefit riders may allow the policyholder to access a portion of the death benefit while they are still alive to help pay for medical expenses or other related costs. This can provide the policyholder and their family with much-needed financial support during a challenging time.

In the case of permanent disability, if the policyholder becomes disabled and unable to work, the policy’s waiver of premium riders may continue to pay the policy premiums, keeping the policy in force and ensuring that the death benefit will still be paid in the event of their death. This can provide the policyholder and their family with a sense of security and peace of mind, knowing that they will still have access to financial resources even if the policyholder is unable to work.

In the event of the insured’s death, the death benefit paid to the beneficiaries can be used to provide financial support for the family and to help ensure that their children receive a quality education. The death benefit can also be used to cover funeral expenses, pay off debts, or provide a source of income for loved ones.

It’s important to note that the above benefits will depend on the specific features and riders included in the policyholder’s VUL policy. Policyholders should carefully review the policy contract and speak with their insurance agent to understand the coverage and benefits available to them. By considering the unique needs and goals of their growing family, policyholders can choose a VUL policy that will help provide the financial security and support they need.

100 Most Frequently Asked Questions About Seafarer Insurance

- What is VUL Insurance and how does it benefit Filipino seafarers?

- How does VUL Insurance for seafarers in the Philippines differ from other types of insurance?

- What are the specific coverage options available in VUL Insurance for Filipino seamen?

- How can Filipino seafarers apply for VUL Insurance?

- Are there any age restrictions for seafarers to be eligible for VUL Insurance in the Philippines?

- What are the premium payment options available for VUL Insurance for Filipino seamen?

- How does VUL Insurance provide financial security for Filipino seafarers and their families?

- Can Filipino seafarers avail VUL Insurance while working abroad?

- What are the tax benefits of VUL Insurance for seafarers in the Philippines?

- How do Filipino seamen make claims under VUL Insurance?

- What is the process for nominating beneficiaries in VUL Insurance for Filipino seafarers?

- Are pre-existing medical conditions covered under VUL Insurance for Filipino seamen?

- How does VUL Insurance for seafarers in the Philippines handle disability coverage?

- What are the investment components of VUL Insurance for Filipino seamen?

- Can VUL Insurance for Filipino seafarers be used as collateral for loans?

- What happens to the VUL Insurance policy if a Filipino seaman changes professions?

- How does critical illness coverage work in VUL Insurance for Filipino seafarers?

- Are there any exclusions or limitations in VUL Insurance for seafarers in the Philippines?

- How can Filipino seamen customize their VUL Insurance policies?

- What is the grace period in VUL Insurance payments for Filipino seafarers?

- Can VUL Insurance for Filipino seamen be combined with other insurance policies?

- How long does a Filipino seafarer need to pay premiums for VUL Insurance?

- What are the consequences of policy lapse in VUL Insurance for Filipino seamen?

- How does VUL Insurance support the retirement planning of Filipino seafarers?

- Can Filipino seafarers avail partial withdrawals from their VUL Insurance policies?

- What factors should Filipino seamen consider before choosing a VUL Insurance plan?

- How do death benefits work in VUL Insurance for Filipino seafarers?

- Can VUL Insurance for Filipino seamen cover their children’s education?

- What is the process of updating personal information in VUL Insurance for Filipino seafarers?

- How does VUL Insurance provide coverage during maritime emergencies for Filipino seamen?

- Are there any specific riders that Filipino seafarers can add to their VUL Insurance policies?

- How does inflation affect VUL Insurance policies for Filipino seamen?

- What are the options for increasing coverage in VUL Insurance for Filipino seafarers?

- How does VUL Insurance for Filipino seamen address international coverage?

- What are the customer service options available for VUL Insurance policyholders in the Philippines?

- How can Filipino seafarers compare different VUL Insurance plans?

- What is the claims settlement ratio for VUL Insurance companies in the Philippines?

- How do life stages affect the VUL Insurance needs of Filipino seamen?

- Can Filipino seafarers hold multiple VUL Insurance policies?

- How does VUL Insurance cater to the unique needs of female seafarers in the Philippines?

- What are the renewal options for VUL Insurance policies for Filipino seamen?

- How can Filipino seafarers ensure their VUL Insurance policies remain active?

- What are the implications of policy surrender in VUL Insurance for Filipino seamen?

- How do policyholders receive dividends in VUL Insurance for Filipino seafarers?

- Can VUL Insurance for Filipino seamen be transferred to another insurance company?

- How does VUL Insurance address the risk of piracy for Filipino seafarers?

- What are the key factors to consider when reviewing VUL Insurance policies for Filipino seamen?

- How do global economic changes impact VUL Insurance for Filipino seafarers?

- Can VUL Insurance policies for Filipino seamen be upgraded or downgraded?

- What are the best practices for managing VUL Insurance for long-term benefits for Filipino seafarers?

- How do currency exchange rates affect VUL Insurance premiums and payouts for Filipino seafarers?

- What are the implications of late premium payments on VUL Insurance for Filipino seamen?

- How can Filipino seafarers access their VUL Insurance policy details online?

- Are there any special VUL Insurance plans for senior Filipino seafarers?

- How does VUL Insurance for Filipino seamen accommodate changes in maritime laws?

- What are the benefits of long-term commitment to VUL Insurance for Filipino seafarers?

- Can Filipino seafarers’ VUL Insurance cover be extended to their spouse and family?

- How do natural disasters affect VUL Insurance claims for Filipino seamen?

- What are the key indicators to assess the performance of VUL Insurance investments for Filipino seafarers?

- How does job change or unemployment affect VUL Insurance for Filipino seamen?

- What are the environmental considerations in VUL Insurance for Filipino seafarers?

- Can VUL Insurance for Filipino seamen be linked to their bank accounts for automatic premium payments?

- What is the role of insurance agents in managing VUL Insurance for Filipino seafarers?

- How do health and lifestyle choices impact VUL Insurance premiums for Filipino seamen?

- What are the latest trends in VUL Insurance for seafarers in the Philippines?

- How do international maritime regulations influence VUL Insurance for Filipino seamen?

- Can Filipino seafarers claim VUL Insurance for maritime accidents?

- What are the procedures for updating beneficiary information in VUL Insurance for Filipino seafarers?

- How does VUL Insurance assist Filipino seamen in estate planning?

- What are the cybersecurity measures for online VUL Insurance services for Filipino seafarers?

- Can VUL Insurance premiums for Filipino seamen be paid in installments?

- How does VUL Insurance for Filipino seafarers accommodate career progression and income changes?

- What is the role of medical examinations in VUL Insurance applications for Filipino seamen?

- How do Filipino seafarers ensure compliance with both Philippine and international VUL Insurance standards?

- Can VUL Insurance for Filipino seamen be bundled with other maritime insurance policies?

- What are the procedures for VUL Insurance policy renewal for Filipino seafarers?

- How do Filipino seamen’s travel patterns impact their VUL Insurance coverage?

- Are there any specific VUL Insurance plans for Filipino seafarers working on different types of vessels?

- How do emergencies at sea impact the VUL Insurance claims for Filipino seamen?

- What are the procedures for converting VUL Insurance policy for Filipino seafarers to a different type of insurance?

- How do VUL Insurance policies for Filipino seamen handle coverage during lay-off periods?

- What are the implications of maritime piracy incidents on VUL Insurance for Filipino seafarers?

- Can Filipino seafarers pause their VUL Insurance coverage during non-active periods?

- How does VUL Insurance for Filipino seamen cover accidental death or dismemberment at sea?

- What are the restrictions on VUL Insurance payouts for Filipino seafarers under certain conditions?

- Can Filipino seamen avail of loan facilities against their VUL Insurance policies?

- How do Filipino seafarers’ unions interact with VUL Insurance providers?

- What are the advancements in digital technology impacting VUL Insurance for Filipino seamen?

- How does VUL Insurance for Filipino seafarers address the challenges of long-term voyages?

- What are the considerations for Filipino seamen when choosing a VUL Insurance provider?

- Can Filipino seafarers include critical illness riders in their VUL Insurance policies?

- How do changes in Filipino seafarers’ marital status affect their VUL Insurance?

- What are the steps for Filipino seamen to increase their investment in VUL Insurance?

- How do VUL Insurance providers in the Philippines support seafarers in understanding their policies?

- Can Filipino seamen’s VUL Insurance policies be transferred to dependents?

- What are the benefits of consolidating multiple VUL Insurance policies for Filipino seafarers?

- How do Filipino seafarers ensure that their VUL Insurance policies stay relevant to their changing needs?

- What are the implications of retiring from seafaring on VUL Insurance for Filipino seamen?

- Can Filipino seafarers avail of VUL Insurance if they are working on international vessels?

- What are the common misconceptions about VUL Insurance among Filipino seafarers and how can they be addressed?

OUR MISSION

With a multitude of coverage options, exclusive discounts and personalized service, we deliver the boat insurance experience you deserve.

Coverage (+) | Discounts (+)

Popular Options Available for Every Quote and Policy

- Towing & Roadside Assistance

- Agreed Value

- "All Risks" - Fire, Theft, Collision

- Bodily Injury & Property Damage

- Medical Payments

- Personal Property & Equipment

- Cost of Defense - Unlimited

- Hurricane Haul-out

- Marinas as Additional Insureds

- Tenders / Dinghys

- Disappearing Deductibles

- Environmental / Fuel Spill / Pollution

Apply Now & Start Saving

BOATING SAFETY COURSE

A qualified safety course will help you learn basic boating rules, while also saving you money on boat insurance.

CLEAN DRIVING RECORD

You know that a spotless MVR helps save on car insurance. The same holds true for marine insurance.

NAVIGABLE WATERS

If you only navigate in protected waters, such as the Chesapeake Bay or Long Island Sound, you can save money without sacrificing anything.

MULTI-CRAFT

Insuring more than one watercraft with us will give you a significant discount.

WINTER LAYUP

We offer big savings if the vessel is not afloat during the winter months.

In boating, your experience counts. So you'll be able to count your savings by telling us about yours.

We'll give you a hefty discount for initially applying online and helping us save time.

INSURANCE FOR BOATS BY BOATERS

500,000+ INSURED BOATERS

40+ YEARS IN BUSINESS

EXCEPTIONAL CUSTOMER SERVICE

Unmatched Coverage. Custom Policies. Experienced Underwriters.

Free Quotes

SkiSafe's smooth and simple online quoting process takes the complexities out of getting boat insurance.

Start Quote >>

Policy Service

We are boat insurance specialists. This means that we provide the flexibility and cover- age to fit any boater’s needs.

Coverage Options >>

Nothing is more important than a strong claims team that works to quickly and fairly resolve every claim.

“I saved over 25% by switching to SkiSafe”

- Read More (+)

CUSTOMER COMMENTS

"Three boats over fourteen years with SkiSafe and we absolutely love them." "Very happy with SkiSafe. I remain a loyal customer and will continue to do so."

"SkiSafe has the best customer service of any company I have ever worked with." "I want to thank SkiSafe for all your diligent and expeditious handling of my claim."

"SkiSafe has been a wonderful company to have in my corner." "Hands down the best rates out there."

Got a Question?

Complete our short form for a prompt response and world class tax advice.

Yes please contact me regarding mortgages

By selecting this, you agree to the Privacy Policy .

Sign in to your account

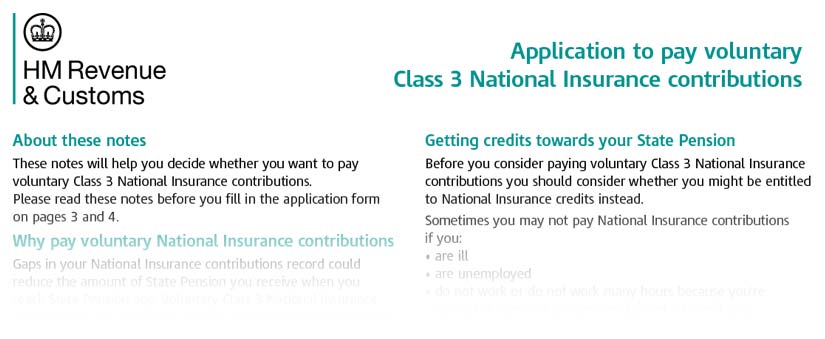

National insurance contributions - what yacht crew need to do.

(First published 22nd July 2016. Updated 13th March 2019)

Even if you are (or have been) a UK tax resident and religiously file your seafarers tax return every year (which you probably should), does it mean you benefit from such things as the UK State Pension?

Unfortunately not! In order to qualify for any UK state pension (currently approximately £155 per week from around aged 67), you need to pay National Insurance contributions (NIC) .

On top of which, you need at least 10 qualifying years to receive any of the ‘new state pension’ (for those born after 1951).

In order to be eligible to pay NIC and therefore build up some allowance for UK state pension you must have a Nation Insurance Number.

So if you are a seafarer or yacht crew, what do you need to do?

Continue reading to find out more or hit the links below to jump to a relevant chapter that interest you:

National Insurance Classes

What to do if you have a gap, how much could i receive, speak to us or comment.

There are 4 main classes of Nation Insurance Contributions (NIC);

- Class 1: Paid by UK-based Employees Earning More than £155 per week and under State Pension age

- Class 1A or 1B: Paid by Employers

- Class 2: Paid by Self-Employed People

- Class 3: Voluntary Contributions

- Class 4: Paid by Self-Employed with Profits Above £8,060 per annum

For yacht crew, who very rarely have any social security contributions in any country, due to the flag state not collecting them from employing companies or due to not having social security systems as we know them, it is highly likely that you will have gaps in your National Insurance record.

If you do have a gap it is possible to pay ‘voluntary’ contributions to top up your National Insurance record and receive more pension income later.

We believe that crew should be paying the Mariners Class 2 NICs which are considerably cheaper than Class 3 and have the additional benefit of ‘contribution based employment and support allowance’ when they return to the UK, which is not available if you pay class 3 NICs.

Currently it costs £2.80 a week for Class 2 (£145.60 per annum) or £14.10 a week for Class 3 (£733.20 per annum).

Either way, the cost is very low to secure an income for life later.

Image source: https://pixabay.com/photos/investment-finance-time-3247252/

To put this into perspective, if you were to theoretically only pay Class 3 for 35 years* you would invest a total of £25,662.

You would then receive £155 per week from the age 67 which is £8,060 per annum which equates to a yield on investment of 31% per year - a no brainer, assuming of course the UK government can continue to pay!

*It's however unlikely you can only pay Class 3 for all 35 years, but the point is clear!

However, the form to apply for a review of the National Insurance gap and to register to pay voluntary NICs is complicated and quite detailed which can put some people off from even applying to see if they are eligible to pay it.

This is also another great reason to keep a seaman’s discharge book up to date at all times, right from the start of your career.

I would like to thank Clare Viner from Marine Accounts, experts in yacht crew taxation, for her assistance in researching this article.

There is also a wealth of information on the UK government website and a Mariners National Insurance Questionnaire which can be filled out for a review of the situation.

Peter Brooke is a financial adviser to the yachting community with the Spectrum IFA Group. Spectrum has created Horizons , a unique financial solution just for yacht crew. Peter can be contacted directly via email .

If you want to get your National Insurance contributions back on track, don't leave it too long as you could miss out on the benefits of a state pension in your latter years.

It is advised you speak to a professional financial advisor or accountant who can offer insight and knowledge into the best ways to get your contributions up to date, using the most suitable NI class.

If you're concerned about your state pension and want to get your national insurance contributions in order, our team can review your situation and offer professional advice.

Get in touch with us today or alternatively, let us know what you think in the comments section below.

Click for National Insurance Advice for Seafarers & Yacht Crew

Liked this article? Try reading: National Insurance in the UK and Changes to French Social Security Laws

Any advice in this publication is not intended or written by Marine Accounts to be used by a client or entity for the purpose of (i) avoiding penalties that may be imposed on any taxpayer or (ii) promoting, marketing or recommending to another party matters herein.

Before you go...

You're about to visit a page on our legacy site. We're currently in the process of updating all our tax tools and while this page is still active please return to the main Marine Accounts site after completition.

Refer a friend and receive £50!

Upon successful completion of the referral the cash will be transferred to you.

- MyNewMarkets.com

- Claims Journal

- Insurance Journal TV

- Academy of Insurance

- Carrier Management

Featured Stories

- Chubb’s Greenberg Defends Appeal Bond to Trump

- Florida Jury Awards $32M Against Cleveland Clinic

Current Magazine

- Read Online

Supreme Court Opinion on Maritime Law Solidifies Insurer’s Choice-of-Law Clause

A dispute between an insurer and a yacht owner that went all the way to the U.S. Supreme Court resulted in a decision — the first of its kind on marine insurance in about 70 years — to clarify federal maritime law and state insurance law.

The highest court recently released a unanimous opinion that choice-of-law provisions in maritime contracts, governed by federal maritime law, are enforceable over state law. Maritime contracts include marine insurance policies.

The case at hand, Great Lakes Insurance v. Raiders Retreat Realty, goes back to 2019 when a yacht ran aground in Florida, sustaining hundreds of thousands of dollars in damage. Munich Re’s Great Lakes denied the claim and sued Raiders Retreat in Pennsylvania federal court after an investigation found that fire extinguishers on the boat did not meet required standards. Raiders Retreat then countersued, alleging breach of contract under Pennsylvania’s Unfair Trade Practices and Consumer Protection Law. The insurer won in U.S. District Court for the Eastern District of Pennsylvania — which found that federal choice-of-law provisions in the policy could be enforced.

Raiders appealed and, while the U.S. Court of Appeals recognized choice-of-law provisions in maritime contracts, it sent the case back to the district court to consider whether applying New York law would violate Pennsylvania’s policy regarding insurance. Insurers typically include choice-of-law provisions in contracts and declare that New York law applies when there is no federal precedent.

The American Institute of Marine Underwriters said the Supreme Court’s decision clarified the insurer’s choice-of-law clause in a policy and said it cannot be disregarded due to another state’s laws. There are narrow exceptions but none applied to this case, the court said. “The ruling adheres to the principles of uniformity and certainty in maritime law,” the AIMU said. Great Lakes was represented by AIMU member, The Goldman Maritime Law Group, and an amicus brief, cited several times in the opinion delivered by Justice Brett M. Kavanaugh, was written by member Wiggin and Dana on behalf of AIMU.

“As well stated in the court’s opinion, this decision will enable marine insurers to better assess risk,” said John Miklus, president of AIMU, in a statement. “By enforcing an insurance policy’s choice-of-law provisions in jurisdictions that are well developed, known, and regarded, the court recognizes that insurers can lower the price and expand the availability of marine insurance.”

Kavanaugh wrote that the presumption of enforceability of the provisions “facilitates maritime commerce by reducing uncertainty and lowering costs for maritime actors.”

“Maritime commerce traverses interstate and international boundaries, so when a maritime accident or dispute occurs, time-consuming and difficult questions can arise about which law governs,” he continued. “By identifying the governing law in advance, choice-of-law provisions allow parties to avoid later disputes — as well as ensuing litigation and its attendant costs.”

Pamela A. Palmer of the Clark Hill law firm said the high court opinion will help to “eliminate any confusion in the industry that marine insurance contracts are somehow different than or held to a different standard than general maritime contracts.”

“What strikes me in the decision is the court’s acknowledgment that choice-of-law provisions are important to reduce uncertainty and to lower costs for maritime entities but, more importantly in the context of marine insurers, knowing what law applies enables marine insurers to better assess risk and to price policies,” Palmer said. “This is a huge consideration for the marine insurance industry and had the court held otherwise the price and availability of insurance would be severely impacted — considerations that ironically would have harmed policyholders in the long run despite what would have felt like a short-term policyholder win in this case.”

Onlookers also waited to see if the Supreme Court would address a 1955 decision in Wilburn Boat Co. v. Fireman’s Insurance Co., another maritime insurance case in which the court ruled a court could apply state law if there is no established maritime law. However, Kavanaugh concluded Wilburn Boat did not need to be considered because it did not involve choice-of-law provisions.

“While it would have been an additional victory for proponents of maritime uniformity for the court to have overruled Wilburn Boat, Justice Kavanaugh did not take that additional step,” wrote Charlie McCammon, president of marine risk consulting, in a blog for WTW.

In a concurring opinion, Justice Clarence Thomas wrote separately about Wilburn Boat, saying it is “at odds with the fundamental precept of admiralty law.” “Wilburn Boat’s rationale is deeply flawed,” he added.

Topics Carriers Pennsylvania

Was this article valuable?

Thank you! Please tell us what we can do to improve this article.

Thank you! % of people found this article valuable. Please tell us what you liked about it.

Here are more articles you may enjoy.

Written By Chad Hemenway

Chad is National News Editor at Insurance Journal. He has been covering the insurance industry since 2007, reporting on trends and coverage in most lines of insurance as well as natural catastrophes, modeling, regulation, legislation, and litigation. Chad can be reached at [email protected]

Latest Posts:

- Skeptical AM Best Tags US D&O Segment With Negative Outlook

- Chubb’s Greenberg Defends Issuing Appeal Bond to Trump: ‘We Don’t Take Sides’

- Pie’s Financial Strength Rating of A- Under Review by AM Best

From This Issue

Restaurants and Bars; Markets: Boats & Marinas; Corporate Profiles, Spring Edition

Interested in carriers .

Get automatic alerts for this topic.

- Categories: Features

- Have a hot lead? Email us at [email protected]

Insurance Jobs

- Commercial Lines Underwriter – REMOTE - Bridgeport, CT

- Commercial Lines Underwriter – REMOTE - Birmingham, AL

- Commercial Lines Underwriting Assistant – REMOTE - Santa Fe, NM

- Senior Copywriter - Chicago, IL

- Sr. Middle Market Commercial Underwriter, Account Executive Officer - Chicago, IL

- Majority of Underwriters Predict Cyber Risks Grow 'Greatly' in 2024: Survey

- What's to Come in 2024: AI Expansion, More Catastrophes, Network Consolidation

- South Carolina Liquor Liability Market 'Extremely Unprofitable,' DOI Report Says

- NCCI: Wage Growth Likely to Continue Workers Comp Payroll Growth

- Do Regulators, Insureds and Agents Understand How Reciprocal Carriers and Some New MGAs Work?

- Bankruptcy Court Approves New Jersey Diocese's $87.5M Plan for Abuse Victims

- Genesis's $21 Million Settlement With SEC Green Lit by Judge

- Ferrari Sued for Failing to Fix 'Life-Threatening' Brake Defect

- Florida Jury: NICO Did Not Act in Bad Faith in Keys Crash that Killed 4 Women from Spain

- Chances of a Weather-Roiling La Niña This Year Are Now Above 80%

- March 21 Excess and Surplus Lines - Doing Business Well in a Hard Market

- April 4 Cyber Insurance - Where in the World is Coverage?

- April 11 Artificial Intelligence and Insurance Agents - Panic or Promise?

- April 18 Waiting on the Grand Reopening: Business Income Essentials

- Client log in

Metallurgicheskii Zavod Electrostal AO (Russia)

In 1993 "Elektrostal" was transformed into an open joint stock company. The factory occupies a leading position among the manufacturers of high quality steel. The plant is a producer of high-temperature nickel alloys in a wide variety. It has a unique set of metallurgical equipment: open induction and arc furnaces, furnace steel processing unit, vacuum induction, vacuum- arc furnaces and others. The factory has implemented and certified quality management system ISO 9000, received international certificates for all products. Elektrostal today is a major supplier in Russia starting blanks for the production of blades, discs and rolls for gas turbine engines. Among them are companies in the aerospace industry, defense plants, and energy complex, automotive, mechanical engineering and instrument-making plants.

Headquarters Ulitsa Zheleznodorozhnaya, 1 Elektrostal; Moscow Oblast; Postal Code: 144002

Contact Details: Purchase the Metallurgicheskii Zavod Electrostal AO report to view the information.

Website: http://elsteel.ru

EMIS company profiles are part of a larger information service which combines company, industry and country data and analysis for over 145 emerging markets.

Similar companies

Related emis industry reports.

To view more information, Request a demonstration of the EMIS service

IMAGES

COMMENTS

From local charter vessels to luxury yachts and package policy solutions for marinas, we got you covered. ... Seafarer Marine Insurance is a registered series of Mission Underwriting Managers, LLC. Mission Underwriting Managers, LLC is a licensed insurance agency, NPN 19970643, that sells various property and casualty insurance. ...

For too long the tough life of the seafarer has gone unnoticed, but that has now changed. Legislation is bringing reform and improvements to working conditions, and Crewsure offers a product for this moment. Crewsure Marine is a single insurance policy embracing today's needs and benefits; personal to the seafarer, yet paid by the employer.

WYCC Insurance provides cover for Seafarers in Yachting, Cruising, Shipping industry and for Expatriates or shore based personnel. WYCC Insurance benefits are compliant with the applicable law (MLC, Flag, CBA), local law and employers' wishes (SEA). Only one name for employee benefits all around the world whatever the nationality, fiscal ...

Benefits of Marine Insurance for Seafarers. In short, it's designed to cover risks faced by seafarers, including natural disasters, piracy, collision, cargo damage, and personal injury. A. Financial protection against losses. One of the primary benefits of marine insurance for seafarers is financial protection against losses.

Seafarer Marine Insurance | 144 followers on LinkedIn. Proving insurance solutions for all of your marine needs | Our experienced team will help you navigate policy terms and conditions to ensure ...

IMG understands your challenges and healthcare needs, at sea and in port. We're proud to provide comprehensive and portable marine crew insurance plans designed specifically for professional yacht and marine crew. The plans provide coverage 24 hours a day, and you have the freedom to choose any doctor or hospital for treatment around the world.

Luxury Yacht Insurance. Great American provides comprehensive coverage for Luxury Yachts valued between $2 million to $25 million. Coverage is available to U.S. and Canadian owners. While coverage is available for privately owned yachts, we can provide coverage under a corporate Named Insured and include occasional charter exposures.

ANTIBES OFFICE. 45 avenue Pasteur. F- 06600 Antibes. Tel : +33 (0) 4 69 96 94 00. Email : [email protected].

Welcome aboard to www.seafarerinsurance.com, where navigating through the complex waters of insurance for seafarers is made simple. As we chart our course towards 2024 and look towards the horizon of 2025, the need for comprehensive and adaptable insurance solutions for those who make their living at sea has never been more apparent.

Top rated boat insurance company for over 3 decades. We offer a wide range of boat insurance and jet ski insurance. Get a FREE online boat insurance quote today to start saving! ... same holds true for marine insurance. NAVIGABLE WATERS. If you only navigate in protected waters, such as the Chesapeake Bay or Long Island Sound, you can save

Thomas Murphy, MBA President of Seafarer Marine Insurance Marine Underwriting and Operations Executive driving product development and underwriting initiatives to boost revenue results.

National Insurance Classes. There are 4 main classes of Nation Insurance Contributions (NIC); Class 1: Paid by UK-based Employees Earning More than £155 per week and under State Pension age. Class 1A or 1B: Paid by Employers. Class 2: Paid by Self-Employed People. Class 3: Voluntary Contributions. Class 4: Paid by Self-Employed with Profits ...

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services Coverage Period: 01/01/2021 - 12/31/2021 SEAFARERS HEALTH & BENEFITS PLAN: PLAN S Coverage for: Individual + Family | Plan Type: PPO For more information about limitations and exceptions, see the Summary Plan Description at www.seafarers.org or call 1-800-252-4674.

A dispute between an insurer and a yacht owner that went all the way to the U.S. Supreme Court resulted in a decision — the first of its kind on marine insurance in about 70 years — to clarify ...

Contact Us. If you need any assistance regarding your benefits: SHBP Claims Department. 45353 St. Georges Avenue. Piney Point, MD 20674. Phone: (800) 252-4674 (Option 3) | Fax: (301) 994-0116. Email: [email protected].

Main Activities: Iron and Steel Mills and Ferroalloy Manufacturing | Nonferrous Metal (except Copper and Aluminum) Rolling, Drawing, and Extruding. Full name: Metallurgicheskii Zavod Electrostal AO Profile Updated: February 22, 2024. Buy our report for this company USD 29.95 Most recent financial data: 2022 Available in: English & Russian ...

See other industries within the Manufacturing sector: Aerospace Product and Parts Manufacturing , Agriculture, Construction, and Mining Machinery Manufacturing , Alumina and Aluminum Production and Processing , Animal Food Manufacturing , Animal Slaughtering and Processing , Apparel Accessories and Other Apparel Manufacturing , Apparel Knitting ...

Get directions to Yuzhny prospekt, 6к1 and view details like the building's postal code, description, photos, and reviews on each business in the building

Agencies, Brokerages, and Other Insurance Related Activities Other Fabricated Metal Product Manufacturing Other Financial Investment Activities Insurance Carriers. Printer Friendly View Address: d. 5 kab. 13, ul. Pionerskaya Elektrostal, Moscow region, 144007 Russian Federation