Marine Insurance

Powering your cover.

Maritime Insurance Cover

Stock Throughput Policy

Hull Insurance

Speed boats / Yachts

No matter the size of your speed boat or yacht, don’t leave it to chance, get it covered today.

We work with only the best marine insurers.

Our expert brokers are highly knowledgeable and have deep experience in this unique field. We have a detailed understanding of the risks ranging from Jet Skis and recreational speedboats, sailboats, and yachts through to larger ship damage and maritime construction risks, to natural catastrophes and piracy, to name a few. Our specifically-designed cover is designed to offer maximum protection for your marine needs.

Is Hull Insurance necessary for all types of vessels?

All vessels on open water need to have hull insurance. Even if you own a small boat for personal use, a catamaran, or a large yacht, hull insurance is essential for any vessel going up to cruise...

DOES MARINE INSURANCE COVER ENVIRONMENTAL POLLUTION

Ships are a substantial source of pollution, both in terms of air pollution and marine pollution. Air pollution from ships Air pollution from ships comes primarily from the burning of heavy fuel...

PASSENGER LIABILITY FOR VESSELS USED FOR TOURISM

Many dams, lakes, and other open water have commercialized tourism boats operating on them ("Sunset Cruises" being very popular). There is a massive responsibility for the owners and operators of...

MARINE INSURANCE FOR JET SKIS AND OTHER PERSONAL WATERCRAFT

Marine Insurance for Jet Skis and other Personal Watercraft Nothing is more exhilarating than being outside, on the water, on a jet ski, or on a small boat. It’s even better to know that you have...

HOW PIRACY AFFECTS YOUR MARINE INSURANCE POLICY

As kids, we all read books and comic stories about piracy. (Remember Captain Hook?) Many children’s and young adults’ fancy dress parties had the theme of pirates, considered a fantasy of the past....

JETTISON OF CARGO AND GENERAL AVERAGE

Any vessel in open water is exposed to extreme forces of nature. Because of climate change and global warming, these conditions have become more unpredictable and more severe. Estimates are that the...

WHAT IS MARINE INSURANCE

Marine insurance is a unique form of insurance that covers a variety of risks associated with transporting goods by sea. This type of insurance is vital for businesses that rely on transporting...

IS SHIPPING INSURANCE THE SAME AS MARINE INSURANCE

These two types of insurance can be confusing because the words "shipping" and "marine" both relate to the sea. However, in the context of insurance, the words differ vastly. They have in common...

HULL INSURANCE

The parts of a ship are not commonly known. The hull of a vessel is its framework or shell. It's the main structural component of the vessel, designed to support the weight of the ship, its cargo,...

WHY MARINE INSURANCE POLICIES ARE PERSONALIZED

Marine insurance policies are typically customized for many reasons. This is because the risks and needs of different individuals and businesses differ significantly. Some of the main considerations...

THE ROLE OF TECHNOLOGY IN MARINE INSURANCE

That's not a star - it's a satellite. Some people don't like the idea of our skies being littered with tech hardware. But modern satellites have enabled ships to link to the internet, which can be...

MARINE BIOFOULING

During the first week of January 2023 hundreds of passengers aboard the luxury 930-guest capacity Viking Orion were stranded on board off the coast of Australia for a week, because of “marine...

Website Terms and Conditions of Use: These Terms of Use (“the Terms of Use”) govern your (“the User” / “You”) use of the (Marine Insurance ) website located at the domain name (www.MarineInsurance.co.za) (“the Website”). By accessing and using the Website, the User agrees to be bound by the Terms of Use set out in this legal notice. If the User does not wish to be bound by the Terms of Use, the User may not access, display, use, download, and/or otherwise copy or distribute any Content obtained from the Website. The Terms of Use become effective when you access the site for the first time and constitute a binding agreement between Marine Insurance and the User, which will always prevail. The current version of the Terms of Use will govern our respective rights and obligations each time you access this site. By accessing and using the Website the User agrees and acknowledges that Marine Insurance will be processing the User’s personal information and / or use of the Website in order to render the Online Services. Marine Insurance confirms that it will process the personal information of the User in accordance with the provisions of the Protection of Personal Information Act, Act 4 of 2013, and that appropriate security safeguard measures have been implemented to protect the personal information. Personal information will only be processed for a legitimate business purpose and will only be shared with a third party where it is necessary to render the Online Services or is required by law. The User accordingly consents to: Marine Insurance processing their personal information in order to provide the Online Services which includes, but is not limited to, processing the information with risk information agencies (where applicable), for the purposes of evaluating and processing the User’s request, to ensure that the most competitive rates are received; and Marine Insurance transmitting the information provided by the User, on the electronic e-quote form – • to the provider whose illustrative quote the User wishes to discuss, for the purposes of the provider to contact the User and conclude the relevant offer; and • to affiliated partners, for the purposes of them responsibly marketing their products and services to the User. In the event that the User’s session on the Website is suspended and / or the User does not finalise a transaction, Marine Insurance will attempt to contact the User in order to establish whether Marine Insurance can be of any further assistance and / or whether the User experienced any difficulties. Should the User so request, his / her details will be removed and / or not processed further by Marine Insurance. Should the User wish to receive a quote, the User will be prompted further to agree to the processing of the User’s information in order for Marine Insurance to render the Online Services. Should the User not agree to such processing, Marine Insurance will suspend the service and will not be able to provide the User with the Online Services. The User will be prompted as to whether the User wishes to receive further marketing material, updates or direct marketing from Marine Insurance and / or its affiliates by providing his / her consent. Should such consent be withheld, Marine Insurance and / or its affiliates undertakes not to direct any such marketing material, updates or direct marketing to the User. Where a User has previously agreed to Marine Insurance processing their personal information and / or to receiving marketing or marketing related material from Marine Insurance, this consent will remain in force until the User has requested Marine Insurance to refrain from such processing.

Suggested text: Our website address is: https://marineinsurance.co.za.

When visitors leave comments on the site we collect the data shown in the comments form, and also the visitor’s IP address and browser user agent string to help spam detection.

If you upload images to the website, you should avoid uploading images with embedded location data (EXIF GPS) included. Visitors to the website can download and extract any location data from images on the website.

If you leave a comment on our site you may opt-in to saving your name, email address and website in cookies. These are for your convenience so that you do not have to fill in your details again when you leave another comment. These cookies will last for one year.

If you visit our login page, we will set a temporary cookie to determine if your browser accepts cookies. This cookie contains no personal data and is discarded when you close your browser.

When you log in, we will also set up several cookies to save your login information and your screen display choices. Login cookies last for two days, and screen options cookies last for a year. If you select “Remember Me”, your login will persist for two weeks. If you log out of your account, the login cookies will be removed.

If you edit or publish an article, an additional cookie will be saved in your browser. This cookie includes no personal data and simply indicates the post ID of the article you just edited. It expires after 1 day.

Embedded content from other websites

Articles on this site may include embedded content (e.g. videos, images, articles, etc.). Embedded content from other websites behaves in the exact same way as if the visitor has visited the other website.

These websites may collect data about you, use cookies, embed additional third-party tracking, and monitor your interaction with that embedded content, including tracking your interaction with the embedded content if you have an account and are logged in to that website.

Who we share your data with

If you request a password reset, your IP address will be included in the reset email.

How long we retain your data

If you leave a comment, the comment and its metadata are retained indefinitely. This is so we can recognize and approve any follow-up comments automatically instead of holding them in a moderation queue.

For users that register on our website (if any), we also store the personal information they provide in their user profile. All users can see, edit, or delete their personal information at any time (except they cannot change their username). Website administrators can also see and edit that information.

What rights you have over your data

If you have an account on this site, or have left comments, you can request to receive an exported file of the personal data we hold about you, including any data you have provided to us. You can also request that we erase any personal data we hold about you. This does not include any data we are obliged to keep for administrative, legal, or security purposes.

Where your data is sent

Visitor comments may be checked through an automated spam detection service.

Enter your details below and a specialist marine insurance broker will be in touch asap!

I agree to the Terms & Conditions and Privacy Policy

Get Covered

Specialist marine insurance

Santam marine, land, sea, air and rail, we cover all modes of transport.

Santam Marine is the largest marine insurer in Africa, with an extensive footprint throughout the continent. We insure against a wide range of marine risks and also boast an array of technical and reinsurance support services.

Why choose Santam Marine insurance

Largest marine insurer.

We are Africa’s largest marine insurer in terms of product range and footprint, providing technical and reinsurance support to various African insurers.

Superior insurance solutions

Our superior, tailor-made solutions cover all modes of transport – by sea, air, road and rail, both locally and internationally. We offer a world-class claims service.

Our specialist network

Our global network of specialised surveyors and loss adjusters is skilled in the assessment of loss and the pursuit of recoveries against third parties, where required.

More about insurance by Santam Marine

Santam Marine is the largest maritime insurer in Africa, with an extensive footprint throughout the continent. Whether you own a small private craft or run a multinational company, we have the expertise to tailor-make and advise you on the most appropriate products for your needs. We offer a wide range of marine insurance products to meet and exceed your expectations.

Our range of solutions

Stock throughput, marine cargo (includes imports and exports), transit and related liabilities (includes goods in transit, hauliers’ liability), hull (includes commercial, fishing and pleasure craft), marine liabilities.

This form of cover combines the insurance provided under marine cargo, goods in transit, as well as storage of stock into a single product offer. The Stock Throughput Policy offers end-to-end cover starting from the supplier’s premises, extending to cover for all modes of transport, including any storage warehouses worldwide, to final delivery.

There are numerous risks associated with marine cargo that could result in partial damage or complete loss. It is therefore essential to ensure that you are covered for this risk.

What's covered:

Physical loss or damage to all cargo being imported or exported locally and/or internationally

All transit legs locally and/or internationally

Project cargo which can be extended to include delay in start-up under an advanced loss of profit policy

There are numerous risks associated with goods being moved or transported, for both the owner as well as the carrier of the goods. You therefore need to ensure you are adequately covered for this risk. Our Goods in transit cover is suitable for clients who need insurance for local transit; it covers goods transported via sea, air, road and rail. This section is suitable for hauliers that are responsible for moving cargo, and who might not necessarily own the goods that are being transported. This provides cover for goods in the care, custody or control of a carrier, either under contract or under common law. This section is set up to cover the risks associated with loss or damage to the cargo.

Vessels of all shapes and sizes are subject to extreme conditions and risks, and therefore at Santam we understand and appreciate the importance of providing adequate cover for such risks. Santam allows you to select a policy option that covers total loss, and makes provision for adding various extensions, depending on the age and value of the vessel concerned. Damage to your vessel could have devastating effects on your business, which you did not plan for. This policy caters for fishing vessels, diamond recovery vessels, and charter vessels which are used on a commercial basis.

Marine liability covers you in the event that you or your employees are held legally liable.

Ship repairer's liability

Container’s liability

Marina operator's liability

Stevedore's liability

Charterer’s liability

Freight forwarder’s liability

011 912 8000

marine.santam.co.za

Cookies settings

We use cookies and similar technologies to help personalise content, tailor and measure ads and provide a better experience. By clicking accept, you agree to this, as outlined in our cookies policy.

Get a quote

To get business insurance, provide a few details and let us call you.

Please provide your first name

Please provide your surname

Phone number

Please provide a valid phone number

Please provide a suburb

Postal code

Please provide a postal code

E-mail address

Please provide a valid e-mail address

Please agree to the Terms & conditions

Thanks for your details !

An advisor will be in touch with you within 2 business hours.

We will send your reference number ( ) to

Our business hours are:

07:00 - 19:00

08:00 - 13:00

Complete the form below.

Secured by Entrust. Click to verify

First name *

Phone number *

Select Branch * Johannesburg Cape Town Durban Port Elizabeth Please indicate the branch.

I agree to Terms & Conditions Please agree to terms and conditions

We will call you shortly.

Name * Please provide your name.

Email * Please provide a valid email address.

Phone number * Please provide your phone number.

Message * The Message field is required.

We will call to discuss your claim

Would you like to provide further details before we call? This will help streamline the process

You have 30 seconds to decide

No, thanks Yes

Name of Insured * Please provide your name.

Phone Number * Please provide your phone number.

Broker * Please provide your broker's name.

Stock Throughput

Cover provided under the Marine cargo and Goods in transit product, including the storage of stock.

Goods in Transit

Cover for imported and exported goods covering all transit legs.

Marine Liabilities

Liability cover for damage to third party property and personal injury.

Marine Cargo

Cover for commercial vessels such as fishing vessels, diamond recovery vessels, charter vessels, barges and tugs and pleasure craft such as yachts and motor boats

Why insure with Santam Marine?

- We are Africa’s largest marine insurer in terms of product range and footprint, providing technical and reinsurance support to various African insurers, such as Santam Namibia, Botswana Insurance (BIC), Nico, Alliance Insurance and CGSM.

- Our superior, tailor-made solutions cover all modes of transport – by sea, air, road and rail, both locally and internationally.

- We offer a world-class claims service.

- Our global network of specialised surveyors and loss adjusters is skilled in the assessment of loss and the pursuit of recoveries against third parties, where required.

Cookie Policy

Santam uses cookies to optimise the design of its website and provide you with the best possible online experience. By continuing your visit to this website, you consent to the use of cookies. Read our Terms & Conditions for more information.

Copyright © Santam South Africa’s leading short-term insurance company | Sitemap | Terms and Conditions

You have disabled JavaScript on yuor browser, please enable it for the best user experience.

Life passion adventure

CLUB MARINE INSURANCE

To give Boat Owners the peace of mind that their investment is insured in safe hands, we have teamed up with the highly reputable firm, Club Marine Insurance.

Club Marine is one of South Africa's leading insurance brokerage companies, specialising in all short term insurance products. Having set down roots as early as 1985, they are proud to have a long standing history of Client and Insurer satisfaction.

Club Marine's Watercraft insurance, offers one of the widest cover for all types of boating, whether you use your vessel for the pleasure of a Sunday afternoon cruise along the coast, the thrill of a deep sea fishing, fun filled weekend wake-boarding with the family and or fun day yacht racing. They also offer covers for sailing and power Open water hull travel, Charter operators, Commercial fishing operators, Yacht deliveries , Import & export of your vessels and or Goods in Transit – moving your vessels locally.

Leaving nothing to chance their legal liability is one of the most generous and comprehensive in the market today, offering up to R20 Million holistic liability cover for passenger, third party, crew and water sport activity sections.

Club Marine also offers extended specified item cover to ensure the replacement of sporting and electronic equipment both for accidental damage and for theft due to forcible and violent entry. This includes but is not limited to GPS devices, fish finders, autopilot, life rafts, safety equipment, water toys and fishing gear.

For your emergency protection, the Club Assist national call centre operates 24/7/365, providing you with peace-of-mind should you or your family ever become stranded both on land or sea.

To start enjoying the benefits of being covered by Club Marine Insurance simply complete the available online quote form or feel free to contact the Boating World office for more information.

Quote: SMS "BW" to the number 44077 CONTACT: 0861 819 219 or +27 11 591 3500 EMERGENCY: 0861 CLUB CARE (258 222)

enquire about our Club Marine Insurance

Based in Knysna, we’re ideally placed to manage your boating insurance needs for both coastal and inland pleasure craft.

Maintain Your Lifestyle. Call Melissa.

044 382 0550

As boat enthusiasts ourselves, we’re specialists in providing bespoke insurance to meet your exact needs, so whether your pleasure is in a dinghy or jet ski, motorboat or yacht we can help you choose exactly the right insurance policy for you. Having adequate boat insurance can help to protect you against any third party liability for injury or damage caused by you or your vessel. Third party liability is probably the most frequent claim we receive when it comes to boat insurance. Whether you’re a seasoned sailor or new to boating, there are many considerations for boat owners when it comes to insuring your boat. Let us help you find the right cover and keep you afloat.

Cover & Benefits

- Accidental damage, including fire, theft and malicious damage, sinking, stranding, collisions and salvage costs

- Road Hauliers Liability

- Goods in Transit within South Africa

- Protection and Indemnity Insurance

- Loss or damage to the vessel, gear and equipment.

- Legal liability for claims made by third parties including passengers and guests on-board, or when embarking or disembarking the vessel.

- Loss of gear and equipment from the exterior following forcible theft.

- Personal accident cover for the owner and guests.

- Outboard motor cover - in case of dropping off and falling overboard.

- Salvage charges and liability - for the cost of raising or removal of wreck.

We’ll talk you through the insurance process, understand more about the type of boat you’re looking to insure and then we’ll scour the local insurance market for the best insurance options which offer you the most competitive pricing.

If you use your boat for your own and your family’s pleasure you’ll most likely be looking for a private pleasure craft policy but for larger yachts, we can organise more specialised insurance in the form of hull & machinery and protection & indemnity to give you all round cover, including crew liability.

There’s no better match for your boat insurance than a brokerage that feels comfortable sourcing your insurance cover because we know how boats run, we also know how to help you when you are faced with a problem or an accident, bringing you full circle to your reason for purchasing the insurance in the first place.

Boat Care Tips

Laying up after the season..

- Service your engine/s before laying up for the winter. This includes replacing the oil, oil and fuel filters, impellers and engine anodes. Check belts and replace as required. If you have an auxiliary outboard motor, service this as well with new oil, plugs and impeller.

- Give the boat a good wash and note any slight damage for attention over the winter.

- Clean the interior and especially the bilges, making sure they are dry.

- Check for any play in rudder and shaft bearings. Also check for pitting or corrosion.

- As far as possible always keep your fuel tank/s full over the winter, to avoid a build-up of condensation.

- Check the battery electrolyte level wherever applicable. Are the terminals clean and corrosion-free? Clean and protect as required.

What you need to know ... These are just some of the most frequently asked questions we receive about our Boat cover.

From a small dinghy to a large super-yacht or personal watercraft, each type of vessel will attract a different level of risk, so just like car insurance - boats are usually categorised according to their vessel type and risk.

In general, the actual size of the boat isn't as important as its value, how easily it could be stolen and the potential for damage. If your boat is trailer-able and spends a large amount of time safely tucked away on your drive, you'll probably pay a different premium than if it was stored at a marina.

Finally, the experience of the boat owner and the type of use i.e. private use, as a charter or racing vessel as well as previous claims experience are all taken into consideration when calculating the premium.

- Damage caused by wear and tear

- Wilful misconduct

- Loss of value due to age of vessel

- Losses caused by corrosion osmosis

- Mast, spars and sails whilst racing unless the policy has been extended

- Theft unless the right security devices or locks are fitted

Trusted. Reliable. Partner.

To request a call back, or to get an obligation free quote with a comprehensive analysis of your existing cover versus other cover options, coupled with expert advice:

You have Successfully Subscribed!

Compare, Save & Tailor Your Insurance

Short Term Insurance Specialists, Trusted by Insurers & Clients for over 30 Years!

Established 1985.

Passionate about life., approved by insurers., trusted by clients..

Club Marine Insurance Brokers cc is one of South Africa's leading insurance brokerage companies, specialising in all short-term insurance products. We set down roots in 1985 and, are proud to have a long-standing history of Client and Insurer satisfaction.

At Club Marine, we are passionate about what we do and are able to create tailor-made policies to suit your individual requirements. We understand the importance of adequate insurance and have, over time, developed an in-depth knowledge of the industry, which we offer to you in the form of sound advice, exceptional service and secure cover solutions. Club Marine pioneered Watercraft stand-alone insurance in South Africa over 30 years ago and are still the leaders in this arena.

More about Club Marine Insurance

See the complete picture with Club Marine Insurance

Cargo, watercraft, business and more – get the coverage you want from us.

Cover designed for Carriers, Hauliers, Freight Forwarders, Business owners and Household content moves.

As specialists in the boating industry we ensure that your vessel is protected by the widest cover both locally and abroad.

Comprehensive policies designed for small to large businesses, backed by service excellence and support from SA’s best Insurers.

Car & Home

Cover is offered for buildings, contents, valuables, motor vehicles and pets to suit individual lifestyles.

Hospitality

We offer cover to manage your risk by tailoring a comprehensive solution designed specifically for the hospitality sector.

We offer cover to manage your risk by tailoring a comprehensive solution designed specifically for the travel sector.

Newsletters

While outdoor enthusiasts, watersport lovers and anglers played hard this summer, Team Club Marine was right there cheering them on. Fund raisers, award ceremonies, fishing competitions, golf days…you name it, we did it and loved it.

View Newsletter

Hooray, summer is here at last – and it’s time to break free! Free of roaring repo rates, free from Eskom’s escapades, murky waters and everything doom and gloom. Look around, feast your eyes and fill your tanks with excitement … long leisure-filled days beckon! Plunge right in – boaters, outdoor lovers – this is your season!

As Spring brings everything fresh and new - Club Marine shouts “Out with the old… and in with a whole new “rebrand” - in celebration of the growth of the company and action-packed seasons to come!

In the past few months, we’ve attended several events and competitions around the country, both as sponsors and participants. How exciting it is to catch up in person with anglers, watersport and outdoor lovers – offering our support and celebrating as they enjoy their leisure time action.

September 2020

At long last, it’s officially Spring… bursting with new life and the hope of happier, healthier days ahead! Now, more than ever, we can all appreciate the joy of spending time with family and friends, being outdoors, getting active and getting back on the water.

Summer interrupted! While our private and business lives are in lockdown and all outdoor action suspended – Club Marine, an Essential Services Provider, continues to uphold our excellent service levels.

February 2020

Summer’s in full swing and outdoor lovers countrywide are making the most of the long days and warmer weather. CMI keeps cover… while you head off to your favourite leisure spots – on/off road and on the water, your homes, businesses, travel, even your Cyber Space and more!

December 2019

It’s Holidays, Summertime and the Festive Season… Celebrate Life and have Fun! Do take a look at the fabulous new products and specials from some of our dealers. Wishing our Club Marine family safe travels, much joy, peace and prosperity for 2020! We’ll keep you covered 24/7/365…

Client Testimonials

"Also please allow me to thank you for your excellent service and friendliness, I will go out of my way to promote you and your company and the great service I got from you guys!!!"

"Thank you for THE great service. Not only did your quotation beat all the others by far, your service was professional & within hours my jetski was insured, Great to deal with experts!"

"We received the pay out. Thank you for your exceptional service and how promptly you handled the matter for me. I appreciate a lot."

"Hi, Thanks for the awesome service I received from Club marine! As previously mentioned my experiences with insurance companies was not always pleasant, Being incorrectly advised by brokers etc. However the service I received from you with the claim on my baby was top class!!"

"Baie dankie vir die uitstekende diens! Sien aaseblief die getekende vorm aangeheg. Ek moet se, ek is regtig baie ingenome met die hantering van my eerste (en hopelik laaste) eis."

Get a Comparative Quote

By clicking "Call Me Back" or "Start Quote" I hereby permit Club Marine Insurance Brokers to process my Personal Information, as provided above, and acknowledge that I understand the purposes for which it is required and all terms and provisions outlined in the Club Marine Insurance Brokers Privacy & Cookie Policy.

Office Hours Monday - Friday 07:30 - 16:30

General Enquiries 0861 819 219

WhatsApp 082 568 9344

Quick Links

Home Get a Quote Contact Terms & Conditions Privacy & Cookie Policy Conflicts of Interest Complaints Policy

Cargo Insurance Watercraft Insurance Business Insurance Car & Home Insurance Hospitality Insurance Travel Insurance

Claim Services Submit a Claim

Who We Are Testimonials Newsletters

Club Marine Insurance is an authorised financial services provider (FSP4430).

© 2024 Club Marine Insurance. All Rights Reserved.

Home ▸ Five Things To Know About Boat Insurance

Five Things To Know About Boat Insurance

You own a boat to get away from stress – not to create more. Choosing an insurance policy for your boat can be challenging, particularly if you’ve never done it before. Steer clear of additional stress with these five things every boat owner needs to know about boat insurance .

Types of Cover

There are two core principles that form the backbone of all marine coverage.

Liability coverage

This ensures your legal obligations to third parties are covered in the event of injury, loss of life or property damage occurring due to the usage of your boat.

Physical damage

This covers damage or accidental loss to your boat and its machinery – including the hull, engine sails and any equipment that is necessary to operate your boat.

Value versus money

When looking at different policies, be sure to check whether your physical damage cover falls under agreed value or actual cash value.

Agreed value

This means you will be paid the amount stipulated on the policy in the event your boat is considered a total loss. An amount is agreed upon by the insurer and insured upfront.

Actual cash value

This option doesn’t provide as much coverage but the premiums are usually lower. Rather, you will get back enough to replace your boat’s market value at the time of the claim. The depreciation, current market value and condition of your boat will all be taken into account when deciding how much you will receive.

Trailer and transport coverage

Interestingly enough, when your boat is out of the water and on a trailer, it is still covered. It isn’t covered if your boat is being towed on a trailer, and the trailer causes damages to third party property. This would not be covered by your boat insurance but would need to be included under your motor policy.

However, when the trailer is not being towed and either on the dam bank or boat club slipway whilst you are using the boat, there is cover for physical loss of or damage too but no liability arising therefrom.

Policy Limitations

Most policies have territorial limitations. For example, at Compendium, we offer coverage that applies to any body of water within Southern Africa, and extends as far as 12 nautical miles from the coast of South Africa, Namibia and Mozambique. Ensure you check that your policy covers you in the locations you wish to visit. Certain policies may even exclude certain high-risk areas.

Additional Coverage

A good policy will include coverage for the following liabilities:

- Medical payments: This covers your first aid, ambulance and hospital costs in the event of an accident. Passengers who were also injured will be covered too.

- Towing and assistance: This will ensure the cost of boat towing, emergency repairs, fuel delivery while at sea, and any other emergency assistance is covered.

- Personal property: This covers the loss of any personal items such as clothes, gear and more.

- Third party liability: This cover is not obligatory, but it covers you and your passengers in the event of injury caused by another boat owner who has no liability cover.

What do we cover?

We offer highly flexible cover for a wide range of vessels, including boats, dinghies, yachts, cats, and jet skis. Boating equipment and boating accessories also fall under the cover of this policy. However, should you require more specialised cover, we do offer policy extensions.

For more information on our policies, please contact one of our brokers today.

Compendium Assist

News & events, client portal, information.

Tel. 087 285 4040 Email. [email protected]

Compendium Insurance Brokers (Pty) Ltd is an Authorised Financial Services Provider – FSP10405 & FSP10409. Company Registration No. 2000/009588/07

© Compendium Insurance 2024

Get a Quote

Local and International Waters:

Owning a boat represents a major capital investment and a commitment to substantial running and maintenance. Unlike other major investments, e.g. property, a boat moves through two unpredictable elements – water and wind; and it thus has a greater risk to be damaged.

Abromowitz Sharp & Associates offers marine insurance packages both locally and internationally, working with the best marine insurance specialists. All our policies have the highest level of security.

Attractive features of the policy include no monthly debit order fee if you opt for a monthly deduction, simply take the annual premium and divide by 12. In addition, there is a specified items section where, in the event of a claim; your excess is 10% of the value of the claimed item and not the overall excess – a preferential excess structure.

The underwriters are Mutual and Federal.

- How can we help?

- Insurance quote

Marine Insurance

Information.

General enquiries Tel: +27 (0) 21 712 6686 Our products More about Intasure COVID-19

Sign up to our newsletter

More About Us

- Our Partners

- Social Awareness

- Accreditations

- Privacy Statement

yacht and small craft

Yacht and Small Craft Insurance

Your Name (required)

Your Email (required)

Your Message

A ship in the harbor is safe, but that’s not what ships are for and if you’re an owner of a vessel such as a cruiser, catamaran, yacht, an engine driven boat or cabin cruiser you will need some form of insurance coverage. Vessels can be damaged in transport and are also open to theft, fire, bad weather conditions or overturning and the costs incurred can be extensive when compared to that of proper insurance. There are also considerations that need to be made in terms of third party and medical cover. So before you set sail, talk to us about making sure you are professionally covered.

Click here for us to contact you or get a quote.

- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance

- Employment Practices Liability Insurance

- Environmental Liability Insurance

- Errors and Omissions Insurance

- Insurance Coverage & Advice by State

- See more ...

By Business Type

- Retail Store

- Agriculture & Forestry

- Construction

- Manufacturing

- Wholesale Trade

- Retail Trade

- Transportation & Warehousing

- Information Industry

- Finance & Insurance

- Real Estate

- Scientific & Technical Services

Auto & Vehicle Insurance

- Car Insurance

- Motorcycle Insurance

- Boat Insurance

- RV / Motorhome Insurance

- ATV Insurance

- Snowmobile Insurance

- Personal Watercraft Insurance

- Collectible Auto Insurance

- Umbrella Insurance

Home & Property Insurance

- Homeowners Insurance

- Condo Insurance

- Farm Insurance

- Landlord Insurance

- Renters Insurance

- Mobile Home Insurance

- Contents Insurance

- Vacant Land Insurance

- Flood Insurance

Other Insurance

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

- Health Insurance

- Special Event Insurance

- Short-term / Sharing Insurance

Insurance Solutions & Resources

- Compare Car Insurance

- Compare Home Insurance

Yacht Insurance

Finding the perfect coverage has never been easier.

Insurance doesn’t have to be boring. That’s why we hired Sara East to be our BA insurance writer. Maggie specializes in making mundane subjects hella-entertaining.

Yachts are a luxurious way to be on the water, but owning a yacht means having the right insurance in the event of damage or being destroyed. Because of their price, repair or replacement is likely to be very expensive making the proper coverage crucial for boat owners.

Before using your yacht, an independent agent can work with you to create a customized yacht insurance policy to your specific watercraft, its value, and how you use it.

Boating Statistics

No one likes to think about the dangers of boating, but accidents can happen and it's best to be prepared in the event that you face unexpected hardship. Whether you hit another boater, have an incident with a passenger, or your boat is damaged while being transported or docked, lots of things can lead to a financial headache for you.

Here are some statistics about boating accidents.

- Cabin motorboats, which include yachts, accounted for 14% of all boating accidents

- Only about 20% of all boaters who drowned were on vessels larger than 21 feet

- Operator inattention was cited as the leading cause of accidents involving cabin motorboats

What Is Yacht Insurance and What Does It Cover?

Yacht insurance is a specialized type of boat insurance for luxury boats. Yachts can be used for personal as well as commercial use, so insurance policies must be created to accommodate each of those needs.

While yachts, like most boats, depreciate over time, they still generally have a much higher than average value. Because of their high values, a standard boat insurance policy may not provide enough coverage for your vessel.

The components of yacht insurance are similar to standard boat insurance coverage.

- Bodily injury and property damage liability: Covers the costs associated with injuries or property damage you cause to another person, as well as legal fees. If the liability limits in your yacht insurance policy are not adequate to protect your assets from a lawsuit, you may want to consider buying an umbrella liability policy , which provides a much higher liability limit.

- Collision coverage: Pays for damage to your boat after a collision with another boat or object.

- Comprehensive coverage: Covers non-collision damage or loss, including theft, fire, vandalism, or damage caused by an object other than another boat.

Additional yacht insurance options to consider

- Uninsured/underinsured boaters insurance: Covers any damage or injuries from an accident with an uninsured or underinsured boater. Since boat insurance is rarely required by law, if you have a significant amount invested in a vessel, this is a good insurance option to discuss with your agent.

- Medical payments coverage: Covers medical expenses and funeral expenses for anyone on that is injured, entering, leaving or while on your boat.

- Equipment and personal effects coverage: Pay to repair or replace damaged or lost items such as gear, fishing equipment, cameras, and other personal belongings.

An independent agent can work with you to determine the appropriate coverage for your needs. Because these agents work with multiple insurance companies, they can help protect all of your interests with a broad range of insurance coverage, all from one agency office.

Is Yacht Insurance Different from Standard Boat Insurance?

Yacht insurance provides similar types of coverage as standard boat insurance . However, yachts have some specific differences from standard boats, and yacht owners generally need certain protection that regular boat insurance does not provide.

For example, a yacht policy tends to restrict hauling on a trailer to only a few hundred miles, while boat insurance tends to provide coverage for trailering over longer distances.

Also, deductibles for yacht policies are very flexible, instead of having set amounts like $250, $500 or $1,000. In addition, yacht policies can include coverage for raising and removing a sunken yacht, while boat policies generally do not include this coverage.

Is Yacht Insurance Required?

Yacht insurance is not typically required by state law. However, sailboats often do have insurance requirements. So, if you have a sailing yacht, insurance may be required by law.

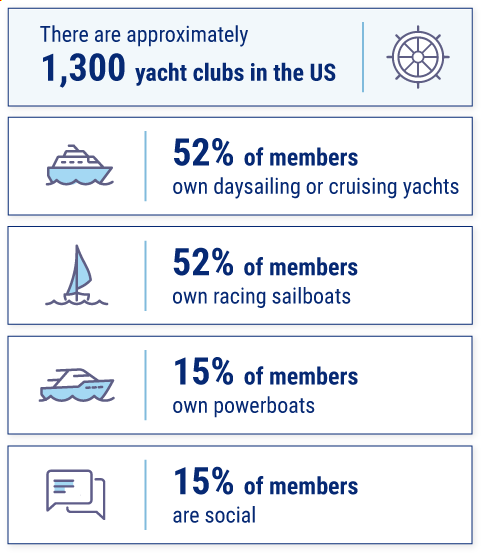

Yacht club membership statistics

You will also need to buy insurance to protect your investment in your vessel if you finance the purchase of your yacht through a lender.

Many marinas require that you have insurance in order to slip your boat at the marina. Check your local marina's guidelines, and be sure to learn about your state’s laws and regulations.

Do I Need Yacht Insurance?

A yacht can range in price from $300,000 to several million dollars. Purchasing one is a big investment and having the ability to insure your investment can ease your mind if there's an accident or your yacht needs repairs or replacement.

Insuring your yacht is also not just about the boat. In the event that an injured party files a liability claim against you, you will want to have enough coverage in place to protect your boat, home, savings, investments, and future income.

Assessing your financial situation will help you to determine how much yacht insurance you need.

Save on Boat Insurance

Our independent agents shop around to find you the best coverage.

How an Independent Insurance Agent Can Help with Yacht Insurance

A local independent agent will talk with you, free of charge, to learn about your yacht and insurance needs. They'll gather multiple quotes for you from several different companies and help you compare options and rates. Your agent can assist you with every aspect of your insurance and will be your point of contact if you need to file a claim.

An independent agent can help to prevent gaps in coverage that leave you exposed to risk. You will know you are getting the right coverage for your needs, and that you are not paying for any unnecessary coverage.

https://www.ussailing.org/wp-content/uploads/2018/01/Demographics2010.pdf

Call us today for a quote 011 831-0720

Our Services

How can we help you, cargo insurance for imports & exports.

Road Hauliers Liability

Insurance designed to cover the liability of the transporter whilst carrying cargo.

Stockthroughputs. Transit and stock in a single policy.

Goods in Transport

Insurance critical to nearly any business involved in transporting goods.

High Valued Pleasure Craft

Marine Builders Risks

A policy for boat builders that covers a vessel, or vessels, whilst in build and under construction.

Commercial Hulls in particular fishing vessels

Household goods and personal effects transit insurance

Are you moving home, locally, cross border, or overseas?

Ship Repairers Liability

Get In touch

How can we help you, our insurance.

Email Address

Marsh.com Login

Please log in to access the full marsh.com site.

Click here to login as colleague

Yacht insurance: What every owner should know

Although most owners know the importance of a yacht or boat insurance policy, the terms and conditions can be challenging to fully comprehend. Ensuring your yacht is appropriately insured means being clear on what a policy covers and excludes.

What is yacht insurance?

Normally, owners would want or require protection against the following:

- Loss of, or damage to, their own property (i.e. the boat);

- Liabilities to third parties

Therefore, a typical yacht insurance policy, such as Marsh YachtCover, will have two basic sections:

Section 1: Hull and Machinery (H&M)

This section covers loss or damage to the boat and its machinery — including the hull, engines, sails, personal property, and equipment necessary to operate the boat.

Marsh YachtCover typically uses an "All Risks" wording, which provides cover against all perils to which the yacht may be exposed, with the exception of some named exclusions.

The most common causes of loss include:

- Perils of the sea (e.g. grounding, stranding, heavy weather damage, capsizing or sinking)

- Contact and collisions (e.g. with other vessels or docks)

- Fire and explosion

- Accidental damage (e.g. during loading, discharging or moving stores, gear, equipment)

- Theft or vandalism

- Like all insurances, yacht insurance will only pay for a loss if the loss is “fortuitous” — meaning that the loss must be accidental in some sense and not certain to occur. Therefore, insurers exclude: Loss caused by inherent vice or ordinary wear and tear.

- Loss caused by willful misconduct of the assured.

The number and type of exclusions differ from insurer to insurer. Check your full policy wording to ensure you have the coverage you require.

Tip : Check that your insurance policy extends to cover the yacht when stored on land, and whilst in transit on the road by trailer.

Section 2: Protection and Indemnity (P&I)

This section covers legal obligations to other parties — such as bodily injury, loss of life, pollution, or damage to a third-party property — while the boat is operating or under your ownership. Liabilities include:

- Third-party property damage : including loss or damage to any other boat, harbour, or dock caused by your boat.

- Wreck removal : the cost of raising, removing and destruction of the wreck if legally required.

- Bodily injury : claims for loss of life, personal injury, and illness of guests onboard.

- Pollution : including cost of clean-up, prevention measures, and third-party liabilities involving an accidental discharge.

- Legal costs : including the cost of correspondents, lawyers, surveyors, and experts required to handle any claim or legal defence.

You can also extend your liability coverage to include watersports.

Additional Coverage Features

Marsh YachtCover typically includes other coverage features that enhance your level of protection, such as:

- Medical Payments Covers reasonable medical expenses for all on-board, boarding, or leaving the insured boat on a per person basis. This may include the cost of an ambulance, treatment, and hospital charges.

- Emergency Assistance Pays for the costs incurred when emergency assistance is required, even if you and your yacht are not in immediate danger, such as towing a yacht stranded at sea.

- Uninsured Boater Coverage Pays for bodily injury to persons aboard the yacht who are injured by an uninsured owner or operator of another yacht.

- Bottom Inspection Pays for reasonable costs incurred for boat inspection after grounding, stranding, or striking a submerged object even if no damage is found, without application of any deductible.

- Marine Habitat Pays for damages that you are legally obliged to pay if you cause damage to marine habitat through physical contact with the yacht, such as dropping anchor onto a protected coral reef.

In addition, Marsh YachtCover offers optional cover depending on your needs and requirements:

- Boat Show and Demonstration Coverage Covers the boat while exhibited during recognised boat shows, sea trials, and while the yacht is being navigated for demonstration purposes.

- Personal Accident Coverage Unlike coverage under the P&I section, this is a no-fault product that can provide accidental death or permanent disablement benefits for insured persons, including the individual yacht owner, whether or not the accident is related to the yacht itself.

- Crew Liability Liabilities to crew are excluded under typical yacht insurances. Therefore, if you employ crew you will need to purchase a standalone yacht liability insurance for a limit of up to US$500 million. This can also be extended to include Personal Accident Coverage for them, as described above.

Protect with Marsh YachtCover

Marsh YachtCover provides comprehensive yacht insurance coverage for yachts valued above US$500,000 and up to a maximum of US$18 million and is supported by a team of experienced brokers and claims specialists who have served over 700 owners across Asia. Contact us to receive a quotation today.

Essential information on yacht insurance

A hassle-free guide to filing a yacht insurance claim

Are there benefits to using a yacht insurance broker?

Marsh yachtcover.

Venture out to sea with confidence

Peeravut Sukho

Country Sales Leader, Thailand

Please note that Marsh PB Co., Ltd and Marsh McLennan are not engaged by nor involved in any manner with Bonus Ranch and its promotion, and has not placed any insurance for nor insured any of its businesses or operations. Marsh as a licensed insurance broker will not request customers to make payment via non-standard methods, such as the transfer of money to any individual’s bank account.

- Search Search Please fill out this field.

- Personal Finance

Yacht Insurance: What It Means, How It Works

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

What Is Yacht Insurance?

Yacht insurance is an insurance policy that provides indemnity liability coverage for a sailing vessel. It includes liability coverage for bodily injury or damage to the property of others and damage to personal property on the vessel. Depending on the insurance provider, this insurance could also include gas delivery, towing, and assistance if your yacht gets stranded.

Key Takeaways

- Yacht insurance provides indemnity liability coverage for a sailing vessel.

- It has two principal parts: hull insurance and protection and indemnity (P&I) insurance.

- While there is no legal agreed upon length that separates a yacht from a pleasure boat, generally it is considered to be somewhere between 27 and 30 feet.

Understanding Yacht Insurance

Some companies specialize in providing coverage for antique and classic boats. You can choose between an actual cash value or agreed value policy. The former is cheaper but factors in depreciation and market value, so your payout will be less. Some policies include discounts based on your boating education, safety features, and whether you have a hybrid or electric boat. Some companies also offer a package deal that decreases the rate on a yacht insurance policy if you purchase additional policies, such as for your home or car.

Boats are defined as vessels under 197 feet long, while ships are 197 feet long or longer. There is no agreed upon length for a yacht , but they are generally considered to be at least 30 feet long. A vessel under 27 feet is considered a pleasure boat.

Although there isn't a standard definition of what the size of a yacht is, we can see that there is a general agreement within a range. With that being said, this general range falls within class 2 and class 3 of the Federal boat classification system.

For its own purposes, the National Boat Owners Association marks the dividing line at 27 feet. Most yacht coverage is broader and more specialized than pleasure boat coverage, because larger vessels travel farther and are exposed to greater risks.

Yacht insurance is broader and more specialized than pleasure boat coverage, due to the fact that a yacht can sail farther and thus runs greater risks.

A yacht insurance deductible, the amount of money you must pay out of your own pocket before your insurance kicks in, is usually a percentage of the insured value. A 1% deductible, for example, means that a boat insured for $100,000 would have a $1,000 deductible. Most lenders allow a maximum deductible of 2% of the insured value.

Generally, yacht insurance coverage does not include wear and tear, gradual deterioration, marine life, marring, denting, scratching, animal damage, osmosis, blistering, electrolysis, manufacturer’s defects, defects in design, and ice and freezing.

Two Parts of Yacht Insurance

There are two principal sections of a yacht insurance policy.

Hull insurance

Hull insurance is an all-risk, direct damage coverage that includes an agreed amount of hull coverage. That amount is settled on when the policy is written, and in the case of a total loss it will be paid out in full. In addition, there is replacement cost coverage on partial losses, though sails, canvas, batteries, outboards, and sometimes outdrives are not include and instead are subject to depreciation.

Protection and indemnity (P&I)

Protection and indemnity (P&I) insurance is the broadest of all liability coverages, and because maritime law is particular, you will need coverages that are designed for those exposures. Longshore and harbor workers’ coverage and Jones Act coverage (for the yacht’s crew) are included and important, because your losses in these areas could run into six figures. P&I will cover any judgements against you and also pays for your defense in admiralty courts .

Insurance Information Institute. " Boat insurance and safety: Boat insurance coverage ." Accessed Jan. 31, 2022.

National Boat Owners Association (NBOA). " The Best Yacht Insurance Rates ." Accessed Jan. 31, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Insurance Discounts ." Accessed Jan. 31, 2022.

Malhotra Insurance. " Watercraft and Boat Insurance: Is There a Difference? " Accessed Jan. 31, 2022.

U.S. Government Publishing Office. " Coast Guard, DOT ." Accessed Jan. 31, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Boat Insurance Coverage FAQs: What is a normal deductible? " Accessed Jan. 31, 2022.

Absolute Insurance of Palm Beach County, Inc. " Yacht Insurance ." Accessed Jan. 31, 2022.

International Marine Underwriters. " Commercial Hull and P&I ." Accessed Jan. 31, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Boat Insurance Coverage FAQs: What should I look for in a yacht policy? " Accessed Jan. 31, 2022.

Gallagher Charter Lakes. " Protection & Indemnity Insurance – What is it??? " Accessed Jan. 31, 2022.

- Property Insurance: Definition and How Coverage Works 1 of 21

- The Importance of Property Insurance 2 of 21

- What Is Personal Liability Insurance? Definition and Coverage 3 of 21

- Scheduled Personal Property: What it is, How it Works 4 of 21

- Unscheduled Personal Property: What It Is, How It Works 5 of 21

- Floater Insurance: What it is, How it Works, Examples 6 of 21

- Unscheduled Property Floater 7 of 21

- Wear and Tear Exclusion: What it is, How it Works, Claim Disputes 8 of 21

- A Quick Guide on How to Insure Jewelry 9 of 21

- Jewelry Floater: What Is It, and How Does It Work With Insurance? 10 of 21

- Special Insurance for Designer Clothes 11 of 21

- Consignment Insurance: What It Is, How It Works 12 of 21

- A Quick Guide to Landlord Insurance 13 of 21

- Best Landlord Insurance Companies 14 of 21

- Mobile Home Insurance: Do You Need It? 15 of 21

- Modular vs. Manufactured Home Insurance 16 of 21

- Tiny House Insurance: How to Insure Your Tiny Home 17 of 21

- Watercraft Insurance: What It is, How It Works 18 of 21

- Yacht Insurance: What It Means, How It Works 19 of 21

- What Is Umbrella Insurance Policy? Definition and If You Need It 20 of 21

- How an Umbrella Insurance Policy Works 21 of 21

:max_bytes(150000):strip_icc():format(webp)/jet_ski_103967155-56a0e1d45f9b58eba4b4cd01.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- MERCHANDISE

- CLEAN OCEANS

- CUSTOMER CARE

Boat Insurance - what does it cover?

Many South Africans have discovered this to their cost when not, or under-insuring, their boats in the hope nothing will happen to them or their boats.

While boat insurance is NOT a legal requirement in South Africa, a boat purchased through a financial institution may come with a requirement that insurance is taken out for the duration of the loan.

Boat insurance works the same way as car insurance does. If you damage your boat or cause injuries or damages to someone else, you file a claim with your insurer asking them to pay for the damages. If the incident is covered, your insurer pays for the losses or injuries up to your coverage limits.

New boats are more likely to be insured by owners due to the size of the investment or due to financing of the vessel.

There is however a large proportion of boat owners with older boats or boats purchased second-hand that do not have insurance on their watercraft. In this case, owners often feel that any, damages encountered may be absorbed.

In brief, the risk is more than physical loss or damage to your vessel but also extends to liability claims where a boat owner may be held liable for having seriously injured a third party — for example, another water-skier or swimmer. These liability claims are normally large and the expense of defending them can easily run into hundreds of thousands of rands. Not all facilities and marinas enforce or stipulate that the clients that utilize their facilities have insurance in place but this scenario is slowly changing. - Source: SABBEX / Boating South Africa - Caryne Duvenhage of Club Marine

Insuring a private watercraft/boat

There are a variety of Insurance companies and brokers in South Africa to cover your boat or watercraft who offer a wide range of cover for all types of pleasure watercraft or boats available.

Cover may take into account the use of the vessel in inland waterways (i.e. rivers and dams) as well as coastal waters through to deep-sea fishing.

Cover can also be extended to include numerous liability requirements as in the case with charter operators or commercial users or additional equipment.

When insuring your boat, the following may be listed on your cover:

- Value of the boat

- Value of your outboard motor/s

- Value of accessories

- Note that boat trailers are normally NOT included in watercraft cover and need to be insured separately.

Your policy may include, third-party liability, extended liability, credit shortfall, SASRIA registration, and roadside assistance, out of border cover.

Almost all insurance policies come with an ‘excess’ clause – this being the amount you will have to pay upfront in the event of a claim, so it is vital you carefully examine the policy quote before signing on the dotted line.

This insurance excess must be paid, regardless of the circumstances surrounding the accident. The insurance company uses this to dissuade fraudulent or suspicious insurance claims and also to lower premium payments.

For more information, feel free to ask your nearest Suzuki Marine Dealer who will gladly assist you!

Topics: News , Product Features , Buying a boat , Innovation Awards , New products , Events , Promotion , Clean Ocean Project , Brand , Why Suzuki , Technical , Bass Fishing , Testimonials , Commercial Users , Engine Performance Report , Start Boating , Accessories , Suzumar

Recent Posts

Popular articles.

- Start Boating

- Clean Ocean Project

- Accessories

- Buying a boat

- Product Features

- Testimonials

- Bass Fishing

- Innovation Awards

- Commercial Users

- New products

- Engine Performance Report

- Boating Lifestyle

- Aftersales Service

- Fuel Efficiency

How to “Break in” your NEW Suzuki outboard motor

The process of breaking in your specific Suzuki outboard motor is outlined in the Suzuki owner's manual, however, here are some quick...

South African Fishing Permits, now available online

The Department of Forestry, Fisheries and the Environment (DFFE) has launched an online Recreational Fishing Permit Application that...

What License And Documents Are Required When You Start Boating?

Only if the engine is smaller or equal to 15hp, you do not need a skipper’s license.

For all the other cases, before you get on your...

- TERMS & CONDITIONS

- PRIVACY POLICY

- COMPANY INFO

Horizon Underwriting Managers (Pty) Ltd, has been serving the South African Insurance Market since 2012, we underwrite on behalf of Lombard Insurance. Our dedicated team are specialists in their field and provide the best coverage, as well as risk management advice. We offer a wide range of marine policies and plans tailor-made to meet your specific insurance requirements. We look forward to partnering with you in business excellence.

Full support to our brokers and clients from proposal to policy document and beyond...

A nationwide footprint with offices in Johannesburg, Durban and Cape Town

Cover for marine import and export, transit, stock throughput and commercial hull, as well as charterers, stevedores and container liabilities

A+ backing from Lombard Insurance Company Limited

Access to global markets that provide A+ reinsurance capacity

About Chubb: About Chubb

About Chubb: About Chubb in the U.S.

About Chubb: Careers

About Chubb: Citizenship

About Chubb: Investors

About Chubb: News

Claims: Claims

Claims: Claims Difference

Claims: Claims Resources

Claims: Report a Claim

Login / Pay My Bill: Login for Business

Login / Pay My Bill: Login for Individuals

Login / Pay My Bill: QuickPay for Businesses

Login / Pay My Bill: QuickPay for Individuals

Login / Pay My Bill: Login to CRS

Contact Us: Contact Us

Contact Us: Global Offices

- File a claim

- Get a quote

Yacht Insurance

Protect your superior watercraft with superior protection from Chubb.

Chubb has been a leading provider of yacht insurance for over 100 years, offering some of the most comprehensive policies available for private, pleasure watercrafts. Being on the water is an experience of peace, calm, and new adventures on the horizon. It’s an experience you want to protect. Our Masterpiece® Yacht insurance policy offers superior coverage for pleasure yachts 36 feet or greater in length. And for captained vessels 70 feet or greater in length and valued at $3 million or more, our Masterpiece Yacht Preference policy has the specialty coverages you and your crew need.

Masterpiece® Yacht Policy Highlights

Agreed Value Coverage

We pay the entire agreed amount, with no deductible, for a total loss. With our Masterpiece Yacht Select policy, eligible vessels can receive Replacement Cost coverage up to 120%.

Liability Protection

Limits of coverage to suit your personal needs, including: legal defense costs, liability as required by the Oil Pollution Act of 1990, wreck removal, and Jones Act coverage for paid crew.

Replacement Cost Loss Settlement

Repair or replacement of covered property is paid for without deduction for depreciation for most partial losses.

Uninsured/Underinsured Boater Coverage

Pays for bodily injury to persons aboard the insured watercraft who are injured by an uninsured owner or operator of another vessel.

Medical Payments

Reasonable medical and related expenses are included for all those onboard, boarding or leaving the covered vessel. These benefits are provided on a per person basis, rather than per occurrence. Optional and customized limits are available.

Search & Rescue

Up to $10,000 for the expenses incurred by an insured in relation to a governmental unit such as the United States Coast Guard (USCG) who provide emergency aid and assistance are included for no additional charge. With our Masterpiece Yacht Select option, coverage is available up to $25,000.

Longshore and Harbor Workers’ Compensation Act (LHWCA)

When Liability coverage is purchased, coverage is automatically provided for those employed aboard the vessel who are within the jurisdiction of the LHWCA.

Personal Property & Fishing Equipment Coverage

Protection is automatically included for the clothing, personal effects and fishing gear of the boat owner and their guests. Optional higher limits are available.

Coverage for Marinas as Additional Insured

Marinas, yacht clubs and similar facilities where clients keep their vessels are included as Additional Insureds.

Trailer Coverage

We automatically include coverage up to $5,000 for your trailer used with your insured vessel. Higher limits are available.

Emergency Towing & Assistance

Our policy includes this coverage with optional higher limits available.

Boat Show & Demonstration Coverage

We automatically provide this coverage, at no additional charge.

Precautionary Measures

We will pay up to the policy limit the reasonable costs incurred to haul, fuel or dock the insured watercraft endangered by a covered peril.

Bottom Inspection

We will cover the reasonable costs to inspect the bottom of an insured vessel after grounding, stranding, or striking a submerged object. There is no deductible for this coverage.

Oil Pollution Act of 1990 (OPA) Coverage

If Liability coverage is purchased, our policy provides coverage in addition to the Liability limit, up to the required OPA statutory limits, regardless of the Liability limit chosen. Additionally, if the OPA statutory limit is increased in the future, our policy will automatically increase the applicable OPA limit to match the new higher statutory limits.

Temporary Substitute Watercraft

Up to $5,000 to charter a temporary substitute watercraft if the insured vessel is out of commission due to a covered loss and cannot be repaired within 72 hours. With our Masterpiece Yacht Select policy offering, the limit of Temporary Substitute Watercraft is increased to $10,000.

Marine Environmental Damage Coverage

This feature provides protection up to $10,000 for fines and penalties as a result of marine environmental damage, as defined by the policy terms. Coverage is provided in addition to the insured's applicable Liability and OPA limits. With our Masterpiece Yacht Select policy offering, the limit of Marine Environmental Damage Coverage is increased to $25,000.

57% of boating accidents happen on calm days with waves less than 6 inches.

Chubb offers some of the most comprehensive protection and services available rain or shine.

*Source: 2016 Recreational Boating Statistics, United States Coast Guard

Masterpiece Yacht Preference

Masterpiece Yacht Preference fulfills the specialty insurance needs of luxury yacht owners with captained vessels 70 feet in length and greater, valued at $3 million or more.

No depreciation applies on the following items

Machinery inside the hull, Personal Property, dingy/tender, and Personal Watercraft.

Emergency Towing Service

We include coverage up to the amount of Property Damage with no deductible.

The medical payments limit offered is on a per occurrence basis, and we will pay costs incurred up to three years from the date of occurrence.

Marina as Additional Insured

The marina, yacht club, or similar facility where the insured yacht is docked, moored, or stored is included as an Additional Insured.

Captain and Crew Coverage

Liability coverage is extended to the captain and crew members serving aboard the insured yacht.

Defense Costs

Defense costs are included in addition to the limit of liability and includes up to $50,000 loss of earnings.

Mooring or Slip Rental Agreement Waiver

When waiver of subrogation is required through a written contract by a yacht club, marina, or similar facility used for the purpose of storage or slip rental, our Masterpiece Yacht Preference policy will permit an insured to waive their rights of subrogation.

Masterpiece® Recreational Marine Insurance Brochure

Your client’s guide to watercraft protection. Make sure they’re protected, with the right coverage, so they can relax on and off the water.

Related Coverage

We provide exceptional boat insurance with tailored protection.

We help you stay ahead — and informed with these helpful tips and tricks

This information is descriptive only. All products may not be available in all jurisdictions. Coverage is subject to the language of the policies as issued.

Find an Agent

Speak to an independent agent about your insurance needs.

Boat Insurance

Wher-rena Boatland is not a insurance company but we do have several companies that we recommend that offer great prices on insurance. Click on the logos links to get a quote today.

Your Sailing Yacht Insurance Specialist

You require expertise and experience in your sailing yacht insurance specialist, and for over three decades w.r. hodgens marine insurance has delivered. se habla espanol, sailing yacht insurance, our background and knowledge make navigating to the correct sailing yacht insurance coverage for private yachts, charter or bareboat, catamarans, or fleet operations simple and clear, with proven results and satisfied customers. your sailboat investment needs protection, and the critical peace of mind. w.r. hodgens marine insurance brings through personalized and comprehensive underwriting experience helps smooth out every passage. we have programs for all sailing yachts and our sailboat insurance coverage extends worldwide, from the usa, bahamas, cuba, and caribbean through the panama canal, pacific ocean, and the mediterrranean and all other areas..

- Worldwide navigation limits

- Agreed value

- Personal Effects

- Uninsured boater insurance

- Paid crew, charters

- Pollution liability yacht insurance

- We insure all top builders

- Towing, underway assistance

The sailing yacht lifestyle you've earned deserves an insurance specialist dedicated to preserving both that lifestyle and your substantial investment. W.R. Hodgens Marine Insurance brings that commitment along with the sailing and insurance expertise to keep you underway, on course, and secure anywhere your sailing yacht takes you. Contact W.R. Hodgens Marine Insurance for all your yacht insurance needs.

Sailing yacht quote.

Get fast quotes from AAA Underwriters.

Peace of Mind

Get peace of mind today.

Charter Insurance

Charter Insurance for single yacht or fleet needs.

Sample Yacht Insurance Builders

We have listed here a sampling of only some of the sailing yacht builders we insure. sailing yacht insurance has coverage for all quality sail yachts. contact us with your sail yacht information for an insurance quote now..

Abeking and Rassmussen Adrina Alubat Alliaura Marine Antares Yachts Azzura Cabo Rico Class Yacht CNB Superyacht Comar Contest Yachts Cookson DK Yachts Delfine Denchomarine Derecktor Elan Marine Fantasi Yachts Finngulf Goetz Grand Soleil Latini Marine Lerouge Yachts Marten Maxi Yachts McMullen and Wing Morris Yachts Murtic Yachts Newport Nordia Passport Pendennis Perini Navi Reichelpugh Rivolta Royal Huisman Sangermani Santa Cruz Seawind Cats Sparkman and Stephens

Alden Allied Amel Angleman Arcona Baltic Bavaria Bayana Beneteau Bruce Roberts C and C Cal Cantiere del pardo Grand Soleil Catalina CCYD Cheoy Lee Damstra Dean Dehler Delphia Deutsche Werke Dufour Duwamish Erickson Fisher Fountaine Pajot Freedom Freeport Fuji Gib Sea Gulfstar Hanse Yachts Hallberg Rassy Kelly Herreshoff Hinckley Hunter Hylas Kanter

Island Packet Islander Jenneau Jomeri Jongert Lagoon Littleharbor Maio Manta Marten Moody Morgan Nauticat Nautor Niad Pacific Seacraft Pearson Privilege Sabre Saga Saturna Schock Seawind Skookum Southern Ocean Spencer Swan Tartan Tayana Trintella Tripp Design Valiant Vismara Vitters Westsail Warwick Wyliecat X-Yachts

Sailing Yacht Insurance Made Simple

Fill out the Sailing Yacht Insurance Quote Form to get started. Or call us at 954-523-6867 and we will be happy to help you.

COMMENTS

Welcome to SA's #1 Marine Insurance comparison website. If you need quotes for your vessel, hull, boat, yacht, jetski or stock throughput, you're at the right place! ... ("the User" / "You") use of the (Marine Insurance ) website located at the domain name (www.MarineInsurance.co.za) ("the Website"). By accessing and using the ...

If you own a small yacht or a fleet of ships, you need marine insurance. Protect yourself from risk with the largest maritime insurer in Africa. Direct: 0860 444 444 Claims: 0860 505 911 ... marine.santam.co.za Quotes. [email protected] [email protected] ...

We are Africa's largest marine insurer in terms of product range and footprint, providing technical and reinsurance support to various African insurers, such as Santam Namibia, Botswana Insurance (BIC), Nico, Alliance Insurance and CGSM.

To start enjoying the benefits of being covered by Club Marine Insurance simply complete the available online quote form or feel free to contact the Boating World office for more information. Quote: SMS "BW" to the number 44077. CONTACT: 0861 819 219 or +27 11 591 3500.

044 382 0550. [email protected]. As boat enthusiasts ourselves, we're specialists in providing bespoke insurance to meet your exact needs, so whether your pleasure is in a dinghy or jet ski, motorboat or yacht we can help you choose exactly the right insurance policy for you. Having adequate boat insurance can help to protect you against any ...

Watercraft Insurance Quote. At Club Marine we strive to simplify the take-up process as much as possible. We are able to offer you, peace of mind that your insurance is in place once we've received your completed proposal form. It is also very easy for you to request a quotation online and one of our specialist consultants will get back to ...

Trusted by Clients. Club Marine Insurance Brokers cc is one of South Africa's leading insurance brokerage companies, specialising in all short-term insurance products. We set down roots in 1985 and, are proud to have a long-standing history of Client and Insurer satisfaction. At Club Marine, we are passionate about what we do and are able to ...

There are two core principles that form the backbone of all marine coverage. Liability coverage. This ensures your legal obligations to third parties are covered in the event of injury, loss of life or property damage occurring due to the usage of your boat. Physical damage. This covers damage or accidental loss to your boat and its machinery ...

Unlike other major investments, e.g. property, a boat moves through two unpredictable elements - water and wind; and it thus has a greater risk to be damaged. Abromowitz Sharp & Associates offers marine insurance packages both locally and internationally, working with the best marine insurance specialists.

At Intasure, we proactively manage your client portfolio, giving you relevant, unbiased advice and personalised financial services. We are committed to providing you with innovative, flexible, practical insurance solutions along with pertinent advice that is tailored to suit your needs. Intasure is an Authorised Financial Service Provider FSP ...

Home » Products & Services » Personal Insurance » Yacht and Small Craft Insurance. 0861 COVERED 506, 5th Floor, The Equinox, Milton Road, Sea Point, 8005 Your Name (required) ... catamaran, yacht, an engine driven boat or cabin cruiser you will need some form of insurance coverage. Vessels can be damaged in transport and are also open to ...