Cookies are used to make this website work and to enhance your experience. To learn more about the types of cookies this website uses, see our Cookie Policy. You can provide consent by clicking the "I Consent" button or by canceling this cookie notice. Read our Privacy Policy for more information about information we collect.

Cookies are used to make this website work and to enhance your experience. To learn more about the types of cookies this website uses, see our Cookie Policy. We need your consent to use marketing cookies. Marketing cookies are used to track visitors across websites. The intention is to display ads (via third party services) that are relevant and engaging for individual users. Please select the checkbox below to indicate your consent.

You are using an outdated browser. Please upgrade your browser to improve your experience.

AFRICA OIL ANNOUNCES THE PASSING OF LUKAS H. LUNDIN

VANCOUVER, BC , July 27, 2022 /CNW/ - (TSX: AOI) (Nasdaq-Stockholm: AOI) – Africa Oil Corp. ("AOI", "Africa Oil" or "the Company") regrets to announce the death of the Company's founding shareholder and inspirational leader behind the Company, Mr. Lukas H. Lundin , in Geneva, Switzerland on 26 July 2022 at the age of 64, following a two-year battle with brain cancer. View PDF version

Over the past 40 years, Lukas Lundin was the driving force behind the tremendous success of the Lundin Group of Companies. Lukas started his career in the international energy and mining sectors in the early 1980s working side-by-side with his father, the late Adolf H. Lundin .

Under the leadership of Lukas and his brother Ian, and in close cooperation with the rest of the Lundin family, the Lundin Group of Companies has grown into an internationally recognized group of energy and mining companies with operations around the globe, employing more than 15,000 people and creating opportunities for tens of thousands more.

The eleven companies that make up the Lundin Group of Companies today have a combined market capitalization exceeding USD $11 billion .

Lukas Lundin founded Africa Oil Corp in 2007 by transforming a former group company, Canmex Minerals Corporation, into an East African oil exploration vehicle. Following some major discoveries in Northern Kenya , the company has grown into a large, highly successful full cycle company with production in Nigeria and development and exploration projects throughout Africa .

Lukas Lundin's sons Harry, Adam, Jack and William say in a joint statement: " Our father is our biggest inspiration. His passion for the industries to which he devoted his life was unparalleled. Lukas saw people as the key to success and spent decades building some of the strongest management teams in our industries. He always strived to empower those working with him and continuously pushed us to aim higher. We could not have had a better father and mentor.

"Our family is deeply saddened about Lukas' passing but takes comfort in the knowledge that his legacy will live on for generations to come. Having worked side-by-side with Lukas for many years, all of us look forward to continuing to build on the successes of the companies within the Lundin Group - with the support of our shareholders and stakeholders, not least the members of the local communities where we operate. The companies in the Lundin Group stand stronger than ever and the Lundin family is united in our commitment to remain long-term shareholders."

Africa Oil's President and CEO, Keith Hill , commented, "The world has lost a leading force in responsible, sustainable and profitable development of natural resources. I have lost a good friend and mentor who gave me the opportunity to grow a number of companies under his guidance and leadership. His tireless enthusiasm, his endless persistence and his steadfast knowledge that we were performing an invaluable service to the world by working with developing nations to create value through the responsible development of their resources, should be a model for future generations. We look forward to continuing his vision under the leadership of the third generation of the Lundin family business who will undoubtedly preserve and grow his legacy."

Africa Oil Corp. is a Canadian oil and gas company with producing and development assets in deepwater Nigeria ; development assets in Kenya ; and an exploration/appraisal portfolio in Africa and Guyana . The Company is listed on the Toronto Stock Exchange and on Nasdaq Stockholm under the symbol "AOI".

The information was submitted for publication, through the agency of the contact person set out below, on July 27, 2022 at 11:30 a.m. ET .

SOURCE Africa Oil Corp.

- Corporate History

- Corporate Directory

- Corporate Governance

- Board of Directors

- Project Overview

- Block 3B/4B

- Sustainability Reports

- ESG Policies

- Standards of Operations

- Community Development Highlights

- Transparency Disclosures

- Independent Audit Reports

- Investment Centre

- Dividend Information

- Share Capital

- NCIB Program 2022-2023

- Equity Financing

- Analyst Coverage

- Financial Calendar & Events

- Financial Statements, Meeting Materials & Corporate Filings

- Corporate Presentations

- News Releases

- Contact Info

- Request More Info

- Privacy Policy

The Stunning Ritz Carlton EVRIMA Yacht

Gliding Across Tokyo’s Sumida River: The Mesmerizing Zipper Boat

CROCUS Yacht: An 48 Meter Beauty by Admiral

PHI Yacht – Royal Huisman’s $45 Million Superyacht

- Zuretti Interior Design

- Zuretti Interior

- Zuccon International Project

- Ziyad al Manaseer

- Zaniz Interiors. Kutayba Alghanim

- Yuriy Kosiuk

- Yuri Milner

- Yersin Yacht

- Superyachts

SAVANNAH Yacht – Extravagant $140 Million Superyacht

She can accommodate up to twelve guests and twenty-four crew members and is known for her unusual underwater lounge. SAVANNAH is available for charter for a weekly price of US $1 million per week.

SAVANNAH yacht interior

The SAVANNAH yacht is described as a masterpiece of design, and her interior has several unusual features. Twelve guests find space in her six cabins which were designed by the CG Design.

The master suite even has a private balcony, and many of the cabins were designed with unconventional rounded shapes to give the yacht a unique touch.

She has a hammam, open-concept gym, a spa and indoor glass balconies with large TV walls that can be individually programmed.

However, the most sought-after feature among charter guests is the underwater viewing lounge which can be transformed into a cinema if requested.

It was custom-designed and is unique to SAVANNAH. She also has a basketball court on board and never fails to surprise her guests with luxurious amenities.

Specifications

The SAVANNAH yacht was built by the Dutch shipyard Feadship and delivered to her owner in 2015.

She is 83.5 metres (273.11 ft) long with a 12.5-metre (41 ft) beam and a 3.95-metre (13 ft) draft. Her gross tonnage lies at 2,250 tons, and she sails under the flag of the Cayman Islands.

Her unique hybrid engines allow her to reach a range of 6,500 nautical miles. SAVANNAH’s top speeds lie at 17 knots, although she cruises most comfortably at 14 knots.

She was the first hybrid superyacht delivered by Feadship and remains one of their most elaborate projects.

The SAVANNAH yacht has a beautiful silvery-white exterior with large windows. Guests can enjoy her four decks with a large pool aft.

Her top deck features a spacious jacuzzi with fantastic views. Since SAVANNAH is available for charter, she carries a variety of toys and equipment on board.

Most notable are her three jet skis, two laser sailboats, four seabobs, three kayaks, and four standup paddleboards.

She also has four mountain bikes, inflatables, a trampoline, and towable toys available for the enjoyment of the guests.

SAVANNAH has four tenders, two of which are 9.5 meters (31 ft) long. Like her interior, the exterior of SAVANNAH was designed by the Parisian design office CG Design.

Her owner bought SAVANNAH for a total price of US $140 million in 2015. She generates additional annual running costs of US $10 to 15 million.

Do you have anything to add to this listing?

Love yachts join us., related posts.

ILONA Yacht – Luxury on Water $100M Superyacht

AL LUSAIL Yacht – World-class $500M Superyacht

HOME Yacht – Immaculate $35 M Superyacht

AMORE VERO Yacht – Incredible $120M Superyacht (Update 2022)

Subscribe Sign In Register

The Life and Death of Adolf Lundin

One of the world’s most audacious wildcatters, adolf lundin embraced high-risk games and politically incorrect ventures. the swedish legend amassed a fortune — after some staggering losses. even as he faced the end of his life, he dreamed of one more oil strike. an institutional investor exclusive:.

- Copy Link copied

Adolf Lundin’s final interview.

In a sunlit mid-September afternoon, purebred horses graze on the hilly meadows of Adolf Lundin’s 120-acre farm near the French village of Romblaz, some 15 miles west of Geneva. With his century-old farmhouse under renovation, Lundin and his wife, Eva, have moved a few hundred yards away, into a two-bedroom guesthouse normally used by visiting relatives. The day is unseasonably warm, but Lundin, 73, wears a wool sweater, drapes a blanket over his lap and sits next to crackling flames in the stone fireplace of the house’s spacious living room, with a vaulted ceiling two stories high. He is racked by the chills of advanced leukemia.

Eva, a breeder of show horses, offers coffee and then excuses herself. She wants to discuss with a foreman the construction work that remains at the main house.

An avid, lean-muscled jogger until disease struck four years ago, Lundin is tired. But he is eager to recount his life story — an improbable swashbuckling tale filled with harrowing ups and downs, brilliant bets, high-stake gambles and no end of controversy that altogether earned him the admiration of normally staid Swedish investors, the enmity of the Swedish press and a personal fortune estimated at $3 billion. “Early on I learned that it takes as much time and effort to do a small project as a large one,” Lundin explains, his spindly legs sticking out from beneath the blanket on his lap.

There was, seemingly, no place on earth Lundin would not go to find his fortune, nowhere he would not dig or deal. He found gold in Argentina; copper in the Congo; oil in Sudan and Malaysia; natural gas in the Middle East and Russia; nickel in Australia; and a variety of minerals in Canada, Europe and the U.S.

To finance these projects, Lundin created an unconventional business model that gave him management control, turned over technical tasks to more-experienced companies and drew capital from retail and institutional investors fired up by his vision of high risks and high returns from exotic corners of the globe. More-traditional business models depend on bank loans to finance projects, but Lundin’s ventures scared away banks — or drove up lending rates.

For years the Swedish press excoriated Lundin for cutting deals with governments notorious for corruption and brutality. Singling out an especially contentious Lundin oil venture in war-torn Sudan in 2001, Sweden’s then-minister of Foreign Affairs, the late Anna Lindh, called his activities detrimental to Sweden’s image. “We expect Swedish companies to respect an ethical code in line with human rights and the environment in which they operate abroad,” she said.

But there is no denying Lundin’s business acumen. While amassing a fortune for himself and his family, he earned at least twice that much for thousands of mostly Swedish and Swiss investors with the nerve to endure the steep rises and falls of Lundin stocks. “It was wild, but if you stuck by Adolf, you made a lot of money,” recalls Rudolf Müller, 66, a retired Swiss investment banker with UBS who invested his money and that of his clients with Lundin.

Eventually, Lundin built up his own exploration and production entities, the Lundin Group of Cos., now numbering 12. Eleven of them are publicly listed, with a total market capitalization of $11.9 billion. But at times Lundin failed so miserably that he was ridiculed by financiers and once forced to sell his home and car. “I was never poor — just temporarily broke,” he says.

Today, Lundin is best known for his investments in Russian natural gas. His Vostok Nafta Investment fund is the single largest foreign portfolio investor in Gazprom (see box). It has a 1.34 percent stake in the controversial, state-controlled Russian energy giant, whose market capitalization is $250 billion.

Yet even with time running out, Lundin is consumed by ambition. Asked if he had accomplished all his goals, he replies that in fact he dreams of one more spectacular venture: “I would like to make a huge oil strike in Russia.”

Two weeks later, on September 30, Adolf Lundin is dead.

“He always had to win,” recalls Bertil Gylling, 77, a friend who knew Lundin as a boy in Sweden. Gylling, who is now the retired chairman of his family investment company, AB Gylling & Co., says that in soccer games and sailing races, Lundin displayed an American-style competitiveness that was sometimes jarring in low-key, egalitarian Sweden.

The young Lundin identified with the rough-and-ready image of American cowboys and oil barons, even though neither existed in his Stockholm suburb of Äppelviken. He spiced his English with tough-guy clichés — “No guts, no glory” and “When the going gets tough, the tough get going” — straight out of the Hollywood action movies that enthralled him as a boy. He was riveted by popular biographies of John D. Rockefeller and J. Paul Getty.

Although Lundin came from a middle-class family — his father, Harry, managed a brewery and later became a chemistry professor — he gravitated toward Swedish society. In 1957 he married Eva, the daughter of Walter Wehtje, who spent most of his career working for the Wallenbergs, the wealthiest Swedish business dynasty, rising to CEO of Investor AB, the family’s holding company. Eva’s sister, Olga, married Marc Wallenberg, heir apparent to the business empire until his suicide in 1971. The Wallenberg connection gave Lundin badly needed cachet when he began to promote himself as a natural-resources entrepreneur.

Still, Lundin’s career got off to a slow start. After graduating as a mining engineer from the prestigious Royal Institute of Technology in Stockholm, he drilled exploratory oil wells in Colombia for Royal Dutch Shell Group from 1957 to 1960. But his repeated failure to strike oil earned him the nickname “Saltwater Lundin” at Shell, and he left the company. With financial support from his father-in-law, he earned an MBA in 1961 from the Centre d’Etudes Industrielles in Geneva. His father-in-law then helped him land a job as head of oil exploration activities in the North Sea and later in Portugal for Nynäs Petroleum, a company controlled by the Axelson Johnson Group, a leading Swedish business conglomerate.

But Lundin, who hadn’t abandoned adolescent fantasies of becoming an American-style oil tycoon, chafed at the notion of remaining a well-paid management employee. “John D. Rockefeller was long dead,” he recalled in his interview with Institutional Investor. “So Armand Hammer became my idol.” He thought Hammer, the maverick American chairman of Occidental Petroleum, showed real genius by operating in high-risk countries that the oil majors avoided, like Libya, Peru and the Soviet Union. Like Hammer, Lundin was convinced that one of the few advantages a smaller natural-resources company enjoys over the global giants is the ability to gamble on projects in countries that are politically suspect and not creditworthy enough.

In 1966, after five years on the job, the restless Swede resigned his oil exploration post at Nynäs and accepted an appointment as deputy director of the Centre d’Etudes Industrielles, his former graduate school, where he took charge of fundraising and student recruitment and taught courses in petroleum economics. He found time to indulge a new passion — investing for himself and his wealthy in-laws in mining and oil companies listed on stock exchanges around the world.

In 1968, while at CEI, Lundin began managing his own small fund, First Investors International Mining and Petroleum Fund. “As deputy director of CEI, he got to travel all around the world and would inspire his students with stories of new, exciting projects,” recalls Bo Hjelt, a Swede who studied at CEI when Lundin was on the faculty and who became his partner in a mining company before starting his own management consultancy business. Lundin regaled students with stories of searching for oil in the Colombian jungles and exploring nickel sites in the Australian outback. “Many former students invested in Lundin’s ventures and brought him other investors,” says Hjelt.

Lundin would make Geneva his business headquarters for the remainder of his life. But in 1970 he left CEI to devote himself to investing and stock picking. That year he made his first substantial profit: He earned more than $300,000, more than tripling his speculative investment one year earlier in shares of Aaro Explorations, a Canadian lead and zinc mining company.

Over the next couple of decades, there would be much bigger wins — and losses — for Lundin and his investors. Lundin loyalists took it all philosophically: “With Adolf, it was often a roller coaster,” recalls Hjelt, a longtime investor in Lundin projects. “You made a lot of money, and sometimes you were wiped out.”

One loss at the outset nearly derailed the enterprise. The episode — detailed in a 2002 biography, Adolf H. Lundin, by Robert Eriksson, a Swedish journalist who later became head of investor relations for Lundin Group — was one that Lundin could blame only on his own boneheaded tactics.

A Lundin-managed fund, Austro International Investment Corp., devised a scheme in 1970 to buy up shares in Tasminex, an Australian mining company, if the fund were to receive news before the rest of the market that a large nickel deposit had been discovered. A secret contact, an employee at Tasminex, was supposed to send a coded telex to a Lundin associate that would read “BUY THE FILLY” if nickel was found, or “DO NOT BUY THE FILLY” if it was not. In fact, no nickel lode was located, but a garbled telex was misinterpreted by Lundin and his partners, and they hastily purchased a large stake in Tasminex. With no significant nickel deposits, Tasminex stock dropped, and the value of Austro’s shares plummeted more than 90 percent, from Sf1.5 million ($348,000) to only Sf100,000. (Tasminex, now known as Tasmania Mines, is still listed on the Australian Stock Exchange. Austro was liquidated in 2002.)

Asked about the episode in his last interview, Lundin conceded that it took “a lot of perseverance and some successful projects” to regain investor confidence after the big loss. For a time, even the Wallenbergs shied away from him. As for the possibility of impropriety, Lundin seemed unconcerned. “Back then, that kind of insider trading was legal in Australia,” he said. In fact, Australia didn’t pass stringent laws against insider trading until 1991.

It wasn’t long before another ethically ambiguous episode helped establish Lundin’s reputation as a significant entrepreneur and a daring, innovative deal maker. In 1972, Lundin flew to Doha, the capital of Qatar, to negotiate with the emir, Sheikh Khalifa bin-Hamad al-Thani, for a concession to explore and develop potential oil and gas fields in the Persian Gulf. The contact with the Qatar ruler had been made through an Egyptian, Ahmed el Dib, who became a 50-50 partner with Lundin in the deal.

For days Lundin stayed at the emir’s palace — taking morning walks with the ruler through the gardens, conversing for hours — and made no headway. Finally, he thought up a ruse to further his cause: Claiming to be an infallible weather forecaster, he bet the emir $1 million that Qatar, despite its desert climate, would be drenched in rain the following day. The emir readily accepted the wager. “Of course, it didn’t rain,” Lundin told his biographer. “The emir got $1 million, and I got my first oil concession.” In the interview at his farmhouse, Lundin asserted that such practices play a much diminished role in oil, gas and mineral deals nowadays. “Officials have found other ways to make money,” he said. Royalties and taxes, he suggested, offer ample opportunities to siphon off funds.

The emir gave Lundin only 120 days to create a consortium with the capital and technical expertise to carry out exploration and development off the Gulf coast. Lundin put together a group of German oil companies led by Wintershall, a subsidiary of chemicals conglomerate BASF. But the price was steep. Lundin and his Egyptian partner could keep only a 5 percent stake in the consortium — in effect, a finder’s fee and a commission for negotiating with the emir. The rest belonged to Wintershall and its partner companies.

But Lundin was in desperate straits, all the more so because the Wintershall consortium delayed drilling off Qatar for four years, until 1976. Returns from his other investments were disappointing. By then, Lundin and his family — wife Eva, sons Lukas and Ian, and daughters Nico and Mona — could no longer afford to live in Switzerland. But he dismissed any thought of moving back to Sweden. “I still had good business contacts in Geneva,” he said. “And back then, Stockholm was not an international financial center.”

The solution was to sell their large villa on the shores of Lake Geneva and move to a nonworking farm just across the border in France, where living costs were lower — and where Lundin would reside for the rest of his life. There was other belt-tightening. Eva drove the children to school in a beat-up old car, while Adolf commuted to his Geneva office by Vespa. According to friends, it was Eva’s money and emotional support that helped Lundin get through that period. “He was very fortunate to have a wife like her, who believed in him even when things went so badly,” says old friend Gylling. “She never complained.”

By the end of 1976, Lundin’s career had taken a dramatic turn for the better. The Wintershall consortium made a stunning strike: It wasn’t oil, but natural gas — and in such quantities that the field turned out to be one of the largest ever. By 1980, Lundin and his Egyptian partner’s 5 percent stake was worth $15 million. Lundin sold his share and began to build up his other petroleum, gas and mining ventures. One of the earliest was International Petroleum Corp. In 1980 the company negotiated an oil and gas concession in the Persian Gulf. To finance drilling, Lundin turned to the Vancouver Stock Exchange, which was known for financing mining projects, to issue C$8 million ($6.8 million) in shares representing 70 percent of International Petroleum.

It was the beginning of a business model in which a Lundin company would purchase a concession, keep 30 percent for the family and sell the rest either to another natural-resources company or to outside shareholders — or to a combination of both.

Still, the roller-coaster ride wasn’t over. In 1977, Lundin established Musto Explorations, a mining and investment company. He kept 30 percent, and the remaining shares went mainly to Canadian and European investors. In 1983, Musto bought the rights to a gallium and germanium deposit in Utah and invested $13 million in the venture. But when the project finally got started after a three-year delay, the yields were barely one eighth of what had been anticipated. By the time the project was abandoned in 1988, it had cost $35 million. The Utah debacle was one of the costliest failures in the history of Lundin Group, but it was followed by one of its biggest bonanzas: a gold and copper strike at an undeveloped site, Bajo de la Alumbrera, in Argentina.

In 1992, Argentina was reeling from years of political and economic instability that had scared off foreign investors, particularly from long-term ventures like mining. Not Lundin. Through his company International Musto Exploration — Musto Exploration’s successor, in which Lundin and his family once again held a 30 percent stake — Lundin purchased the rights to the undeveloped gold and copper deposits of the northwestern province of Catamarca, paying the local government a paltry $2 million in cash and agreeing to turn over 20 percent of any future net profits once mining operations got under way and the original investment had been recovered. International Musto issued $12 million in new shares, mainly to Swedish and Swiss investors, to pay for a feasibility study. It concluded that Bajo de la Alumbrera contained up to 300 tons of gold and 2.7 million tons of copper. In 1994, International Musto sold a 50 percent stake in the project to Australian mining company Mount Isa Mines for $130 million. And the following year, on Lundin’s recommendation, International Musto shareholders sold the remaining 50 percent to two other mining companies — Australian North and Rio Algom, a Canadian operation — for $325 million. “This is the biggest deal of my life,” Lundin told a Swedish news agency in a 1995 interview.

With Adolf Lundin’s death, control of the entire Lundin portfolio of companies has been turned over to his sons Lukas, 48, and Ian, 45, who have helped manage the group for the past 12 years.

Lundin gave his sons little choice but to run his businesses. Lukas recalls a family vacation on the French Riviera in 1970 when his father took his sons to a café and informed them that it was time to decide who would eventually take over his mining ventures and who would take charge of oil and gas activities. “He then left,” says Lukas. “Neither Ian nor I really knew what to do.” When their father returned ten minutes later, Lukas, 12, had agreed to be the miner, while Ian, not quite ten, opted for oil and gas.

The two brothers seem comfortable with the division of labor. “We complement each other very well,” says Lukas, chairman of the various Lundin mining companies and based in Vancouver. “I’m the builder and entrepreneur. And my brother is the organizer who makes sure everything works.”

It’s an assessment shared by Ian, based in Geneva. He points out that Lundin companies are now run in a style that suits his temperament as well as the demands of institutional investors, whose holdings have overtaken those of retail investors. Unlike earlier times, when they were just wildcatters who partnered with bigger operating firms, today almost all Lundin ventures are vertically integrated companies that carry out exploration, production and sales. “We are definitely more organized and disciplined,” says Ian, who oversees most of the oil and natural-gas ventures as well as the trust that invests the Lundin family fortune. “Twenty years ago we were cowboys.”

Despite the huge risks involved in his projects, Adolf Lundin was always able to raise capital among Swedish businessmen, professionals and shopkeepers with a reputation for being conservative investors. “He came along at a time when Swedes were investing mostly in rather dull engineering companies, and he showed them the possibilities that existed in emerging markets,” says Peter Elam Håkansson, chairman of Stockholm-based East Capital, which manages $2 billion in Russian equities. “He was also a very good storyteller — utterly fascinating.”

Members of the Swedish financial community liken Lundin’s fundraising efforts with retail investors to church revival meetings. Mats Carlsson, now head of equities for Ohman Fondkomission, a Stockholm-based investment bank and brokerage, recalled his first encounter with Lundin in 1991. It was at a meeting with investors in a cramped room at the brokerage that employed Carlsson at the time. “Lundin spoke passionately about his various companies to maybe 30 or 40 investors — everybody from mom-and-pop storekeepers to some successful entrepreneurs,” says Carlsson. “At the end, I just stood at the door and took their stock orders, from a couple of thousand dollars to $200,000.”

Lundin never hid the risks involved in his ventures and always put up sizable capital of his own. Müller, the retired Swiss investment banker, urged clients to follow his own rules: Never touch your retirement savings or mortgage the house — and invest only money you can afford to lose. “But people made money and then kept reinvesting it all,” he says. “They forgot these were very speculative projects — and a lot of them got angry when their shares tumbled.”

The Swedish press also began to take aim at Lundin. It wasn’t the risk of his projects (there were in fact more winners than losers), but rather the political controversies they raised. For example, despite Sweden’s support of a global economic embargo against apartheid-era South Africa, Lundin invested in a gold project in that country in 1982. The venture, East Daggafontein Mines, was one of the least expensive gold producing sites in the world. By early 1983, Lundin and his partners — British asset manager M&G Securities and French bank BNP — owned 35 percent of the operation and took management control. Lundin’s original 1 million rand investment ($926,000) earned him 20 million rand when he sold his 10 percent stake in 1988. (By then the rand’s value had dropped against the dollar, making Lundin’s stake worth $8.8 million.)

In his last interview Lundin defended East Daggafontein. “We improved the lives of people we worked with there,” he said. He also asserted that tax revenues from projects like his gold operation created a solid economic foundation for the postapartheid era that began in 1994 under then-president Nelson Mandela. But Lundin can’t claim to have known in the mid-1980s that the brutally repressive white minority rule was nearing an end in South Africa.

The Swedish media was also blistering in its attacks on Lundin for negotiating with Zaire’s dictator, Mobutu Sese Seko, for a copper concession in 1996. Mobutu, who took power in a military coup in 1972 and remained dictator until his death in 1997, siphoned a personal fortune estimated at more than $5 billion from his poverty-stricken nation’s treasury, while executing hundreds of suspected opponents. Lundin’s response to his critics came in a January 1997 interview with the Canadian national daily the Financial Post. “If you want to find the really big reserves today, whether ore bodies or oil fields,” he said, “you are forced to operate in countries that are not popular with the general public.”

In 2001, Lundin was denounced in the Swedish media for his oil investments in Sudan, a country shattered by civil war. Human rights groups alleged that the Sudanese armed forces were using a road built by Lundin Oil, an exploration and production company, to mount attacks against insurgents belonging to the Sudan People’s Liberation Army, or SPLA, in the southern part of the country. In a November 2003 report, Human Rights Watch took Lundin Oil and Canada’s Talisman Energy to task. “Oil companies operating in Sudan were aware of the killing, bombing and looting that took place in the south, all in the name of opening up the oil fields,” wrote Jemera Rone, Sudan researcher for Human Rights Watch. “These facts were repeatedly brought to their attention in public and private meetings, but they continued to operate and make a profit as the devastation went on.”

But Lundin rejected any blame for the atrocities. “We are bringing the Sudan out of misery,” he asserted in a March 2001 interview with Swedish financial daily Dagens Industri. Later that year, however, Lundin Oil ceased all drilling because battles were raging within its concession area, and the company was sold to Talisman for $400 million. With the proceeds, Lundin created Lundin Petroleum, currently its main oil and gas exploration and production company. In June 2003, Lundin Petroleum sold its remaining interest in a Sudanese concession to Malaysia’s Petronas Carigali for $142.5 million. But after the 2005 peace accord between Sudan and the SPLA rebels, Lundin Petroleum decided to return to the country; it is planning to drill three exploratory wells in southern Sudan by early 2007.

Despite the controversies, Lundin was hardly a pariah. His stature as a leading Swedish entrepreneur abroad led King Carl XVI Gustaf to name him international Swede of the year in 1998. Lundin was able to persuade some prominent Swedes — including former prime minister Carl Bildt and economist Anders Åslund, a onetime adviser to former Russian president Boris Yeltsin — to sit on the boards of his companies.

Lundin used his younger brother Bertil, a senior intelligence officer in Sweden’s Defense Ministry who briefed the prime minister almost daily, to help woo Bildt after he stepped down as head of government in 1994. Bertil, who died in 2004, arranged meetings between his brother and the former prime minister in Stockholm and later in Geneva, where Bildt served as the United Nations secretary general’s special envoy to the Balkans from 1999 to 2001. Bildt accepted Lundin’s offer to join the board of directors of Vostok Nafta Investment in 2000 and stayed at the post until last month, when he was appointed foreign minister in the new center-right Swedish government. “He has been a very valuable board member,” says Ian Lundin, alluding to Bildt’s political instincts.

Political savvy has certainly been essential in Lundin’s dealings with Gazprom, the Russian gas monopoly that accounts for more than 90 percent of Vostok Nafta’s $3.8 billion portfolio and about one third of Lundin Group’s total assets. Vostok Nafta, run by chief executive Per Brilioth, first started investing in Gazprom in the mid-1990s, when it began building up a portfolio of Russian energy companies. According to Lundin, he had initially considered buying Siberian oil fields but decided that the lawlessness and violence surrounding the privatization of oil and gas in those years just after the collapse of the Soviet Union made it too risky a venture even for him. “Since it wasn’t possible to wildcat in Siberia, I wildcatted on the Moscow stock exchange,” said Lundin during the interview at his French farmhouse.

His gamble paid off: In 2005, Vostok Nafta’s net income was $1.04 billion, compared with $336 million the year before. But now — under pressure to offer a more diversified fund — Lundin’s sons are thinking about winding down Vostok Nafta or transforming it as they continue to look for other investments in Russia. The most promising oil concession acquired by Lundin Petroleum, where Ian is chairman, is at a Caspian Sea site. It is contiguous to the area where Lukoil has already discovered an estimated 1 billion barrels. This is the promised oil strike that Adolf Lundin spoke about so excitedly in his final interview.

He was still talking about the venture on the phone to Brilioth on Thursday morning, September 28. Then pneumonia set in. With his wife and four children at his bedside, Lundin asked for a dose of morphine. He woke once and asked for another dose.

Death came on Saturday morning. In keeping with his wishes, his body was cremated and the ashes scattered over his beloved farm meadows. As his former biographer pointed out, “Like almost everything he did in life, he planned the end well.”i

- Latin America

- Defenders’ Database

- Defenders’ Days

- Emergency Fund

- Natalia Project

- Core International Crimes

- Civil Rights Defender of the Year Award

- About Civil Rights Defenders

- Annual Reports

- Anti-Corruption and Complaints

- Code of Conduct

- Impact Report

- Fundraising Policy

- Policy on Equity, Investment of Cash and Cash Equivalents

- Privacy Policies

- Contact – Departments

- Board of Directors

Join Our Team

- Publications

- Corporate Partnerships

- Memorial or Celebratory Donation

Report 2: First week of the long-awaited Lundin Oil trial is now completed

- Trial Reports

- 15 September 2023 07:53

Last week, the initial three days of the main trial proceedings were concluded, in a case scheduled to extend for a minimum duration of two and a half years. Ian Lundin and Alexandre Schneiter face charges related to their alleged complicity in war crimes. Specifically, they are accused of promoting the Government of Sudan’s use of warfare, which entailed systematic attacks on civilians, or at least, indiscriminate attacks between 1999-2003. The purpose of this report is to provide an overview of the charges outlined in the indictment and the defence’s stance on the substantive aspects of the case.

The long-awaited Lundin Oil-trial began last Tuesday at Stockholm District Court. The presiding Judge Tomas Zander has previously overseen the trial against an Iranian citizen suspected of participating in the mass executions and torture of political prisoners in Iran in the late 1980s ( read more here ). The trial is scheduled to extend until 2026. After the prosecution and defence have had the opportunity to present their respective cases to the court, the parties have called for a substantial number of witnesses to testify. One notable example is former Swedish Prime Minister Carl Bildt, who is called a witness in relation to his role as a member of the board of Lundin Oil between 2001-2006.

The tension outside courtroom 34 at the District Court in Stockholm was palpable on Tuesday as the trial’s scheduled starting time of 9:30 approached. Gatherings of activists and representatives of Swedish and international media waited in tense anticipation for the lead defendant Ian Lundin to arrive. By 9:45, he had still not made an appearance. [1] Only a pair of black dress shoes were visible beneath the weighty oak screen the court had put up outside the courtroom to shield him from public view. When Ian Lundin finally emerged, he gave a short, prepared statement to the assembled press and accredited members of the public. His words were marked with confidence as he reiterated that the accusations against him were completely false and that the company had always operated on the highest ethical standard. “We look forward to defending ourselves and we believe that we will receive a fair trial,” Ian Lundin stated before he entered the courtroom.

The indictment

The trial commenced with the prosecutors presenting the indictment against the defendants. Ian Lundin and Alexandre Schneiter are facing charges of aiding and abetting international crimes. To establish this, the prosecution must demonstrate that the Sudanese government carried out attacks on civilians, or at least indiscriminate attacks, and that the defendants promoted this method of warfare, with the knowledge of its criminal nature.

The prosecutors began by providing some background information on the case. From 1997 to 2003, the Republic of Sudan experienced a protracted non-international armed conflict involving the Sudanese Government and certain regime-led militia groups and opposing rebel groups, most notably the Sudan People’s Liberation Movement/Army (SPLM/A). On 6 February 1997, Ian Lundin acting on behalf of the Lundin Companies, entered into an Exploration and Production Sharing Agreement (EPSA) with the Government of Sudan. Alexandre Schneiter was also present at the signing ceremony. The purpose of the EPSA was to grant the Lundin companies concession rights to extract oil within a geographical area designated as Block 5A, in exchange for certain fees and future revenues to be paid to the Sudanese government. The exploration and extraction of oil was to be conducted through a consortium, with Lundin Petroleum AB’s subsidiary, Sudan Ltd as the operator. Lundin Petroleum AB was a successor to Lundin Oil AB following the sale of a large part of the business to the Canadian company Talisman. [2]

The prosecutor asserted that Ian Lundin and Alexandre Schneiter, through their respective roles in the Lundin companies had a decisive influence over Sudan Ltd.’s operations in Block 5A. The prosecution argued that their cooperation with the Sudanese government promoted the regime’s unlawful warfare, which was allegedly carried out to secure the company’s business venture in the area.

The Government of Sudan and militia groups led by the regime engaged in illicit warfare

On April 21, 1997, the Sudanese government and several militia groups entered into the Khartoum Peace Agreement, encompassing regions in southern Sudan, including Block 5A. The prosecution alleged that the rebel group SPLM/A did not enter into this agreement, a point contested by the defence. Nevertheless, the agreement governed the allocation of future revenues arising from oil extraction. Consequently, the prosecution holds that the conflict in southern Sudan from that juncture, also revolved around the control of prospective oil extraction. The prosecution asserted that the Sudanese government and the militias led by the regime conducted offensive military operations to secure control over oil exploration areas, resulting in the killing and displacement of civilians.

The indictment centres around five military operations conducted by the Sudanese military and regime led militia groups in or around Block 5A between 1999-2003. According to the prosecution, these military operations were necessary to create conditions for the planned activities of Sudan Ltd. in Block 5A, as the government did not exercise prior control over this area.

During these five military operations, the Sudanese government and regime led militia forces engaged in warfare which included aerial bombardments, the use of attack helicopters and multiple ground force offensives, killing and injuring civilians as well as resulting in massive destruction of civilian property and civilian displacement. The prosecution holds that unknown perpetrators from the Sudanese government and military, as well as regime-led militia groups, through this warfare committed serious violations of international humanitarian law.

Ian Lundin and Alexandre Schneiter’s Alleged Promotion of Illicit Warfare

The prosecution maintained that Ian Lundin and Alexandre Schneiter, whether individually or in concert, promoted the Sudanese government and regime-led militia group’s use of illicit warfare to create conditions for Sudan Ltd.’s operations. Specifically, the prosecution pointed to eleven instances where Ian Lundin and Alexandre Schneiter aided and abetted the Sudanese government and regime-led militia groups in their violations of the laws of war.

Between May 3-17, 1999, Ian Lundin made the decision that the Lundin companies should present demands to the Sudanese government asking that the Sudanese military take over the responsibility to ensure the security and establish favourable conditions for Sudan Ltd.’s operations in Block 5A. The Sudanese government agreed to this during a Joint Military Committee (JMC) meeting that took place on June 8, 1999.

Around November 8, 1999, Ian Lundin entered into an additional agreement with the Sudanese government. Under this agreement, he undertook the responsibility to finance and build an all-weather road in an area that was not at that time under the control of the Sudanese military or regulated militia. Ian Lundin entered into this agreement with the understanding that it would result in a series of actions, including indiscriminate attacks by the government forces, with the aim of securing government control of the area in question.

During a meeting in November 1999, where representatives from the Sudanese government and Lundin Oil Consortium members were present, Ian Lundin once again reiterated his request for the Sudanese government to establish favourable conditions for the company’s operations in an area not under the control of the Sudanese military or regulated militia. These agreements followed multiple unlawful offensive military operations by the Sudanese military and regulated militia in Block 5A, according to the prosecutor.

The prosecutor contended that Ian Lundin repeatedly made comparable demands and entered into similar agreements, with the Sudanese government up until October 2002. Lundin Petroleum AB withdrew from Sudan and Block 5A on April 25, 2003.

Alexandre Schneiter is likewise accused of making comparable demands to the Sudanese government during meetings which occurred on October 4, 2000, July 11, 2001, and October 25, 2001. Additionally, he allegedly identified the rebel force SPLM/A as a threat to the company’s operations and expressed appreciation for the Sudanese government’s efforts to establish secure conditions for the Sudan Ltd.’s business activities in the area. The prosecution asserts that these statements were made with an awareness of the government’s involvement in unlawful warfare.

Alexandre Schneiter and Ian Lundin are also accused of making the decision that Sudan Ltd. should undertake construction of additional all-weather roads. Their alleged intent in making this decision was for the Sudanese government, as part of the preparations for construction, to carry out offensive military operations that could encompass attacks on civilians, or at least indiscriminate attacks.

These allegations will be expanded upon in the forthcoming reports, as the prosecution provides evidence for their claims.

Ian Lundin’s position on the substance of the case

Ian Lundin denied all allegations. He also opposed the prosecution’s petition for disqualification from engaging in commercial activities. His defence attorney, Torgny Wetterberg, prefaced his statement by expressing his gratitude to the court and then proceeded to outline Ian Lundin’s stance on the substance of the case.

Typically, the defendant in a Swedish criminal trial is simply expected to share whether they deny or confess to the allegations made by the prosecutor. In this case, however, the court granted a request from the defendants for an exception to criminal procedure to allow them to share a more in-depth explanation of their position.

Wetterberg asserted that the defence has two primary concerns with the indictment. Firstly, he contended that the essential facts of the case had been fabricated. Furthermore, he argued that the facts presented in the indictment do not constitute sufficient evidence that the defendants have committed any criminal offence. He claimed that many of the circumstances outlined in the indictment completely lack support in the preliminary investigation, that some have been disproven by the investigation, and that others are beyond the scope of what the investigation can substantiate. An opportunity for the defence to further develop their position and present evidence in support of their claims has been scheduled for November 29, 2023.

As an example of their stance, the defence criticised the maps used by the prosecution to indicate the locations of where indiscriminate attacks supposedly took place. They emphasised to the court that even fundamental data presented by the prosecution in this case should be thoroughly examined and questioned, given the flaws they said were there in the preliminary investigation.

The defence argued that the case should be dismissed on several grounds. First and foremost, the defense claimed that there was no sufficient evidence to prove that unidentified perpetrators from the Sudanese government, military, or regime-led militia groups, committed serious violations of international humanitarian law in Block 5A during 1999-2003. To secure convictions against Ian Lundin and Alexandre Schneiter the prosecution is obligated to establish the commission of an offender under international law by some party. Consequently, disputing the existence of such an offence is an important argument on behalf of the defence.

Regarding the accusations against Ian Lundin individually the defense first restated that Sudan Ltd.’s operations within Block 5A were completely legitimate and in accordance with international regulations. For example, they pointed out that the EPSA agreement referenced by the prosecution was an internationally approved, standardised agreement used by many oil companies globally.

Secondly, the defence contested the claim that Ian Lundin had decisive influence over the Lundin companies. The consortium was responsible for the decision making regarding the business activities of Block 5A, which Ian Lundin did not take part in. It is noteworthy in this context that the defence did not allege that any other individual within the consortium engaged in criminal activity of any kind.

Thirdly, they refuted the assertion that Ian Lundin, or any representative of Sudan Ltd., ever demanded that the Sudanese military take over responsibility for securing and creating the conditions for Sudan Ltd.’s operations in Block 5A. Instead, the discussion possibly revolved around the prospect of passive protection through the deployment of a guard force. The defence further clarified that Ian Lundin had no knowledge of the fact that the Sudanese government would need to engage in illicit warfare to comply with their agreements. Additionally, they denied that Ian Lundin’s actions had any influence on the conduct of the Sudanese military or regime-led militia groups in any manner.

Lastly, the defence raised concerns about the vagueness of the language used in the indictment. They left the court – and media – with a fundamental question: “How can you prove something which you cannot define?”

Alexandre Schneiter’s position on the substance of the case

On the second day of the hearing, Alexandre Schneiter’s defence team had the opportunity to present their position on the substance of the case. Alexandre Schneiter, although perhaps not as widely recognised as Ian Lundin among the general public, is a geologist and geophysicist, who started working for IPC in 1992. IPC would later merge with Sands Petroleum AB in 1997, creating Lundin Oil AB. In 1995, he was assigned to the role of Vice President of Exploration and, in 2002 he was promoted to Chief Operating Officer.

The defence devoted a significant amount of time to describing Alexandre Schneiter’s responsibilities within the company. Their aim was to contest the allegation that Alexandre Schneiter ever had a decisive influence over the Lundin companies. Instead, they emphasised that Alexandre Schneiter spent most of his time in Geneva, working behind a desk, analysing technical data to determine where drilling for oil would be ideal. Furthermore, they contested the claim that the individuals mentioned in the indictment were subordinates accountable to Alexandre Schneiter. Apart from a British consultant, the defence argued Alexandre Schneiter had no company staff reporting to him within Sudan until the year 2002.

The defence chose to dedicate a significant part of their presentation to expound their position concerning point 9 f. of the indictment. This allegation regards statements attributed to Alexandre Schneiter during a meeting between representatives of the Sudanese government and the consortium on July 11, 2001. The defence argued that Alexandre Schneiter never informed the Sudanese representatives of any planned seismic activity in the alleged areas. They emphasised that Alexandre Schneiter never demanded that the Sudanese military create conditions for their business operations in Block 5A. Furthermore, they raised doubts about the causal link between Alexandre Schneiter’s actions during a meeting in Geneva and the alleged war crimes in Sudan. Lastly, they claimed that Alexandre Schneiter never had any intent to aid or abet the Sudanese regime or regime-led militia’s alleged illicit warfare.

The defence also reiterated their stance that the conflict in the region was driven by other factors unrelated to the oil exploration . They contested the notion that a PowerPoint presentation slide shown at a meeting in Geneva could have had anything to do with it. Furthermore, they underscored that Sudan Ltd.’s business operations in Sudan were relatively minor compared to other companies active in the region. Consequently, since the whole company’s effect on the region was so insignificant – the effect that Alexandre Schneiter’s actions could have had on the alleged war crimes must have been completely inconsequential. In any case, the chain of events presented by the prosecution would have been broken by multiple messages to the Sudanese government urging for peace in the region. Finally, they urged that Alexandre Schneiter lacked intent as to the alleged war crimes, since he himself observed civilians living in peace in the region in 2001.

At one point, Alexandre Schneiter’s defence team also attempted to use the time to argue that the preliminary investigation lacked evidentiary strength. However, at this point, Judge Tomas Zander intervened to interrupt the defence. According to the judge, the defence was crossing a line by using the exceptional permission granted by the court to explain their position to pass judgment on the quality of the preliminary investigation before the prosecution had had the opportunity to present it. This would violate the rights of the prosecution and, as such, the defence had to wait.

The defence instead criticised the manner in which the preliminary investigation had been conducted. They highlighted the fact that between 2016 and 2023, Alexandre Schneiter had been suspected of 95 different acts of participation. Notably, of the 62 suspected acts originally stated in 2016, none remain in the current indictment. The defense argued that this should be taken as an indication that the prosecution’s case lacks a solid foundation. In their closing remarks, they stated that the indictment was too vague to ever lead to a conviction.

Orrön Energy AB’s position on the substance of the case

Lastly, counsel for the company Orrön Energy AB had the opportunity to present their position on the substance of the case. The prosecution has petitioned for a corporate fine of SEK 3 000 000 to be imposed on the company, as well as a forfeiture of SEK 2 381 300 000. To prove that the fine and forfeiture should be invoked, the prosecution has to show that the profits Lundin Petroleum AB received were the result of criminal activity within the company’s operations.

Orrön Energy AB denied any assertion that criminal activities had taken place within the company’s operations. They also disputed the causality between the alleged crimes and the profit generated by the company in Sudan. In fact, they argued that the conflict in Sudan obstructed their ability to conduct business in the region, making it improbable that the conflict contributed to their profits.

Furthermore, Lundin Petroleum AB never actually received any profit from the sale of Sudan Ltd. Instead, the purchase sum from the sale of the company was paid to Sudan BV (a Dutch company), not Lundin Petroleum AB. As a result, the prosecution’s calculation of the profit which Lundin Petroleum AB supposedly earned due to the alleged crimes lacks foundation.

The defence also spent a considerable amount of time disputing the methodology employed by the prosecution to calculate the growth of the profit since 2003. They argued that the calculation lacks a solid basis and represents a purely theoretical example of how profits could have grown within the company. Hence, it was obviously excessive to petition for such a large sum to be forfeited from the company.

Next report

In the next report, we will present a summary of the prosecution’s first week of presenting the statement of facts. The prosecution’s presentation is anticipated to continue until 8 November 2023, and will delve into each of the grounds of prosecution mentioned in the indictment.

Report 21: The Last Part of Alexandre Schneiter’s defence’s opening presentation

- 19 April 2024

Alexandre Schneiter´s defense completed the final section of its opening presentation this week, which focused on explaining Alexandre Schneiter´s position on the charges of aiding and abetting in poi...

Report 20: Part Four of Alexandre Schneiter’s defense’s opening presentation

- 11 April 2024

This week´s proceedings saw Alexander Schneiter’s defense continue its presentation. They addressed the reorganisation within Sudan Ltd., which allegedly diminished Alexandre Schneiter´s role in the c...

Report 19: Part Three of Alexandre Schneiter’s defence’s opening presentation

- 3 April 2024

During this week´s proceedings, Alexandre Schneiter´s defense focused extensively on describing various internal security reports from the period October 2000 – July 2001, detailing the course o...

Head Office

Civil Rights Defenders Östgötagatan 90 SE-116 64 Stockholm Sweden

Contact [email protected] +46 (0)8 545 277 30

Get Involved

- Open Positions

- Internships

Lundin Group

Creating meaningful value.

The Lundin Group comprises a portfolio of companies in the minerals, metals, renewables and energy sectors. Our commodity exposure is diverse, but all Lundin Group companies share a singular purpose: creating meaningful value for shareholders and communities through responsible resource development.

There is no finish line to our purpose. It is an ongoing journey driven by the passion, accountability and entrepreneurial spirit that underpins the culture of our companies. We are explorers, builders and operators. However, we also see ourselves as catalysts for creating legacies.

Latest News

Marketing and corporate.

ShaMaran Petroleum Corp.

The Lundin way: "They have the vision, they go where the resource is, and they have the patience to capture the value long-term. That is exactly the ShaMaran story." – President & CEO Garrett Soden talks consolidation in Kurdistan and value creation.

Lundin Gold Inc.

“What we want to do at Lundin Gold is help develop this gold resource to create wealth for all levels of government and local communities, and our shareholders as well.” – President & CEO Ron Hochstein

Bigger and better. With more mineralization resulting from high-grade discoveries, the Vicuña District is catching the attention of the sector and continues to show upside potential.

Lucara Diamond Corp.

Explore the extraordinary: Lucara Diamond's Karowe asset is a stand-out project in the diamond industry and the future of the mine extends underground.

Vicuña 2.0 - The evolution of a new giant copper-gold-silver district: a portfolio of complementary assets

Lundin Foundation

“I am an entrepreneur” - A business incubator created by the Lundin Foundation and Lundin Gold was awarded the UN Global Compact Ecuador Award for good practices in sustainable development.

NGEX Resources Inc.

“Definitely the best initial drill holes that I’ve been involved with in my career,” says NGEx President & CEO Wojtek Wodzicki on Lunahuasi, the Vicuña District’s fourth and newest discovery.

International Petroleum Corp.

COO William Lundin outlines how the company has tripled its Reserve Life Index since inception and expects to generate $700M to $1.4B in free cash flow over the next five years.

Lundin Mining Corporation

"Lundin Mining is now really embarking on a new phase in the life of the company … with two meaningful transactions” says President Jack Lundin in a Stockholm investor presentation.

In a podcast interview, President & CEO Ron Hochstein highlights how the combination of high-quality asset and high-quality team translates at Fruta del Norte.

President & CEO Wojtek Wodziki provides an overview of the new Potro Cliffs discovery in the Vicuña district. “We’re onto a brand new very significant system here.”

BNN Bloomberg: Peter Rockandel and Jack Lundin discuss the acquisition of a majority interest in Caserones copper mine, and Jack’s Mt Everest fundraising initiative for brain cancer research.

In a Kitco News interview, President & CEO Ron Hochstein credits his team’s culture of striving to do “better and better” and accepts Kitco’s CEO of the Year award in the operating category.

In a Kitco News interview, President & CEO Jamie Beck puts Filo del Sol’s size and potential into context, and accepts Kitco’s CEO of the Year award in the non-operating category.

Speaking with BNN Bloomberg’s Peter Bell, President and CEO Peter Rockandel highlights the company’s “five excellent assets and no debt” and Josemaria, a world-class development-stage project.

Congratulations to NGEx Minerals, selected to the 2023 Venture 50, recognizing the top performers on the TSX Venture Exchange over the last year in market cap growth and share price appreciation.

At PDAC 2023, the Lundin Group hosted the panel event “Legacy Creation.” As part of that, we honoured Lukas Lundin, including showing this special video.

Lundin Energy

Torstein Sannes, former Director of Lundin Energy, describes the vision, perseverance, and teamwork involved in the discovery of the multi-billion Johan Sverdrup oil field offshore Norway

Africa Energy Corp.

Gazania Prospect Summary by Tobias Tonsing, Principal Geophysicist, Africa Energy

Bluestone Resources Inc.

Jack Lundin discusses Bluestone’s approach to responsible development, one of the key factors to the Lundin Group success over the years.

In the Spotlight

Empowering growth

The Lundin Foundation believes communities deserve access to opportunities for growth. Successful local solutions demand out-of-the-box thinking, flexibility, and an in-depth understanding of the surrounding environment.

Vicuña: a giant district in the making

Vicuña is an emerging giant copper-gold-silver district controlled by Lundin Group companies. Giant metal districts contain multiple giant metal deposits. We have three and are in the early discovery stage of potentially delineating a fourth. V iew the Lundin Group Vicuña District Presentation .

Creating value through the energy transition

Orrön Energy has a core portfolio of high quality, cash flow generating assets in the Nordics, as well as greenfield opportunities in the Nordics and Europe. Orrön also significant financial capacity to fund further growth and acquisitions.

Lundin Cancer Fund

The Lundin Family is committed to raising awareness and funding to help advance brain cancer research in a meaningful way.

By donating to the Lundin Cancer Fund, you are helping to carry on Lukas’ legacy and push the boundaries of brain cancer research.

How to donate

USA kbfus.networkforgood.com/projects/54524-f-kbfus-funds-fondation-chuv-ch

Canada kbfcanada.ca/en/projects/pushing-the-boundaries-of-innovation-for-brain-tumor-research/

Switzerland & Other Countries lausanneuniversityhospital.com/pushing-the-boundaries-of-innovation-for-brain-tumor-research Please write "Lukas Lundin" in the box labelled "Motif du Don".

Or via Wire Transfer Fondation CHUV (in memory of Lukas Lundin) Banque Cantonale Vaudoise IBAN: CH14 0076 7000 T525 3600 1 BIC: BCVLCH2LXXX Clearing: 767

Thank you. We appreciate your support.

Company Snapshot

Lundin Mining is a diversified Canadian base metals mining company with operations and projects in Argentina, Brazil, Chile, Portugal, Sweden and the United States of America, primarily producing copper, zinc, gold and nickel.

Lundin Gold, headquartered in Vancouver, Canada, owns the Fruta del Norte gold mine in southeast Ecuador. Fruta del Norte is among the highest-grade operating gold mines in the world.

Lucara is a leading independent producer of large exceptional quality Type IIa diamonds from its 100% owned Karowe Mine in Botswana and owns a 100% interest in Clara Diamond Solutions, a secure, digital sales platform positioned to modernize the existing diamond supply chain and ensure diamond provenance from mine to finger.

International Petroleum Corp. (IPC) is an international oil and gas exploration and production company with a high quality portfolio of assets located in Canada, Malaysia and France, providing a solid foundation for organic and inorganic growth.

ShaMaran Petroleum Corp. is a Canadian independent oil and gas company focused on the Kurdistan region of Iraq.

Filo Corp. is a Canadian exploration company focused on advancing our key project, Filo del Sol. Filo del Sol hosts a high-sulphidation epithermal copper-gold-silver deposit associated with a large porphyry copper-gold system. It is a very large mineralized system, with dimensions, based on wide spaced drill holes, of 7.5km north-south, 1km east-west, and 1.5km deep.

NGEx Minerals Ltd.

NGEx Minerals is a copper and gold exploration company based in Canada, focused on exploration of the Lunahuasi copper-gold-silver project in San Juan Province, Argentina, and the nearby Los Helados copper-gold project located approximately nine kilometres northeast in Chile's Region III. Both projects are located within the Vicuña District, which includes the Caserones mine, and the Josemaria and Filo del Sol deposits.

Bluestone Resources is a Canadian-based precious metals exploration and development company focused on opportunities in Guatemala.

Deeply embedded within our approach to sustainable development is a commitment to connect people with tools and knowledge that unlock economic prosperity.

Orron Energy AB

Orrön Energy is a renewable energy company with a core portfolio consisting of high quality, cash flow generating assets in the Nordics, coupled with greenfield growth opportunities in the Nordics and Europe.

Faraday Copper Corp.

Faraday Copper is a Canadian exploration company focused on advancing its flagship copper project in Arizona, U.S.

Fireweed Metals Corp.

Fireweed Metals is a public mineral exploration company on the leading edge of critical minerals project development. Fireweed is well-funded, with a healthy balance sheet and has three projects located in Canada.

Montage Gold Corp.

Montage Gold is a Canadian-listed company focused on becoming a premier multi-asset African gold producer, with its flagship Koné project, located in Côte d’Ivoire, at the forefront.

Group Total Market Cap

* July 2022 - Lundin Energy acquired by BP Aker

CORPORATE OFFICE Suite 2800, Four Bentall Centre, 1055 Dunsmuir Street, Vancouver, BC, V7X 1L2 Tel: +1 (604) 689-7842

STOCKHOLM ADDRESS Hovslagargatan 5, 3rd floor, SE-111 48 Stockholm, Sweden Tel: +46-8-4405450

©2024The Lundin Group | Site by Adnet

- Advertise With Us

- Subscribe To Newsletter

- Decarbonisation

- Gas & LNG

- Middle East & North Africa

- North America

- South America

- Thought Leadership

- Video Interviews

- About dmg energy

- Energy events

- Connections

- Upcoming Webinar

Oil Billionaire Ian Lundin Risks Jail Sentence as Historic Trial on Sudan War Crimes Begins

By Bloomberg

Sep 05, 2023

Ian Lundin, chairman of Lundin Petroleum AB, left, and Alex Schneiter, chief executive officer of Lundin Petroleum AB, pose for a photograph ahead of an interview in Stockholm, Sweden, on Thursday, Nov. 29, 2018. Photographer: Mikael Sjoberg/Bloomberg

(Bloomberg) -- The oil billionaire ex-owner of Lundin Oil AB will this week appear in Sweden’s biggest ever criminal prosecution over his alleged involvement in atrocities in Sudan to help further the company’s business in the war-torn region.

Ian H. Lundin, former chairman and controlling owner of Lundin Oil, and Alex Schneiter, its ex-chief executive officer, are accused by Swedish prosecutors of complicity in war crimes in Sudan between 1999 and 2003. The trial at the Stockholm district court follows an almost 13-year investigation and is scheduled to last two-and-a-half years.

Both Lundin and Schneiter deny all the allegations.

“No other trial has been close to being as time-consuming,” Thomas Bodstrom, a lawyer representing a group of Sudanese in the prosecution, said in an email. The two men risk jail terms if found guilty.

The company, which sold its oil and gas business in 2022 and changed its name to Orrön Energy AB, is separately facing a confiscation order of 2.4 billion Swedish kronor ($218 million) over the allegations.

The case will probe Lundin’s presence in an area of South Sudan known as Block 5A, where Sudanese armed forces led military operations to take control of the area and ease the way for Lundin Oil’s exploration, the prosecutors argued.

They started the investigation in 2010 after a report from the European Coalition on Oil in Sudan found that 12,000 people died and 160,000 were forcibly displaced in Block 5A between 1997 and 2003.

“People were abused, raped and murdered. The rivers were poisoned, killing cattle and causing famine,” Bodstrom said. “The prosecutors have strong evidence that Lundin Oil, through its actions, shares the responsibility.”

According to the prosecution, the military systematically attacked civilians, through bombardments from transport planes, shooting civilians from helicopter gunships, abducting and plundering civilians and burning entire villages.

“The prosecution has no chance for success because the charges are based on allegations that are not supported by the investigation,” Torgny Wetterberg, Ian Lundin’s lawyer, said. “It’s a mystery why the prosecution is pursuing this case.”

In a 2018 interview with Bloomberg, Lundin and Schneiter denied the accusations, saying neither they, nor anyone else at the company had knowledge of any crimes committed. They said the company’s presence helped the local population in an area haunted by a decade of battles among armed groups.

“We are facing Sweden’s longest trial ever. If you need that much time to show that you have a case, you don’t have a case,” Per E Samuelson, Schneiter’s lawyer said in an email. “There is no connection between any action Alexander Schneiter has taken and any combats in Sudan.”

©2023 Bloomberg L.P.

By Rafaela Lindeberg

Related articles

Guyana Takes Exxon to Court Over Misstated Value of Equipment

Stocks Rally as Jobs Put September Fed-Cut in Play: Markets Wrap

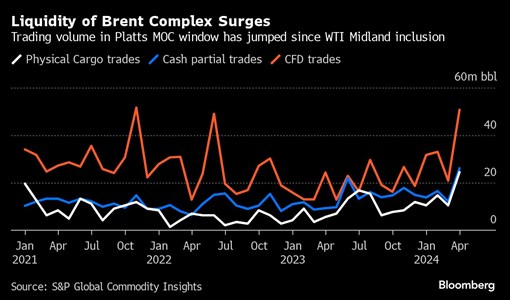

World’s Most Important Oil Price Transformed by Adding US Crude

BHP Woos South Africa in Pursuit of $39 Billion Anglo Takeover

Shell beats forecasts with $7.7b Q1 profit in 2024

Oil Extends Drop on Mideast Cease-Fire Prospects, US Inflation

Keeping the energy industry connected.

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Holds Drop as Mideast Cease-Fire Talks Erode Risk Premium

Oil Drops as Progress on Cease-Fire in Gaza Shrinks Risk Premium

Red Sea Diversions Spew Carbon Emissions Equal to 9 Million Cars

Qatar Energy Minister: demand for oil and gas will continue for a long time and industry must act responsibly

Exxon and Chevron Output Booms in World’s Hottest Oil Patches

Pemex Ekes Out Tiny Profit as Oil Production Decline Resumes

Oil Heads for Weekly Advance Ahead of Critical US Inflation Data

Oil Holds Modest Loss as Risk-Off Tone Counters Lower Stockpiles

Oil Holds Gain With Stockpile Data and Iran Sanctions in Focus

Shell, TotalEnergies in Talks for Stakes in New Adnoc LNG Plant

Top stories.

Berlin Pioneers New Market for Urban Solar Power

HSBC Asked by $890 Billion Investor Group to Set Energy Goal

FTC’s Surprise Attack on US Oil Icon Rattles Shale Sector

ECP Is in Advanced Talks to Acquire Atlantica Sustainable

French Power Grid Curbs to End This Week, More Due in August

Enel Hydro-Power Plant Blast in Italy Leaves at Least 3 Dead

Exxon Oil Traders in Belgium Protest Move to London

A Software Billionaire Is Betting Big on a Wild Climate Fix

Europe’s energy sector at the crossroads amid push for renewables, year of elections and AI

ARO Drilling hit by suspension for one of its contracted jack up rigs with Aramco

Elsewhere on Energy Connects

GE Vernova’s new AI-powered autonomous software to transform energy asset inspections

Azoto deal confirms WSG’s role as major Canadian nitrogen services provider

Hydrogen economy set for rapid global growth

Public-private energy partnerships critical to hit global net zero targets, says former head of IEA

Watch/Listen

CSIS: long-term LNG demand to reshape global export capacity growth

Deploying computational chemistry to speed up the energy transition

Bio-energy to play a key role in shaping the energy transition

More women in energy vital to the industry’s success

Partner content

Ebara elliott energy offers a range of products for a sustainable energy economy.

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum

Why the energy industry is on the cusp of disruptive reinvention

Chevron helping drive Egypt’s journey to become Africa’s energy powerhouse

Energy Workforce helps bridge the gender gap in the industry

EGYPES Climatech champion on a mission to combat climate change

Fertiglobe’s sustainability journey

India’s energy sector presents lucrative opportunities for global companies

Oil India charts the course to ambitious energy growth

Maritime sector is stepping up to the challenges of decarbonisation

COP28: turning transition challenges into clean energy opportunities

Why 2030 is a pivotal year in the race to net zero

Harnessing digital reality innovations to drive sustainability across the industry

Explore energy connects.

- dmg energy events

Stay Updated

©2023 Energy Connects. All Rights Reserved

Back To Top

Lundin enjoys record free cash flow and highest ever production

Swedish independent reports record free cash flow for 2021

- Ole Ketil Helgesen

© 2024 Euronext N.V. All Rights Reserved. The information, data, analysis and information contained herein (1) include the proprietary information of Euronext and its content providers, (2) may not be copied or further disseminated, by and media whatsoever, except as specifically authorized by Euronext, (3) do not constitute investment advice, (4) are provided solely for informational purposes and (5) are not warranted to be complete, accurate or timely.

Merger between Aker BP and Lundin Energy’s E&P business completed

Lundin Energy’s E&P business was transferred to Aker BP on 30 June. “Our ambition is to create the world’s best oil and gas company with low costs, low emissions, profitable growth and attractive dividends. We will also play an important role in the global energy transition,” says Aker BP CEO, Karl Johnny Hersvik.

The merged company is the second largest operating company on the Norwegian continental shelf (NCS). The company has a substantial resource base which provides a very good foundation for further growth and leads the way in terms of both low costs and low emissions per barrel.

“In 2016, Aker ASA worked in tandem with bp to merge Det Norske and BP Norge into Aker BP. The ambition back then was to create the leading exploration and production company offshore. Now we’re taking another big step, in cooperation with the Lundin family. Together, we will work to develop Aker BP into the oil and gas company of the future. We will lead the way when it comes to low costs, low carbon, profitable growth and attractive dividends. We will also take the lead to bring about fundamental improvements, such as through digitalisation,” says chair of Aker BP’s board, Øyvind Eriksen.

The best team

Aker BP is uniquely positioned for profitable growth. The company will operate or participate as a partner in most of the major field developments on the NCS in the next few years, with NOAKA, a new central platform on Valhall, the King Lear tie-back to Valhall, Wisting and Skarv satellites as the largest projects. Overall, Aker BP plans to invest more than NOK 150 billion in development projects in the period up to 2030. During the same period, the company will drill around 180 new wells and carry out an exciting exploration programme. All this will contribute to significant production growth in the years ahead.

“The leading company needs to have the leading team. With the merger of Aker BP and Lundin, I’m confident that we have the best team on the Norwegian shelf. But we’re going to need even more people to join in and help us create the E&P company of the future,” says Karl Johnny Hersvik.

Will give more back to society

The development projects, the exploration activity and operation of our six production hubs create significant positive ripple effects for the supplier industry, along with tens of thousands of jobs with highly competent companies across the country.

“These are the same companies that will further develop the knowledge and expertise needed to deliver on renewable projects,” says Hersvik.

He points out that the energy transition is the largest and most important strategic challenge the industry has ever faced.

“The world needs more energy which is sustainable, affordable and reliable. Aker BP is already today among the oil and gas companies in the world with the lowest CO 2 intensity. We are progressing according to plan to achieve our targets to reduce our emissions by 50 percent by 2030, and plan to neutralise the remaining emissions,” says Hersvik.

“In addition to reducing emissions, the oil and gas resources must be managed in a way that gives even more back to society,” he adds.

That’s why Aker BP has made a strong commitment to a wide range of digitalisation measures aimed at increasing productivity. At the same time, the company is working closely with its alliance partners to maximise value creation and reduce emissions. The company wants to lead the way in transforming the oil and gas industry.