Offshore Risk Management

Marine-Aviation-Specialty Risks Insurance Services

- Call us on US 305-743-7711 Caribbean 305-743-7711 Pacific Rim 305-743-7711 UK +44 (0) 203 371 9167

Skippers Choice® Liability Insurance for Mariners

Charter and Delivery Captain & Crew Liability Insurance

Often a Skipper will have an opportunity to work a passage or relieve a buddy for a charter and needs insurance coverage before assuming command or taking the helm.

Skippers Choice® Marine Liability can be customized to cover Your Third- Party Liability…

- as a delivery skipper or crew, or a captain who drives more than one vessel

- when the owner requires you to have insurance for a passage, a delivery or charter use

- when you act as a captain for clients who bareboat charter but want a captain to operate the boat while they enjoy themselves

- if the owner’s insurance does not cover you when are the operator or in command.

- if the boat has low limits of liability insurance coverage or a judgement against you exceeds the owner’s coverage (if any)

- Legal fees related to a covered Liability claim against you

Some scenarios where Skippers Choice could protect you 24/7*.

- You deliver boats for one or more boatbuilder, boat broker or repairer.

- You are a boat broker and operate boats for Buyers or Sellers or Dealers.

- A bareboat company needs a captain to drive a rental boat.

- You are a captain for a ferryboat or water taxi.

- You do not have the money to pay for a lawyer if you are sued.

- You need coverage for trips outside of the USA.

- You operate a Commercial Passenger boat or a Tourist Submarine. Skippers Choice is designed to cover you if there is an accident or you are dragged into a lawsuit.

- You are retired and want to make some money part-time doing charters or deliveries

The list is endless and the examples above are just a few or the operations we insure.

Get a Quote Frequently Asked Questions

*DISCLOSURE: The information above is for illustrative purposes only and does not replace any terms, conditions, limitation or restrictions of any insurance policy. READ YOUR POLICY.

Search our Site:

Get started today

Charter Boat Insurance

An all risk commercial policy that fully protects your property, passengers and crew..

If you are the owner of a Charter Boat you have come to the right place for your Charter Boat Insurance needs. Charter Lakes has been providing Charter Boat Insurance (uninspected passenger vessels) for 34 years. Our mission is to provide our clients with the broadest coverage available at the most competitive price. We have taken that one step further with the introduction of our new Charter Boat Policy. In our humble opinion, this is the broadest Charter Policy available in the country. Regardless of your budget, we have the flexibility to tailor a policy for you that meets your coverage needs.

Charter Boat Standard Policy Provisions Include:

- Written on an Agreed Value basis

- Disappearing Deductible Clause

- Protection and Indemnity Liability Coverage

- Pollution Liability

- Passenger Medical Payments Coverage

- Personal Property/Fishing Tackle Coverage

- Towing and Emergency Assistance

- Dockside Liability Coverage

- Replacement Vessel Liability

* Please consult one of our agents for complete explanation of coverage *

Optional Coverage Features Include:

- Liability coverage for your employment of Captain(s) and Crew

- Marine General Liability (for land based property like an office or store)

- Charter Legal Liability (for your booking trips on non-owned boats)

- Excess Protection and Indemnity

- Shoreside Liability

- Additional Interests/Loss Payees/Breach of Warranty

Types of Charter Operations We Insure:

- Sport Fishing Charter Boats

- Eco and Nature Tours

- Whale Watching

- Expedition (Multi Day) Charters

Charter Lakes focusses 100% of its energies on marine insurance with a special focus on passenger vessels. We make it easy for you to purchase the broadest coverage available at the most competitive price. Let our experienced Agents go to work for you. Fleet discounts apply.

- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance

- Employment Practices Liability Insurance

- Environmental Liability Insurance

- Errors and Omissions Insurance

- Insurance Coverage & Advice by State

- See more ...

By Business Type

- Retail Store

- Agriculture & Forestry

- Construction

- Manufacturing

- Wholesale Trade

- Retail Trade

- Transportation & Warehousing

- Information Industry

- Finance & Insurance

- Real Estate

- Scientific & Technical Services

Auto & Vehicle Insurance

- Car Insurance

- Motorcycle Insurance

- Boat Insurance

- RV / Motorhome Insurance

- ATV Insurance

- Snowmobile Insurance

- Personal Watercraft Insurance

- Collectible Auto Insurance

- Umbrella Insurance

Home & Property Insurance

- Homeowners Insurance

- Condo Insurance

- Farm Insurance

- Landlord Insurance

- Renters Insurance

- Mobile Home Insurance

- Contents Insurance

- Vacant Land Insurance

- Flood Insurance

Other Insurance

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

- Health Insurance

- Special Event Insurance

- Short-term / Sharing Insurance

Insurance Solutions & Resources

- Compare Car Insurance

- Compare Home Insurance

Charter Boat Insurance

(Everything you need to know - and more.)

More than seven million people visit our site every year looking for unbiased information about insurance and other related topics. And with great readership comes great responsibility, which means we’re dedicated to providing honest and accurate information.

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

Small business owners can turn a hobby into a way of life when they start a charter boat company. If you are starting a business to share your love of the open water for a profit, you should think about what kind of insurance you need to carry to keep you and your passengers safe.

Maritime law requires charter boat businesses to meet very specific insurance coverage requirements. While you may be talented at the helm of a boat, navigating the rocky waters of maritime insurance can be a challenge.

You can use this independent agent matching tool to find the best insurance solution in your area. Provide some details about what you're looking for, and the tool will recommend the best agents for you. Any information you provide will be sent only to the agent you pick.

Save on Boat Insurance

Our independent agents shop around to find you the best coverage.

What Are Charter Boat Business Requirements?

Starting up a charter boat business requires a large initial investment and sound strategic planning. If your charter boat can carry more than six passengers, the vessel must be certified by the US Coast Guard before it can be used for business purposes.

To operate a charter boat, you must have a captain’s license and should be certified in first aid and CPR. Finally, you will need to obtain a maritime insurance policy specifically designed for charter boat businesses.

What Does Charter Boat Insurance Cover?

The two main components of charter boat insurance coverage are:

- Protection and indemnity coverage

- Hull and machinery coverage

Protection and indemnity coverage is typically known as liability insurance . It covers any bodily injury or third-party property damage that you may cause while operating your boat.

It also provides coverage for legal fees and court costs if your business should be sued due to an accident or injury. The main purpose of this insurance is to protect your business from financial ruin if you are sued.

Hull and machinery coverage compensates you for damage to the vessel, including the engine, navigation equipment, deck machinery and electronics. It applies when your boat sustains loss or damage after a collision, fire, theft, vandalism or a destructive weather event.

You can elect named-risk or all-risk coverage. The purpose of this coverage is to ensure that you can repair or replace your boat when necessary, and thus can continue your business operation.

How Much Charter Boat Insurance Do I Need?

Because you have invested a large sum of money in your charter boat business, make sure your investment is suitably covered by an inclusive insurance policy. Be sure to completely assess your risks and coverage needs when shopping around for your policy.

When it comes to liability coverage , most insurance professionals agree that purchasing as much coverage as possible is advisable. In today’s litigious society, an injury lawsuit can prove to be expensive enough to hurt your business.

Having high liability limits will ensure that you have enough coverage if one or more people are injured in an accident. You can also consider an umbrella liability insurance policy to further raise your liability coverage. Check with your agent to see which option is the best for your needs and risks.

What Charter Boat Insurance Coverage Options Do I Have?

There are many different kinds of charter boat businesses, like companies that provide scenic tours and fishing excursions. Likewise, there are many variations in insurance needs and coverage types.

When discussing charter boat insurance coverage and options, you may come across unfamiliar industry terms. A general understanding of these terms can help you discuss policy options with an insurance agent. Here are a few phrases commonly used in the industry:

- Full-time charter coverage: This type of commercial insurance coverage allows for year-round coverage, including day trips and extended charters.

- Part-time charter coverage: This is a modification of a personal pleasure craft insurance policy that allows owners of yachts to use their boats commercially as charter boats for a set number of days a year. Most policies allow for 10 to 20 days of coverage per year.

- Jones Act/paid crew coverage: The Jones Act, also known as the Merchant Marine Act of 1920, requires every member of the crew to be individually covered for liability if they sustain an injury while on board. Some insurance companies require the names of all crew members aboard each vessel before it departs. This can make things tricky when it comes to last-minute hires or pick-up crews.

- Bareboat charter coverage: This is a special type of boat rental insurance coverage that you will need if another person operates your boat and you are not on board. Anyone chartering your boat must sign a statement absolving your business from liability in the event of an accident or injury. Bareboat coverage policies will usually limit the number of people that can be aboard the boat during the charter run.

- Six-pack charter coverage: This is full-time commercial charter boat coverage designed specifically for boats carrying no more than six people at a time. These boats are not required to be US Coast Guard certified.

- Shore excursion coverage: This is an option that can be added to your protection and indemnity insurance to provide liability coverage for your customers before and after they step onto the boat. Without this additional coverage, you would not have liability protection if a customer were to slip and fall immediately after exiting the vessel, unless it was covered under your business insurance plan.

Is Charter Boat Insurance Expensive?

The cost of insuring one or more charter boats can be high. However, the coverage is necessary, not only because it is required by law, but because without it, a single accident could potentially bankrupt your business.

Because your insurance policy will be one of your business’s main expenses, it is important that you choose your carrier and policy options carefully.

The Policy Has to Match the User

Your charter boat business will have unique coverage needs based on the boat (or boats) you are insuring, the number of employees you have, the services you are providing to your customers, and the risks you may face due to operating a business on the water.

You will therefore need a specialized charter boat insurance policy that is suitable for your particular business model.

Use this independent agent matching tool to find the best insurance plan in your area. Provide some details about what you’re looking for, and this technology will recommend the best agents for your needs. Any information you provide will be sent only to the agents you pick.

- Member Login

EXPERT ADVICE FOR YOUR BUSY LIFE.

Yacht Crew Insurance: What Every Captain Needs To Know

Posted July 17 2014

When you decided to become a yacht captain, you dreamed of an adventurous life spent cruising the ocean at the helm of a mighty vessel. While that is certainly part of a captain’s life, there are also a host of other tasks you must accomplish when accepting the responsibility of a yacht captain.

One of the most important of these tasks may include choosing a yacht crew insurance plan for you and your crew. When searching for a comprehensive marine crew insurance plan that will ensure your crew are protected, consider the following:

Evaluate the Full Value of the Plan

The plan you select will play a role in determining the financial security of your owner and crew, so you need to carefully choose the coverage based on features and services provided. Do not focus solely on the cost. MHG has been providing yacht crew insurance for over 15 years and during that time, we have seen insurance plans come and go. Right now there are some new plans out there that look like Gold, for the price of Pyrite! Remember, if it sounds too good to be true, it probably is. Please, do not buy insurance (or most anything else) based solely on lowest cost. Talk to someone who can help explain what you are really getting (or not) before something happens and you find yourself or your crew thinking something was covered that isn't.

Crew Leisure Activities May Require Extra Coverage

Yacht crews tend to be adventurous souls focused on enjoying an active lifestyle, and working on the water presents the opportunity to indulge in some very exciting activities. Some of your crew’s favorite leisure pursuits carry an increased risk, however, and some yacht crew insurance policies do not cover injuries obtained while engaging in certain activities. There are insurance plans that include additional coverage for sporting activities, such as scuba and other water and winter sports, so be sure to look for those features. A comprehensive marine crew insurance plan that includes coverage for crew leisure activities will decrease liability exposure and protect both owner and crew.

Comprehensive Emergency Services Must Be Included

When a member of your crew suffers a serious injury or illness there are a number of issues that must be resolved quickly. If your crew member is unable to travel with your vessel or continue working onboard, you may be required to provide a flight home for that crewmember. You may want this feature included in the marine crew insurance plan you choose, along with adequate provisions for emergency medical evacuation and repatriation of remains.

Tailor Your Coverage to Your Crew

When choosing a marine crew insurance policy , the best way to balance costs and benefits is to consider the specific composition of your crew and the coverage desired. For example, if you don’t have any North American crew and do not plan to sail in North America, you can save premium by purchasing a policy that does not include coverage there. Does your crew consist of several members who have been long term crew for this particular yacht owner? Perhaps you should consider tailoring a plan to provide additional benefits for your crew above and beyond the standard policy.

The experienced Insurance Specialists at MHG Insurance are ready to help you with all the details of --> yacht crew insurance: what every captain needs to know --> , what coverage every crew member should have, and which carrier is best for your particular situation. MHG Insurance offers a wide range of yacht crew insurance plans and international medical insurance for expatriates , with customizable coverage for all nationalities and itineraries.

Call MHG Insurance today at +1 954 828 1819 or +44 (0) 1624 678668 or visit us online at mhginsurance.com to find the yacht crew health insurance plan that meets your requirements.

Categories:

- Business Insurance

- Expatriate Insurance

- Marine Crew Insurance

- Ocean Marine Insurance

- Property and Casualty Insurance

- Travel Insurance

- Trip Cancellation Insurance

- US Life and Health

What Others Are Reading

- Want to Join a Cruise as a Guest Lecturer? Here's Everything You Need to Know.

- The Resurgence of Travel Agents

- How Much Money Could Trip Cancellation Insurance Save You?

- The Best Places in the World to Network for New Yacht Crew Jobs

- What It's Like to Work on a Cruise Ship?

Talk To A Broker!

Call +1 954 828 1819 or +44 (0) 1624 678668 to speak with a broker about your specific insurance needs or fill out this form and we will get back to you within one business day.

Want a Quote Online? Click Here...

Insurance for Charter, Watersports & Leisure Sports Operators

- Get a Marine Quote

- Get a Skippers Choice Liability Quote

- Get an Aviation Quote

- Get a Medical Quote

- Rental Insurance

- Charter Boat Insurance

- Store or Shoreside Operations Insurance

- Delivery Insurance

- Demise Charters/Charters Liability Insurance Packages

- Charter & Delivery Captain Liability Insurance

- Medical Expense/Health Insurance

- YachtHaul Expense Reimbursement

- LifeLine Expense Reimbursement

- Need help? Contact Us

Skippers Choice® Liability Insurance for Mariners

Charter & Delivery Captain & Crew Liability Insurance

Often a Skipper will have an opportunity to work a passage or relieve a buddy for a charter and needs insurance coverage before assuming command or taking the helm.

Skippers Choice® Marine Liability can be customized to cover Your Third- Party Liability…

- as a delivery skipper or crew, or a captain who drives more than one vessel

- when the owner requires you to have insurance for a passage, a delivery or charter use

- when you act as a captain for clients who bareboat charter but want a captain to operate the boat while they enjoy themselves

- if the owner’s insurance does not cover you when are the operator or in command.

- if the boat has low limits of liability insurance coverage or a judgement against you exceeds the owner’s coverage (if any)

- Legal fees related to a covered Liability claim against you

- You deliver boats for one or more boatbuilder, boat broker or repairer.

- You are a boat broker and operate boats for Buyers or Sellers or Dealers.

- A bareboat company needs a captain to drive a rental boat.

- You are a captain for a ferryboat or water taxi.

- You do not have the money to pay for a lawyer if you are sued.

- You need coverage for trips outside of the USA.

- You operate a Commercial Passenger boat or a Tourist Submarine. Skippers Choice is designed to cover you if there is an accident or you are dragged into a lawsuit.

- You are retired and want to make some money part-time doing charters or deliveries.

*DISCLOSURE: The information above is for illustrative purposes only and does not replace any terms, conditions, limitation or restrictions of any insurance policy. READ YOUR POLICY.

© copyright 2002-2024 CharterBiz. All rights reserved. CharterBiz is an insurance program managed by Offshore Risk Management . This site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. *Some products and services may not be available to you. Most submissions result in a premium indication or quotation. **With your prior permission, some products and services may be underwritten by B-rated or unrated insurers.

SUPERYACHT INSURANCE & CREW MEDICAL INSURANCE

Ocean is your home, we got you covered.

YOUR MEGA YACHT INSURANCE & MARINE CREW HEALTH INSURANCE SPECIALIST WORLDWIDE LOCATED IN FORT LAUDERDALE, FLORIDA

SUPERYACHT INSURANCE

Hull & Liability Insurance Coverage for Mega & Superyachts worldwide.

CREW MEDICAL INSURANCE

International Crew Health Insurance Coverages for Groups and Individuals.

COVID TRAVEL MEDICAL

International Insurance Medical Plan. Short Term Policy. Proof of Coverage Letters.

INSURANCE PLANS

Most popular.

GeoBlue Navigator Plan

GeoBlue Navigator Health Plan. Worldwide medical coverage designed for maritime crews and employers. The policy uses the Blue Cross/Blue Shield PPO network, available in ALL 50 states and the coverage extends WORLDWIDE.

IMG Global Crew Medical Insurance

A long-term (1+ year), annually renewable, comprehensive worldwide medical insurance program for professional marine captains and crew.

Visa Requirement & Agreement

Temporary b1/b2 visa for yacht crew.

If you are a non-U.S. resident and you are working on a yacht that navigates the United States waters, you need to have a B1/B2 visa.

Yacht Crew Traveling in Europe

Schengen agreement.

If you are planning to visit or travel through European countries, you should be familiar with the requirements of the Schengen Agreement. The Schengen Agreement is a treaty creating Europe's Schengen Area, which encompasses 27 European countries, where internal border checks have largely been abolished for short-term tourism, business trips, or transit to non-Schengen destinations.

The European Union has postponed the ETIAS 'e-visa' until November 2023

Travel More & Worry Less

TRAVEL INSURANCE COVERAGE

Short-Term and Long-Term!

Marine Crew Insurance Sales & Recognition

YACHT INSURANCE EXPERTS

WHY SUPERYACHT INSURANCE GROUP?

One-stop shop.

SYIG is a full-service broker, offering Crew Medical, Life Insurance, Travel Insurance, Disability Income and Yacht Insurance.

SYIG has been catering to the Marine Industry since 2002. Yacht Captain Steve Rodda, with more than 30 years’ experience running ships and luxury yachts, acts as a consultant.

Personalized Sevice

SYIG’s VIP Client Service is our competitive advantage. We focus on building trusting and personal relationships with you and offer objective advise and dependable customer service.

Get in touch

333 Las Olas Way, CU1, Ft Lauderdale, FL 33301

O : (+1) 954-323-6733

T: (866)-635-1445

MONDAY-FRIDAY: 09:00 – 19:00

SATURDAY-SUNDAY: 10:00 – 14:00

SUPERYACHT INSURANCE GROUP more on Facebook

Location, location, location.

SYIG IS SERVING THE GLOBE! LOCATIONS INCLUDING THE FOLLOWING (but are not limited to): Fort Lauderdale, Miami, Palm Beach, Palma, Barcelona, Antibes, Montecarlo, Italy, St Maarten, Bahamas, Australia.

COVERAGE FOR CREW OF ANY NATIONALITY. Including, but not limited to: South Africans, Australians, US, Canadians, UK, Spanish, Italians, French, Danish, Swedish etc.

- OBAMACARE – BIG CHANGES in 2016!

- Superyacht Insurance

- Group Medical Insurance

- Individual Medical Insurance

- Travel Insurance

- Misc. Policies

- Accidental Insurance (AD&D)

- Disability Income Insurance

- Life Insurance

Corporate Websites

Superyacht Insurance Group

Copyright © 2020 – All Rights Reserved Superyacht Insurance Group

Terms & Conditions

Site development by Webalise

Log in to Markel

- US Broker Agent

US customer login

Log in to make a payment, view policy documents, download proof of insurance, change your communication and billing preferences, and more.

Log in to access admitted lines for workers compensation, business owners, miscellaneous errors and omissions, accident medical, general liability, commercial property, farm property, and equine mortality.

Markel Online

Log in to access non-admitted lines for contract binding property & casualty, excess, and commercial pollution liability.

MAGIC Personal Lines portal

Log in to access personal lines products including marine, specialty personal property, powersports, bicycle, and event insurance.

Markel Surety

Log in to access Markel's surety products.

Yacht insurance

The marine insurance leader for over 45 years.

Find a Markel marine agent and get a free, no-obligation quote today.

If you love your yacht, you’ll love our insurance.

We’ve been the yacht insurance leader for over 45 years because we provide coverages that fit your yacht and your lifestyle. Markel yacht insurance can offer distinct advantages in coverage features, options, knowledge and experience.

Why do you need yacht insurance?

Whether you own a yacht or a houseboat, we understand it’s not a typical boat and shouldn’t be covered by a typical boat insurance policy. That’s where we come in—each Markel yacht insurance policy can be customized to fit your yacht, your needs, your budget and your style.

Still not sure?

Here’s a few of the potential advantages to insuring your yacht with us:.

More complete coverage than any other carrier at no additional cost.

Experienced yacht underwriters and marine claims specialists who provide prompt, responsive service.

Discounts and cost-effective coverage options to save you money.

Flexible payment options.

Save money by customizing your yacht insurance

Actual cash value coverage (ACV) Reduce your coverage to ACV, which factors in depreciation of your yacht should you have to file a claim.

Lay-up option We’ll discount your yacht insurance premium during the winter months when your yacht is not in use.

Higher deductibles If you can manage minor repairs to your boat on your own, selecting a higher deductible will reduce your premium.

Windstorm exclusion Live in an area that isn’t at risk for a hurricane? You may consider removing windstorm coverage from your policy.

Liability only Coverage in case you damage another yacht and/or person (doesn’t require a survey—even for older boats).

What we offer

We offer coverage for a variety of watercrafts over 26 feet in length, including:.

- Sport fishing boat

Our coverages can include:

- Coverage for your yacht

- Coverage for you

- Optional coverages

Hull and equipment insurance protection including:

- Protect and recover can cover reasonable costs incurred when trying to protect your yacht from further damage after an accident

- Consequential damage for non-wood yachts–normal wear and tear and deterioration is not typically covered under a yacht insurance policy. However, if your yacht suffers damage from fire, explosion, sinking or collision because of one of these conditions, you may be protected

- Ice and freezing damage coverage if you contracted with a commercial marina or repair facility

- Agreed value for total loss

- Deductible waived on most total losses

- No depreciation on most partial losses

- Automatic tender coverage

Windstorm extra expense If there is a named storm, watch or warning, we will share the expense with you to help protect your yacht before the storm makes landfall.

Personal effects coverage For all the “extras” you physically bring onto your yacht. (i.e., smart phone, camera, etc.)

Emergency towing and assistance Coverage for towing expenses if your yacht happens to get stuck in or out of the water, including the delivery of gas, oil and parts.

Rental reimbursement coverage Coverage for when your yacht is being repaired from a covered loss.

Uninsured boater Unfortunately, not all boaters on the water have insurance. This coverage helps protect you and your family members if you are injured in an accident caused by an uninsured boater. Coverage is automatically included if watercraft liability is purchased.

Pollution liability Pollution coverage helps protects you if you are held legally liable due to an oil pollution leak or spill.

Medical payments Coverage for injuries suffered during an accident on your yacht.

Paid crew (Jones Act) Protection for you if you are legally responsible for injuries to a paid captain or crew member while on your yacht.

Protection and indemnity Coverage in the event that you are responsible for injuries to another person, or damage to their boat or property. Wreck removal is included with purchase of hull coverage.

- Boat trailer coverage

- Boat lift and boat house coverage

- Fishing tournament reimbursement for fishing boats

- Fishing equipment protection

- Transit and storage coverage

- Trip coverage

- Trip interruption reimbursement

- Personal liability coverage if you live aboard your yacht

Frequently asked questions about yacht insurance

General questions.

How much coverage do I need? Each boat, person, location and situation is different. There isn't a good way to give a "ballpark" figure for how much coverage you need. It’s best to evaluate your comfortable level of risk when protecting your boat, assets and passengers. Your best option is to call our boat specialists at +1.800.236.2453 to discuss the best coverage for you.

Can I insure my yacht for liability only? Yes, we offer protection and indemnity (liability only) coverage to help protect you in case you are responsible for injuries to another person or damage to another boat or property. Many carriers do not offer liability-only policies for yachts, or if they do, require a survey. However, Markel’s protection and indemnity coverage does not require a survey, so you’re able to do what you love without worries out on the water.

Will my policy cover normal wear and tear of my yacht? Most insurance policies will not cover normal wear and tear of your yacht and the deterioration or the resulting damage. However, if your yacht is damaged from fire, explosion, sinking, collision or stranding, you may be protected under our consequential damage coverage.

Can I use my yacht for chartering? We know that sometimes yacht owners charter their yacht for sightseeing tours or even sport fishing to help offset some of the costs of owning a yacht. Markel offers an optional limited charter coverage for these situations provided the captain of the watercraft has a minimum of 2 years loss-free experience of yachting. Additional restrictions may apply.

I live on my yacht. Am I covered? Markel provides live aboard coverage. Be sure to disclose that you live aboard to your agent.

My yacht is in a corporation's name. Can I still insure it with Markel? Our yacht insurance policy can cover corporately titled boats for both personal use and client entertainment. We do require all corporately titled boats designate a designee of the watercraft. Contact your agent to learn more.

Do I need to insure my yacht in the winter? It may seem that since you don't use your yacht in the winter you don't need to insure it. This is a risky way of looking at insurance and one that we have seen cost far too many people far too much money. Your yacht is at risk for damages at all times of the year, not only when it's on the water. For example, if your yacht is placed in storage for the winter and is damaged, you will not have any assistance in paying for those repairs without an active insurance policy.

Do you cover unique boats? We offer coverage for various kinds of boats that other insurers may shy away from, including: high performance boats, airboats, hovercraft, etc. Not sure if your watercraft will be covered? Give us a call at +1.800.236.2453 to speak with one of our marine insurance specialists.

What kind of fishing equipment is covered? Your rods, reels and tackle are automatically covered under your personal effects coverage up to the limit purchased. If that coverage isn't sufficient, our fishing equipment coverage provides insurance protection at replacement cost. Please contact one of our marine insurance specialists at +1.800.236.2453 to find out more.

Claims questions

How do I file a claim? We understand that no one wants to file a claim. That's why we do everything we can to make the process as painless as possible. You can report your yacht insurance claim by calling our office at +1.800.236.2453 or submit your claim online and we'll take it from there.

How long will it take for my claim to be processed? We are committed to investigating, evaluating and resolving marine insurance claims in a timely manner.

Is there anything I can do to help speed up the claim process? Yes, you can help streamline the claims and settlement process and avoid delays by providing the following information when you file your claim:

- Policy number

- Date, time and location of loss or damage

- Description of loss or damage

- Digital photos (if possible)

- Phone number to reach you

Additional resources

Related articles.

From boat safety tips to breaking down yacht insurance, find the information, advice, and resources you’ll need all in one place.

Warrior Sailing

Markel is a proud supporter of Warrior Sailing, an organization dedicated to healing and strengthening the lives of veterans through sailing. Visit warriorsailing.org to learn about Warrior Sailing and how you can donate to the program so they can continue to help the lives of wounded veterans.

Related products

Specialized coverage designed specifically for boats 26 feet or less, such as pontoons, runabouts, fishing boats and more.

High performance boat

Insure your high performance watercraft with a high performing policy for all your specific needs.

Personal watercraft

Fit your budget and boating style with affordable and customizable coverage for your personal watercraft.

About Chubb: About Chubb

About Chubb: About Chubb in the U.S.

About Chubb: Careers

About Chubb: Citizenship

About Chubb: Investors

About Chubb: News

Claims: Claims

Claims: Claims Difference

Claims: Claims Resources

Claims: Report a Claim

Login / Pay My Bill: Login for Business

Login / Pay My Bill: Login for Individuals

Login / Pay My Bill: QuickPay for Businesses

Login / Pay My Bill: QuickPay for Individuals

Login / Pay My Bill: Login to CRS

Contact Us: Contact Us

Contact Us: Global Offices

- File a claim

- Get a quote

Boat & Yacht Insurance

From small boats to large yachts, it’s smooth sailing with Chubb.

Whether you own a runabout, sailboat, yacht or mega-yacht with a full-time captain and crew, we offer some of the most comprehensive coverage and services available.

Our Products

For over a hundred years, we've offered unparalleled stability and protection with our boat and yacht insurance.

Coverage is available for all types of pleasure boats 35 feet and less, including bowriders, fishing, wake boats, and cabin cruisers, and for personal watercraft vessels like wave runners and jet skis.

Coverage is available for pleasure yachts 36 feet or greater in length and up to $3 million in value, and for captained vessels 70 feet or greater in length, valued at $3 million or more.

See the chubb difference.

Watch this short video to see how Chubb kept their client cruising when they experienced some trouble in the water.

Coming Out of Lay-Up

If your boat stays in lay-up over winter, you’ll need to take care of a few things before it’s ready for the following summer. Here are some suggestions to help you make sure your is ready for a successful launch and a safe and relaxing season.

Going Into Lay-Up

Once summer ends, many boat owners across the country will begin to prepare their vessels for winter storage. Read our full length "Going Into Lay-Up" brochure to help you complete this important lay-up process.

Related Coverage

From high-rise condos to historic buildings, we’ve got your home covered.

With liability coverage, let us be your personal peace-of-mind partners.

We help you stay ahead — and informed with these helpful tips and tricks

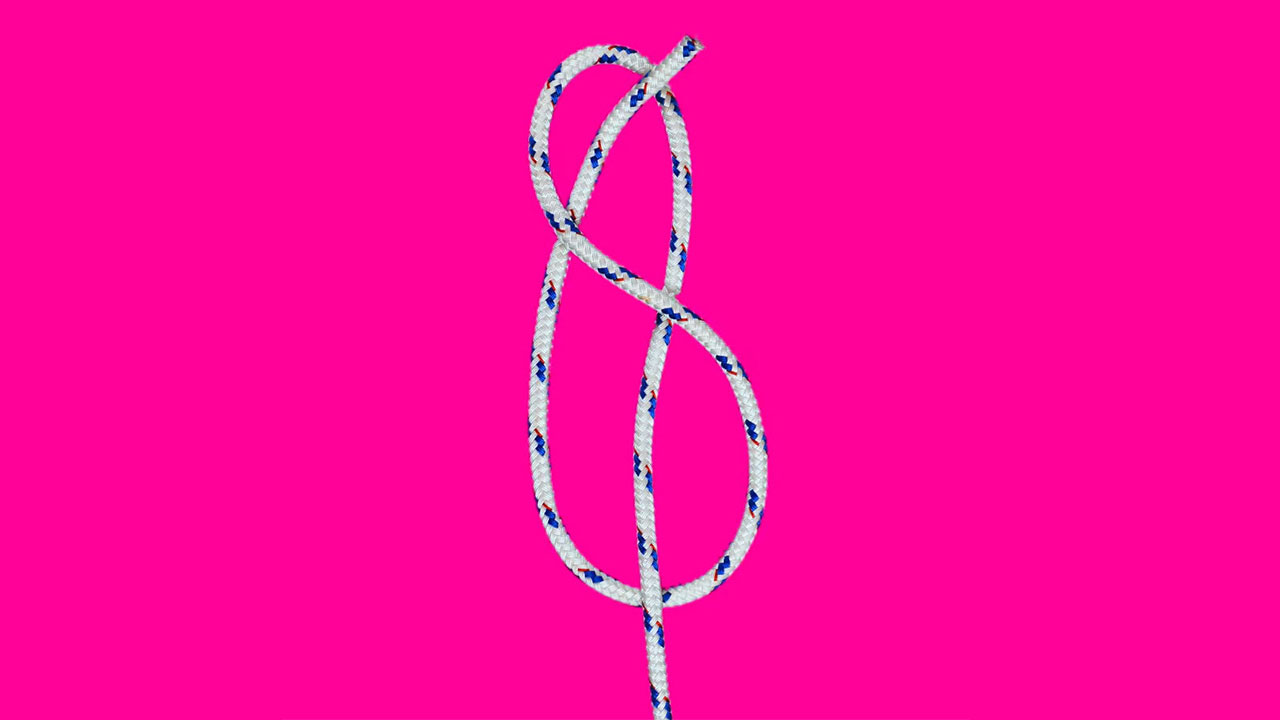

Figure eight knot.

An ideal knot to keep the free end of a line from running out of a block or fairlead.

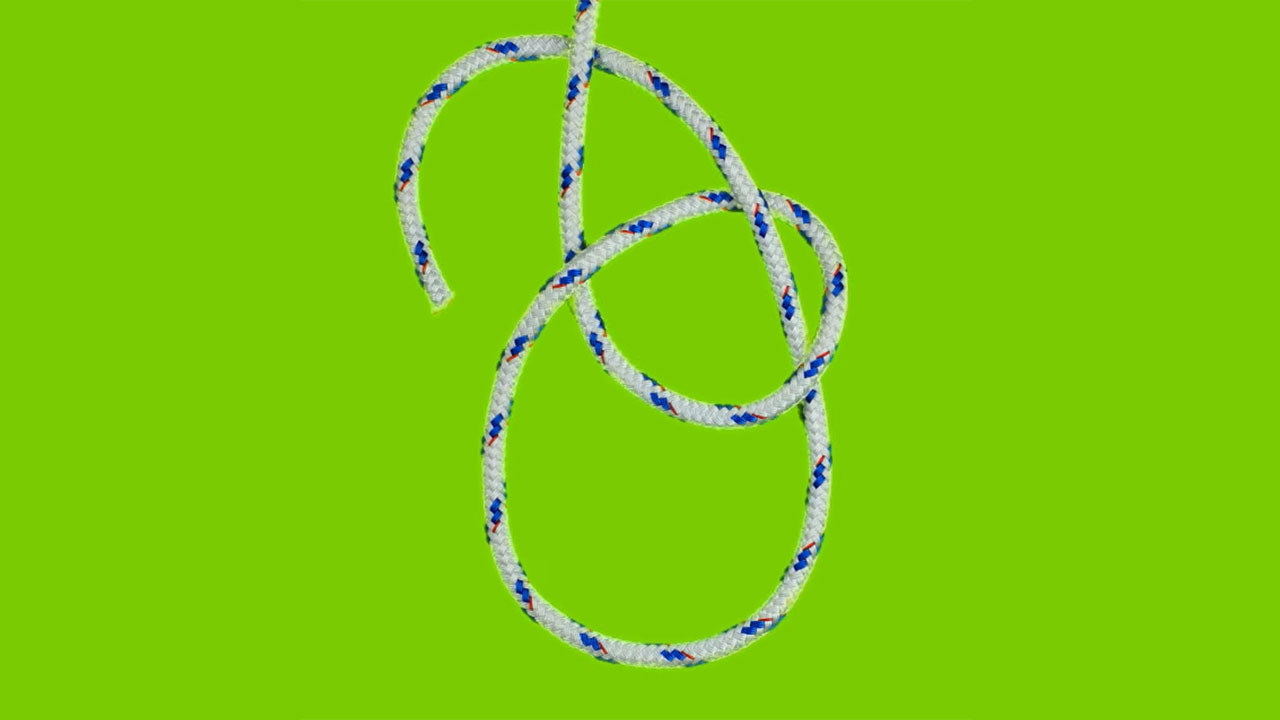

Bowline Knot

Sometimes referred to as the “King of Knots,” it forms a fixed loop that won’t slip, but is easy to untie.

Square Knot

Used at sea for reefing and furling sails.

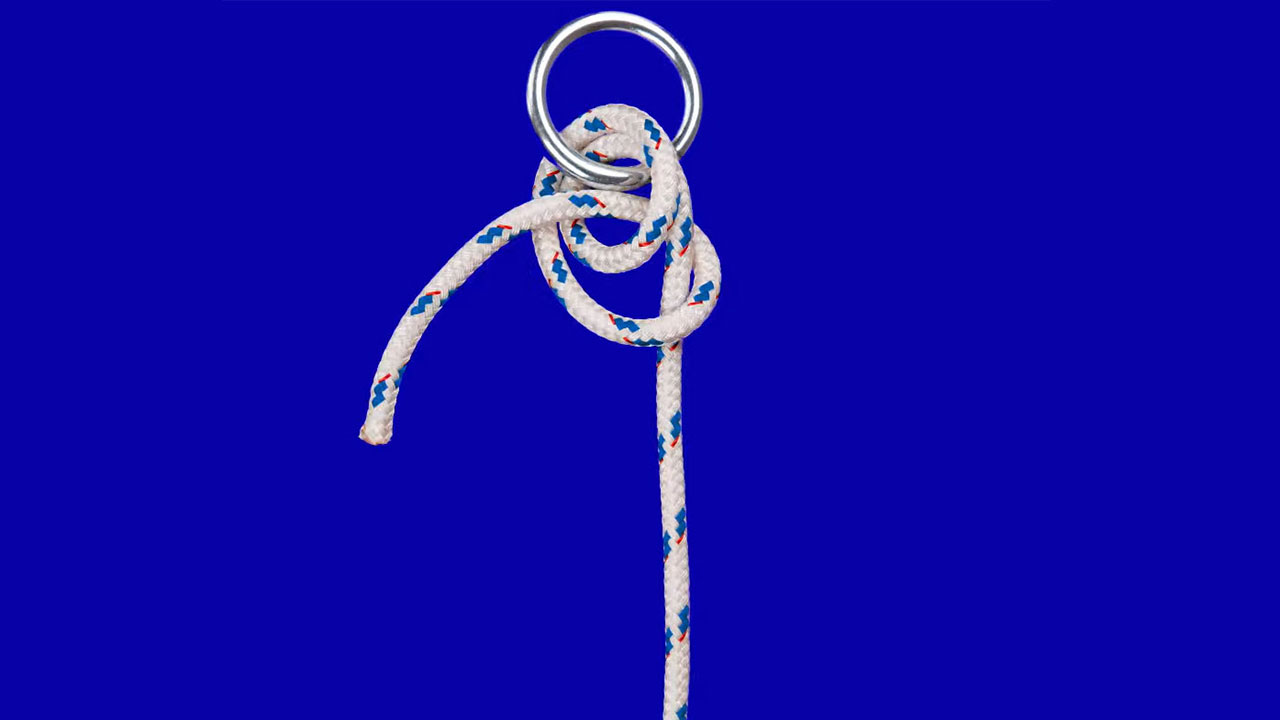

Anchor Bend Knot

Used to secure a line to a ring on a buoy or anchor rode. A strong, chafe-resistant knot.

Two Half Hitches Knot

Reliable, quickly tied, and the hitch most often used in mooring.

Clove Hitch Knot

The general purpose hitch, used wherever you need a quick, simple way of securing a line around a post, railing, spar or cleat.

Find an Agent

Speak to an independent agent about your insurance needs.

This information is descriptive only. All products may not be available in all jurisdictions. Coverage is subject to the language of the policies as issued.

Get Instant Quote

Boat Captain Insurance – Cost and Coverage

Whenever you budget the expenses of your business, Boat Captain insurance must be included in the list because you can’t always know exactly what can happen in the future.

Need General Liability Insurance for Your Boat Captain Business? Get Your Free Quote

With the protection provided by liability insurance and all the other types of insurance we will tell you about, you can protect your business and yourself in case something unwanted happens.

Like any business owner, for your Boat Captain enterprise, you must consider how much financial danger you are taking on.

If your Boat Captain business runs without proper insurance, you are taking an enormous chance not just of losing some money but of a final wipe-out.

Need Boat Captain Business Insurance? Get Your Free Quote

This is because the laws in every state are very strict in enforcing liability on the owners of businesses for the results of their actions.

In this article, we are giving very general guidelines for small businesses to highlight what the main kinds of insurance that you need are, and where possible, a rough guide to how much you can expect to pay.

The question is, can you afford to NOT have insurance for your Boat Captain business?

What this means, for any Boat Captain business owner, is that if some customer claims that your business caused them some physical or economic damage, a court can award damages far beyond the total size of your business.

Get Your Business Insurance, For Your Free Quote, Try NOW!

Your Boat Captain business is not harbored by laws in the same way as states are, where edicts can place a “cap” on the maximum level of liability.

In some states, like New Jersey , there are specific monetary levels that limit the amount a judge can award in any case against the state.

In a court case, it’s purely the privilege of the jury to award whatever amount they deem appropriate, even sometimes giving a plaintiff more than they have claimed.

When you are running your Boat Captain operations, you can’t escape responsibility for the consequences of your actions.

Even more importantly, unless you have spent in advance the money necessary to have your business running as an LLC , all of that liability belongs to you as a person.

What does Boat Captain insurance protect you from?

For your Boat Captain business, the most important sorts of insurance are intended to cover the risks to your business from accidents, from unexpected events, and from mistakes.

As well there are some legal kinds of insurance that various states require.

In the next few paragraphs, we will describe the most important points any Boat Captain business owner should remember when negotiating the insurance needed.

The main types of insurance for your Boat Captain businesses are liability insurance, commercial insurance, asset insurance and workers compensation insurance.

Need General Liability Insurance? Get Your Free Quote

Liability insurance

General liability insurance.

Any Boat Captain business is dealing directly with other people, and that means you always have the danger that some accident can happen to them bodily or else something of theirs can be damaged.

In such a case, they can sue you for compensation.

General liability insurance policy for your Boat Captain business protects you against claims coming from injury to customers or damage to their property.

It protects your Boat Captain business from the claims themselves and also to any associated court costs and legal fees of the lawsuits.

In many cases, it can also help you to qualify for extra business from city and state organizations, where contracts insist on proper liability insurance.

The average level of general liability insurance for your Boat Captain business would be with a boundary of $1 million for a single submission and a total of $2 million for the whole year.

See the table in the costing section below for average prices of general liability insurance for your Boat Captain insurance operations.

Professional liability insurance for your Boat Captain business

In the event where a customer alleges some negligence, errors, or omissions in how you conducted your Boat Captain business for them, you can quickly be involved in a monetary claim.

Even if the case against you is decided in your favor, the cost of defense can be large, and the impact on your reputation can be damaging.

Almost all small Boat Captain business should have enough professional liability insurance to cover a once-off claim of $25,000, with annual cover of $50,000.

See the table in the cost of Boat Captain insurance section below for average prices of professional liability insurance for your Boat Captain operations.

Are You Covered? Get Your Free Quote

Product liability insurance

Whatever goods you sell or advice you give about the goods, you are running a risk that clients may claim that what they received didn’t meet your description of function, or that your recommendation was basically incorrect.

You need to know the explicit laws of product liability in your own state .

For example, in California , all businesses in the supply chain can be held culpable for damages caused by products claimed to be defective.

To cover yourself against any following lawsuit, you need Product liability insurance for Boat Captain

Only you can estimate exactly how much insurance you must have.

Best advice is to talk to experienced insurance agents, brokers or company representatives for help.

Commercial insurance

Commercial vehicle insurance for your boat captain business.

Be careful! – almost all policies for private vehicle insurance do not cover any occurrence like theft or accidental damage when the vehicle is being used for business purposes.

The right way to make sure that your vehicle is insured for both its own value, and the valuable contents, is by taking out a designated commercial vehicle insurance package.

Commercial car policies guarantee the value of any vehicle in case of accident, malicious damage, fire, or theft.

As well, in case of any accident, the car itself, the content and any legal bills, medical expenses, and property damage is guaranteed if your van is involved in an accident.

Most states, other than Virginia and New Hampshire , insist on this type of insurance.

The necessary value of the insurance depends on the depreciated value of the vehicle, and your declared level of cover of contents.

Tools and Equipment insurance

Since your Boat Captain business needs specific and expensive equipment, you know how much it can cost to replace it in case of any damage, loss, or theft.

The gear may be subject to malicious damage, deliberate fire, theft, other such unexpected acts.

As well, acts of nature like lightning strikes, hurricanes, earthquakes, and other highly damaging natural events can eliminate your whole business in one stroke.

Unless you can afford to immediately replace such specific gear quickly out of your own pocket, you should have full-level equipment insurance so that you can immediately buy any equipment needed to keep your Boat Captain business running.

It is difficult to advise how much equipment insurance you need – it’s basically dependent on how much you have invested in your Boat Captain business’ equipment .

Commercial Property insurance

Any Boat Captain business that owns or rents space in a building needs a commercial property insurance policy .

If you own the property, you probably have a substantial capital investment, in addition to a big liability if there’s a mortgage.

Your physical building location should carry insurance coverage for the value of the premises and contents against accidental occurrences like fire and storms, and against deliberate damages like theft and vandalism.

If your Boat Captain business operates in areas of high risk, like Florida or North Carolina , additional coverage may be needed for earthquakes and hurricanes or tornadoes.

In other states like Washington , where intense cold snaps can cause damage to outer coverings of Boat Captain business premises, there is a need for more additional cover than in warmer climes.

Whereas the level of cover depends completely on the value of the property, it’s not possible to say what cover your need, but we have been able in the table in the cost of Boat Captain insurance section below to give some indication of the average prices per million dollars of property insurance for your Boat Captain business.

Temporary insurance by month, week or day for your Boat Captain business

Is your Boat Captain business working part-time or casually, or is the level of business variable?

Using short-term insurance makes good sense. Business insurance by the month, day, or week – temporary insurance for Boat Captain – are special policies where you can cover a specific period when you want to be covered.

By only paying for that period of cover, you will save by having lower premiums but still having adequate risk cover.

The key feature of short-term insurance is that you pay for the cover for a defined period – a designated date, or a week or month starting on a specific date, for example for 30 days beginning on the specified date.

When you are expecting periods of higher business activity, get the existing cover increased.

Talk to your insurance agent, broker or the company’s representatives to see what options you have.

Business Owners Policy BOP for your Boat Captain business

You have the chance to combine most of the important kinds of small business insurance in one policy that is known as the business owner’s policy – BOP .

A BOP combines commercial property and public liability insurance by amalgamating these coverages into one insurance policy, which can save you money.

BOP insurance will shield you if any claims of injury or property damage are made.

It is frequently the right choice for small and medium-sized Boat Captain businesses, such as yours.

There are some limits that will determine whether BOP is suitable for your own business.

BOPs will not cover your professional liability or commercial vehicle cover.

Also, the size of your business will dictate whether you are permitted to take out BOP cover.

The typical business that is eligible for a BOP policy must have no more than one hundred employees, and not more than five million dollars in annual sales.

In addition, you must separately take out the mandated worker’s compensation, health and disability insurance as determined for your state.

Workers Compensation insurance for your Boat Captain business employees

In many states, it is mandatory to have workers compensation insurance when your Boat Captain business has one or more employees.

Workers compensation insurance covers the enterprise against any costs that arise if any hired hand experiences an injury or becomes sick as a result of work.

The benefits include medical expenses, death benefits, lost wages, and vocational rehabilitation.

Failure to meet a state’s requirements in this regard can leave you as the employer required to pay penalties levied by the states.

Some states, such as North Dakota , Ohio, Washington, West Virginia, and Wyoming only allow coverage from the government-run monopoly state funds.

In these states, you can’t take out your workers compensation obligations from private insurance providers.

Workers compensation rates are calculated based on the employee’s pay, and usually come out at around $1.00 per $100 per month.

However, you must consult the relevant authorities in your state.

Average costs of these types of insurance

Although every Boat Captain insurance need is unique, there are enough examples of standard quotes from insurance companies for us to give appropriate guidelines, including what are the cheapest rates offered.

Of course, you should always check with a broker what’s relevant for your business.

The list below is of annual premiums we have researched for the main types of insurance your Boat Captain businesses needs.

Get Your Free Quote >

Cost of insurance for your Boat Captain operations depends on many different factors.

We have calculated these figures for small freelance Boat Captain businesses.

In larger states like California , premiums are generally about 20%-30% higher than national averages, while in smaller states like Oregon , they usually are about 20%-30% lower.

The location and size and type of your Boat Captain business can have a big effect on the cost of different policies.

You should consult with professional insurance agents and brokers, or insurance company representatives.

What Are You Looking For? Choose and Get Your Free Quote:👇️ General Liability Insurance -> Professional Liability -> Product Liability Insurance -> Commercial Auto -> Workers Compensation -> Commercial Property -> Other Business Insurance ->

As well you can let the internet do the work for you by enquiring about insurance companies near where your business is located.

Another useful source of information is the local Better Business Bureau in your suburb.

What is small business insurance for Boat Captain operations?

This is a general term used to describe basic insurance policies designed to protect Boat Captain business owners from risks like bodily injury, property damage, claims of negligence.

Does my Boat Captain business have to have insurance?

Some of the forms of insurance are not mandatory for you to operate your business, but they can protect you from risks in your business operations.

Several other forms are required by state law, such as workers compensation and vehicle insurance.

What does a small Boat Captain business insurance policy cover?

Liability insurance provides insurance against lawsuits or claims filed by a client for bodily injury, property damage, or negligence.

The precise cover will vary based on your own operations.

See the table in the costing section above for average prices of the recommended policies for Boat Captain insurance .

How much will Boat Captain business insurance cost?

On top of the size of the business, several other factors, such as location and claims history, are used to determine your policy’s cost.

You should talk to professional insurance agents and brokers, or insurance company representatives.

You can search for more information insurance for Boat Captain, in the search box below, and follow the relevant links.

Related Industries:

Airport Manager Insurance - Cost and Types Of Policies

Bus Monitor Insurance - What Kind and at What Cost

Tags: Boat Captain

Cosmetology Insurance – What Kind and at What Cost

Wind & Storm Damage Restoration Insurance – What Kind and at What Cost

Convert Buses and Vans Into Tiny Homes Insurance – What Kind and at What Cost

Siding Installation Insurance – What Kind and at What Cost

The purpose of SBCoverage.com is to make the information accessible for small businesses.

We are not an insurance company or insurance agent

We may receive a commission when a purchase is made using our links.

All the content, materials, and information available on this website are for general informational purposes only and doed not constitute insurance advice.

Privacy Policy

Terms & Conditions

alabama , alaska , arizona , arkansas , california , colorado , connecticut , delaware , florida , georgia , hawaii , idaho , illinois , indiana , iowa , kansas , kentucky , louisiana , maine , maryland , massachusetts, michigan , minnesota , mississippi , missouri , montana , nebraska , nevada , new hampshire , new jersey , new mexico , north carolina , north dakota , ohio , oklahoma , oregon , pennsylvania , rhode island , south carolina , south dakota , tennessee , texas , utah , vermont , virginia , washington, west virginia , wisconsin , wyoming

How to Estimate Insurance Costs for a Business

Entertainers and Performers Insurance in North Dakota

Entertainers and Performers Insurance in New Jersey

Entertainers and Performers Insurance in New Hampshire

Entertainers and Performers Insurance in Pennsylvania

Entertainers and Performers Insurance in Oregon

Request a Free Quote (305) 254-7733

Yacht In s urance

The best yacht insurance rates.

From America's boat insurance experts since 1984

Get a Quote

- Marine Insurance

- Boat Insurance Quote

- Company Information

- Testimonials

- Boat Safety

- Boat Towing

- Boat Insurance Guide

- Yacht Insurance

- Insurance Glossary

- Report A Claim

- California Boat Insurance

- Maryland Boat Insurance

- Michigan Boat Insurance

- Texas Boat Insurance

- North Carolina Boat Insurance

- New York Boat Insurance

- Florida Boat Insurance

- Minnesota Boat Insurance

- Louisiana Boat Insurance

The Differences between Boat & Yacht Insurance

When you look at a boat insurance policy, you'll notice the language is unlike your typical homeowner's or auto policy. What you may not know is that vessel insurance can even vary from policy to policy, depending on a variety of factors.

Yachts are classified as vessels 27 feet or more in length, while boats are 26 feet or less. No matter what type of vessel you have, when it comes to the type of policy, seek out Agreed Value. Agreed Value policies are cover all damages, except for sails, outboard motors, canvas covers, cushions or other specified items. They do not reflect depreciation or market value, which means you will get a greater settlement in the event of a claim. Other policies such as Actual Cash Value may be cheaper, but they also factor in depreciation and market value and will subtract that from your payout.

Also, when it comes to navigation limit, boat and yacht insurance policies can vary due to different exposures. For example, a boat policy typically includes unlimited overland transportation on a trailer, while a larger yacht policy would restrict overland trailering to only several hundred miles.

Deductible amounts can also differ. A yacht policy can offer deductibles of up to 3 percent for any hull damage. However, deductibles for a total loss, marine electronics loss or a windstorm loss can vary depending on your particular policy. By contrast, a boat policy offers a flat deductible, typically of $250, $500 or $1,000.

Because yachts inherently incur more risk due to their size and navigation, the liability feature of yacht insurance provides broad coverage designed to shield you from the effects of the maritime law. Your coverage is much broader than with a typical watercraft liability policy, and offers protection to permissive users, captain and crew liabilities, along with the Jones Act, a federal law that allows a seaman who gets injured on the job to bring a suit for damages against his or her employer.

Besides, yacht insurance addresses salvage to a damaged yacht, legal liability to remove a sunken wreck and uninsured boater coverages. In a typical boat policy, only general liability protection is included. For example, if your boat sinks in the Great Lakes or any of its tributaries, the U.S. Coast Guard says it must be raised. There will be salvage costs, fuel clean-up - and you'll have to pay the bill regardless of your coverage.

While most yacht policies provide salvage coverage, they do so in different ways. Some choose to limit the dollar coverage to a stated amount or percentage of the hull amount.

Another very important part of the salvage issue is wreck removal. Some companies include wreck removal under their hull coverage, which then limits its value. A true yacht policy will include it under the protection and indemnity limit, which will provide much higher limits and additional coverage.

Get Your Insurance Quote

Another difference is that in yacht policies, your legal defense is in addition to protection and indemnity limits, while boat policies offer legal defense within the limit of liability.

Yacht policies have warranties, including the seaworthiness, navigation limits territories and navigation lay-up limits. While some boat policies do not require warranties, others may incorporate them.

Many boaters consider adding their vessels to their homeowner's insurance in an attempt to reduce their costs. Although the cost is substantially less when you add a boat to a homeowner's policy, but you don't get near the coverage. In this case, the old adage still holds true - you get what you pay for. The bottom line is not the amount of your policy premium, but how much you will collect at the time of loss.

For more information on boat and yacht insurance, or to talk to an experienced agent about different coverage options, contact NBOA Marine Insurance. Representing several A+ rated carriers, their insurance specialists will be able to create a customized policy that fits your specific needs and would be happy to answer any questions you may have.

Call 1-800-248-3512 or start your online boat insurance quote today.

CELEBRATING 35 YEARS AS ONE OF THE NATION'S TOP INSURANCE PROVIDERS!

Charters and Guide Insurance

Contact us to discuss your charter boat insurance coverage options:

Get a Quote

Charter Boat & Guide Insurance from Charter Boat Experts

For more than 20 years the marine insurance experts at Anchor Marine have been trusted advisers in helping our customers purchase insurance for their charter & guide boats .

Our expertise doesn’t stop with marine insurance either. One of our own agents has 20 years of experience as a guide, captain and owner of a charter company. That means not only do we understand what you need from your insurance coverage, but also why and what it means to run your own charter boat business.

Whether you are a river guide, a 6-pack operator, or own a fleet of inspected vessels, our agents have firsthand experience in knowing your boats, the waters you operate in and the workings of your business.

*Perhaps no other charter boat insurance agency has this unique combination of experience. *

At Anchor Marine Underwriters, we know the ins and outs, ups and downs of both marine insurance and the guide business.

Have questions? We’ve got answers.

Our knowledge is a valuable resource we don’t mind sharing to insure you are making sound, informed decisions.

Anchor Marine has worked hard to build strong, professional relationships with our clients as well as our industry peers.

Because of this, we are able to work with the best marine insurance companies, which gives us a wide range of options in marketing your specific insurance coverage.

We know that you are in business to make a profit and insurance is a big expense, so we will shop the markets to make sure you are getting the best rate possible while still having coverage that meets your needs.

Customer Service Driven – We Are at Your Side

Anchor Marine is at your side from your very first call regarding any loss, damage or injury to your vessel or its passengers.

We remain totally involved as a liaison to expedite the claims process. Our responsiveness to your claim situation is as important to us as it is to you.

Getting you “back to boating” is out top priority.

We’re proud to be one of the nation’s most respected marine insurance brokers and even more proud of the fact that our biggest source of new customers is referrals from current customers.

Our customers trust us not only to insure their boats, but also the boats of their friends and family. A “friend to friend” referral is the highest compliment we can receive and we feel privileged to be in such good company.

From 6-pack boats in Alaska, to drift boats in Oregon or inspected vessels in California to the East Coast and everything in between, we’ve got you covered.

Let the experts at Anchor Marine “guide you through the process of vessel insurance” Fast, Easy & Free Charter & Guide Boat Insurance Quotes – Use the Form or Call Us

WE've GOT YOU COVERED

COVERSHIP & YACHT is an international network of independant insurance agencies specialised in advising and sourcing the most efficient insurance solutions to protect the interests of the yacht Owners, Captain, their crew members and the industries of the superyacht community worldwide.

With a local presence on the main superyacht hotspots; Monaco, Nice, Fort Lauderdale and West Palm Beach, our agents share the same expertise and proactive attitude when servicing our demanding clients from the industry.

On both sides of the Atlantic, our experienced insurance sales’ agents are supported by the strong technical and legal knowledge of our yacht Captain and Lawyer prevention team which makes COVERSHIP one of the most performant and reliable superyacht insurance team of the market.

WE’ve GOT YOU COVERED

COVERSHIP & YACHT are fully authorised insurance agencies in the US by the Florida Department of Financial Services, in France by the Organisme pour le registre des intermédiaires en assurance (ORIAS), and in Monaco by the Gouvernement Princier de la Principauté de Monaco, and insured accordingly.

Latest news ...

COVERSHIP : Embracing the Greek Yachting Market : An opportunity for collective growth

At COVERSHIP, we recognize these dynamics and see the opportunity...

COVERSHIP : Insights on sustainable yachting at the 2nd Monaco Smart Yacht Event

In the iconic Yacht Club of Monaco took place the...

OUR PRODUCTS & SERVICES

Yacht Owner

Thanks to its extensive market knowledge and recognition, COVERSHIP proposes worldwide competitive insurance program...

View more …

Yacht Professional

COVERSHIP also specializes in proposing error and omission insurance solutions to the yacht managers, yacht sales and charter brokers...

Aviation & High value assets

COVERSHIP’s expertise and network of partners extends to aviation, fine art, jewels,...

Yacht Charterer

COVERSHIP has set up a proven comprehensive charterer’s interests insurance program...

Shipyard & Yard Contractors

Builders’ risks, annual shipyard repairer and subcontractor’s liability and property...

Marine & Transport

COVERSHIP’s expertise and network of partners extends to all maritime and transport insurances solutions...

Yacht Crew Member

COVERSHIP offers a full range of benefits for the crew members worldwide, high level of coverage with affordable premium...

Insurance audit & claim

With extensive international legal experience, COVERSHIP is able identify the clients’ risk...

Privacy Overview

- Car Insurance

- Best Boating Travel Insurance For Australians

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Our Pick Of The Best Boat Insurance For Australians

Published: Apr 18, 2024, 8:17pm

It may not come as a surprise that Australians love taking boats out on the water as 87% of the population live within 50km of the coast. Data from the Boating Industry Association for 2022/23 shows that 2.5 million Australians have a boat licence—that’s almost 10% of the population.

As a boat is a considerable investment, it’s a good idea to protect it as you would your car. Boat insurance can offer similar benefits to car insurance , such as cover for damage to the boat itself and its contents, and legal liability, if you damage someone else’s property, or someone is injured or dies as a result of an accident you’ve caused.

However, it additionally offers more boat-specific cover, paying out for environmental damage caused by an oil, fuel or waste leakage, for example. Many policies also offer cover for sailboat racing and waterskiing, typically as an optional extra and for an additional premium.

As all policies differ in their features, it’s essential to compare them to find what you need for a suitable price. You should first decide, if you need third-party only; third party, fire and theft; or comprehensive cover which protects against the widest range of eventualities. We’ve conducted extensive research into the latter, to find what we consider to be the best comprehensive policies. All policies include cover for loss or damage to your boat as a result of storms, floods, fire and theft. You can find out how we scored them in the methodology section further down this page.

Note: the below list represents a selection of our top category picks, as chosen by Forbes Advisor Australia’s editors and journalists. The information provided is purely factual and is not intended to imply any recommendation, opinion, or advice about a financial product. Not every product or provider in the marketplace has been reviewed, and the list below is not intended to be exhaustive nor replace your own research or independent financial advice. For more information on how Forbes Advisor ranks and reviews products, including how we identified our top category picks, read the methodology selection below.

Nautilus Marine Boat Insurance

Gio boat insurance, racv boat insurance, suncorp boat insurance, nrma boat insurance, apia boat insurance, youi comprehensive boat insurance, club marine boat insurance, methodology, what is boat insurance, what does boat insurance cover, what else should i consider when comparing boat insurance policies, what is agreed vs market value, can i cancel my policy, how can i compare boat insurance, frequently asked questions (faqs).

- Best Car Insurance Australia

- Best Motorcycle Insurance

- Best Car Insurance For Under-25s

- Best Caravan Insurance

- Best CTP Insurance

- What Is Car Insurance?

- What Is Excess In Car Insurance

- Comprehensive Car Insurance Guide

- Third Party Car Insurance Guide

- How Much Is Car Insurance?

- Guide to Third Party Fire and Theft Car Insurance

- Multi Car Insurance

- Applying For Your Learner Licence In Australia

- What Is A Novated Lease?

- RACV Car Insurance Review

- AAMI Car Insurance Review

- Youi Car Insurance Review

- NRMA Car Insurance Review

- Budget Direct Car Insurance Review

- Allianz Car Insurance Review

Agreed or market value

- Choice of repairer

Liability cover

Limit not readily disclosed

This offering is the most comprehensive we found, covering your boat up to 250 nautical miles from the Australian coastline. Unlike most boat insurance policies, there’s the option to have your boat insured at market or agreed value.

There’s $5,000 each for emergency expenses and funeral costs, $20,000 for personal effects, $500,000 for marine damage, and $50,000 for related fines and penalties. This policy also allows you, rather than the insurer, to choose a repairer for your boat if damaged. Additionally, you have a choice of how much you pay in excess on accepted claims, which can lower or raise the policy premium, to a more favourable level. This policy is also a rare one in that it automatically covers sailboat racing, limiting the distance to up to 100 nautical miles. Additional cover can be purchased for longer races. Note that while this policy offers legal liability cover, the limit is not disclosed.

Aside from comprehensive cover, this insurer also offers third party only, extended blue water yacht racing and blue water cruising policies.

- Lay-up discount available

- 21-day cooling off period

- Insures at market value or agreed value

- No rescue cover

- No salvage cover

- Cover for ‘reasonable’ repairs at market value only

$10 million

As is common with boat insurance, this policy covers you up to 200 nautical miles off Australia’s shores. However, it offers up to $10 million in salvage and removal cover, which is relatively high compared to policies provided by other insurers.

It also includes $250,000 to cover the cost of removing or containing damage caused by pollution from your boat and related legal costs, if your boat is stranded or damaged. There’s $5,000 each for emergency repair, the boat’s contents and fatal injury. Unlike certain policies, this one also covers rescue, paying out up to $5,000. However, one drawback is that your boat can only be insured at agreed value. A lay-up discount and cover for sailboat racing and watersports are optional extras that can be added.

If you make a successful claim, the policy allows you to choose the repairer. You can also pay an excess amount that you choose on taking out the policy. Paying a low amount in excess typically raises the policy premium and vice versa.

This insurer also offers third-party boat insurance as an alternative to comprehensive cover.

- $10 million legal liability

- Rescue cover included

- Insures at agreed value only

This policy pays out up to $5,000 for emergency expenses, and covers damage up to the agreed value, as long as your boat stays within 200 nautical miles of Australia’s coastline.

It also covers rescue up to $5,000 and salvage costs, as long as they are ‘reasonable’, while $250,000 is available for clean-up expenses to remove, contain or clear debris and liquid from your boat as a result of an insured event. For funeral expenses, there’s $10,000, while $10 million is provided in legal liability cover. However, content cover is only available to bolt on to the policy as an optional extra. Insurance for sailboat racing and watersports are also available as add-ons, for an extra premium.

Unlike certain policies, you can choose a repairer, which is an added bonus. You also have a choice of how much excess you pay on each accepted claim. Note that this comprehensive offering is the only type of boat cover this insurer offers.

- $250,000 clean-up costs

- Covers ‘reasonable’ salvage costs only

- Contents cover not automatically included

Suncorp’s comprehensive boat insurance offers a suite of attractive features: there’s $10 million in salvage and removal cover; an equal amount in legal liability cover; $250,000 for pollution by oil, fuel or waste; and $5,000 each for emergency expenses, the boat’s contents, and for fatal injury.

The policy will remain valid up to 200 nautical miles from Australia’s shores, covering your boat at agreed value only and paying out up to this value for rescue. Note that if the boat is damaged, only the insurer can choose a repairer. However, you will have a choice of how much excess you pay on accepted claims, when you first take out the policy. Paying more in excess can lower your policy premium and vice versa.

Cover for sailboat racing and water-skiing can be added on to the policy at an extra cost. This insurer offers third party cover, as an alternative to comprehensive cover.

- No choice of repairer

This policy will cover your boat up to 200 nautical miles from Australia’s coastline, covering ‘reasonable’ repair costs up to an agreed value only. However, it allows you to choose a repairer, if you wish, and offers several excess options to choose from when taking out the policy. Opting to pay a higher excess on accepted claims can lower the policy premium and vice versa.

The policy also includes salvage cover, though no specific limit is readily provided, and $10 million in legal liability cover, including $250,000 for clean-up costs. It also offers $10,000 for funeral costs, up to $800 for emergency repairs and an additional $1,000 to cover emergency transport and accomodation. There’s $1,000 to cover the boat’s contents, which is relatively low compared to other insurers, but there is the option to increase this amount to $1,500 by paying an additional premium.

This policy does not cover rescue, but insurance for sailboat racing and water-skiing are available at an additional cost. This insurer also provides third party insurance as an alternative to its comprehensive offering.

- 21-day cooling period

- $800 only for emergency repairs

In addition to $5,000 in cover for rescue, Apia’s comprehensive boat insurance includes $10 million each for salvage and legal liability. It also offers $250,000 for clean up and $5,000 for emergency expenses.

For fatal injury, there’s $5,000, while up to $250 is provided for the boat’s contents and $250 for personal effects. Cover for sailboats and watersports come as optional extras, at an additional cost. Cover remains valid up to 200 miles from the Australian mainland and Tasmanian coastlines.

The policy offers several excess amounts to choose from, allowing you the ability to lower your policy premium, if you prefer to pay more in excess, and vice versa. Note that the insurer will choose a repairer for you on this policy. As an alternative to comprehensive cover, it also offers third party insurance.

- $10 million salvage

- Insured at agreed value only

- No lay-up discount