Bayfront Miami condo tower embroiled in legal battle over major assessment

10 unit owners are suing the association and property management firm

- Katherine Kallergis

A bayfront Miami condominium in need of repairs is in a legal fight pitting unit owners against the condo association.

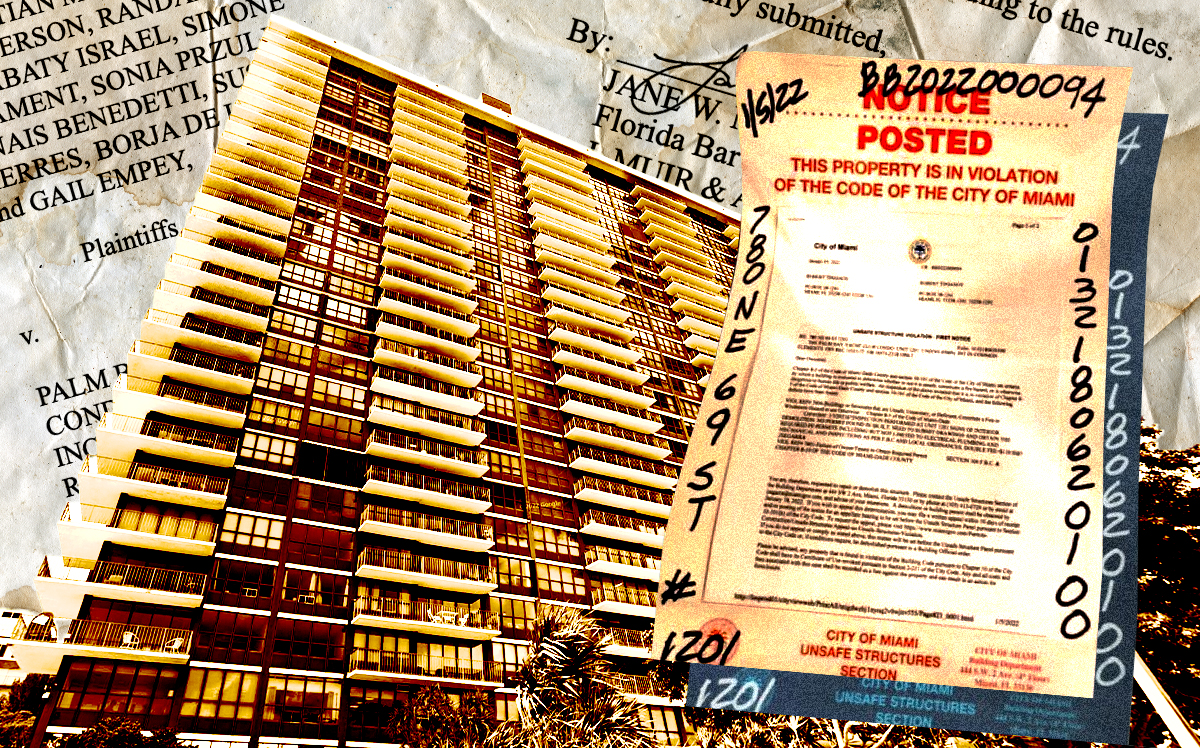

The 27-story, 235-unit Palm Bay Yacht Club made headlines last week over a proposed $46 million special assessment to fund repairs required for the property’s 40-year recertification. A group of 10 unit owners filed a lawsuit in October against the Palm Bay Yacht Club Condo Association, affiliates of the property management firm AKAM and other companies, alleging fraud and negligence.

The tower at 780 Northeast 69th Street was constructed in 1982 on a waterfront lot that includes a pool, sports courts and a parking lot.

In the lawsuit, unit owners allege that AKAM and the association knowingly made false statements about the scope of the project by including additional repairs beyond those required by the 40-year recertification, said attorney Jane Muir, who represents the 10 unit owners. The lawsuit alleges each unit owner would owe more than $175,000 for the repairs. It claims that AKAM is double-dipping and inflating the cost of the project, which AKAM denies.

An amended complaint, filed in Miami-Dade Circuit Court in December, alleges that engineers hired by the plaintiffs found errors that had a combined cost of more than $11 million. It claims that the defendants “mismanaged, misappropriated, or facilitated the misappropriation of association funds.”

“Absent court intervention, defendants will encumber the residents with insurmountable debt, risking foreclosure and bankruptcy for many individual residents and for the association,” the lawsuit states.

Unit owners are seeking an injunction against the association, with the goal of having a receiver appointed to take over the association, according to Muir. An evidentiary hearing that began on Monday was postponed to later this week, said representatives for both sides.

“No matter what these 10 unit owners think, the work has to be done. It’s only limited as to what can or cannot be done,” said attorney Jonathan Bloom of Bloom & Freeling, who represents AKAM. “Don’t people want to go to bed safe?”

The dispute is also playing out in the court of public opinion, with the unit owners appearing on local TV news fighting the size of the assessment and how money allegedly has been handled.

Sign Up for the undefined Newsletter

By signing up, you agree to TheRealDeal Terms of Use and acknowledge the data practices in our Privacy Policy.

Increased scrutiny of the physical conditions of condo buildings in the 20 months since the deadly Surfside condo collapse has led many associations across South Florida to impose multimillion-dollar special assessments or increase homeowners association fees to pay for life and safety repairs.

Palm Bay Yacht Club’s association estimated that the recertification — which is required by law in Miami-Dade County — will cost about $33 million, and that the cost to replace the windows and doors with storm impact windows and doors is $15.7 million. The building has received unsafe structure violations from the city of Miami.

Amid the legal battle, the board voted on Saturday to approve a loan to fund the $33 million recertification project. The association approved replacing the railings, but did not approve the impact windows and doors, according to a spokesperson for AKAM. The spokesperson declined to disclose the loan amount.

According to a letter sent to unit owners, an engineering firm found that the balcony railing system “reached its end of useful life,” and the railings no longer comply with the city’s building code.

“My clients do agree that the recertification must be achieved, and they also believe that some repairs must be done,” Muir said. “The problem is the scope of the project.”

Greg Main-Baillie, who leads the new condo restoration division at Colliers, said he expects more associations will face similar lawsuits in the wake of the Surfside collapse, as many condo owners don’t understand what it takes to maintain older structures. Main-Baillie compared an aging building to a person in need of surgery.

“Until you actually get into the area of infection, you really don’t understand how bad it is,” said Main-Baillie, who is not involved in Palm Bay Yacht Club. “In the buildings that haven’t maintained themselves, the cancer is going to spread.”

The letter the association sent to owners suggests the same, imploring owners to “properly repair and protect our investment.”

“We feel bad that unit owners are going to incur expenses,” Bloom told The Real Deal . “[But] when you buy a condominium, you take the good, bad and the ugly.”

Paradise Lost: Sky-high insurance premiums, required reserve funds and major repairs have some condo associations and owners in dire financial straits

(WSVN) - As we continue our series on South Florida’s housing crisis, tonight we focus on condos. Some of the estimated 3.5 million Floridians living in condo units face a perfect storm of financial problems, with no easy fix. 7’s Karen Hensel has this special assignment report, “Paradise Lost.”

The Palm Bay Yacht Club in Miami and Palm Lakes in Margate could not be any more different. One is 27 stories, the other just four. One overlooks Biscayne Bay, the other is west of the Turnpike.

But what both condominiums have in common is financial strain set in motion by the condo collapse in Surfside more than two years ago.

Robert Norris, president, Palm Bay Yacht Club: “I knew right then, you know, our lives were all changing immediately, because our building was built at the same time that the Champlain was built.”

Robert Norris is the Palm Bay Yacht Club Board president.

Robert Norris: “We’re looking at a $33 million project for our 40-year recertification. So all of the board members felt the pressure.”

That project includes everything from concrete demolition and restoration to redoing balconies.

And those repairs come at a cost. The average assessment is around $140,000 per unit owner.

Robert Norris: “I can’t even begin to explain the number of nights that I couldn’t sleep because I knew that there would be people in this building that might not be able to afford it.”

And in Margate, some owners in the Palm Lakes Condominium can’t afford it.

Bonnie Underwood, condo unit owner: “You know, I’m kind of old to be homeless.”

Bonnie Underwood and the other residents are facing nearly $2,000 a year more in maintenance fees next year.

Bonnie Underwood: “It’s absolutely killing me, and I don’t think I’m the only one here in this association who’s feeling this, because the buildings are emptying out.”

Efi Barakakos, condo unit owner: “It’s tragic. People do not know what to do. They’re trying to sell their units, but where are they going to go? It’s very difficult.”

The reason for that difficulty is a state law passed after the Surfside collapse . It requires condo associations to collect reserve money for costly future major repairs like structural work.

Efi Barakakos: “We’re on fixed incomes here, and it’s very difficult for people to afford 100% reserves. We’re a four-story building, which is considered low-rise. We’re 11 miles away from the ocean. We can’t compare it to Surfside at all.”

David Podein, attorney, Haber Law: “I think it is a dire situation on the horizon.”

Condo law attorneys David Podein and Jonathan Goldstein are sounding the alarm.

David Podein: “Between skyrocketing insurance costs, the huge capital needs for the structural repairs and the mandatory reserve funding, we felt that there is this confluence of factors that could create a ‘zombie condo.'”

“Zombie condos” are large buildings that are mostly empty because many of the owners couldn’t afford to live there anymore.

Robert Norris: “I would think a lot of buildings in South Florida, that they’re just not to be able to do it. It’s going to be an Armageddon of some sort.”

Robert feels fortunate his association found financing for their $33 million project, which would allow unit owners to pay the assessment over time.

Still, he says, their insurance situation is a challenge.

Robert Norris: “We can’t get full insurance value for this building. This building is valued at $100 million. We’re only insured up to $20 million, and our insurance went up 60%.”

According to the Insurance Information Institute, associations have seen premium increases as high as 500%. Some are calling on state lawmakers to fix these complex condo problems. “Paradise Lost” continues Thursday at 10 p.m. with a look at tenants who say landlords are taking advantage of them in a tight rental market.

Karen Hensel, 7News.

“The Condominium Special Assessment Program is designed to provide funding assistance to help condominium owners in Miami-Dade County pay for special assessment requirements that arise from rehabilitation and repairs due to applicable building integrity recertification requirements.”

FOR MORE INFORMATION: miamidade.gov/global/service.page?Mduid_service=ser1689262443911730

Copyright 2024 Sunbeam Television Corp. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

- DeSantis signs bills that he says will keep immigrants living in the US illegally from Florida

- Sunny Isles Beach traffic stop leads to woman’s arrest for counterfeit diplomatic tag

- 39-year-old Hollywood middle school teacher charged with molestation of a minor

- Police: 4 dead in apparent murder-suicide in NW Miami-Dade

- FBI arrest former Chaminade-Madonna College Prep teacher, 35, accused of having affair with 15-year-old student

Miami Condo Residents Upset Over 40-Year Recertification Cost

Neighbors at the palm bay yacht club are looking at a monthly increase of up to $5,000, by jamie guirola • published february 8, 2023 • updated on february 9, 2023 at 5:19 am.

Residents at a Miami condominium are upset over their building's 40-year recertification and what they say they will have to pay.

There will be a vote soon on whether to approve a plan that could cost residents at Palm Bay Yacht Club Condominium an extra $200,000 in homeowners association fees.

"We have a lot of issues, many but the main issue is about the money," said homeowner Borja de la Pazza.

Palm Bay is in its 40-year recertification process.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

"Which is gonna bring many people into foreclosure, and this is really, really sad for this community," de la Pazza said.

Homeowners are upset about what they call an excessive assessment by the board of directors and management company. The recertification would include installing hurricane impact windows, the demolition of some areas, remodeling and overall general improvements.

A look at how the new law banning Florida's homeless from sleeping in public works

Heavy rain expected ahead of busy weekend in South Florida. See what the models say

The bill is a $200,000 lump sum, or to pay over 20 years an additional $1,300 a month for recertification and pay an extra $3,500 per month for impact windows.

Aline Tom just moved here less than a year ago. Residents like Tom who are against the plan said they found an estimate that’s about half of what's being proposed, which could make the difference in who stays and who leaves.

"Select residents of Palm Bay Yacht Club have made a series of false and misleading statements in regards to proposed plans addressing the recertification program," a statement from the attorney of AKRAM Property Management read in part. "We look forward to clarifying the misinformation and resolving the ongoing litigation."

This article tagged under:

Subscribe

Photo: Nick Garcia

Photo: Atrium on the Bayshore

Photo: Becker & Poliakoff

Photo: Zuma Press

Towering Uncertainty

More than 2 million floridians live in condos subject to a new reinspection law passed in the wake of the 2021 champlain towers south collapse. for some, the price of keeping safe might cost them their homes..

Sonja Przulj loves her two-bedroom, two-bath condominium in Miami, located on the 21st floor of the 27-story Palm Bay Yacht Club, with spectacular views of Biscayne Bay, downtown Miami and South Beach. She paid $285,000 for the corner unit in September 2021 after renting in the building for years.

Przulj, 39, purchased at the height of the pandemic, when she was working nonstop as a nurse. “It seemed like it was meant to be,” she says. “But the thrill was very short-lived.”

That’s because less than a year later, Przulj, who lives in the condo with her husband, Jean Pablo Vialle, and their five-year-old son, was hit with a $145,000 special assessment by the condo association to pay for repairs in the aging building.

“It’s an earth-shattering number,” she says. And one she can’t afford to pay.

Built in 1982 at the height of South Florida’s high-rise condo building boom, the Palm Bay Yacht Club has not worn the years well, according to inspection reports from engineers hired by the condo management company. Facing its 40-year inspection, the tower’s list of issues is reported to include cracks, crumbling concrete and separation of the stucco layers. Needed repairs include remediation or replacement of expansion joints, waterproofing and drainage, and window repairs, records show. The condo also needs its tennis court replaced and its pool and jacuzzi repaired. The total cost assessed to residents of the 235-unit building is estimated at $33 million.

Przulj says that she’ll have to pay the special assessment back in four quarterly payments over a year unless the condo association is able to obtain a bank loan to help finance the necessary repairs and improvement projects. In that case, it would be payable over 20 years, she says. Last year, she became one of a group of 10 Palm Bay Yacht Club residents who filed suit against the condo association, the property management firm and a number of contractors alleging that the state of the building is being exaggerated, that they are being overcharged and that the association mismanaged past upkeep and financial responsibility over the building. “There is no way myself, or probably half the building, can come up with that money,” Przulj says. “I risked it all by buying this unit, and I have nowhere to go with my family.”

Attorneys for those being sued have called the allegations false, saying the repairs are mandated by law and the condition of the tower is dire. It has been the subject of numerous hearings in front of Miami-Dade County’s unsafe structures committee. “It defies logic to allege that the association and board of directors are deliberately acting in bad faith to put themselves in more debt than is necessary,” defense attorneys wrote in one filing. The case is in mediation, but in April, Judge Thomas J. Rebull ruled that it would not be in the public interest “in light of the Surfside Condominium collapse” to further delay concrete restoration on the tower, including installing shoring to the condominium’s parking garage.

The dispute pitting residents against each other is a scenario likely to be playing out again in Florida as state laws go into effect requiring older condos three stories and taller to be reinspected at earlier intervals and for condo associations to be more diligent in funding reserves for on-going maintenance and repairs. The June 2021 collapse of the 12-story Champlain Towers South, killing 98 people in Surfside, laid bare safety concerns about Florida’s older condo towers — the earliest ones now reaching past 50 years of age. Scores of other high-rises were built 40 years ago during a building boom in South Florida, an era when insufficient building codes and lax inspections were the subject of repeated grand jury investigations.

Before the collapse in Surfside, condo buildings in Florida weren’t required to be inspected by a licensed architect or engineer after being occupied, with the exception of those in Miami-Dade and Broward counties which had enacted their own, stricter local ordinances. Champlain Towers South’s 40-year inspection, as required under Miami-Dade’s recertification program, was underway but repairs had not been made at the time it collapsed. When state lawmakers first responded to the disaster nearly a year later, the state began requiring all condominium buildings of at least three stories or higher to undergo a “milestone inspection” after 30 years, and every 25 years if they were within three miles of a coastline.

The buildings then would be required to be inspected at 10-year intervals going forward. Condo associations also were required to ensure they had sufficient cash on hand for future structural repairs and could no longer waive or underfund reserves. The 2022 law caused such upheaval that this spring lawmakers and the governor pushed the requirement for coastal buildings back to 30 and are leaving it to local governments to decide if a 25-year inspection is “justified by local environmental conditions” including proximity to seawater.

The scale of who might be affected by the reinspections and ensuing costs is massive, according to legal and engineering experts. When the Florida Bar produced its report on the Surfside collapse, it cited figures from the Florida Department of Business and Professional Regulation saying there are more than 912,000 condominium units (out of some 1.5 million total units) in Florida at least 30 years old. Calculated using U.S. Census formulas, the state pegs the number of people living in condo units 30 years and older at upwards of 2 million.

But the uncertainty faced by those now living in older buildings with expensive repairs remains as some associations come to realize past boards never funded the reserves needed to maintain aging buildings, and now the state gives them no option. “I’m very proud of how quickly my boards have leapt into action,” says Donna DiMaggio Berger, a partner at Becker & Poliakoff in Fort Lauderdale who is board certified in condominium and planned development law. “But some are now being threatened with recall by unit owners who want to throw a monkey wrench into the maintenance and repair process because they don’t want to pay assessments. That is the type of craziness going on now.”

With so many unit owners unable to pay special assessments, some boards are seeking loans to help cover the cost of repairs — loans that are collateralized by the association’s receivables from residents’ payments on assessments, says Telese Zuberer, an attorney with Icard Merrill in Sarasota who represents homeowner and condo associations. Others expect the payments to be made on relatively short payment schedules, like Przulj could be required to do.

Unit owners opting to sell when facing a special assessment may find it difficult or impossible to find a buyer willing to assume that obligation. But some developers are capitalizing on the situation by attempting to buy out entire towers.

Edgardo Defortuna, president and CEO of Fortune International Group in Miami, is among a group of South Florida developers who target older condo towers — particularly those in prime locations or on the waterfront — for redevelopment, buying out entire towers of homeowners, dissolving the condo association and tearing the towers down. Defortuna says that due to the scarcity of land in South Florida, the projects make sense, especially when condo owners are paid well above market rates to vacate the units. “You can make an offer for all the units in the building that is above the market price of each individual unit,” he says. “Then you can terminate the condominium, knock it down and build a new tower.”

Defortuna says Fortune has completed three condominium terminations to date and has plans to acquire additional properties. Fortune typically offers owners up to twice the market value of their units, he says, and the firm’s brokerage arm helps them find a new place to live.

“If you spend $100,000 redecorating your unit and change your bathrooms and kitchen, a buyer might be willing to pay $100,000 extra because this unit is better than the rest,” he says. “But if you’re special assessed for $100,000 to pay for fixing columns and filling cracks to make sure the building won’t fall down, a buyer coming in will see you have the same old unit as before and won’t pay any more for it. You’re not adding any value to your unit other than making the building sound structurally.”

While much of the initial impact of the post-Surfside reforms is being felt in South Florida, where most of the state’s earliest condo towers were built, the ramifications of the new inspection and reserve laws eventually will be felt statewide. Bilzin Sumberg Partner Joseph Hernandez, who represents developers in condo terminations and redevelopment, says there’s no way to sugarcoat that many condo-dwelling Floridians are living in homes not built to last.

“That’s a cold hard reality,” Hernandez says. “They all have a variety of functional obsolescence issues — poor engineering (or) they are starting to degrade because they are by the water. The value of the units continues to decline. It doesn’t take a genius to figure out when you have increasing costs and a decreasing value of the unit. … There may be some special cases out there where the building over their history, they may have made some changes and stayed ahead of it. But the majority of them have reached the point where it is only getting worse.”

Berger, the condominium association attorney, says the new law is the final cap on an era where a coastal residence is attainable for most buyers. “Developers marketed condominiums and cooperatives as your little slice of affordable paradise where you could live on the ocean and enjoy those views,” Berger says. “But it seems like only the very wealthy are going to be able to afford to live in older coastal buildings. Still, if Florida ends up with the safest housing stock in the country, that is a very positive thing.”

The prospect of a $145,000 special assessment and the ensuing court fight have soured Palm Bay Yacht Club resident Przulj on condo life. “I love this building, and everyone who comes here sees how special it is,” she says. “But living in a condo feels like you’re never in control. I don’t know if this was such a smart move.”

Florida’s new condo inspection law

- Applies to buildings at least three stories tall.

- For buildings less than 30 years old, the milestone inspection must be completed by Dec. 31 of the year in which the building reaches 30 years of age and every 10 years thereafter.

- Buildings for which a certificate of occupancy was issued on or before July 1, 1992, must have their initial milestone inspection by Dec. 31, 2024.

- If justified by local environmental conditions, including proximity to seawater, local enforcement agencies responsible for enforcing the milestone inspection requirements can opt to require a 25-year inspection.

No Easy Out

While some condo tower boards are seeking loans to help cover the costs of needed repairs, it’s not a slam-dunk solution for all. Governing documents sometimes don’t give condo boards the authority to take out a loan. “In other cases, the windstorm deductible the association has chosen (to make the coverage affordable) is too high to make the association a feasible borrower for most banks,” points out Donna DiMaggio Berger, a partner at Becker & Poliakoff in Fort Lauderdale who specializes in condominium and planned development law. “It’s a perfect storm with the state doing little currently to sort it out.”

Tags: Miami-Dade , Southeast , Around Florida , Feature

Stuck in licensing limbo, Florida nursing students want answers. They're not getting them

Florida settles lawsuit over LGBT education bill

Florida is growing. Can affordable housing keep up?

Incoming income tax instructor indicated

For SUBSCRIBERS

FLORIDA TREND MAGAZINE

Florida Business News

The National Association of Realtors last week reached a settlement agreement in a national lawsuit. Professionals involved in the real estate market have been processing how this change will affect the industry in Florida.

After the city commission passed a resolution in January urging local, state and federal entities to make funding available to support the Underdeck, Miami has been awarded a $60 million transportation grant for the project.

Sarasota County taxpayers will pay more than $270,000 in legal bills after losing two lawsuits after a local judge ruled against county commissioners' decision to allow large hotels to be developed on Siesta Key.

CEO Dan Fontana believes Ty Fy’s Studio 2 will be a draw for business, and when he opens in the spring, he’ll be getting bookings from around the country.

Raymond James Financial's board says Paul Shoukry, its CFO, has been named president as part of its "multiyear succession planning process, effective immediately."

Florida Trend Video Pick

Three women are helping build the tallest residential building on the West Coast of Florida. According to one industry group, only 10 percent of construction industry workers are female.

Video Picks | Viewpoints@FloridaTrend

Should Congress ban the popular social media app TikTok in the U.S.?

- Need more details

- What is TikTok?

- Other (Comment below)

See Results

Florida Trend Media Company 490 1st Ave S St Petersburg, FL 33701 727.821.5800

© Copyright 2024 Trend Magazines Inc. All rights reserved.

Independent American Communities

Consumer Education for Homebuyers, Home, and Property Owners | Exposing Condo & HOA Dysfunction, Corruption, & Abuse

Condo, HOA members face rising fees and special assessments

By Deborah Goonan, Independent American Communities [email protected]

Rising HOA fees, special assessments, HOA fines, and bitter HOA lawsuits are making HOA living a lot more expensive.

Associations hit members with rising condo, HOA fees, huge special assessments

California hoa fees rise 20%.

Many members of the Yorba Linda Villages Condominium Association (CA), fear they will be forced to sell their homes. Homeowners say they cannot afford the recent steep increase in their HOA fees. Their condo association just raised monthly fees by 20%, the maximum increase allowed by California law. In addition, each owner must pay a special assessment of $9,000 in “emergency fees,” for immediate repairs. Many of the owners in Yorba Linda Villages are first time home buyers and families with young children. They stretched their budgets to be able to purchase their condo units in the past few years. Most never expected such drastic increases in HOA fees, which turning their dream of homeownership into a costly nightmare.

Washington condo owners to pay large special assessments

Unit owners in the Copperfield Condominium Homeowners Association of Portland, WA, recently learned they must pay $40,000 – $52,000 per unit, to fund a $5 million replacement of siding on all of the buildings. The Copperfield community has 111 dwellings that were built some 50 years ago. Most of its residents are either retired or disabled, living on a fixed income, or employed in low-wage jobs. The HOA considers itself “lucky,” as it has acquired bank financing of the project. Many HOA do not qualify for construction loans. The HOA says this will allow owners who can’t pay the full assessment by April 1 to spread out the cost over the next 25 years. However, owners who can’t pay an additional $288 to $387 per month in HOA fees will be forced to sell their condos.

Florida recertification triggers huge special assessment for condo owners

A similar situation is playing out in Miami, FL, where owners of condos in the 40-year old Palm Bay Yacht Club Association are expected to pay a special assessment of $175,000 for each unit they own. The money is necessary, according to the condo association, to pay for a 40-year building recertification. The recertification process entails an inspection of the structural health of the building, followed by completion of necessary repairs. If repairs are not made quickly, Miami-Dade County will condemn the building and force all residents to vacate. The Palm Bay Yacht Club is a 27-story condo tower with 235 units. Market prices start at around $300,000 and top out at more than $1 million. Obviously, the huge special assessment presents a bigger hardship for owners of less expensive units, as well as owners who purchased their condos for much lower prices many ingrs ago.

…More details…

But, there’s more to this story. You see, the condo association’s property management company hired an engineer to do the recertification inspection, concluding that the structure requires $46 million in repairs. Not surprisingly, condo association members think that estimate is highly inflated. After all, the entire building is valued at $50 million. So, owners got together and hired their own engineer, who has estimated repair costs at about $23 million. In other words, the homeowners’ expert’s estimate is half of the HOA’s engineer’s estimate. That’s why owners have hired an attorney to dispute the amount of the HOA’s special assessment. The legal complaint accuses the management company, AKAM, of a conflict of interes, because AKAM plans to award overpriced contracts to one of its sister companies. Sources :

New HOA fees at Yorba Linda community may force residents out of their homes , By David Gonzalez, KABC, February 11, 2023

A Homeowners Association in East Portland Is in Knots Over What a $5 Million Repair Might Mean for Its Low-Income Residents , by Sophie Peel, Willamette Week, Feb. 15, 2023

Owners asked to pay $175,000 each toward Miami condo 40-year recertification, CBS News Team, Feb. 7, 2023

Angry condo owner admits to arson

In a shocking report, Miami police have arrested a 53-year-old man on 4 counts of arson. Marc Lane Hermann admitted to setting his Longwood, FL, condo unit on fire in January, then shooting himself in the neck. According to local reports, Hermann claims he was seeking revenge against his condo association. Four condos were damaged by the blaze, which was ignited after a gasoline explosion. Hermann reportedly has a court date in March. ( Source : Homeowner wanted revenge against his HOA, so he set his condo on fire, Florida cops say By Madeleine List, Miami Herald, Jan. 24, 2023)

Chicago’s John Hancock building condo association seeks to evict a 91-year-old unit owner over unpaid fines and HOA fees

Jim rodgers suffers from early onset dementia..

Long time condo owner, Jim Rodgers, faces fines from the condo association for causing a nuisance by smoking on his balcony. The unit owner has also fallen behind on his condo maintenance fees. For these reasons, a court recently gave the condo association the green light to evict Rodgers. But moving to a new home at this stage of life would be a hardship for Rodgers. As a solution to the problem, Rodger’s Power of Attorney has located a buyer for the condo unit. The proceeds of the sale would allow the Rodgers to pay his condo association fines and past due HOA fees. The new owner of the condo unit has agreed to allow Rodgers to rent back his unit for the rest of his life. Unfortunately, the condo association won’t cooperate with this compromise. It threatens to add the new owner to its still pending nuisance lawsuit against Rodgers. 91-year-old man faces eviction from John Hancock condo – CBS Chicago (cbsnews.com)

NYC condo dispute over unpermitted addition leads to jail time for penthouse owner

Here’s a truth-is-stranger-than-fiction condo nightmare story. Joe Riccardi, owner of a penthouse condo in New York City, has been locked in a battle over an unpermitted rec room addition to his condo since 2016. Riccardi did not build the addition, which was already in place when he purchased the property. Nevertheless, the courts say it’s Riccardi’s responsibility to have the recreation room demolished, at a cost of nearly $300,000. The condo owner says he has been unable to find any contractor willing to take the job. And besides, he can’t afford the six-figure cost of demolition. But that didn’t stop a Judge from throwing him in jail — three times — for contempt of court. Riccardi spent several months in prison at Rikers, locked up with gang members and convicted murderers, and was released shortly after Christmas 2022. After NBC New York aired an investigation report on Riccardi’s nightmare, a pro bono attorney agreed to take Riccardi’s case. Hopefully, justice will be served. ( Source : NYC Condo Owner Sent to Rikers Three Times in ‘Nightmare’ Property Fight – NBC New York )

Ontario condo association insists on evicting owner’s service dog

Etobicoke condo owners may file a complaint with the Ontario Human Rights Tribunal against the Kings Gate Condominium Association. According to CTV News , the condo association is threatening to evict their registered service dog. Before purchase, the owner and his wife provided the condo board with evidence of the service animal’s registration. But apparently that’s not good enough for the HOA. ( Source : Young Toronto family says condo board is threatening to evict their service dog | CTV News )

Elected official and neighbors push back against high HOA fees in poorly run community

Richland County (SC) Councilman Don Weaver is the owner of four homes in Brookhaven. He says he also owns dozens of homes in other HOA-governed communities, and that he formerly served on the Brookhaven HOA board. Weaver tells WIST that Brookhaven is the “worst ran HOA” he has ever experienced. No doubt that, as an elected official, Weaver had sufficient clout to get the local news to broadcast his community’s HOA horror story. The report publicizes widespread dissatisfaction with Brookhaven’s HOA board and management company. Plenty of other owners in Brookhaven agree that the HOA isn’t transparent about finances. And they complaint that management is harassing owners with fines for alleged violations of HOA rules. ( Source : Homeowner’s association under scrutiny by Columbia residents (wistv.com) )

Hostile investor buys HOA’s parking lot in tax sale, charges residents $120 per month to park

Cleveland (OH) owners of townhouses and condominiums in Smokey Ridge Estates are furious over a hostile investor’s attempt to collect $120 per month for each parking space in their community. Daniel J. Praznovsky purchased the lots containing parking spaces at a state tax sale auction in September 2022. Smokey Ridge Estates HOA once owned the land parcels as common property for the benefit of residents. Somehow, over the years, the HOA became inactive, and no one paid the property taxes for the parking area. Praznovsky has offered to settle with the HOA for $2.4 million, which equates to $30,000 per each condo owner in the 80-home community. Understandably, condo owners refuse to pay, and are suing Praznovsky in court. The big question is: how could the state allow the HOA to default, and then permit a third-party investor to buy the HOA’s property at a tax sale? Apparently, there’s no oversight of HOA, and it’s perfectly legal for a third party to buy common property without the HOA’s knowledge. ( Source : Dispute over residents forced to pay surprise parking fees goes to court (dispatch.com) )

Partial condo collapse captured on camera at construction site in Ontario

A completely sold-out 5-story, 226-unit condominium building, which was still under construction, partially collapsed earlier this month (February 2023). The building is located in Welland, near Niagara Falls, ON. Presumably, the accident will cause scores of condo buyers to back out of their sales contracts — if they can. Will skittish condo buyers get their money back? See this link for video footage. Luxury Welland condo collapse captured on video | CP24.com

Important property rights case to be heard by U.S. Supreme Court

Pacific Legal Foundation is handling the case of a Minnesota woman who lost her home to a tax sale. Geraldine Tyler, 93, owed $15,000 in property taxes. The home sold for $40,000, and the county reportedly kept the excess money from that sale. Tyler sued. A Court of Appeals ruled last year that the county was entitled to keep the money, and had no obligation to return it to Tyler. Pacific Legal Foundation is now appealing the case to the U.S. Supreme Court. Lawyers argue that it’s illegal for government to keep cash proceeds over and above the tax debt amount. The Foundation’s case calls this ‘equity theft,’ which is not permitted under the Fifth and Eight Amendments of the U.S. Constitution. Note that is case does not apply to HOAs, only to governments. Still, the parallels to HOA foreclosures are strikingly similar. The decision in this case could prompt similar lawsuits against HOA foreclosures that essentially steal equity from homeowners. ( Source : Supreme Court takes up property ‘theft’ dispute over unpaid taxes (yahoo.com) )

HOA Legislative news

Connecticut lawmakers to consider updated home sale disclosure requirements.

Homeowner consumer advocates in Connecticut ask for legislation to protect homebuyers, some of whom find out, after the sale, that their concrete foundation is faulty. A proposed bill would require that home sale disclosure documents inform buyers that they are unable to obtain state funded concrete foundation repair assistance when they waive a home inspection. Crumbling foundations, due to faulty concrete that contains a corrosive mineral called pyrrhotite, have become a common problem for homes in the state. In order to save their homes, condominium associations, as well as owners of detached single family homes, must apply for CT state funding to repair or replace their failing concrete foundations. ( Source : Concrete Crisis Remains Focus of Lawmakers – NBC Connecticut )

North Carolina constituents call for regulation of real estate developers in control of HOAs

Homeowners in North Carolina are asking state lawmakers to help regulate real estate developers that remain in control of HOA communities for many years, sometimes decades. One particular problem is that many of the planned communities built by corporate developers (such as Lennar) are constructing roads in HOA communities that don’t meet Department of Transportation standards. When the developer finally hands over control of the HOA to its members, homeowners find out — too late — that they’re stuck with subpar private roads. Bringing roads up to state standards can cost HOA homeowners millions of dollars. And state government will not accept responsibility for public maintenance until NDOT approves construction. Other privately-funded HOA infrastructure expenses for owners in planned communities include stormwater ponds, drainage pipes, retaining walls, and sidewalks. In both planned communities and condominiums, while developers control HOA boards, they tend to underfund capital reserve accounts, leaving it up to homeowners to make up the difference in the future. Homeowner-led HOAs are then forced to drastically increase HOA fees to cover the gap in reserves. Property owners say legislative oversight — with enforcement — is necessary. ( Source : Homeowners vs Developers: The fight for HOA control in North Carolina (wbtv.com) )

Colorado legislature to debate creating HOA, Metro District task forces

Meanwhile, in Colorado, the Legislature is considering a bill that would create two task forces to study HOAs and Metro Districts in the state. The task forces would then recommend appropriate regulatory legislation. As expected, the HOA industry opposes the bill. But hopefully Legislators will ignore the real estate and CAI lobbyists this time. ( Source : Bill aiming to hold HOAs accountable has first committee hearing (denver7.com) )

Virginia Senators defeat bill that would have created more incentives for HOAs to fine homeowners

Here’s a bit of good news on the Legislative front. This year, Community Associations Institute’s Legislative Action Committee made an attempt to override Covenants and Restrictions of older HOA-governed communities in Virginia. The group convinced the Assembly to introduce VA HB 2098, a bill that would have made fines legal throughout the state, even iVirginiaf the authority to fine is not included in the HOA’s Covenants. Property rights attorney John Colby Cowherd explains that, if the Legislature chose to pass HB 2098, it would result in more HOA fines, and fewer rights for owners to appeal those fines. The bill passed easily in the Assembly, but, thankfully, it was soundly defeated in the Senate. You can view several state Senators speaking in opposition to the bill in this video of the Senate of Virginia Committee and Floor Streaming, February 21, 2023 – Regular Session – 10:00 AM. Fast forward to view the relevant commentary at 2:48:00 – 2:60:00. Finally, some state Legislators are starting to acknowledge HOA overreach and fight back against HOA-trade group lobbyists.

Sources : February 22, 2023 – Regular Session – 10:30 am – Feb 22nd, 2023 (granicus.com)

2023 Statutory Amendment Would Stimulate HOAs to Fine Virginia Homeowners Even More , by John Cowherd, PLC (Feb. 8, 2023, updated Feb 21, 2023)

After many years in court, FL condo owner loses property to hostile investor, plans to appeal

The New York Times recently printed a full-page article highlighting the story of Howard Fellman’s years-long battle to keep his condo. Fellman has been the lone holdout in a condo termination attempt that began nearly 2 decades ago. As explained in NYT , when he purchased his Boca Raton condo at Crystal Palms, the governing documents stated that the condo association could only be terminated if 100% of unit owners voted in favor of it. However, over the years, an investor acquired most of the units in Crystal Palms, enough to vote himself on to the condo board, and appoint allies. After several years, the investor voted to amend the Condominium Covenants to change approval for termination to just 80% of unit owner interests, instead of 100%. Condo law in Florida and many other states allow less than unanimous approval for a condo termination or deconversion. Since the investor already controlled more than 80% of the vote in the condo corporation, it was easy to terminate the condominium, eventually forcing Fellman to sell on terms favorable to the investors. Fellman plans to appeal the court’s decision to force him to sell. ( Source article posted on LinkedIn )

Have an HOA news story to share? Contact me at [email protected]

Share this:

You must be logged in to post a comment.

Watch CBS News

Owners asked to pay $175,000 each toward Miami condo 40-year recertification

By CBS Miami Team

Updated on: February 7, 2023 / 7:06 PM EST / CBS Miami

MIAMI - A shocking assessment for one condominium in Miami this week.

Owners are being asked to pay $175,000 each towards their 40-year recertification. This is a story we have been hearing more and more across South Florida.

Residents say something isn't adding up and they are putting the blame on their homeowners' association.

"I'm in shock in disbelief," said Christian Murray.

Murray has lived in the Palm Bay Yacht Club condos since 2016. Now he and many other residents are worried if they'd be able to keep their homes.

Background The building needs its 40 year recertification, meaning, an engineer needs to come and see if the building needs structural and electrical repairs. It's not uncommon that some areas need to be fixed.

When the property managers brought in their engineer, they claimed the building needed $46 million dollars in repairs.

"We'd have to pay nearly $200 thousand in repairs," said Murray. "That's insane."

Murray says the entire building itself is worth around $50 million.

So residents hired a different engineer to do the same assessment, and they were told the building needed around $23 million in repairs, a far cry from the initial $46 million.

"Asking for $46 million is really extraordinary," said attorney Jane Muir.

Muir was hired by the residents to fight against the property managers.

The Problem Upon further investigation, Muir said the initial engineer largely inflated the cost of repairs. Residents believe the property manager, called AKAM, is not only inflating numbers but also wants to hire their sister company, Project Management Group, to do the repairs.

"It's going to ruin their lives, people are going to lose their homes," said resident Sonia Przulji. "I cannot afford this. I've cried myself to sleep wondering what I'd do."

"I want the truth," said resident Margarita Genova-Cordova. "This is not right."

CBS4 reached out to the AKAM attorneys and they've agreed to speak with us.

The CBS Miami team is a group of experienced journalists who bring you the content on CBSMiami.com.

Featured Local Savings

More from cbs news.

Miami FBI joins search for man wanted in 2021 murder, reward increased to $10,000

Zoo Miami helps make sick boy's wish to be a zookeeper for a day come true

What's on the ballot for the 2024 Florida primary? Here's what's being voted on

Miami International Airport having record-breaking Spring Break season, travel tips if you have plans

Palm Bay Yacht Club Condo Owners Facing a $46 Million Repair Bill

Published Date: February 10, 2023

Category: LOCAL NEWS

Condominium owners at the Palm Bay Yacht Club in Miami are facing a daunting assessment, demanding each owner contribute $175,000 towards their building’s 40-year recertification. This assessment has sent shockwaves through the community, leaving residents deeply concerned and disbelieving of the figures presented. They are pointing fingers at their homeowners’ association for the exorbitant cost estimate.

Assessment Discrepancy

The 40-year recertification process is a routine procedure for aging buildings, requiring a professional engineer to assess the structure and electrical systems for necessary repairs. However, when the property manager, AKAM, hired their engineer for this task, they asserted that the building required a jaw-dropping $46 million in repairs. This eye-popping figure left many residents in disbelief, especially considering that the entire building’s estimated value is around $50 million.

Independent Evaluation

In response to this shocking assessment, residents decided to take matters into their own hands. They enlisted the services of an independent engineer to conduct a fresh assessment. To their relief, this engineer estimated repair costs to be approximately $23 million, significantly less than AKAM’s initial evaluation.

Legal Action and Concerns

As a result, residents have engaged legal representation, including attorney Jane Muir, to challenge the property manager’s assessment. They strongly suspect that the cost of repairs has been vastly inflated. Moreover, there are concerns about a potential conflict of interest, as AKAM is reportedly considering hiring their sister company, Project Management Group, to oversee the repairs.

Emotional Toll and Calls for Transparency

Many residents are deeply distressed by the financial burden this assessment places on them, with some fearing that they may lose their homes if they cannot meet these exorbitant costs. The situation has stirred emotions within the community, with residents demanding transparency, fairness, and accountability from the homeowners’ association.

Residents Speak Out

Sonia Przulji, one of the residents, expressed her concerns, stating, “It’s going to ruin their lives; people are going to lose their homes. I cannot afford this. I’ve cried myself to sleep, wondering what I’d do.” Another resident, Margarita Genova-Cordova, echoed these sentiments, saying, “I want the truth. This is not right.”

Ongoing Investigations

CBS4 has contacted AKAM’s attorneys, who agreed to discuss the matter further. This suggests that ongoing investigations are in progress, and more revelations may come to light as the situation unfolds.

Original Article By CBS Miami

February 20, 2024

Construction Set to Begin on 32-Story Worldcenter Condo Tower

February 15, 2024

Why SIRS Matters: The Importance for Building Owners

BLOG , Reserve Study

NEED MORE INFORMATION?

Talk to a PES engineer today! Whether you’re seeking a local connection for a development opportunity or in need of recertification before the nearing 2024 deadline we’d love to hear about your project.

- 2870 Stirling Road, Suite 215 Hollywood, FL 33020

- Phone: (954) 994-2660

- Email: [email protected]

Mon – Fri: 9AM – 5PM

© Copyright 2024 | All Rights Reserved

Community Associations Network

Bayfront miami condo tower embroiled in legal battle over major assessment.

A bayfront Miami condominium in need of repairs is in a legal fight pitting unit owners against the condo association. The 27-story, 235-unit Palm Bay Yacht Club made headlines last week over a proposed $46 million special assessment to fund repairs required for the property’s 40-year recertification. A group of 10 unit owners filed a lawsuit in October against the Palm Bay Yacht Club Condo Association, affiliates of the property management firm AKAM and other companies, alleging fraud and negligence. Read the article………………………..

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

- Building Gallery

- Building Advisor Login

- Partner Program

- Post a Listing

- Agent Marketing

- View Saved Buildings

- View Saved Searches

- View Saved Searches

- Luxury Condos

- Foreclosures

- Find an Agent

- Post Listing

- Building Reviews

- Atlanta Austin Boston Charlotte Chicago Cleveland Dallas Denver Fort Lauderdale Honolulu Houston Indianapolis Las Vegas Los Angeles Miami Milwaukee Minneapolis Naples Nashville NYC Orlando Palm Beach Philadelphia Phoenix Portland San Antonio San Diego San Fran San Jose Seattle St Louis Washington DC View All Buildings Building Reviews

- Get a Free Quote

- Building Documents

- Buyer Hotline -

- View My Account

- Saved Buildings

- Saved Searches

780 NE 69 St Miami, FL 33138

Palm Bay Yacht Club

27 Floors - Biscayne Bay And Miami Skyline Views

- Total units 235

- For sale 14

Do you want to talk with a Palm Bay Yacht Club Specialist?

March 21st, 2024 - Welcome to Palm Bay Yacht Club

Building description.

Located directly on Biscayne Bay in North Miami, Palm Bay Yacht Club is an exclusive 27 story building hosting 235 units. The building showcases breathtaking views of Biscayne Bay and Miami Beach. Palm Bay Yacht Club offers various floor plans with one or two bedrooms. Many units have been upgraded with stainless steel appliances, new flooring, granite countertops, and luxurious bathrooms. Residents have access to an array of amenities including pool, fitness center, sauna, four tennis courts, lobby bar, convenience store, and a playroom. Located in a prime location, Palm Bay Yacht Club is just minutes from downtown Miami, Brickell, Miami Design District, Wynwood, entertainment, restaurants, and shopping. Palm Bay Yacht Club offers waterfront luxury at an affordable price.

Year Built 1982

Building amenities.

- Fitness Center

- Tennis Courts

- Convenience Store

- 24-Hour Security

Palm Bay Yacht Club Building Advisor

Helpful Links for Buyers and Renters

Free Condo Buyer's Guide

Please download our Free Condo Buyer's Guide to help you save time and money.

A agent will be in touch with you to schedule a showing or provide you with building information.

Want to appear as the agent above? Learn More

Get a FREE Building Report! Track listings, closed sales and values.

Association Information & Financing

Association information.

- HOA Fee: Contact Advisor

- Managment Company: Contact Advisor

- Manager Name: Contact Advisor

- Manager Phone: Contact Advisor

- Manager Email: Contact Advisor

Lender Approvals

- FHA: Contact Advisor

Association Documents

Unit Inventory & Sales History

3 units with 1 bedrooms for sale at palm bay yacht club, 11 units with 2 bedrooms for sale at palm bay yacht club, 4 units with 1 bedrooms for rent at palm bay yacht club, 5 units with 2 bedrooms for rent at palm bay yacht club, 28 units with 1 bedrooms just sold at palm bay yacht club, 237 units with 2 bedrooms just sold at palm bay yacht club, 1 units with 4 bedrooms just sold at palm bay yacht club, palm bay yacht club total units: 235.

NEIGHBORHOOD North Miami

Avg. list price in palm bay yacht club, avg. price / sq. ft. in palm bay yacht club, avg. rental price in palm bay yacht club, avg. days on market in palm bay yacht club, recent sales.

- Move slider to adjust the date range.

- Hover your cursor over any bar in the graph for unit sales details.

Reviews for Palm Bay Yacht Club

The palm bay club.

I live in the green building, not to be mistaken for the brown building which is in the same complex. We bought our apartment in 1992 and it is the best thing we ever did.<br/><br/>If you were looking to rent or preferably buy an apartment in this building now, there is a lot I could tell you. We have lived through several down and upswings in the market and seen a great many managers come and go. Even considering this volatility Palm Bay is a very good building. Once you have paid your maintenance, which compared to other bldgs in the area is fairly low, there is nothing else to pay for. <br/><br/>The pool is wonderful, the tennis courts are never filled, the exercise room is 1st class, there is a room especially devoted to little children, a library, a convenience shop, parking and free cable is considered part of maintenance and most important the staff could not be more friiendly and helpful. The views from almost any apartment are spectacular especially those facing south.<br/><br/>There are people here of all ages. A few over the age of 65, the vast majority are middle aged and work during the week. And, there are a few children. I love the place.

PALM BAY YACHT CLUB

Hola por favor me podria enviar informacion acerca de este apartamento de dos habitaciones en este sitio,pues tengo un hijo interesado gracias mil de antemano.<br/><br/>MARCELA CALLE

Live in the building?

Positive reviews increase value. Write a review today!

Mortgage Rates & Calculators

Nearby similar buildings.

Nirvana North Miami

Palm Bay Yacht Club North Miami

Nirvana, 777 Ne 62 St North Miami

Nirvana, 750 Ne 64 St North Miami

Palm Bay Towers, 720 Ne 69 St North Miami

Experience the benefits of free & personalized real estate services..

- Save time and money!

- No commitments or contracts

- Get the best price!

- Neighborhood and building information

- Free Expert Advice

NEARBY CITIES

- El Portal Condos for Sale

- Miami Shores Condos for Sale

- North Bay Village Condos for Sale

- Biscayne Park Condos for Sale

- Miami Beach Condos for Sale

PALM BAY YACHT CLUB NEIGHBORHOODS

- South Beach Condos for Sale

- Downtown Miami Condos for Sale

- Brickell Condos for Sale

- Flamingo / Lummus Condos for Sale

- North Miami Condos for Sale

PALM BAY YACHT CLUB ZIPS

- 33164 Condos for Sale

- 33137 Condos for Sale

- 33150 Condos for Sale

- 33151 Condos for Sale

- 33127 Condos for Sale

FEATURED BUILDINGS

- Quantum On The Bay

- Icon Brickell - W Miami

- The Club At Brickell Bay

- Opera Tower

- Century Park

Get Notified

Get building report.

Your building report is ready! View Now

SAVED BUILDINGS

- Palm Bay Yacht Club

Palm Bay Yacht Club Condos For Sale - Miami

Welcome to your local Palm Bay Yacht Club condos for sale & Miami real estate resource. To request up-to-date information, including sales history and prices, property disclosures, and more about Palm Bay Yacht Club properties for sale, or to arrange your 780 NE 69 St, Miami, FL private showing, contact your local real estate experts today. Read more about Palm Bay Yacht Club real estate .

Condos For Sale in Palm Bay Yacht Club Miami

Get notified when matching listings become available. We also have found more listings nearby within 5 miles of this community.

See All Homes for Sale in Miami Beach View TODAY's New Listings by beds, baths, lot size, listing status, days on market, & more!

Purchasing a condo in Palm Bay Yacht Club? Call Laurie Finkelstein Reader Real Estate at (954) 415-4602 today! Our real estate agents are here to help with the Palm Bay Yacht Club housing market.

Palm Bay Yacht Club Condo Search

The Palm Bay Yacht Club condo listings on this page are updated several times per day with information from the Miami, Florida MLS.

Every Palm Bay Yacht Club MLS listing features important details entered by the listing agent, such as property price, days on the market, square footage, year built, lot size, number of bedrooms and bathrooms, assigned schools, and construction type.

Check the current listing status and the local Palm Bay Yacht Club property tax information. As available, numerous property features such as greenbelt locations, views, swimming pools, and Palm Bay Yacht Club community amenities, including parks and golf courses, will be listed.

Palm Bay Yacht Club Miami Condo Specialists

Interested in buying a condo in Palm Bay Yacht Club? Let our Miami real estate experts guide you through the sale of your current residence or the purchase of your new Palm Bay Yacht Club property. As local real estate agents, we're well-versed in the unique dynamics of the Palm Bay Yacht Club real estate market.

Connect with Laurie Finkelstein Reader Real Estate to get more information about buyer or seller representation. Selling your Palm Bay Yacht Club property? Visit our market analysis page to receive a free condo value estimate within minutes.

Search Condos For Sale in Palm Bay Yacht Club Miami

Back to Miami Real Estate

- Selling a Home

- Guaranteed Offer

- Pricing Your Home

- Marketing Your Home

- Showing Your Home

- Adding Value

- Free Market Analysis

- Virtual Home Selling

- Sell Now Move Later

- Off-Market Listings

- Mortgage Calculator

- Mortgage Pre-Approval

- First Time Buyers

- Making an Offer

- What Are Closing Costs?

- Escrow: Now What?

- Financial Terms Glossary

- Personalized Home Search

- Virtual Home Buying

- Communities

- Forever Client Club

- Why List With Us?

- Advanced Search

- Search by Map

- Property Tracker

- Featured Listings

- Life & Culture

- entertainment

ONLY AVAILABLE FOR SUBSCRIBERS

The Tampa Bay Times e-Newspaper is a digital replica of the printed paper seven days a week that is available to read on desktop, mobile, and our app for subscribers only. To enjoy the e-Newspaper every day, please subscribe.

IMAGES

COMMENTS

The 27-story, 235-unit Palm Bay Yacht Club made headlines last week over a proposed $46 million special assessment to fund repairs required for the property's 40-year recertification. A group of ...

The Palm Bay Yacht Club stands 27 stories high at 780 NE 69th St., and real estate listings for its residences - with price tags between $338,000-$600,000 - boast of Biscayne Bay views, luxury amenities and an idyllic South Florida lifestyle. ... The Champlain Towers South Condo Association approved a $15 million assessment in April 2021 to ...

Palm Bay Yacht Club Expand (Milena Malaver for Biscayne Times) ... Palm Bay Towers, due for its 50-year recertification, is in the midst of paying off a $21.5 million assessment approved by the board in 2021 that will cover concrete restoration, spalling and sea wall repairs, upgrades of life safety engineering systems, a new generator and ...

Palm Bay Club condo owners hire engineer who says things do not add up 03:46. MIAMI - A shocking assessment for one condominium in Miami this week.. Owners are being asked to pay $175,000 each ...

The Palm Bay Yacht Club in Miami and Palm Lakes in Margate could not be any more different. One is 27 stories, the other just four. ... The average assessment is around $140,000 per unit owner.

Neighbors at the Palm Bay Yacht Club are looking at a monthly increase of up to $5,000 By Jamie Guirola • Published February 8, 2023 • Updated on February 9, 2023 at 5:19 am NBC Universal, Inc.

Palm Bay's Triple Trouble. Litigation against the Palm Bay Yacht Club's $46 million assessment is well underway, with final testimonies, closing arguments and a judge's ruling expected within the next week or so. The Biscayne Times' February 2023 cover story broke news on allegations of fraud and secrecy made by the residents of the 27 ...

File this story in the misery loves company section for Key Biscayne condo owners who are facing special assessments on their units. This week, a condominium in Miami Beach - Palm Bay Yacht Club - a 27 stories, 235-unit complex located in the Upper Eastside neighborhood - were outraged over a $175,000 assessment for each unit due to repairs needed as part of the building's ...

NEWS. How Condo Associations and Attorneys Can Help Lower Steep 40-Year Recertification Assessments. Last week, condo owners at the Palm Bay Yacht Club condos in Miami were told they needed to pay ...

From her condo balcony on the 21st floor of the Palm Bay Yacht Club, Sonja Przulj can see Biscayne Bay, downtown Miami and South Beach. A $145,000 special assessment from her condo association ...

The Palm Bay Yacht Club is a 27-story condo tower with 235 units. Market prices start at around $300,000 and top out at more than $1 million. Obviously, the huge special assessment presents a bigger hardship for owners of less expensive units, as well as owners who purchased their condos for much lower prices many ingrs ago. …More details…

Owners asked to pay $175,000 each toward Miami condo 40-year recertification 03:13. MIAMI - A shocking assessment for one condominium in Miami this week.. Owners are being asked to pay $175,000 ...

Palm Bay Yacht Club. The Champlain Towers South Condo Association approved a $15 million assessment in April 2021 to complete repairs in preparation for its 40-year recertification process. The oceanfront 12-story building in Surfside collapsed weeks later on June 24, killing 98 people. And, just as the Champlain Towers residents were shocked ...

Condominium owners at the Palm Bay Yacht Club in Miami are facing a daunting assessment, demanding each owner contribute $175,000 towards their building's 40-year recertification. This assessment has sent shockwaves through the community, leaving residents deeply concerned and disbelieving of the figures presented. They are pointing fingers at their homeowners' association for the ...

Buildings A bayfront Miami condominium in need of repairs is in a legal fight pitting unit owners against the condo association. The 27-story, 235-unit Palm Bay Yacht Club made headlines last week over a proposed $46 million special assessment to fund repairs required for the property's 40-year recertification. A group of 10 unit owners filed a.

Palm Bay Yacht Club condo residents hired and an engineer who says that the cost of doing repairs will not be as much as they first thought.

Repairs at a Miami condominium where unit owners were hit with over $100,000 in assessments each will go forward after the association and property management firm was accused of mismanagement and ...

Palm Bay Yacht Club is a 27 story condominium building in Miami, FL with 235 units. There are currently 14 units for sale ranging from $325,000 to $1,529,000. The last transaction in the building was unit 2002 which closed for $450,000. Let the advisors at Condo.com help you buy or sell for the best price - saving you time and money.

The prospect of a $145,000 special assessment and the ensuing court fight have soured Palm Bay Yacht Club resident Przulj on condo life. "I love this building, and everyone who comes here sees ...

After Logging In, you can: View building notices, documents and forms in online Library. Submit maintenance requests for needed repairs. Post visitor or contractor permission-to-enter instructions. Check on status of your package or dry cleaning deliveries. Access online building address book and events calendar.

Welcome to your local Palm Bay Yacht Club condos for sale & Miami real estate resource. To request up-to-date information, including sales history and prices, property disclosures, and more about Palm Bay Yacht Club properties for sale, or to arrange your 780 NE 69 St, Miami, FL private showing, contact your local real estate experts today.

The residents of Palm Bay Yacht Club began making payments April 1 toward repairs for the property's 40-year recertification, the costs of which some owners have maintained are largely and artificially inflated. ... Palm Bay Towers, due for its 50-year recertification, is in the midst of paying off a $21.5 million assessment approved by the ...

The Tampa Bay Times e-Newspaper is a digital replica of the printed paper seven days a week that is available to read on desktop, mobile, and our app for subscribers only. To enjoy the e-Newspaper ...

Sonja Przulj loves her two-bedroom, two-bath condominium in Miami, located on the 21st floor of the 27-story Palm Bay Yacht Club, with spectacular views of Biscayne Bay, downtown Miami and South Beach. She paid $285,000 for the corner unit in September 2021 after renting in the building for years.