NEW ON BOATSATSEA

- Lettouli III

- La Mia Stella

NEWEST SPECIAL OFFERS

- Elvi ( 15% off)

- Summerwind ( 20% off)

- Ocean Vibes ( 10% off)

- Euphoria ( 10% off)

- Infinity ( $1,500 off)

- The Pursuit ( $3,000 off)

- See All Special Offers

TOP CHARTER YACHTS

- Crystal Dreams ( 15% off)

- Mystic ( $2,000 off)

- Island Standard Time ( $3,000 off)

- Bella ( $3,000 off)

- See All Yachts

Most Searched Yacht

Ad astra 5.4.

From $28,500 per week

TOP DESTINATIONS

- Virgin Islands (BVI & USVI)

- Leeward Islands / St. Martin

- Windward Islands / Grenadines

EUROPE / MEDITERRANEAN

- Amalfi Coast & Sicily

- Riviera & Corsica & Sardinia

- Spain / Balearics

- New England

- South America

MY FAVORITE YACHTS

- See Favorite Yachts

- Send & Share Favorite Yachts

- Empty Favorite Yacht List

- Yacht Charter FAQ

- Rates Explanations

- Concierge Service

- Customer Satisfaction

- BoatsAtSea Reviews

- Dedicated Support

- Privacy Policy

- Cookie Policy

Seaglass 74 - Crewed Catamaran Charter

Seaglass 74 $51,600, seaglass 74.

Seaglass 74 Image 1/28

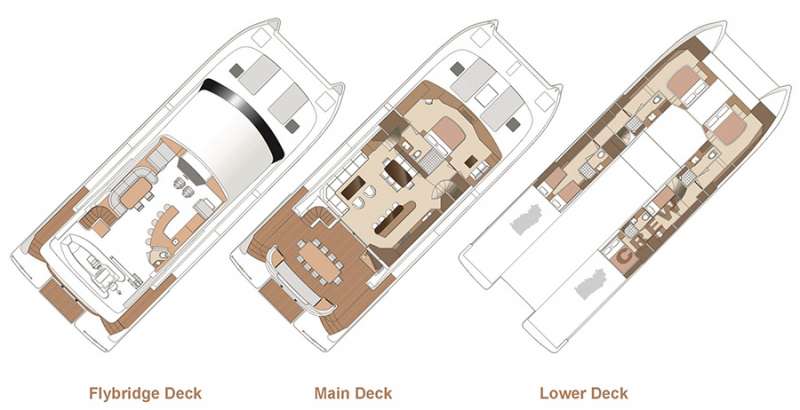

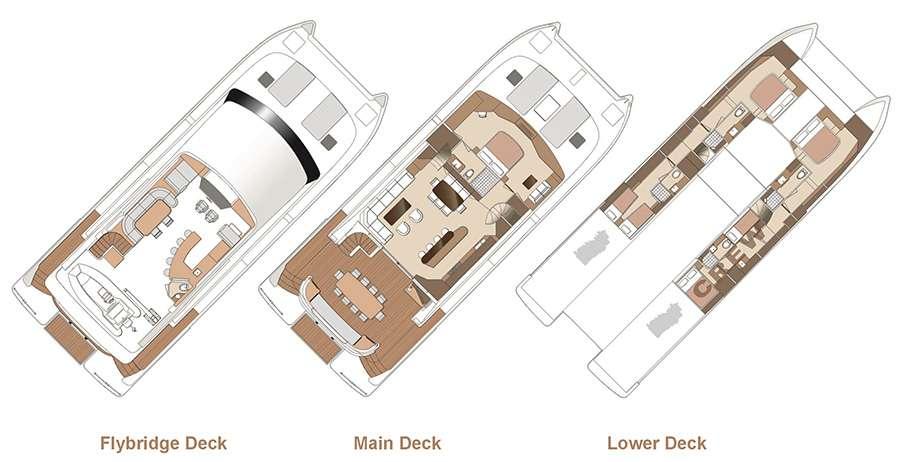

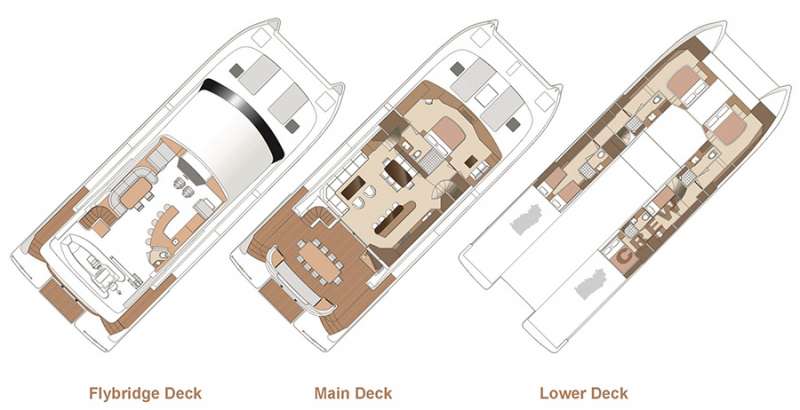

Layout of Seaglass 74

Spacious Main Deck Salon

Alfresco dining on the aft deck

On Deck Primary Stateroom

VIP King Stateroom

VIP King Stateroom Port

Twin Stateroom

Seaglass 74 Image 11/28

Seaglass 74 Image 12/28

Seaglass 74 Image 13/28

Seaglass 74 Image 14/28

Seaglass 74 Image 15/28

Seaglass 74 Image 16/28

Seaglass 74 Image 17/28

Seaglass 74 Image 18/28

Seaglass 74 Image 19/28

Seaglass 74 Image 20/28

Crew of Seaglass 74

George Filip (Deck Hand/Steward)

2023 Best Motor Yacht Runner Up (BVI Charter Yacht Show)

Sample dish on board of Seaglass 74

- From $51,600 / week

- Catamaran + 3 crew

- Summer Port: Cruising Areas Summer: Caribbean Virgin Islands Summer Port: BVI Winter: Caribbean Virgin Islands Winter Port: BVI Prefered Pickup: Village Cay - Winter ">BVI

- Winter Port: Cruising Areas Summer: Caribbean Virgin Islands Summer Port: BVI Winter: Caribbean Virgin Islands Winter Port: BVI Prefered Pickup: Village Cay - Winter ">BVI

- Length: 74 ft / 22.6 meters 74 feet 22.6 meters

- Guests: 8 in 4 cabins

- Builder: Horizon

- Built: 2018 / Refit: 2021

- Offers Rendezvous Scuba Diving only

$62,000 $51,600

All Inclusive

- Reviews (15)

Seaglass 74 Description

SEAGLASS 74 - ´The Ultimate Cruising Yacht.´ Best in Show 66ft and up, 2019 St. Thomas Charter Yacht Show A spacious and pacey power catamaran, 74ft (22.5m) Horizon-built SEAGLASS 74 is highly awarded and popular with charter guests for her many features and amenities. Described as “The Ultimate Cruising Yacht”, SEAGLASS boasts exceptional space equal to a much larger monohull vessel and is available for charter in the Bahamas. The modern clean lines of Sea Glass 74, a Horizon PC74, have been skillfully created from the drawing board of renowned designer, JC Espinosa, known for his flair for designing very elegant mega yachts. Sea Glass 74 is a stunningly beautiful power catamaran with free-flowing lines, a superstructure that is pleasing to the eye and draws your attention to study her complex simplicity. The yacht’s luxurious, plush interior sets her apart. Charter guests will appreciate the main deck, with all the primary living areas on a single level, including the massive aft deck with dining for 10 and lounging for 8, a bar and ample storage lockers. The large saloon offers seating for 8, separate inside formal dining for 8, gourmet galley with island and bar with 4 stools. Forward on the main deck is the glamorous full beam primary stateroom with walk around King bed, 180-degree views, spacious en-suite bathroom, sofa, vanity, and ample storage. The lower decks offer two large King VIP en-suite staterooms, port, and starboard forward. The fourth guest en-suite stateroom, port aft, can be configured to accommodate a couple or 3 children. The crew cabin is in the starboard aft section of the yacht. The yacht’s flybridge is an entertainer’s delight, with large comfortable dining and lounging for up to 10 guests, a well-equipped bar with seating for 5, a day head, a separate BBQ area and dinghy stowage plus loads of room for chaise lounges once anchored off a secluded beach in an exotic location. The aft deck Hi/Lo swim platform, suspended between the hulls, ensures that everyone can access the water with ease. The foredeck offers two large sun pads and bow seats. Step aboard Sea Glass 74 for a luxurious vacation of fine dining, relaxation, and adventure.

Cruising Area of Seaglass 74

Accommodations, specification, water sports, scuba diving, entertainment, green initiatives, seaglass 74 crew profile.

Paul grew up on the coast of Cornwall in the UK where he learnt to sail dinghies when he was only 12 years old. He achieved his Commercial Yacht Master and Cruise Instructor in Gibraltar, which opened the door to this amazing lifestyle. He has sailed extensively in the UK, the Atlantic & the Mediterranean. In more recent years, has been fulfilling his dream of operating luxury Catamarans in the Caribbean & Bahamas. Paul got hooked on diving in 1995 and became a Dive Instructor in 2012. He enjoys underwater photography and would love to dive beneath the ice in the Antarctic. Growing up around the Rocky Mountains in Canada, as a youth April wanted to explore the world, and soon traveled from coastline to coastline. She lived in New Zealand for 7 years where she fell in love with the adventure of sailing. It began with her employment as a stewardess on a 72ft Swath Ocean Catamaran in 2007, and quickly grew from there. Obtaining her Commercial Yacht Master and becoming a qualified diver opened up a love, respect and appreciation for life on the water. Combined with a passion for nutritional creativity, April uses innovative techniques to bring you fresh, healthy dishes and sail you into a culinary paradise. George Filip is a Romanian who speaks fluent English and is fluent at all watersports which makes him a great first mate. Equally adept at assisting above and below deck. He helps the Captain and guests on deck and acts as chief steward below - George is especially popular at Happy Hour where he shows off his expertise as a mixologist. Paul, April and George feel privileged to be your hosts and thoroughly looking forward to giving you a vacation of a lifetime. Crew are fully vaccinated for COVID 19.

Seaglass 74 Calendar

Seaglass 74 reservations & port locations, seaglass 74 rates / week, low price: $62,000, high price: $64,500, additional rate details, seaglass 74 guest reviews, may 2023 you guys were fantastic.

April, Paul and George, You guys were fantastic! Best yachting experience, we have ever had! The food was outstanding - favourites were steak, pzza & pasta. Boss & Karina

Dear Paul, April & George, We simply can´t thank you enough for a priceless vacation! The three of you are an incredible team! We enjoyed your warmth, humor, passion & professionalism. Thank you! With Love, Kavina & Bob

Paul the fearless leader, April the Master Chef & George the host with the most!

Paul, April & George, Thank you All for an amazing week abroad SeaGlass. As first time ´Yachties´ you all made us feel right at home. Paul the fearless leader, April the Master Chef & George the host with the most! You all take great pride in your work, and it shows. The attention to detail was amazing.and it looked effotless - even- though we know you work hard to make things just right. We will always remember this trip and all of you fondly. Hope our paths cross again someday. Jay & Kathy P.S. Kudos to Paul for is folk rock playlist, had my Mom singing along. LEGENDARY!!

May 2023 - Amazing experience on SeaGlass

Paul, April and George, Thank you so much for an amazing experience on the Sea Glass. Your hard work, attention to detail and focus on a great customer experience really came through every minute of every day. We were not left wanting for anything and felt part of the process and experience and that made all the difference in what a terrific week was! Thank you again for all you did and all you do! Steve and Kristina. P.S. My diet is about to take a huge turn for the worst after a week of April´s cooking.

Special Family Vacation Filled with endless memories

Captain Paul, April & George - Thank you for an unbelievable experience! You exceeded expectations in every regard. This will always be one of our most special family vacations filled with endless memories and thank you for the endless ´Mexican Water´ George! You were top notch @ keeping out glasses full! The Santiago & Schussler Families until New Year! Paul, April & George - Thanks for such a great trip. It was definitely needed and greatly appreciated. I hope when sure trials are over, will be back. Until then, smooth sailing & lots of hugs. Katy & Paul

March 2023 BVI

Paul, April & George, You´re an incredible team showing us kindness, respect and professionalism in everything you do. You extend warmth of creativity in a friendly and manner all while making great choice in explaining to us. It was a joy to experience SeaGlass and meet you all. Thank you for everything. Facert

February 2023 BVI

Thank you for an absolutely unforgettable week of Fabulous food, fun, and friendship. Every moment was magical thanks to George´s exceptional service, attention to detail and mad flite skills to April´s sweet smile and savory dishes and to Paul´s excellent command of the boat and taste in music. We knew we would make new friends. Can´t wait to see you again, whether in Orlando or back on the Sea Glass! Love Larry & Kristy Ann Brown I hope you do not forget me as I will never forget you. Love you guys. Thank you guys for an amazing trip! You all made us feel like family and we appreciate that. Please do not forget to look us up next time you´re in the Abacos, we would love to show you a good time. Amy Holley

January 28 - Feb 4, 2023

This has been a once in a lifetime experience (We hope not!) And, we couldn´t have asked for a more wonderful crew to guide us through it all! Captain Paul made us feel very safe and knowledgeable about the BVI - not to mention his winning knowledge of the songs of the 80´s!! George - Aka ´Mr. Deeds´ was extraordinary quick to make a drink, make our bedrooms up or shape stories of his homeland. April - there are no words, so sweet, so talented - an artist in the kitchen. Yum! You and Paul are such a wonderful couple! Thank you for making us feel like a part of your crew! Thank you also for putting up with our sense of humor and craziness. Take care - We wish you all the best and thank you again and again. Todd & Laura Miller, Linda & Larry Martin, Chris and Mitch Embrey.... CY and Betsy King! Captain, April and George - This has been the vacation of a lifetime! You all did everything to make this the most special week. George - Your love of poker & famous expresso martini will live in our memories forever. April - Holy smoker! Your amazing meals were the highlights of our trip and your cheer made us feel like family. Captain - You are the perfect blend of boss and teacher. We always felt safe & secure in your hands. Thank you for making this the trip of a lifetime. We miss you already! Larry and Linda Martin, C & Betsy King, Chris and Mitch Embrey, Laura & Todd Miller

January 2023 BVI Trip of a Lifetime

April, Paul & George Thank you all for a trip of a lifetime!! You 3 are an amazing Crew plus best of all fantastic people! Paul you created the best itinerary and pulled it off with such ease and agility! April your food was first class but my favorite was your sweet spirit!! I loved being around you George. Thank you for spoiling us all!! You are top notch. I am certain we will talk about you 3 this trip you all made for us for many years to come!! I can´t wait to to book another trip on Sea Glass. Love Killy & Connen Ferrell Sea Glass was an absolute Blast!! This crew made every day a joy, so accommodating, fun and always helpful. Thank you from the bottom of our hearts!! We will never forget this beautiful boat, such an amazing trip and Paul, April and George Thank you A. Andy Niemann

We had such a wonderful time on Seaglass this past week. It was so beautiful waking up to the perfect turquoise water. Everywhere we went was more beauitful than the place before. Captain Paul was so great, always finding us the right spot in calm protected waters with the right currents for swimming and beautiful views. And we just adored April, I woke up this morning immediately missing her amazing breakfast spreads. Plus, she is the most delightful person. I´m still not sure how I´m going to get back to life without a George, I don´t remember how to make a drink myself.

April, Paul & George, Thank you very much for the wonderful week aboard SeaGlass. Being boater - we can appreciate the major effforts you made on our behalf. The meals were exceptional and the service provided by George and paul was much appreciated. We felt very safe while aboard and look forward to joining ´the crew´ again next year on SeaGlass! Thank you again - take care and be safe - Bob and Barbara

January 2022

We Love you Guys April, Paul and George, Thank you for your amazing hospitality! We all needed this aamazing trip away from reality! The amazing meals April provided to Paul bringing/showing us the best parts of teh Bahamas to Georges´sTOP NOTCH careand genuine care of anything & everything we needed. Your hospitality is top notch! We felt so spoiled & taken care of! We will never forget you all. We sinceerely appreciate your care & generosity for us all. We wish you all of the best in everything. I pray we meet again! Thank you Thank you Thank you! Jim & Jennah Mike & Alex Scott & Hollie Chris & Heidi

Pauk, April + George, Thank you so much for the incredible experience! This trip was truly unforgettable all thanks to you guys Your efforts to make sure everything runs smoothly does not go unnoticed. Hope you have a great start to the year and hope to be back on the boat soon. Erik S.

Wow! Expectations exceeded!

Paul, thank you for the most perfect spots of awesome beauty + serenity, and for the effort in all you did as Captain of this awesome boat! April - the wonderful and delish food that was such a surprise - and that Oleo dessert! Goerge - you were so awesome remembering our cocktails --anticipating what we wanted next, never ending freshies! All of you were so sweet; so easy to be with and made this a trip of a lifetime! Quire & Keely Wilmington NC. Paul, April and Geoge Incredible adventure and memory of a lifetime. The boat was so comfortable and enjoyable. Thank you for working so hard to make it so memorable. We wish you the best in all of your future adventures and that Sea Glass will continue to be a refuge for many for years to come. Blessings David Lawson...

Too difficult to express in words how wonderful the last 15 days have been. Pbvioulsy we will have to do it again. Be safe. Cheers - Jerry + Gigi

Seaglass 74 Sample Menu

Breakfast is served with a selection of fresh breads, spreads, fruits, yoghurts, cereals, tea, coffee & fruit juices every morning

Wild Alaskan Salmon Benedict w/ Homemade Hollandaise

Greek Yoghurt Breakfast Bark w/ Fruit, Toasted Almonds & Honey

Belgian Waffles w/ Bacon, Maple Syrup & Bananas

Huevos Rancheros Tostadas w/ Mini Chorizo & Fresh Guacamole

Classic Crepes Suzette w/ Grand Marnier & Orange Zest

Creamy Eggs Florentine w/ Sauteed Dijon Spinach, Crumpets & Bacon

Tuna & Avocado Sushi Stack w/ Spicy Sriracha Sauce

Salmon Sliders w/ Yoghurt, Cucumber & Dill Dressing

Creamy Chicken Pot Pies w/ Garden Greens & Balsamic Glaze

Thai Chilli Chicken Satay w/ Spinach & Mandarin Salad

Seared Yellowfin Tuna Nicoise w/ Soft Boiled Eggs & Baked French Loaf

Asian Citrus Prawns w/ Creamy Red Cabbage Coleslaw

Mini Taco Bites w/ Guacamole & Salsa

Baked Potato Croquettes w/ Spicy Fondue

Oven Roasted Beetroot Hummus w/ Crudites & Freshly Baked Bread

Sushi Medley w/ Wasabi, Soy Sauce & Ginger

Coconut Meatball Poppers w/ Creamy Peanut Sauce

Charcuterie Board w/ Premium Selection from the Delicatessen

Seared Scallops on an Edamame Foam

Caramelised Brie & Onion Tart w/ Mesclun Greens

Prosciutto Asparagus Puff Pastry w/ Garlic Butter

Grilled Watermelon & Feta Salad w/ a Balsamic Reduction

Slow Roasted Tomato Panna Cotta w/ Tapenade Twists

Chilli Lime Shrimp Cups w/ Avocado Salsa

Pork Tenderloin w/ Orange Brandy Jus w/ Kumara Puree & Broccoli Rabe

Edamame Risotto w/ Wild Mushrooms and Mesclun Salad

Lobster Linguine Haddock w/ a White Wine Rose Sauce

Filet Mignon & Prawn Vermicelli Sarong w/ Red Wine Reduction & Garlic Potatoes

Thai Mahi Mahi Curry w/ Coconut Rice

Haddock, Poached Eggs & Crushed Potatoes w/ a Mustard Beurre Blanc Sauce

Frangelico Chocolate Ganache w/ Berries & Homemade Ferrero Roches

Mini Blueberry Pies w/ Vanilla Bean Ice Cream

Pina Colada Cake & Cocktail w/ Rum Floater

Vanilla Bean Panna Cotta w/ Berry Coulis & Maple Toffee Crisp

Key Lime Piew/ Cream & Lime Zest

Bananas Foster w/ a Creamy Baby Guinness

All menu items are subject to availability at local supermarkets and may change dependent on stock available.

SIMILAR YACHTS

Check out similar yachts to seaglass 74.

Ocean Vibes

$61,965 / week

Guests in Cabins: 8 / 4

Length: 74.8 ft (22.8 m)

Summer Port: St. Thomas, USVI

Winter Port: St. Thomas, USVI

Prices from: $61,965 / week

$51,030 / week

Length: 67 ft (20.4 m)

Prices from: $51,030 / week

$41,130 / week

Length: 60 ft (18.3 m)

Prices from: $41,130 / week

$32,175 / week

Length: 62 ft (18.9 m)

Prices from: $32,175 / week

$37,000 / week

Length: 63 ft (19.2 m)

Summer Port: Virgin Islands

Winter Port: Virgin Islands

Prices from: $37,000 / week

Christos Anesti

$40,700 / week

Length: 59 ft (18.0 m)

Prices from: $40,700 / week

- Charter with Friends

- Yacht Charter FAQs

- Destination

- Owning & Buying Yachts

- Experiences | Matchmaking

SeaGlass 74

Sea Glass, a Horizon 75ft power cat took the prize for best in show, at the 2019 USVI Charter Yacht Show at Yacht Haven Grande. This sleek elegant yacht designed by JC Espinoza offers a beam width master suite with 180-degree views on the main deck. Sea Glass has an enormous area for entertaining on the fly bridge. Besides the plush interior, and the vast aft deck, the enthusiastic winter season crew of 3 is spearheaded by Captain Paul Trembath along with Chef April Trembath and mate George.

BVI = $62,000 – $64,500 inclusive, depending on number of Guests

- Location: Catamaran Yacht

- Type: Catamaran Yacht

- Price: $62,000 - $64,500

- Experiences

- Family Charters

- Scuba Diving Charters

- Honeymoon Charters

- Two Person Charters

- Destinations

- British Virgin Islands (BVI)

- US Virgin Islands (USVI)

- St Marten and St Barth

- Florida & Bahamas

- South Florida and Cays

- Western Mediterranean

- Eastern Mediterranean

- New England

- Unique Locations

- Chartering FAQs

- Yacht Fleet Blog

- Types of Charter Yachts

- Mechanics of Booking a Charter

- Choosing Your Yacht

- Types of Charter Contracts

- After Your Charter is Booked

- Chartering Your Yacht

- Buying a Yacht

- Yacht Brokerage Search

- Buying & Selling a Charter Yacht

- Owning a Yacht

- Charter Marketing

- Yacht Management

- BVI Charter Requirements

- Crew Placement

- Why Choose Regency

- Kathleen Mullen

- Heather Wood

- Bobbi Fawcett

- Toll Free: (800)524-7676

- Int'l: +1-305-395-7824

- Fax: (305)768-7711

- Office: (284)495-1970

- [email protected]

©2023 Regency Yacht Vacations. All Rights Reserved | Designed By Artisticore

Get your sample itinerary:

- Sorry, we don't offer day trips or bare boats

Power Catamaran Seaglass 74

Power Catamaran Seaglass 74 is a 2017, 74' Horizon Power Catamaran offering crewed yacht charters in the Bahamas. She features a fly-bridge deck, a crew of 3, and accommodations for up to 8 guests in 1 Master King Suite, 2 King cabins, plus a side by side Twin cabin that is convertible to a King on request. Power Catamaran Seaglass 74 is a Carefree Yacht Charters high-end, exclusive selection for families, couples, or special occasions.

Noteworthy Details: Seaglass, with her crew Paul, April, & George, won 2nd place for Best Motor Yacht at the 2023 BVI Charter Yacht Show!

--> Rates from $ 62,000 to $64,500. $ 62,000 to $64,500.--> View availability, rate details and current Special Offer .

To learn more about this crew or for further details about SEAGLASS 74, call us in our South Florida office at (954) 980-9281 or fill out our Quick Request Form .

Watch this short video featuring 74' Crewed Power Catamaran Seaglass!

Special Offer

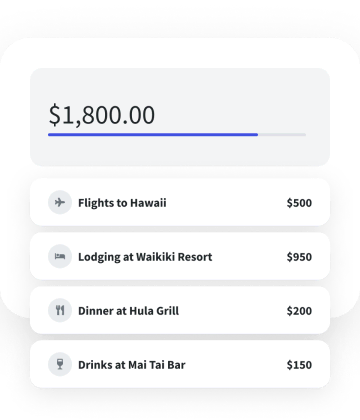

- Accommodates up to 8 guests in 4 cabins

- Rates from $62,000 to $64,500

- Special $51,600 rate for up to 8 guests

- Charters must occur between April 11 - 25, 2024 or May 7 - 16, 2024

- 7 night minimum

Price Details

BVI Winter Rates 2023/24/25 are inclusive to include up to 3 engine hours per day 2/$62,000 4/$62,500 6/$63,500 8/$64,500 SPECIAL SEAGLASS is offering 7 nights for up to 8 guests for just $51,600 (A 20% savings off the 8 pax rate) Available for 7 nights within these dates March 26 – April 2, 2024 April 11– April 25, 2024 May 7 – May 16, 2024 BVI Ports Christmas & New Years weeks 2024/25 - two separate weeks, BVI based Xmas charters must end by the 27th of December, New Years cannot begin earlier than the 29th of December Christmas Up to 8 guests: $73,500 inclusive New Years Up to 8 guests: $73,500 inclusive Not Available for Charter in the US.

Availability

To find the best dates for your charter, call us in our South Florida office at (954) 980-9281 or fill out our Quick Request Form .

Highlighted dates are booked, on hold, or unavailable. We may be able to challenge the dates on hold. Please contact us for details. All other dates not highlighted are available. You can use the arrow icons to navigate through the months.

Dates Color Key

If no color is noted on calendar or in the detailed list below, the dates are available for your charter. Dates can change quickly, so please contact us as soon as possible to begin booking your charter. Highlighted colors mean:

- Booked (Booked by another client group already)

- Hold (Held by another client group, not yet booked, and can be challenged)

- Unavailable (Blocked out by the Owner and unavailable to challenge)

View details on this yacht's availability.

Availability Details

- April 26, 2024-May 5, 2024: Booked: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- May 18, 2024-May 23, 2024: Booked: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- May 25, 2024-May 31, 2024: Booked: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- June 2, 2024-June 8, 2024: Booked: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- June 17, 2024-June 24, 2024: Booked: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- July 8, 2024-November 21, 2024: Unavailable: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- November 26, 2024-December 2, 2024: Booked: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- December 7, 2024-December 14, 2024: Booked: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- December 20, 2024-December 27, 2024: Booked: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- December 29, 2024-January 5, 2025: Booked: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- February 1, 2025-February 8, 2025: Hold: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- April 5, 2025-April 12, 2025: Hold: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- April 14, 2025-April 19, 2025: Booked: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- May 18, 2025-May 25, 2025: Hold: Tortola, Village Cay, BVI to Tortola, Village Cay, BVI

- Location Details : . Winter 2024/25 Seaglass will be available in the BVI with inclusive rates starting November 2024 until mid June 2025 Not available for charter in the US

- Summer Base Port : BVI

- Summer Operating Area : Caribbean Virgin Islands (BVI)

- Winter Base Port : BVI

- Winter Operating Area : Caribbean Virgin Islands (BVI)

- Preferred Pickups : Village Cay - Winter

- Other Pickups :

- Turnaround : 48 hours min firm

Reviews from our Carefree Clients

A family that we booked aboard 74' Power Catamaran Seaglass 74 in March 2020 said:

Lynne- Just wanted to let you know we had an amazing trip on Seaglass with Byron, Molly and their professional crew. Boat was meticulous. Food was amazing. Daily activities always a fun experience. Thank you for helping us arrange the trip. We look forward to another one soon. Best regards, David K., Pennsylvania

Paul grew up on the coast of Cornwall in the UK where he learnt to sail dinghies when he was only 12 years old. He achieved his Commercial Yacht Master and Cruise Instructor in Gibraltar, which opened the door to this amazing lifestyle. He has sailed extensively in the UK, the Atlantic & the Mediterranean. In more recent years, has been fulfilling his dream of operating luxury Catamarans in the Caribbean & Bahamas. Paul got hooked on diving in 1995 and became a Dive Instructor in 2012. He enjoys underwater photography and would love to dive beneath the ice Read More

Crew Pictures

Cabins & amenities.

Accomodation Details

SEAGLASS 74 offers her guests bespoke comfort and room in a main-deck primary king suite, two forward king suites, and an amidships convertible twin -OR- king suite.

Guest Cabins

- Max Guests : 8

- Total Cabins : 4

- King Cabins : 4

- Queen Cabins : 0

- Double Cabins : 0

- Single Cabins : 0

- Twin Cabins : 1

- Pullman Cabins : 0

- Showers : 4

- Electric Heads : 4

- Voltages : 110v

- Hairdryer : Yes

- Water Capacity : 400 gals

- Water Maker : Yes

- Ice Maker : Yes

- Deck Shower : Yes

- Jacuzzi : No

Specifications

- Size : 74 feet

- Builder : Horizon

- Year Built : 2018

- Refit : 2021

- Beam : 28.4

Entertainment

- Kids okay : 0

- Minimum Age of Kids : 12 years of age

- Internet Access : Onboard WIFI

- iPod/Device Hookups : Yes

- Salon Stereo : Yes

- Salon TV/DVD : Yes

- Sat TV : Yes

- Board Games : Yes

- Special Diets : Yes

- Kosher : Inq

- # Dine In : 8

- Crew Smokes : No

- Guest Smoke : Transoms only pls

On-board Water Sports and Diving

- License : -

- Costs : Included for certified divers

- Regulators : 0

- Scuba :Yacht offers Rendezvous Diving only

- Air Compressor : Not Onboard

- Wet Suits : 0

- Dive Lights : 0

- Night Dives : 0

On-board Water Sports

- Dinghy : 16 ft RIB

- Dinghy Horsepower : 100Hp

- Dinghy Pax : 8

- Water Skis : Yes (Adult) 0 (Kids)

- Wake Board : Yes

- Knee Board : Yes

- Snorkel Gear : Yes

- Underwater Camera : 0

- Kayak : 0 (1 Man) 0 (2 Man)

- Stand Up Paddle Boards : 2

- Floating Mats : Yes

- Beach Games : Yes

- Jetskis : No

- Other Toys : 4 water scooters Floating Island 2 x SUPs Masks, Snorkels, Fins 1 x tow ring, 1 x tow hot dog Water skis/mono + pair Wakeboard Giant super noodles

Sample Menu

APRIL TREMBATH

Breakfast is served with a selection of fresh breads, spreads, fruits, yoghurts, cereals, tea, coffee & fruit juices every morning

Wild Alaskan Salmon Benedict w/ Homemade Hollandaise

Greek Yoghurt Breakfast Bark w/ Fruit, Toasted Almonds & Honey

Belgian Waffles w/ Bacon, Maple Syrup & Bananas

Huevos Rancheros Tostadas w/ Mini Chorizo & Fresh Guacamole

Classic Crepes Suzette w/ Grand Marnier & Orange Zest

Creamy Eggs Florentine w/ Sauteed Dijon Spinach, Crumpets & Bacon

Tuna & Avocado Sushi Stack w/ Spicy Sriracha Sauce

Salmon Sliders w/ Yoghurt, Cucumber & Dill Dressing

Creamy Chicken Pot Pies w/ Garden Greens & Balsamic Glaze

Thai Chilli Chicken Satay w/ Spinach & Mandarin Salad

Seared Yellowfin Tuna Nicoise w/ Soft Boiled Eggs & Baked French Loaf

Asian Citrus Prawns w/ Creamy Red Cabbage Coleslaw

Mini Taco Bites w/ Guacamole & Salsa

Baked Potato Croquettes w/ Spicy Fondue

Oven Roasted Beetroot Hummus w/ Crudites & Freshly Baked Bread

Sushi Medley w/ Wasabi, Soy Sauce & Ginger

Coconut Meatball Poppers w/ Creamy Peanut Sauce

Charcuterie Board w/ Premium Selection from the Delicatessen

APPETISER

Seared Scallops on an Edamame Foam

Caramelised Brie & Onion Tart w/ Mesclun Greens

Prosciutto Asparagus Puff Pastry w/ Garlic Butter

Grilled Watermelon & Feta Salad w/ a Balsamic Reduction

Pork Tenderloin w/ Orange Brandy Jus w/ Kumara Puree & Broccoli Rabe

Edamame Risotto w/ Wild Mushrooms and Mesclun Salad

Lobster Linguine Haddock w/ a White Wine Rose Sauce

Filet Mignon & Prawn Vermicelli Sarong w/ Red Wine Reduction & Garlic Potatoes

Haddock, Poached Eggs & Crushed Potatoes w/ a Mustard Beurre Blanc Sauce

Frangelico Chocolate Ganache w/ Berries & Homemade Ferrero Roches

Mini Blueberry Pies w/ Vanilla Bean Ice Cream

Pina Colada Cake & Cocktail w/ Rum Floater

Vanilla Bean Panna Cotta w/ Berry Coulis & Maple Toffee Crisp

Key Lime Piew/ Cream & Lime Zest

Bananas Foster w/ a Creamy Baby Guinness

All menu items are subject to availability at local supermarkets and may change dependent on stock available.

At Carefree Yacht Charters®, we specialize in arranging extraordinary crewed yacht charters in the BVI as well as other Caribbean destinations. For full details, call us in our South Florida office at (954) 980-9281 or fill out our Quick Request Form .

- SEAGLASS 74 BVI Power Catamaran Charter | A Delight

SEAGLASS 74 BVI Power Catamaran Charter is now chartering in the British Virgin Islands. She was awarded “Best in Show” for 66ft and up at the 2019 St. Thomas Charter Yacht Show. SEAGLASS 74 is a 74ft (22.5m) Horizon build.

SEAGLASS 74 is highly awarded and popular with charter guests for its many features and amenities. She is described as The Ultimate Cruising Yacht because of her spaciousness and pacey nature.

The Horizon PC74 has been skillfully created from the drawing board of renowned designer JC Espinosa. He is known for his flair for designing exquisite mega yachts. The modern, clean lines of Sea Glass 74 have been skillfully created from the drawing board of renowned designer JC Espinosa.

There’s a VIP en suite stateroom. Her large saloon seats many guests. In addition to a full beam master stateroom with an en suite bathroom sofa and vanity.

SEAGLASS 74 BVI Power Catamaran Charter fitting for Guest:

This yacht is perfect for charter guests who want to enjoy the water style. The main deck has everything you need to have a great time. Including plenty of room to stretch out and relax or have fun playing games with your friends.

And when it’s time to eat, there’s no need to go below decks. There’s plenty of room for everyone at the dining table up here! Plus, there’s an onboard bar stocked with your favorite drinks. So you can sip while you soak up some sun on the aft deck—it’s like having your private island but better because other people are also around.

*Special: 10% Off on Charters during January and February 2024

-Valid January and February -$58,050.00 for seven nights, including meals, drinks, and BVI Cruising taxes. -7 night minimum

- 74.00 Ft Cat

- Built: 2018

Please click on “View Seaglass 74” for the full e-brochure

General information for SEA GLASS 74

- Built by “Horizon” in 2017

- An appropriately sized crew of 3

- 4 Cabins, all with King sized beds

- Accommodates eight guest

- Large fly-bridge lounge

- Glamorous complete beam master is a king VIP en suite

- Guest en suite stateroom, suite stateroom port aft, fourth guest en suite, other en suite staterooms port side with spacious en suite bathrooms

- The large salon seats many guests and offers ample comfortable space.

- Charters in the Bahamas & The British Virgin Islands “starting Dec. 1st. 2022”

Get to know the Crew of SEA GLASS 74 BVI Power Catamaran Charter

Captain: paul trembath.

Growing up on the coast of Cornwall in the UK, Captain Paul learned to sail dinghies when he was only 12. He achieved his Commercial Yacht Master and Cruise Instructor in Gibraltar, which opened the door to this fantastic lifestyle: sailing extensively in the UK, the Atlantic & the Mediterranean. In recent years, he has fulfilled his dream of operating luxury Catamarans in the Caribbean & Bahamas. Paul became hooked on diving in 1995 and became a Dive Instructor in 2012. Paul loves underwater photography and wants to experience diving beneath the ice in Antarctica.

Chef: April Trembath

Growing up around the Rocky Mountains in Canada, April had always wanted to see more of the world. As a young woman, she traveled from coast to coast before living in New Zealand for seven years, where her love of sailing grew. Her first job was as a stewardess on a 72 ft Catamaran back in 2007, and it wasn’t long before she became a diving expert. With her newly acquired Commercial Yacht Master certificate plus some qualifications in nutrition, April now shares healthy recipes and adventures out on the ocean – so you can come along.

Deckhand/Steward: George Filip

George Filip is a Romanian who speaks perfect English and knows every type of water sport, making him an excellent first mate. George assists the captain and guests on deck, equally skilled in assisting from inside and outside the boat.

In addition, he acts as chief steward below deck – and he’s especially popular during happy hour. This is where he shows off his skills as a mixologist. Paul, April, and George are delighted to welcome you aboard for an unforgettable journey.

Main deck, dining areas, and more

The main deck is impressive, having several entertainment options: dining for ten, lounge seating, and even a bar. In addition to this, there is an upper level called the flybridge. Up here, you will find many different types of areas, including cushioned seats, tables that seat ten people each, and even a separate cooking space.

Which is equipped with all necessary supplies, such as barbecue pits. The aft deck has its own swimming area, so everyone can go swimming no matter where they are standing on the boat. Keep an eye out for how deep it is before jumping off! Atop all of these features sits another wide-open area to relax called the foredeck. Complete with sun pads and plenty of other seating arrangements.

The Modern Interiors of Seaglass 74, BVI Power Catamaran Charter

The design of SEAGLASS is lavish and modern, featuring elegantly crafted wood paneling, LED lights, and contemporary furniture. From the aft deck, the entertaining space flows seamlessly into the saloon. With a sleek bar, cozy lounge, and formal dining table. Wraparound windows let in natural light and stunning views from every angle. This makes it feel like you’re living outdoors, even while indoors.

The ship has an inviting atmosphere of peace—the perfect place to take refuge when life gets too stressful at home or work. Guests are sure to feel right at home with these beautiful features!

Impressive Accommodation| SEA GLASS 74 BVI Power Catamaran Charter

A spacious master suite is located forward on the main deck. This room provides a walk-around king-size bed, 180-degree views, and ample storage space.

Downstairs, there are 2 King VIP Suites with ensuite bathrooms. Each of these suites offers a private entrance and provides guests privacy when desired.

Located amidship at mid-level – but set away from most other cabins to provide your quiet sanctuary – is another King Suite with an en suite bathroom.

Tenders and Watertoys on SeaGlass 74 BVI Power Catamaran Charter

SEAGLASS 74 is fully equipped with everything you need to catch serious fish–a 15ft RIB tender and everything. Snorkeling gear, wakeboard, kneeboard, two Waverunners, and SUPS (for those who want to play it safe).

In addition to beach games, inflatable tow toys are available onboard, while three permanent crew members take care of all your needs.

This spectacular yacht comes with a bespoke experience built just for you – created by expert staff members. Who goes above and beyond to ensure a personalized experience for each guest onboard.

Contact us at 1-321-777-1707 or complete this form to discuss your vacation plans.

Open Gallery

SEAGLASS 74 Yacht Charter Catamaran

Rates & Calendar

Size / Year Built / Builder

Other specifications

- Beam 28.4 Feet

- Draft 6 Feet

- Type Catamaran

Accommodations

Deck jacuzzi, air conditioning, deck shower, hair dryers, wheelchair access, stabilizers, onboard entertainment, salon tv/dvd, salon stereo/music, board games, ipod/mp3 hookups, gym equipment, water entertainment, water skis - adult, wave runners, snorkel gear, floating mats, beach games, fishing gear, under water camera, under water video, stand-up paddle, sea scooters, deep sea fishing, swim platform, boarding ladder (loc/type), fishing gear type, scuba diving, license info, air compressor, diving costs information, technical details, cruising speed, water maker, water capacity, charter types, special diets, kosher diets, gay charters, nudist charters, crew smokes, pets onboard, guest pets allowed, children allowed, minimum age, guest smokes, green initiatives, make drinking water tested for purity, re-usable water bottles, nationality, languages spoken by crew.

APRIL TREMBATH

Breakfast is served with a selection of fresh breads, spreads, fruits, yoghurts, cereals, tea, coffee & fruit juices every morning

Wild Alaskan Salmon Benedict w/ Homemade Hollandaise

Greek Yoghurt Breakfast Bark w/ Fruit, Toasted Almonds & Honey

Belgian Waffles w/ Bacon, Maple Syrup & Bananas

Huevos Rancheros Tostadas w/ Mini Chorizo & Fresh Guacamole

Classic Crepes Suzette w/ Grand Marnier & Orange Zest

Creamy Eggs Florentine w/ Sauteed Dijon Spinach, Crumpets & Bacon

Tuna & Avocado Sushi Stack w/ Spicy Sriracha Sauce

Salmon Sliders w/ Yoghurt, Cucumber & Dill Dressing

Creamy Chicken Pot Pies w/ Garden Greens & Balsamic Glaze

Thai Chilli Chicken Satay w/ Spinach & Mandarin Salad

Seared Yellowfin Tuna Nicoise w/ Soft Boiled Eggs & Baked French Loaf

Asian Citrus Prawns w/ Creamy Red Cabbage Coleslaw

Mini Taco Bites w/ Guacamole & Salsa

Baked Potato Croquettes w/ Spicy Fondue

Oven Roasted Beetroot Hummus w/ Crudites & Freshly Baked Bread

Sushi Medley w/ Wasabi, Soy Sauce & Ginger

Coconut Meatball Poppers w/ Creamy Peanut Sauce

Charcuterie Board w/ Premium Selection from the Delicatessen

APPETISER

Seared Scallops on an Edamame Foam

Caramelised Brie & Onion Tart w/ Mesclun Greens

Prosciutto Asparagus Puff Pastry w/ Garlic Butter

Grilled Watermelon & Feta Salad w/ a Balsamic Reduction

Pork Tenderloin w/ Orange Brandy Jus w/ Kumara Puree & Broccoli Rabe

Edamame Risotto w/ Wild Mushrooms and Mesclun Salad

Lobster Linguine Haddock w/ a White Wine Rose Sauce

Filet Mignon & Prawn Vermicelli Sarong w/ Red Wine Reduction & Garlic Potatoes

Haddock, Poached Eggs & Crushed Potatoes w/ a Mustard Beurre Blanc Sauce

Frangelico Chocolate Ganache w/ Berries & Homemade Ferrero Roches

Mini Blueberry Pies w/ Vanilla Bean Ice Cream

Pina Colada Cake & Cocktail w/ Rum Floater

Vanilla Bean Panna Cotta w/ Berry Coulis & Maple Toffee Crisp

Key Lime Pie w/ Cream & Lime Zest

Bananas Foster w/ a Creamy Baby Guinness

All menu items are subject to availability at local supermarkets and may change dependent on stock available.

Similar yachts to SEAGLASS 74

Sleeps 6 guests in 3 Cabins

Size: 68 Ft

Size: 60 Ft

You make the memories. We make the arrangements.

Unforgettable Adventures: Bahamas Power Catamaran SEA-GLASS

Your tropical vacation is waiting, and Bahamas Power Catamaran SEA-GLASS is the yacht for you!...

Your tropical vacation is waiting, and Bahamas Power Catamaran SEA-GLASS is the yacht for you! It’s the ultimate way to cruise around the tropics and have an amazing time.

Bahamas Power Catamaran SEA-GLASS | The Ultimate Cruising Yacht

Step aboard Sea Glass 74 for a luxurious vacation of fine dining, relaxation, and adventure. This stunning yacht won Best in Show for 66 feet and up boats at the 2019 St. Thomas Charter Yacht Show.

SEA GLASS is a 74-foot Horizon power catamaran with a luxurious, plush interior, perfect for spending time with family and friends. Features include:

- All the primary living areas on a single-level

- Massive aft deck with dining for 10 and lounging for 8, a bar, and ample storage lockers

- The large saloon offers seating for 8

- Separate inside formal dining for 8

- Gourmet galley with island and bar with 4 stools

- Flybridge with large comfortable dining and lounging for up to 10 guests

- Well-equipped bar with seating for 5

- Separate BBQ area and dinghy stowage plus loads of room for chaise lounges once anchored

- Aft deck Hi/Lo swim platform, suspended between the hulls, ensures everyone can easily access the water.

- Foredeck offers two large sun pads and bow seats

Accommodations

Bahamas power catamaran SEA-GLASS accommodates eight guests in 4 well-appointed cabins. Forward on the main deck is the glamorous full-beam master stateroom with a walk-around King-size bed. It has incredible 180-degree views, a spacious en-suite bathroom, a sofa, a vanity, and ample storage.

The lower decks offer two large King VIP en-suite staterooms, port, and starboard forward. The fourth guest en-suite stateroom, port aft, can be configured to accommodate a couple or 3 children. The crew cabin is in the starboard aft section of the yacht.

Bahamas Power Catamaran SEA-GLASS | Water Toys

Since the water temperature is warm year-round in the Bahamas, you will want to enjoy the water toys SEA-GLASS offers, including:

- Floating Mats

- Beach Games

- Fishing Gear

- Wave Runner

Captain Paul grew up on the coast of Cornwall in the UK. There he learned to sail when he was 12. He earned his Commercial Yacht-Master and Cruise Instructor in Gibraltar and has sailed extensively in the UK, the Atlantic, and the Mediterranean.

Paul has fulfilled his dream of operating luxury Catamarans in the Caribbean and Bahamas. He also became interested in scuba diving in 1995 and became a Dive Instructor in 2012. He enjoys underwater photography and would love to dive beneath the ice in the Antarctic.

Chef April grew up around the Rocky Mountains in Canada and, as a youth, wanted to explore the world. She lived in New Zealand for 7 years and fell in love with the adventure of sailing. She became a stewardess on a 72-foot Swath Ocean Catamaran in 2007 and quickly developed her skills in the yachting industry.

April is a culinary genius who knows how to work her magic in the galley. Her innovative techniques create mouthwatering, fresh, and healthy dishes that will take your taste buds on a journey to culinary paradise.

George Filip , the First Mate, is from Romania. This amazing crew member speaks fluent English and is a master of all watersports. He’s always there to assist the captain and ensure the guests have an incredible time on deck. But that’s not all – George also takes on the chief steward role below. He handles everything from morning room cleaning to creating incredible table settings. Oh, and Happy Hour ? That’s where George truly shines! He’s a mixologist extraordinaire, ready to impress you with his cocktail expertise.

Crew members, availability, and rates are subject to change.

Reserve Bahamas Power Catamaran SEA-GLASS

Now is the best time to book your yacht charter vacation on SEA-GLASS.

Horizon Power Catamaran SEA GLASS 74 is now available for charter in the British Virgin Islands .

Experience a Bahamas motor-yacht charter vacation in the Exumas, Abacos, Harbour Island, and Eleuthera.

In addition, you can also charter the new Fontaine Pajot power catamaran Princess Mila in the Bahamas.

Similar Posts

Sunreef Power-Cat ROYAL RITA in the Bahamas

Welcome to the world of ultimate luxury and comfort aboard the Bahamas power-cat ROYAL RITA....

Read Sunreef Power-Cat ROYAL RITA in the Bahamas

Bahamas Yacht Charter Special Occasion

Are you looking for a unique way to celebrate a special occasion? Why not book...

Read Bahamas Yacht Charter Special Occasion

Exciting Nightlife and Bars in the Bahamas

If you’re looking for a night out in the Bahamas, you’re in luck! The Bahamas...

Read Exciting Nightlife and Bars in the Bahamas

Let us deliver on your dream vacation.

Contact us to start a conversation about your dream vacation, and let us show you how we can help bring your vision to life through our exceptional yacht charter services.

Weekly Pricing by Season

All Inclusive

Horizon PC74

This spacious 74' yacht built by Horizon is available for Caribbean charters in the winter season. Seaglass has four cabins which will accommodate 8 charters guests comfortably in 3 king suites and 1 twin that is convertible to a king suite.

- 8 Max Guests

- Engine Type & Size Twin CAT C18ACERT 1180HP

- Water Capacity 400 gl

- Maximum Guests 8

- Double Cabins 4

- Single Cabins 0

About Seaglass

SEAGLASS 74 offers her guests bespoke comfort and room in a main-deck master king suite, two forward king suites, and an amidships twin-OR-king suite.

Her four staterooms can accommodate up to 8 charter guests.

Detailed Specs

- Total Cabins 4

Boat Layouts

- 30′ Scout Tender w/2 300 HP O/B

- 15′ RIB Seats 8

- Floating Mats

- 2 Stand Up Paddleboards

- 2 Wave Runners

- Fishing Gear

- Adult Water Skis

- Snorkel Gear

- Beach Games

- Deep Sea Fishing Equipment

- Trawling and Bottom Fishing Rods

- Dive Tanks, Regulators and BC’s for 8

- Diving Onboard

Entertainment

- Salon Stereo

- Satellite TV

- iPod/Device Hookups

- Purified Drinking Water System

Captain – Paul

Paul grew up on the coast of Cornwall in the UK where he learnt to sail dinghies when he was only 12 years old. He achieved his Commercial Yacht Master and Cruise Instructor in Gibraltar, which opened the door to this amazing lifestyle. He has sailed extensively in the UK, the Atlantic & the Mediterranean. In more recent years, has been fulfilling his dream of operating luxury Catamarans in the Caribbean & Bahamas. Paul got hooked on diving in 1995 and became a Dive Instructor in 2012. He enjoys underwater photography and would love to dive beneath the ice in the Antarctic.

Chef – April

Growing up around the Rocky Mountains in Canada, as a youth April wanted to explore the world, and soon traveled from coastline to coastline. She lived in New Zealand for 7 years where she fell in love with the adventure of sailing. It began with her employment as a stewardess on a 72ft Swath Ocean Catamaran in 2007, and quickly grew from there. Obtaining her Commercial Yacht Master and becoming a qualified diver opened up a love, respect and appreciation for life on the water. Combined with a passion for nutritional creativity, April uses innovative techniques to bring you fresh, healthy dishes and sail you into a culinary paradise.

Mate – George

George Filip is a Romanian who speaks fluent English and is fluent at all watersports which makes him a great first mate. Equally adept at assisting above and below deck. He takes care of everything, from cleaning each room in the morning to incredible table settings. He helps the Captain and guests on deck and acts as chief steward below – George is especially popular at Happy Hour where he shows off his expertise as a mixologist.

Steps to Charter

Step 1: request a quote, choose your boat, lock in your dates, finalize the contract, plan your itinerary, inquire about seaglass.

" * " indicates required fields

Browse Similar Yachts

Promiscuous

What Customers Are Saying

"Excellent Staff, Dedicated Team!"

Excellent staff, have never seen a more dedicated team to making sure your vacation is perfect.

"VCY was the absolute best"

We have chartered several times in the BVIs, and our experience with VCY was the absolute best. The boat was in great condition and the service start to finish was fabulous. We will be back!

"Friendly, Professional & Accommodating!"

Our charter yacht was nearly new and well maintained. VCY was responsive whenever we had questions during our charter as well. Highly recommended!

"Best vacation we have ever taken!"

VCY was fantastic!! They answered every question, helped with all the travel details. Booked us taxis to and from the airport and even got us reservations for a special birthday dinner. We will absolutely be back!

"Exceptional Experience with 1st Class Crew!"

Highly recommend this organization… they were even able to accommodate a last minute itinerary change due to tropical storm “Beryl”!

"Best Week of My Life!"

Virgin motor yachts lined us up with a great Captain and assisted with all the details in preparation. I am already planning to come back in November.

"All Around 1st Class Customer Service"

Our 3rd year with Virgin Motor Yachts and we are starting to plan our trip for next year. An excellent vacation covering 7 islands over the 10 days.

"Search No Further VCY Is It!"

If I were to write everything good about our experience with VCY…I would need another week on their CAT on the BVI!

"Better Than We Could Have Ever Imagined"

From the planning stage to last day of our trip, we could not have asked for any better experience. Alexia and crew were wonderful to deal with.

"Another Amazing Week With VCY"

Amazing customer service. Highly recommend VCY ahead of the other two big companies on the island with very little customer service.

Power Yacht Sea Glass 74

- Availability & Rates

7-Night Charter Rates

Power Yacht Sea Glass 74 Overview

The modern clean lines of Sea Glass 74, a Horizon PC74, have been skillfully created from the drawing board of renowned designer, JC Espinosa, known for his flair for designing very elegant mega yachts. Sea Glass 74 is a stunningly beautiful power catamaran with free-flowing lines, a superstructure that is pleasing to the eye and draws your attention to study her complex simplicity. The yacht’s luxurious, plush interior sets her apart.

Charter guests will appreciate the main deck, with all the primary living areas on a single level, including the massive aft deck with dining for 10 and lounging for 8, a bar and ample storage lockers. The large saloon offers seating for 8, separate inside formal dining for 8, gourmet galley with island and bar with 4 stools. Forward on the main deck is the glamorous full beam master stateroom with walk around King bed, 180-degree views, spacious en-suite bathroom, sofa, vanity and ample storage.

The lower decks offer two large King VIP en-suite staterooms, port and starboard forward. The fourth guest en-suite stateroom, port aft, can be configured to accommodate a couple or 3 children. The crew cabin is in the starboard aft section of the yacht.

The yacht’s flybridge is an entertainers delight, with large comfortable dining and lounging for up to 10 guests, a well equipped bar with seating for 5, a day head, a separate BBQ area and dinghy stowage plus loads of room for chaise lounges once anchored off a secluded beach in an exotic location.

The aft deck Hi/Lo swim platform, suspended between the hulls, ensures that everyone can access the water with ease. The foredeck offers two large sun pads and bow seats.

Step aboard Sea Glass 74 for a luxurious vacation of fine dining, relaxation and adventure.

Green Initiative

Purified drinking water made on board. Reusable water bottles available for use on board.

Meet the Crew

Paul grew up on the coast of Cornwall in the UK where he learnt to sail dinghies when he was only 12 years old. He achieved his Commercial Yacht Master and Cruise Instructor in Gibraltar, which opened the door to this amazing lifestyle. He has sailed extensively in the UK, the Atlantic

& the Mediterranean. In more recent years, has been fulfilling his dream of operating luxury Catamarans in the Caribbean & Bahamas. Paul got hooked on diving in 1995 and became a Dive Instructor in 2012. He enjoys underwater photography and would love to dive beneath the ice in the Antarctic.

Growing up around the Rocky Mountains in Canada, as a youth April wanted to explore the world, and soon traveled from coastline to coastline. She lived in New Zealand for 7 years where she fell in love with the adventure of sailing. It began with her employment as a stewardess on a 72ft Swath Ocean Catamaran in 2007, and quickly grew from there. Obtaining her Commercial Yacht Master and becoming a qualified diver opened up a love, ..read more

respect and appreciation for life on the water. Combined with a passion for nutritional creativity, April uses innovative techniques to bring you fresh, healthy dishes and sail you into a culinary paradise.

George Filip is a Romanian who speaks fluent English and is fluent at all watersports which makes him a great first mate. Equally adept at assisting above and below deck. He helps the Captain and guests on deck and acts as chief steward below – George is especially popular at Happy Hour where he shows off his expertise as a mixologist.

Paul, April and George feel privileged to be your hosts and thoroughly looking forward to giving you a vacation of a lifetime.

Crew are fully vaccinated for COVID 19.

Availability calendar for Sea Glass 74:

Listed below are any confirmed reservations or unavailability, as well as current holds / options. Note: this calendar is not always 100% current. Please contact us for more information about available dates aboard this yacht.

Hours required between charters: 48 hours min firm

7-night Charter Rates by Group Size

Contact us for rates and current availability or to book a charter aboard Sea Glass 74!

Full Specifications for Sea Glass 74

Specifications

Accommodation, water sports, entertainment, sample menu.

SAMPLE MENU - CHEF APRIL TREMBATH

All menu items are subject to availability at local supermarkets and may change dependent on stock available.

Breakfast is served with a selection of fresh breads, spreads, fruits, yoghurts, cereals, tea, coffee & fruit juices every morning

Wild Alaskan Salmon Benedict w/ Homemade Hollandaise

Greek Yoghurt Breakfast Bark w/ Fruit, Toasted Almonds & Honey

Belgian Waffles w/ Bacon, Maple Syrup & Bananas

Huevos Rancheros Tostadas w/ Mini Chorizo & Fresh Guacamole

Classic Crepes Suzette w/ Grand Marnier & Orange Zest

Creamy Eggs Florentine w/ Sauteed Dijon Spinach, Crumpets & Bacon

Tuna & Avocado Sushi Stack w/ Spicy Sriracha Sauce

Salmon Sliders w/ Yoghurt, Cucumber & Dill Dressing

Creamy Chicken Pot Pies w/ Garden Greens & Balsamic Glaze

Thai Chilli Chicken Satay w/ Spinach & Mandarin Salad

Seared Yellowfin Tuna Nicoise w/ Soft Boiled Eggs & Baked French Loaf

Asian Citrus Prawns w/ Creamy Red Cabbage Coleslaw

Mini Taco Bites w/ Guacamole & Salsa

Baked Potato Croquettes w/ Spicy Fondue

Oven Roasted Beetroot Hummus w/ Crudites & Freshly Baked Bread

Sushi Medley w/ Wasabi, Soy Sauce & Ginger

Coconut Meatball Poppers w/ Creamy Peanut Sauce

Charcuterie Board w/ Premium Selection from the Delicatessen

APPETISER

Seared Scallops on an Edamame Foam

Caramelised Brie & Onion Tart w/ Mesclun Greens

Prosciutto Asparagus Puff Pastry w/ Garlic Butter

Grilled Watermelon & Feta Salad w/ a Balsamic Reduction

Pork Tenderloin w/ Orange Brandy Jus w/ Kumara Puree & Broccoli Rabe

Edamame Risotto w/ Wild Mushrooms and Mesclun Salad

Lobster Linguine Haddock w/ a White Wine Rose Sauce

Filet Mignon & Prawn Vermicelli Sarong w/ Red Wine Reduction & Garlic Potatoes

Haddock, Poached Eggs & Crushed Potatoes w/ a Mustard Beurre Blanc Sauce

Frangelico Chocolate Ganache w/ Berries & Homemade Ferrero Roches

Mini Blueberry Pies w/ Vanilla Bean Ice Cream

Pina Colada Cake & Cocktail w/ Rum Floater

Vanilla Bean Panna Cotta w/ Berry Coulis & Maple Toffee Crisp

Key Lime Pie w/ Cream & Lime Zest

Bananas Foster w/ a Creamy Baby Guinness

- Overview

- Availability & Rates

- Specs

- Contact

Interested in Sea Glass 74? Get in touch to learn more or book your vacation!

Seaglass sailing catamaran

75’ / 23 m | Horizon | 2018 / 2020

Seaglass is a 75 feet motor yacht built in 2018 by Horizon . It can host up to 12 people and is perfect for day trips, half-day trips, and sunset cruises. For those with little time on their hands, a full-day boat tour onboard Seaglass is the perfect check off your bucket list of things to do and experiences in Tortola.

Moreover, this motor yacht has 4 cabins to accommodate 8 guests overnight or over the weekend charter to experience lengthy itineraries and further-away destinations. If you’re looking for a boat tour that is tailor-made to meet your needs, Seaglass is a beautiful motor yacht that will deliver.

Your friendly crew of 4 is there to treat you with gourmet food on board or arrange beach BBQs with freshly-caught seafood. You can choose to simply sunbath on the deck, or join your friends of family with exciting activities out on the water. For a day trip or sunset cruise, the yacht offers entertainment and leisure features to celebrate special events, as you cruise along stunning coasts and nearby islands.

Revel in the home-like interiors known for their exquisite attention to detail, offering a luxurious accommodation for guests. If you’re simply in for the ride while your family or group enjoy adrenaline-pumping adventures on the water or on shore, Seaglass below-deck features will truly satisfy your need for some peace and quiet.

Destinations

Seaglass motor yacht is based in Tortola and charters across British Virgin Islands, US Virgin Islands, Puerto Rico promising some of the best attractions. Your day boat tour can include everything from water sports to snorkeling and diving, as well as visiting breathtaking sights around Tortola.

The yacht is also very popular for romantic sunset cruises with a special someone, or for a grand special occasion with friends and family. Get to have the party or romantic dinner under the stars as you witness the sparkling sky above you, or the glittering lights of a cosmopolitan city’s famed skyline.

Seaglass is a beautiful boat that allows for a short boat tour charter along the shores. With a spacious deck that creates the perfect venue for a special celebration, or an intimate sunset cruise, Seaglass is a yacht that brings the genuine beauty of Caribbean .

Charter Seaglass in British Virgin Islands

THANK YOU FOR YOUR REQUEST

Your message has been received, and our team will contact you within 12 hours.

- Seasonal Prices

- RESERVE NOW

CONTACT SUCCESSFUL

23’ - 75 ft - Horizon

thesis topic corporate finance

Home » Blog » Dissertation » Topics » Finance » Corporate Finance » Corporate Finance Dissertation Topics (29 Examples) For Your Research

Corporate Finance Dissertation Topics (29 Examples) For Your Research

Mark Dec 28, 2019 Jun 5, 2020 Corporate Finance , Finance No Comments

The field of corporate finance is highly challenging and for students enrolled in corporate finance degree programs, there are plenty of opportunities. As the field has evolved, it provides the students with unique areas for research. The list of corporate finance dissertation topics is designing keeping in view the emerging areas of interest. We provide […]

The field of corporate finance is highly challenging and for students enrolled in corporate finance degree programs, there are plenty of opportunities. As the field has evolved, it provides the students with unique areas for research. The list of corporate finance dissertation topics is designing keeping in view the emerging areas of interest.

We provide students with an opportunity to select any topic from the list to write their project dissertation on corporate finance. Once the topic is selected, our team of expert writers can help in getting your research completed on the selected research topics on corporate finance.

Also check our finance topics post for more options.

A list Of corporate finance dissertaton topics

Analysing corporate finance decision-making in unstable stock markets.

To find out how the firm size affects financial decision-making in the United States.

Conducting literature on corporate financing theories and frameworks.

A comparison of different internationally accepted financial reporting standards.

To study the emerging concept of integrated reporting in the field of corporate finance.

How businesses can manage transparency in their corporate financial decisions?.

Identifying the relevance of valuation of cash flows in both financial and non-financial organisations.

Examining the role of technological connectivity in integrated financial management.

A comparison and evaluation of different investment models and how it contributes to the success of firms.

Evaluating the current legislation in the area of corporate finance in the market of the UK.

Analysing the corporate policies of multinational companies taking the case of Coca Cola and Nestle.

To identify the prevalent financial innovation trends in Asia.

How does corporate governance influence corporate financial activities and processes in a company?

Analysing the impact of taxes on dividend policies in the case of the banking industry of the developed nations.

The impact of integrating options theory in capital budgeting.

The relationship between corporate strategies and corporate finance.

Analysing the global economic crisis in the light of corporate finance concepts.

Implications of foreign currency transactions on the accountancy processes.

Investigating the role of information technology in banking services.

To identify the advantage of corporate financing tools and techniques.

Studying how the advanced systems and software are supporting the corporate finance decisions.

Analysing the factors that contribute to the financial stability of multinationals.

Comparing the FDI strategies of Europe and Asia.

Examining the growing popularity of mutual funds and index.

To study the role of liquidity and transparency in alternative investments.

To analyse the investment diversification as an alternative investment vehicle.

Conducting an investigation of different corporate scandals and recommending solutions accordingly.

Analysing and interpreting social networking in the field of finance.

Role of dynamic investment models and financial firm policies and frameworks.

Topic With Mini-Proposal (Paid Service)

Along with a topic, you will also get;

- An explanation why we choose this topic.

- 2-3 research questions.

- Key literature resources identification.

- Suitable methodology with identification of raw sample size, and data collection method

- View a sample of topic consultation service

Get expert dissertation writing help to achieve good grades

- Writer consultation before payment to ensure your work is in safe hands.

- Free topic if you don't have one

- Draft submissions to check the quality of the work as per supervisor's feedback

- Free revisions

- Complete privacy

- Plagiarism Free work

- Guaranteed 2:1 (With help of your supervisor's feedback)

- 2 Instalments plan

- Special discounts

Other Posts

- Banking and Finance Dissertation Topics (28 Examples) For Research May 26, 2020 -->

- Finance Dissertation Topics Examples List (37 Ideas) For Research Students May 29, 2017 -->

Message Us On WhatsApp

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management