Police seized 'negative billionaire' Eike Batista's yacht too

Last week Brazilian police raided the home of once multibillionaire, now negative billionaire , Eike Batista. They froze his assets and took his Lamborghini, as well as six other cars, some fancy watches, and a pile of cash.

Now they've taken things a step further and seized his water toys too – including jet skis, a speedboat, and his yacht, the Spirit of Brazil, Bloomberg reported .

This comes after Batista's oil company, OGX, lost $9.7 billion and went bankrupt in 2013, pulling his own net worth down to about $200 million.

Then Batista went on trial for insider trading and stock manipulation.

The story is, Batista started to suspect that OGX's oil fields wouldn't deliver, and personally guaranteed $1 billion to keep things running.

It was enough to stabilize the plunging stock.

Then, prosecutors say, Batista made his move: when suspicions were confirmed and things really started to look bleak for the company, he allegedly sold his own stock and abandoned his $1 billion promise.

Now, four of Batista's companies are bankrupt and he reportedly owes $1.2 billion.

Watch: This Billionaire's Definition Of Success Will Surprise You

- Main content

- Share full article

Advertisement

Supported by

BOATING; Brazilian Superboat Driver Finds Speed 'in the Blood'

By Barbara Lloyd

- Oct. 6, 1991

Taking risks is part of life for Eike Batista, a 34-year-old Brazilian entrepreneur who a decade ago combed the Amazon jungles in search of gold dust. He has since cashed in on his Indiana Jones life style, preferring instead a home at New York's Trump Plaza and a crack at the national offshore powerboat championship.

Batista drives Spirit of the Amazon, a 50-foot speed machine that has dominated the offshore powerboat circuit this year. His craft, which carries four 1,100-horsepower engines, is one of 10 Superboats expected to race today in the $75,000 New York Offshore Grand Prix on the Hudson River.

Twenty-six boats have registered to compete for national titles in four divisions, including the less powerful Open Class boats, and the Pro-1 and Pro-2 Classes. The 144-mile course consists of 18 laps of 8.04 miles each; the loop starts at Pier 45, south of Battery Park City, moves to 40th Street, and then returns back to Pier 45.

Batista flew here Friday from his home and business headquarters in Rio de Janeiro. As chairman of the board of TVX Gold, an international mining company, Batista is far removed from the days when his livelihood depended on single-engine aircraft and dirt runways.

His life now is a series of global meetings. A corporate executive who speaks five languages, Batista oversees gold mines in Canada, the United States, Brazil and Chile. As a sportsman, he is supporting the national powerboat racing circuit for the next three years with a guarantee of $5 million. As a driver, he leads this year's circuit in points. 'A Different Culture'

In a telephone interview from Rio de Janiero, Batista linked his success in Superboat racing with the fascination for going fast that, he said, is part of his Brazilian upbringing. "Speed is in the blood of most Brazilians," he said, noting that Brazilian Formula I race car drivers Ayrton Senna and Nelson Piquet are friends of his.

"Basically, there are no lines separating one lane from another lane on roads in Brazil," Batista said. "People drive as fast as they can go. There are official speed limits, but little enforcement. It's a different culture altogether."

The danger may also be part of what appeals to Batista about powerboat racing. "There is a lot of thrill in it," he said. "But I lived dangerously in my early gold-mining days."

The Superboats are capable of 130-mile-an-hour speeds, and are particularly difficult to maneuver here in the choppy seas created by lap racing in the river. Last year in New York, he and his Spirit of the Amazon team withdrew from the Hudson River race when the boat hit a submerged object. It was an "extremely dangerous" situation, said Batista, noting that the obstruction could have flipped the boat. The man may live for "the thrill in it," but he has no death wish.

When he realized the dangers in gold trading were becoming life threatening after a particularly frightening incident in 1980, Batista gave it up. The story is straight out of Indiana Jones. Carrying a loaded handgun and a bag of gold dust worth $200,000, he was preparing to board a small plane on a jungle runway. With him were two bodyguards. In the distance, he saw a man gunned down for offending a village chief whom Batista had relied on. Batista realized he could be next. 'He Doesn't Get Scared'

Batista left the jungle behind and used his experiences there to develop an international mining company. A degree in metallurgical engineering from the University of Aachen in Germany made Batista familiar not only with mining but with the mechanics of his boat. "I don't make any compromises with the equipment," he said. "A lot of racers don't understand their equipment."

Bobby Moore, the Spirit of Amazon's throttleman, said that Batista's knowledge of the boat was a great advantage. "He's aggressive as hell, and likes to win," said Moore. "He's also mechanically inclined, and that's important for a racer. It's really what makes him a step above the others. He doesn't get scared."

Moore, of Miramar, Fla., is a 28-year veteran of offshore racing who has crewed on four world champion teams. Moore was with Batista last year when Spirit of the Amazon won the world offshore title in Key West, Fla. Also in the boat are Randy Robinson of Miramar, crew chief and co-navigator, and Larry Williams of Kula, Maui, Hawaii, co-navigator.

Batista is a favorite in the New York race, especially in the absence of Chuck Norris, the movie actor, who won the event last year in a close match against one of his Hollywood counterparts, Don Johnson. Neither actor has participated in the racing circuit this year.

Behind Batista in overall points is Powerboat Marine Products, a Superboat owned and driven by Russ Wilkin of Fort Wayne, Ind. If Wilkin should win today's race, Batista must finish in at least seventh-place to beat Wilkin for the national title. America's Cup Challengers Meet

Ten challengers for the America's Cup, who met Thursday in San Tropez, France, agreed on how to proceed in their argument with the San Diego Yacht Club about the date when they must have their final race boats in San Diego. They decided to present questions over the disputed dates to a special committee of trustees (former guardians of the America's Cup) on Oct. 15. The group also announced its trial races series will begin Jan. 25 in San Diego.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

The rise and spectacular fall of Brazilian ex-billionaire Eike Batista

This article was published more than 9 years ago. Some information may no longer be current.

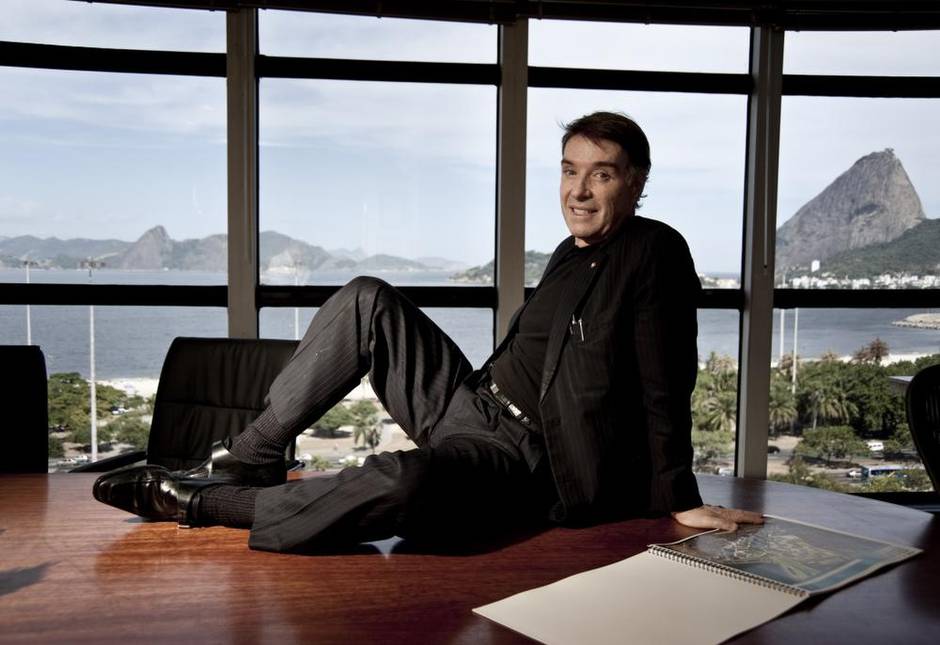

As he was climbing the ranks of the world’s richest people a few years ago, the Brazilian entrepreneur Eike Batista vowed to bring a long-lost pride back to Rio de Janeiro, his adopted hometown – saying it would once more be the “city of the sun,” a new world hub.

Today the sun still shines in Rio, but Mr. Batista holds the grim distinction of being the planet’s most indebted person, out 99 per cent of a $34.5-billion (U.S.) fortune, and the city he pledged to remake is littered with the debris of his shattered ambitions.

The once-iconic Hotel Gloria, which he bought and pledged to restore to grandeur for the 2016 Olympics, is shuttered and decaying. The polluted lake in the heart of the city that he promised to rehabilitate lies rank and fetid in the summer heat. Dozens of police cars he bought for a project to bring security to favelas sit idle, with no one to buy gas or maintain them. At his former corporate headquarters, front windows are splintered and no one has bothered to fix the glass.

Mr. Batista’s epic rise in recent years paralleled that of his country, the hottest emerging market. Now Brazilians are hoping that their nation, tipping into recession and beset by inflation, will not similarly parallel his fall.

“Two years ago Eike was Mr. Brazil – well, Mr. Brazil is a fraud, so what does Brazil have to offer now?” said a former director of his companies who worked closely with Mr. Batista for 14 years, and quit as the bankruptcies mounted. Because the case is before the court, and he faces scrutiny, he was not willing to be speak on the record.

Brazilians are watching in grim fascination as Mr. Batista’s life falls apart. Last week, police repossessed the white Lamborghini he kept in his living room, along with watches and a piano from the palatial home where he now lives a reclusive life. This week they seized his yacht, while his ex-wife had a screaming fit outside the walls of his mansion, saying she was moving back in since police were taking away her assets, too.

Mr. Batista, 58, is not just spectacularly broke: he is on trial for collusion, insider training, money-laundering and “crimes against the financial market,” and legal experts say he stands a good chance of being the first person ever to go to jail for financial crimes in Brazil.

Mr. Batista has denied any wrongdoing. His lawyer, Sergio Bermudes, declined repeated requests for an interview. The case is expected to go on for years, in Brazil’s infamously slow legal system.

Mr. Batista’s father, a Brazilian businessman, married a German woman while studying in Hamburg. A widely respected figure in Brazil’s industrial development, he went on to become president of the mining giant Vale and served as Minister of Mines and Energy. Mr. Batista was born and spent his early years in central Brazil but moved to Germany when he was 12, and studied metallurgical engineering there, although he did not complete college.

At 22 he returned to Brazil and, as he has told the story, borrowed $500,000 from contacts to go to the Amazon where he bought gold from artisanal miners who panned it in the river beds and abandoned mines, and then sold the gold back in the city for vastly higher prices. He made millions fast, and used it to start buying mines of his own, in partnerships with connections of his father’s, he has said.

In 1983, Mr. Batista and backers took over a small Canadian mining company called Treasure Valley, listed on the Toronto Stock Exchange. They renamed it TVX: Mr. Batista’s firms always had an X in the name, to signify the multiplication of wealth. He presided over international expansion as CEO, but poor management and a sharp drop in the price of gold wiped out 96 per cent of the company’s value and it was eventually sold off.

Mr. Batista, however, showed a remarkable ability to persuade investors – both private and institutional – to sign on to his schemes. He set out to chart a new course at a pivotal moment for Brazil, with a commodities boom and market liberalization pushing a huge economic expansion.

In 2001 he built a thermal power plant in northern Brazil, the first project of an energy company called MPX. In 2005, he founded MMX, his mining firm, feeding the Chinese appetite for iron ore, and held a public offering a year later. In 2007 he launched the petroleum firm OGX, with backing from the Ontario Teachers’ Pension Plan, and took it public the next year. He started companies to provide logistics and services to his extractive businesses, and invested nearly $2-billion to build a giant port complex that was to be the centrepiece of a redevelopment of Rio.

“This was something new in Brazil – all of these IPOs,” said the former director of Mr. Batista’s holding company. Brazil’s stock exchange is relatively tiny, with the same number of companies as that of Mongolia.

All along the way Mr. Batista boasted of his close ties to government – and was photographed with the president and governors and celebrities – and lived large, cutting an ostentatious figure of swashbuckling wealth. He anchored an enormous yacht in the Rio harbour and won a number of international titles racing speed boats from his collection. By 2012 he was the seventh wealthiest person in the world, according to the Forbes list, and talked confidently of when he would be Number One. He showered his largesse on the city, funding a children’s hospital and sponsoring sports and cultural events.

Except, says the former executive in the holding company EBX, it wasn’t actually his money: The donations were made in the name of OGX and other companies. “He didn’t do anything with his own money: He spent other people’s,” he said.

The story of Mr. Batista’s unravelling, in essence, is this: He bet big on the “pre-salt” oil fields 200 kilometres off the coast of Rio and more than two kilometres under the sea, raising more than $3-billion from the sale of shares in OGX. But when Mr. Batista began to drill, he didn’t find oil, not on the scale he needed.

Yet he allegedly kept this information to himself, and instead said independent surveyors had asserted that his fields had 10.8 billion barrels of reserves. And the value of his companies rose and rose – until in 2012 OGX’s financial statements made clear that vast sums were being spent on drilling, and very little was coming out of the ground. The share price tanked, and he defaulted on loans.

“His projects made sense at the time – big oil, and then the big port to move it, and the logistics companies,” said Sergio Leo, author of a book on Mr. Batista, The Rise and fall of the Empire of X. “But each company was linked to the success of the other. And the moment OGX failed it went down like a house of cards.”

Soon the X companies were being broken up, sold or ordered into bankruptcy protection. The Ontario teachers fund got out before the carnage, but many minority shareholders were hit hard. “There are lots of arguments he can present to show it was good faith, when he was encouraging people to invest, but it will be difficult to believe because at the same moment he was selling his own shares,” said Mr. Leo. “He knew the company was in bad condition and the fields were not the size publicized, so he knew he would have a big hit in profits. But at the same time he was on Twitter telling people to invest, while he was selling his own shares.”

The former EBX director echoed this assertion, saying he “knows for a fact” that Mr. Batista knew more than a year before it was made public that the oil fields were far less valuable than estimated.

Brazil’s weak financial regulators did not help. “If our regulators were faster probably they could have stopped him before he did so much damage,” said Mr. Leo.

It would be highly unusual for someone with Mr. Batista’s level of privilege to go to jail, and the asset seizures are also unusual for a case involving someone of his social status. Police have so far frozen $1-billion in assets. Last week’s raid on Mr. Batista’s Rio home were covered live on television.

Marcio Lobo, a lawyer who says he lost $25,000 in the bankruptcy of OGX, is representing 60 other minority shareholders in a class action suit against Mr. Batista. New people join the suit every day, he said. “For the first time people are starting to believe in our justice. Before people said he was too rich and too powerful to get our money back. Now they saw police go to his house.”

But some Brazilians have limited sympathy for those who lost money on Batista ventures. “Any Brazilian investor who knew Eike knew he had a screw loose, that he was a lunatic with projects on a crazy scale,” said Ancelmo Gois, the eminence grise of Brazilian columnists who covered the Batista empire closely for years. “Nearly all the victims signed on to play the game with him. They knew what he was.There are no innocents here. There was a carnaval around Eike – champagne and sports cars. It was an orgy, and everyone knew why they were there.”

And Mr. Gois mourns his loss. Brazilian business culture is fatally timid, and chronically dependent on the state, he said, and anyone who succeeds squirrels away profits in their mattress. Mr. Batista, with his breathtaking risks and his flashy success, was different. “I’m not defending him, but his downfall is a huge loss for the city.”

Mr. Batista himself has largely gone to ground. Neighbours in his leafy hilltop neighbourhood say that while he once came and went in a cavalcade of vehicles several times a day, he now leaves in a car with a single body guard, only once or twice a week. “Before this all happened, people would come visit all the time. Businessmen, the governor, the mayor,” said one household employee in the complex, who would not give his name. “Now, after the scandals, no one comes any more.”

Mr. Batista also no longer presides over the dining room of Mr. Lam, an upscale restaurant said to be the favourite of all his acquisitions, where he used to spontaneously pick up the tab for everyone in the room. “He’s working,” said the former EBX director, saying Mr. Batista spends his days trying to hustle up new projects – with partners from Asia, he tells his former employees. “That’s all. He doesn’t have any friends or family.”

In fact Mr. Batista has two sons, Thor and Olin, with his ex-wife Luma de Oliveira, a former Carnaval Queen and Playboy playmate. The sons, 22 and 18, are known for their sports car collections, flying the family jets to DJ parties, and bragging of never having read a book. Their relationship with their father, say former associates of Mr. Batista, is poor. He has a toddler son with a Rio lawyer who now runs a website to sell used designer clothes.

“The truth is I don’t have anything personal against him, I know he’s a father, he has three sons. I’m also a father, I also have sons,” said Mr. Lobo, about the raids. “Having the police come to your home and take your car, take your phone – it’s terrible. But he should have thought of that sooner. He had the opportunity to make things right.”

Mr. Leo, the biographer, said that one cannot compare Mr. Batista’s situation with Brazil’s. “Eike’s situation is irreversible; he will never go back to the good old times,” he said. “Brazil is facing the consequences of bad choices in the past, but it has natural and human resources that will allow us to think about a comeback.”

Brazil’s Eike Batista: From billionaire to bankruptcy

- Show more sharing options

- Copy Link URL Copied!

SAO PAULO, Brazil — A little over a year ago, Brazilian playboy Eike Batista was reputed to be the seventh-richest man in the world and was in the habit of boasting loudly that he’d soon be No. 1. By this week, he had become one of the world’s biggest paupers.

On Wednesday, his flagship oil company, OGX, filed for bankruptcy. A personal fortune once valued at $30 billion had collapsed into a personal debt estimated at more than $800 million. Some Brazilians, long since soured on his cocky persona, responded with glee on social networks to the news that Batista’s yacht, the Pink Fleet, would soon be sold for scrap.

No one wanted, or could afford, the $19-million boat intact.

Batista’s spectacular fall may say more about his personal failings, and what Alan Greenspan called the “irrational exuberance” of the market, than it does about Brazil. It turned out that his much-hyped empire was built on vastly overconfident assumptions — in particular, oil deposit estimates that bore no relationship to reality.

“He ended up swallowed by his own myth,” columnist William Waack wrote for Brazil’s Globo media group.

Still, as Brazil’s economy sinks back to reality after boom-time highs, his implosion has served as a warning to investors, and to Brazilians at large, that much of the fabulous wealth that was on the horizon so recently was based on little more than promises.

Batista “is vain. And at a certain point his vanity prevailed over common sense,” said Adriano Pires, director of the Brazilian Infrastructure Center, an energy consulting firm in Rio de Janeiro. “The case of Batista is not just bad for him and the companies around him, it is very bad for all of Brazil, especially in a moment when we need international investors. He is blemishing Brazil’s credibility a little all around the world.”

Batista grew up the son of Brazil’s wealthy former minister of mines and energy. In a country famous for corruption and nepotism, it seemed a bit more than coincidental when the younger Batista literally struck gold in the mining industry in the 1980s, despite the assertion in his autobiography, characteristically titled “The X Factor: The Path of Brazil’s Greatest Entrepreneur,” that his fortune was the result of hard work and ingenuity.

He acquired government licenses to exploit some of Brazil’s newly discovered offshore oil reserves, and created an interconnected set of energy, mining and logistics companies based around the wells. He cashed in big from international investors, selling stock at a moment when the world believed more than ever in a Brazilian boom and, after the shock of the U.S.-based financial crisis, was looking for a new place to invest.

It was a heady time for Batista and for Brazil. The economy was in rapid expansion, the government was extremely popular, and a rising middle class was euphoric with higher wages. Certifying the country’s ascendance, Brazil was awarded the 2014 World Cup and 2016 Olympics.

Amid assurances of big gains — each of his companies had the letter X in its title, signifying multiple returns — his personal fortune soared, even as the companies brought in little revenue. After he tapped equities markets for all they were worth, he turned to debt markets, borrowing even more to pump up his companies.

“He built his empire based on what have now been proven to be very unrealistic expectations,” said Tony Volpon, a New York-based economist for international bank Nomura Securities. “He made the cardinal sin of using debt to finance what were very risky exploratory activities in oil, and no one does that.”

“He didn’t understand that oil and gas projects are high-risk ventures,” said Pires, of the energy consulting firm. “In this business there is no certainty, just probability. He went around preaching and promising.”

Batista branched out into luxury hotels, rock festivals, restaurants, soccer and ultimate fighting, all without much economic logic behind them, Pires added.

Things began to fall apart last year in dramatic fashion. His bodybuilder son, Thor, struck and killed a cyclist while speeding in a million-dollar Mercedes-Benz SLR McLaren that the Batistas had been in the habit of keeping on display in their living room. The public was shocked by Eike Batista’s response, as he took to Twitter to blame the “carelessness” of the cyclist, an impoverished cargo worker who had to commute by bike on a dangerous highway.

Soon after, it became clear that some OGX wells wouldn’t hit production targets, and the money began to fall away. Batista again took to Twitter, this time to attack those who didn’t believe in him.

After deposits he valued at more than a trillion dollars turned out to be woefully small this year, his company lost more than 96% of its value and has been unable to pay back creditors. Brazil’s state-run banks, which had supported Batista’s companies, backed away.

Though analysts put the lion’s share of the blame on Batista, he sold his projects to investors who were willing to believe him. Brazil seemed to be experiencing a once-in-a-generation moment when its deep social and infrastructure problems were forgotten. Stock investments were soaring across the board as the value of Brazil’s currency was pushed up to what economists warned were unsustainably high levels.

After growing more than 7% in 2010, Brazil’s economy nearly ground to a halt in 2012. Then the social questions again came to the fore in what is one of the world’s most unequal countries. Though inequality dropped dramatically and most Brazilians are better off than ever — the economy is expected to rebound modestly this year, wages continue to rise, and unemployment is still low — the ruling Workers’ Party, during its decade in power, has not invested in much-needed transportation, healthcare or education to adequately satisfy the demands of a new and dynamic middle class.

After a police crackdown on a protest against a bus fare hike, protesters with wide public support filled the streets in June, demanding better public services, and demonstrators still take aim at symbols of capitalist excess. Among the targets of their rage have been the windows of Batista’s office building.

Batista’s fall seems, at least to some, to be a reflection of Brazil’s torn social fabric.

“I never liked Eike, since I don’t believe it’s possible to get so rich like that, especially in Brazil today, without infringing on the rights of the poorest,” said Erica Alves, a 26-year-old teacher from Rio de Janeiro who is active in left-wing organizations. “He became rich ‘winning’ rights from the government to exploit the country’s resources. I wasn’t surprised by his fall, because fast and easy wealth can’t be sustained.”

In Brazil’s new, more austere and more politically conscious moment, Eike Batista has had little to say. His once-active Twitter account has been dormant for 126 days.

Bevins is a special correspondent.

More to Read

Opinion: No more billionaires? We can be more ambitious than that. No one needs more than $20 million

Jan. 29, 2024

Column: Will billionaire Bill Ackman ever learn to shut up?

Jan. 16, 2024

The world could get its first trillionaire within 10 years, anti-poverty group Oxfam says

Jan. 15, 2024

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.

More From the Los Angeles Times

World & Nation

Brazilian police arrest accused masterminds in killing of councilwoman-turned-icon

Poland demands explanation from Russia after a missile enters its airspace

March 24, 2024

Pope Francis skips Palm Sunday homily at start of busy Holy Week that will test his health

137 of almost 300 abducted schoolchildren in Nigeria freed after weeks in captivity

The Rise And Fall Of Brazilian Billionaire Eike Batista

Eike Bastista was the world’s eighth-richest man, and the poster-boy for the new Brazil, flashy and flush with wealth—until his oil and gas bubble burst.

Mac Margolis

Eduardo Martino/archivolatino/Redux

One day, some 30 years ago, before the trophy wife and the floodlights, when a berth on the Forbes billionaires list was still a moon shot, Eike Batista was restless. At age 23, he’d had enough of Europe and the golden cage he’d spent his childhood in, and decided to move back to his native Brazil to make something of himself. The engineering school dropout had sold corned beef to Africa and brokered some Brazilian diamonds with mixed success. But Batista wanted something bigger.

He found it in a glossy photomagazine with a feature on the Amazon gold rush. “I knew that’s where I wanted to be,” he said in an interview two years ago. His father, Eliezer Batista, a legendary Brazilian mining executive, was livid. “I’m going to give you an idiot’s diploma!” he exploded, pounding a fist on the dining room table when he learned his son had bought into a rainforest gold mine. They didn’t talk to each other for the next 10 years, but the young Batista didn’t back down. “This was alluvial gold,” he said. “It was idiot-proof.”

For the next three decades, versions of that scene—the parental scolding, doubling down against withering odds, a daredevil’s self-confidence, a choirboy’s belief in “idiot-proof” assets—would loop over and over again through Batista’s career. If his father doubted him, Batista’s mother pumped him up. “She called me Goldesel,” he said, recalling the Grimm brothers’ fairytale about the good luck donkey that dropped gold pieces from its mouth.

With his bullet-proof ego and camera-ready smile, Batista parlayed his stakes in Amazon gold into cash and then into cachet to leverage ever bigger ventures. In a little less than a generation, he’d rebooted himself into this emerging nation’s alpha investor, shedding the image of pampered playboy to become the world’s eighth richest man, courted by investors and politicians alike.

When he was king, everyone—Anglo American, Pimco, Black Rock, the Schlumberger Group—wanted a piece of Eike (pronounced Ike), as Brazilians know him. His emerging mining and energy conglomerate rocketed to the top of the São Paulo stock market. Cordial and bullish, with a tropical swagger to his step, Batista was not just a Brazilianaire but an emblem of Brazil itself, a sleeper country now aggressively on the make. Some two million people followed his Twitter feed.

It was only fitting that Batista’s fall would be just as spectacular. On Oct. 30, Batista’s signature oil and gas company, OGX, filed for bankruptcy. Once the bluest chip on the São Paulo bourse, worth $35 billion in 2011, OGX is trading at a few cents a share. His mining, logistics and energy companies have been taken over by foreign investors. The net value of the entire cluster of Batista’s businesses, each branded with a letter X, a symbol for the multiplication of wealth, has turned to dust.

Minority stakeholders, who eagerly hitched their wagons to Eike’s rising star, are scrambling to court to recover their crumbling investments. The policy whizzes in Brasilia who reveled in the new national business icon are mulling over how to retrieve the $2.9 billion they loaned to Batista at sweetheart rates through the publicly subsidized development bank. Reporters are no longer invited to helicopter out to the future site of his superport. Batista’s patented pink tie and Cheshire cat smile no longer light up the Rio night. His Twitter feed has gone silent.

Not surprisingly, the slow motion fall of Batista’s holdings has become this year’s rolling headline in Brazil, and beyond. Yet many savvy investors saw trouble coming two years back, when the value of Batista’s corporate portfolio ballooned in the stock market even before he had fetched a single barrel of oil from the ocean floor or loaded his first ton of coal. Yet in road show after road show, he talked up a storm. The massive Porto Açu, a superport and planned city complex north of Rio, may have been little more than a sea bridge connected to a bald building site, but Eike managed to draw world class partners on board.

Investors were impressed with his grasp of details and 30,000-foot perspective on logistics and economies of scale. They winked at his bare knuckle business style and his reputation as a corporate raider, poaching alpha executives from Petrobras, Vale and other mega companies, with lavish pay and stock options. In vexatious Latin America, they knew that a blue chip ego was an asset. “I see myself as a knight of efficiency. If there is something that isn’t efficient, I’m going to break it down,” he said. “The Google guys do that. Steve Jobs was famous for that. They look for ways to make life more user-friendly and that’s how I see myself.”

In time, as production targets were missed and delayed, skepticism stirred. Was Batista all smoke and mirrors? Still, he talked a good game. “Batista doesn’t think big, he thinks huge,” said Armínio Fraga, an investor and former Brazilian Central Bank president, who briefly held a stake in one of the X companies. The joke in the financial trenches was that after Bill Gates, no one had made so much money off of PowerPoint. Eike waved away the Cassandras and spun his dedication to “fundamentals.” “These are not subprime mortgages,” he said of his portfolio that stretched from shipyards to oil rigs. “This is productive investment.” After all, he sat on mountains of ultra high grade Colombian coal and his oil was in shallow offshore wells, not the deepwater crude that Brazil had just discovered a daunting four miles below the surface of the Atlantic. “These are idiot-proof assets,” he said, repeating the blue skies refrain he’d coined a quarter century earlier.

Batista’s eccentricity also helped inflate the X bubble. He was a rarity in a country where the superrich shun publicity or pretend they are like everyone else. Unashamed about his wealth—made from sweat not speculation, he claimed—he worked at leveraging fortune into celebrity. Back in the nineties, when he was already fabulously rich, Batista was known—and often lampooned—as the heat-seeking scion of a top Brazilian mining official and the husband of a carnival queen. Mr. Luma de Oliveira, they called him, after his supernova wife, whom he later divorced. Other moguls might collect Picassos. Batista, a onetime powerboat racer, favored fast cars and yachts. For years, he kept a Lamborghini and a silver Mercedes-Benz SLR McLaren in his living room.

Even when giving, Batista went over the top. He paid over $550,000 at a benefit auction for the jersey of national football hall-of-famer, Ronaldo, and brought Madonna to tears by pledging $7 million to her charity, Success For Kids. When physicians from a struggling public hospital in Rio needed an MRI machine, Batista wrote them a $1.5 million check and shelled out another $500,000 to install it. “I was floored,” says neurosurgeon Paulo Niemeyer, who had contacted Batista for the event.

Every tycoon has a shtick but in business, Batista was all brass knuckles. By the mid-2000s he had shed the showboat wife (reportedly paying Playboy to kill a photo spread of her) and started plunging money into multimillion dollar plays in energy, infrastructure and mining, scooping up properties and resources. He boldly claimed to be sitting on $2.3 trillion in assets, including top grade coal, gold, iron ore and a potential 10 billion barrels of oil.

Of course, living in floodlights had its inconveniences. Last year, when Batista’s 20-year-old son Thor, driving a fancy gull wing Mercedes Benz, struck and killed a cyclist on a Rio highway, the media frenzy turned the tragedy into a tropical version of Bonfire of the Vanities . Feeding the script were the facts that Thor was on his father’s payroll, had racked up a fistful of fines for traffic violations, and that the victim was a bricklayer. Batista’s lawyers blamed the accident on the cyclist’s imprudence but, quickly agreed to pay a generous, undisclosed fee to the victim’s family. In June, Thor was convicted of involuntary manslaughter.

Still, Eike was just the kind of benefactor Brazil ached for: superrich, conscientious and an enthusiastic backer of the arts and worthy causes. “The Eike story played well,” says Alberto Ramos, an emerging market analyst at Goldman Sachs. “There was a narrative that made him more magical, a symbol of the new Brazil, a big emerging, global player.”

Batista’s image got a material bump in early 2012, when his wells in the vaunted Tubarão field, in the southeast Atlantic, started pumping their first barrels of crude. By March, the company had raised about $500 in the bond market, halting a worrying slide in share prices. His cluster of Xs was Brazil’s hottest buy on the bourse. Forbes lifted him to eighth place on its roster of fat cats.

But the expected offshore oil gusher never happened. As it turned out, OGX had vastly overstated its oil reserves. By August 2013, the company announced its prize cache was producing just 17,000 barrels a day, about a third of the yearend target. Investors bolted and by late October, with OGX bleeding top executives and trading at pennies per share, Batista filed for bankruptcy.

Soaring success followed by collapse is nothing new to the business world. Yet Batista’s debacle turned heads. For many Latin America watchers, the fall of this entrepreneurial wunderkind was a body blow to Brazil itself. Not only had a big man stumbled, but the country he so daringly represented also seemed diminished by his woes. After all, authorities in Brasilia had made a point of touting Eike as the new face of Brazilian business, a mogul who took risks but also worked closely with the government to boost national development. Batista was a frequent guest of president Luiz Inácio Lula da Silva. “He deserves our respect,” said Lula’s successor, president Dilma Rousseff, posing alongside the favored tycoon, both dressed in matching oilman’s overhauls on a deep sea rig.

Batista’s success stoked patriotism. Here, after all, was a homegrown mogul, who thrived in a market dominated by giant state oil companies and multinational majors, like Chevron and Exxon. “There was a deliberate effort to forge a national champion,” says former finance minister Mailson da Nóbrega. “Eike was drafted into the role.”

He was also a Cinderella story for the media, eager for a popular idol who didn’t wear football cleats or strut the catwalks. A national newsmagazine splashed him on its cover in a photo montage wearing a beret and a Chinese work jacket: “Eike Xiaoping” read the cover line. The National Development Bank, BNDES, gave him generous loans subsidized by taxpayers.

That deference might explain the eagerness to overlook some of Batista’s failings. “Among energy experts there was plenty of talk about how Eike was overselling his hand, but no one said anything in public,” says Jean-Paul Prates, chief of Expetro, an oil and gas consultancy. “Everyone likes a winner and no one wanted to say the king had no clothes.” The result, says Prates, was “the biggest sham in the country’s recent economic history.”

Not that Batista was conniving to play investors or that Brazilian officials groomed him to lure foreign capital. “Batista was no Mike Milliken [the junk bond trader, convicted of securities racketeering]. This was not Enron, where a company was deliberately defrauding the markets,” says Nóbrega. “The problem was a failure of corporate governance. Eike was allowed to operate without the proper financial anchors.”

In some ways, this was a disaster waiting to happen. Brazil rightly prides itself for having kept tight reins on consumer credit and for its vigilant capital market, virtues that helped the country avoid the bubbles that took down the global financial markets. But the long-sheltered economy is just getting used to the rigors of the globalized market—not least in the oil business, which in Brazil is dominated by a single, state owned giant, Petrobras.

“Brazilian capital markets have little experience overseeing private players,” says Prates. The same goes for the oil and gas regulator, the National Petroleum Agency, which lacks the technical expertise to vet discoveries or evaluate the commercial viability of wells. “Our market isn’t just young, it’s in its infancy,” says Prates. “This reflects poorly on Brazil, which comes off as an immature market. The next time there’s a public stock offering in the oil sector, investors are going to think twice.”

Others are not so sure. “The oil industry is risky business,” says Goldman Sachs’ Ramos. “Sometimes you drill and the wells come up dry. It happens and it’s not necessarily bad management.”

For Brazil, mercifully, the lasting damage may ultimately be limited. “The collapse of Batista’s conglomerate was a shock test for Brazil,” says Nobrega. “There was no earthquake in the markets. No banks are likely to go under. Years ago, a bankruptcy the size of Batista’s might have caused all hell to break lose, maybe even a credit crisis. That shows maturity.”

That may be a small comfort to the man who made and lost $28 billion in a heartbeat. But the fact that a giant fell but barely wobbled this country on the rise is already a victory of sorts.

Got a tip? Send it to The Daily Beast here .

READ THIS LIST

- AI Generator

Premium Access

Custom content, media manager.

Grow your brand authentically by sharing brand content with the internet’s creators.

- Entertainment

12 Views Of Eike Batista Pink Fleet Yacht As Fortune Dwindles Photos & High-Res Pictures

Browse 12 views of eike batista pink fleet yacht as fortune dwindles photos and images available, or start a new search to explore more photos and images..

REUTERS/Fred Prouser 'Negative billionaire' Eike Batista.

Last week Brazilian police raided the home of once multibillionaire, now negative billionaire , Eike Batista. They froze his assets and took his Lamborghini, as well as six other cars, some fancy watches, and a pile of cash.

Now they've taken things a step further and seized his water toys too – including jet skis, a speedboat, and his yacht, the Spirit of Brazil, Bloomberg reported .

This comes after Batista's oil company, OGX, lost $9.7 billion and went bankrupt in 2013, pulling his own net worth down to about $200 million.

Then Batista went on trial for insider trading and stock manipulation.

EBX via The Bloomberg Billionaires Index Batista's yacht, the Spirit of Brazil.

The story is, Batista started to suspect that OGX's oil fields wouldn't deliver, and personally guaranteed $1 billion to keep things running.

It was enough to stabilize the plunging stock.

Then, prosecutors say, Batista made his move: when suspicions were confirmed and things really started to look bleak for the company, he allegedly sold his own stock and abandoned his $1 billion promise.

Now, four of Batista's companies are bankrupt and he reportedly owes $1.2 billion.

NOW WATCH: This Billionaire's Definition Of Success Will Surprise You

More From Business Insider

Brazilian police posted pictures of 'negative billionaire' Eike Batista's impounded Lamborghini on the internet

Eike Batista is now a 'negative billionaire'

There's a new king of private equity

- Insider Reviews

- Tech Buying Guides

- Personal Finance

- Insider Explainers

- Sustainability

- United States

- International

- Deutschland & Österreich

- South Africa

- Home ›

- finance ›

The Fabulous Life Of Eike Batista-The Brazilian Who Is Risking It All To Become Richest Man In The World

His oil and mining companies started hemorrhaging money in 2012. OGX, the oil company, had lost 40% of it's value halfway through 2012, as it had to cut production targets at it's first two oil wells by as much as 75%.

And the mining company, MMX, got slapped with a $1.8 billion way-past-due tax bill.

He started off 2012 with more than $30 billion. By the end of the year, his net worth was down to about $12.4 billion.

Source: The Economist

In 2012, he got Abu Dhabi’s Mubadala Development Company, a government owned fund, to invest $2 billion in EBX Group Co., which gave the fund a 5.63% economic stake in the company.

He was raising money to develop his oil and mining businesses.

Source: Bloomberg

The amount that Batista would have to turn over is unknown , what is known is that he's taking on more risk.

But he's probably okay with that.

PRESENTING: The Amazing Life Of Jeff Gundlach, The World's Greatest Bond Investor>

Batista was born in brazil in 1956 and moved to germany when he was a teen..

On of seven children, Eike was born in 1956 in Governador Valadares, Minas Gerais, Brazil, to a Brazilian father and German mother, he spent his childhood in the country of his birth, but moved to Germany when he was a teenager.

In 1974, he began to study metallurgical engineering at the University of Aachen in Germany.

He used to sell insurance door-to-door when he was in college

His family returned to Brazil when he was 18, and he started selling insurance to make ends meet. All his friends, on the other hand, were rich.

From the Australian Financial Review:

"So I got highly motivated to make some extra money and I sold insurance policies from door to door. It's a great learning experience because some doors open and some don't. I had a lot of teas with old ladies."

But by 1979, he'd dropped out of college before he could finish his degree in metallurgical engineering and returned to Brazil.

Source: Robert the matador joins Eike the bull, Australian Financial Review, October 30, 1999 Saturday, Late Edition

So I got highly motivated to make some extra money and I sold insurance policies from door to door. It's a great learning experience because some doors open and some don't. I had a lot of teas with old ladies.

After school, he tried to export granite, marble and diamonds.

He told the Australian Financial Review:

"I discovered it was controlled by the Italian Mafia, so I quit that and began organizing pick and shovel miners to produce diamonds."

The garimpeiros (shovel miners) would come to his Rio office with diamonds in little bags. Batista introduced them to Jewish dealers from Portugal and Antwerp and collected commissions on each sale.

I discovered it was controlled by the Italian Mafia, so I quit that and began organizing pick and shovel miners to produce diamonds.

But eventually moved on to trading gold, where he made his first millions.

In the early 1980's Batista returned to Brazil and started a gold trading firm Autram Aurem, raising seed money from connections in Rio and quickly establishing a far-flung network of 60 buyers of raw gold in the Amazon.

From The Age:

"The price of gold was shooting up and the cruzeiro [Brazil's currency before the real] was going down," recalls Willie McLucas, a former manager of a European resource fund that invested in TVX in the 1980s.

Source: The boy from Oz goes to Rio for the force, The Age (Melbourne, Australia), June 15, 1999 Tuesday, Late Edition

The price of gold was shooting up and the cruzeiro [Brazil's currency before the real] was going down, recalls Willie McLucas, a former manager of a European resource fund that invested in TVX in the 1980s.

He eventually founded TVX Gold, a gold mining company.

Since the whole gold trading things was working out so well, Batista decided to found his own gold mining company—TVX Gold, in 1980.

The 'X' in the name is supposed to signify 'multiplication,' as in multiplication of wealth.

It was rough going. Once, his bodyguard killed and buried a man in the Amazon

From Australian Financial Review:

Batista was a gold trader at the time, traveling around the pick and shovel miners (garimpeiros) in the Amazon jungle to buy their gold. He also financed some of them and one digger had made no attempt to repay him for six months.

"On one of my tours I went to see him and said: 'Where is my money?' He went screaming mad. He was a drunk. I made the mistake of calling him a son of a b--ch (filho da puta). I turned around and walked a few metres away and bang! He shot me in the back."

"He was drunk. I was lying on the floor and the other guys' [his bodyguards] instinctive reaction was to shoot him because they didn't know whether he would shoot them next."

They buried the garimpeiro in an unmarked grave at the end of the airstrip.

On one of my tours I went to see him and said: 'Where is my money?' He went screaming mad. He was a drunk. I made the mistake of calling him a son of a b--ch (filho da puta). I turned around and walked a few metres away and bang! He shot me in the back.

He was drunk. I was lying on the floor and the other guys' [his bodyguards] instinctive reaction was to shoot him because they didn't know whether he would shoot them next.

And some say Batista wasn't always on the straight and narrow in his dealings.

From the Age:

"Eike would go into the jungle and show these village chiefs a 10-day-old newspaper and say, 'Look, here's the price of gold,'" McLucas, told The Age.

" Meanwhile, the price had gone up, and would go up even more by the time he got back to Rio. He'd pay the chiefs in local currency, which was dropping, and sell the gold in hard currency. You couldn't lose." Source: The boy from Oz goes to Rio for the force, The Age (Melbourne, Australia), June 15, 1999 Tuesday, Late Edition

Eike would go into the jungle and show these village chiefs a 10-day-old newspaper and say, 'Look, here's the price of gold,' McLucas, told The Age.

Meanwhile, the price had gone up, and would go up even more by the time he got back to Rio. He'd pay the chiefs in local currency, which was dropping, and sell the gold in hard currency. You couldn't lose. Source: The boy from Oz goes to Rio for the force, The Age (Melbourne, Australia), June 15, 1999 Tuesday, Late Edition

In 1983 founded EBX, the umbrella under which he would found all his other companies.

Between 2004 and 2012 he would add six public companies under the EBX umbrella:

- OGX (oil), MPX (energy),

- LLX (logistics),

- MMX (mining),

- OSX (offshore industry),

- and CCX (coal mining).

He became a superstar in 1991 when he eloped with model, actress and carnival dancer Luma de Oliveira IN 1991.

The couple met in 1990 and at the height of their romance, they were the darlings of gossip rags and the mainstream media.

The thing was, Batista was seeing a Brazilian socialite at the time they were married (because Oliveira was pregnant) unbeknownst to Oliveira.

From People:

"I just knew he had a girlfriend, but not...who it was."

In the four years before they got divorced, they had two children—Thor and Olin.

I just knew he had a girlfriend, but not...who it was.

Meanwhile, Batista started really living like a billionaire — he won several power boating championship titles.

In the 1990's Batista was the Brazilian, U.S. and world champion in the Super Offshore Powerboat class.

In 2006, he covered the 220 nautical miles between Santos and Rio de Janeiro in just a sliver over three hours and beat the record for the course in his boat, the Spirit of Brazil, according to a Dow Jones profile of the CEO.

Source: Dow Jones

He bought lots of really expensive things.

Things like this yacht.

Source: Bloomberg , EBX

Really, just a whole bunch of expensive stuff.

Like this other yacht.

...and this private jet...

...also, this private jet...

...and this one.

So far the tally is: two yachts and one private jet.

And this really expensive car.

He bought a $1.2 million Mercedes-Benz SLR McLaren. Then he used it to decorate the lounge of the Jardim Botanico mansion in Rio.

And he sure could afford it. At the start of 2012, he was worth more than $30 billion.

Source: BornRich.com

In 2001, he had to resign from TVX, his gold mining company

After plans for a gold mine in Greece went bust because of political opposition, once high-flier TVX took a decided turn for the worse. And then the price of gold started to fall, reaching a paltry $300 an ounce.

Batista resigned in 2001, after the cash-strapped producer was forced to put itself up for sale.

Source: The Globe and Mail

Environmental groups started agitating about what his businesses were doing to the environment.

You don't want to mess with Greenpeace or anyone else who is concerned with the health of Amazon River dolphins near Batista's mining operations.

But 10 years later, Batista bought back into the gold business.

In 2011, Batista bought out Ventana Gold Corp., a company he's had his eye on for a while by then. He first snapped up a 9.5% stake in Ventana in July 2009 through EBX, and by 2010, he controlled 20% of the company's stock.

They finally came to a full sale agreement in 2011, when Batista sweetened the deal, which valued Ventana at a little more than C$1.5 million.

And one of his companies bought the rights to the Ultimate Fighting Championship in Brazil.

IMX, Batista's sports and entertainment company, bought the rights to the Ultimate Fighting Championship (UFC) in Brazil in late 2011. UFC Brazil is a mixed-martial arts fighting competition hosted in Sao Paulo that's aired on pay-per-view television.

Source: Fighters Only Magazine

In the spring of 2012 he was the 10th richest man in the world.

And he told Bloomberg he absolutely had to number 1 because of the competitive spirit that he acquired in his childhood:

"I suffered very heavy asthma, so my mother threw me in the cold swimming pool," he said. "So I cured my asthma through discipline, and I saw that you could achieve things by performing, and it's part of my DNA… I'm very competitive."

Batista also said he wanted to repair Brazil's reputation:

"Brazil lost two generation of Brazilians to the crisis between '84 and '97," he said. "Brazil probably paid $150 billion in extra risk spread [during that time]. The ratings agencies put Brazil in the same level as Nigeria, and today it's better than Germany."

I suffered very heavy asthma, so my mother threw me in the cold swimming pool, he said. So I cured my asthma through discipline, and I saw that you could achieve things by performing, and it's part of my DNA… I'm very competitive.

Brazil lost two generation of Brazilians to the crisis between '84 and '97, he said. Brazil probably paid $150 billion in extra risk spread [during that time]. The ratings agencies put Brazil in the same level as Nigeria, and today it's better than Germany.

By the end of 2012, however, he lost two-thirds of his fortune and needed cash.

Batista struck a deal with a sovereign fund in Abu Dhabi to get his hands on some extra cash.

But if he doesn't deliver a 5% annual return on Abu Dhabi's investment, he has to turn over more of the company by 2019.

Want to learn about another risk taker?

- RIL cash flows

- Charlie Munger

- Feedbank IPO allotment

- Tata IPO allotment

- Most generous retirement plans

- Broadcom lays off

- Cibil Score vs Cibil Report

- Birla and Bajaj in top Richest

- Nestle Sept 2023 report

- India Equity Market

- Best printers for Home

- Best Mixer Grinder

- Best wired Earphones

- Best 43 Inch TV in India

- Best Wi Fi Routers

- Best Vacuum Cleaner

- Best Home Theatre in India

- Smart Watch under 5000

- Best Laptops for Education

- Best Laptop for Students

- Advertising

- Write for Us

- Privacy Policy

- Policy News

- Personal Finance News

- Mobile News

- Business News

- Ecommerce News

- Startups News

- Stock Market News

- Finance News

- Entertainment News

- Economy News

- Careers News

- International News

- Politics News

- Education News

- Advertising News

- Health News

- Science News

- Retail News

- Sports News

- Personalities News

- Corporates News

- Environment News

- Top 10 Richest people

- Top 10 Largest Economies

- Lucky Color for 2023

- How to check pan and Aadhaar

- Deleted Whatsapp Messages

- How to restore deleted messages

- 10 types of Drinks

- Instagram Sad Face Filter

- Unlimited Wifi Plans

- Recover Whatsapp Messages

- Google Meet

- Check Balance in SBI

- How to check Vodafone Balance

- Transfer Whatsapp Message

- NSE Bank Holidays

- Dual Whatsapp on Single phone

- Phone is hacked or Not

- How to Port Airtel to Jio

- Window 10 Screenshot

Copyright © 2024 . Times Internet Limited. All rights reserved.For reprint rights. Times Syndication Service.

WATCH TV LIVE

New Poll: Majority Say Biden Trying to Put Trump in Jail, See More

Eike batista: boats of former billionaire seized to repay $1b debt.

By Morgan Chilson | Friday, 13 February 2015 05:17 PM EST

- Eduardo Campos: Brazil Presidential Candidate Killed in Plane Crash

- Ricardo dos Santos, Surfing Star, Shot Dead Near Home in Brazil

© 2024 Newsmax. All rights reserved.

Sign up for Newsmax’s Daily Newsletter

Receive breaking news and original analysis - sent right to your inbox.

- Sci & Tech

Interest-Based Advertising | Do not sell or share my personal information

Newsmax, Moneynews, Newsmax Health, and Independent. American. are registered trademarks of Newsmax Media, Inc. Newsmax TV, and Newsmax World are trademarks of Newsmax Media, Inc.

Download the NewsmaxTV App

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Buyline Personal Finance

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- March Madness

- AP Top 25 Poll

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

Brazil businessman Eike Batista gets 8-year prison sentence

- Copy Link copied

RIO DE JANEIRO (AP) — Brazilian businessman Eike Batista has been found guilty of market manipulation and sentenced to eight years and seven months in prison.

The federal court’s decision released Monday also includes a fine of 82.8 million reals (nearly $20 million).

Batista was once Brazil’s richest man. The former oil and mining magnate was convicted of using information not yet disclosed to the markets for his own benefit.

Police arrested Batista last month while investigating suspicious money transactions of around 800 million reals (about $203 million).

Batista was already serving a 30-year sentence under house arrest for corruption and money laundering.

His lawyers were not immediately available to comment on the court’s ruling and to say whether they would appeal.

Brazil prosecutor seeks to freeze $641 mln in Batista's assets

Reporting by Alonso Soto; Editing by Rosalind Russell, Bernard Orr

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Woodside seeks better terms to develop Trinidad's Calypso gas project

Australian oil and gas producer Woodside Energy would like to see improved fiscal terms from the Trinidad and Tobago government before committing to develop a deepwater natural gas project there, CEO Meg O'Neill told Reuters this week.

- Guided tour

River Cruise on Luxurious Radisson Boat

- Description

- Choose date

Equipped with ice-breaking technology, these huge fancy yachts are the only river cruisers running all year around. The round trip journey takes two and a half hours and floats past all the big sights like the White House, Novodevichy monastery and the Kremlin. There’s a large open air observation deck up top, while the main body of the ship houses a restaurant with a dance floor for a romantic post dinner dance. For a particularly romantic experience take one of the evening boats and admire the bright lights of the city skyline at night.

The most relaxing and picturesque tour that Moscow can offer: a great way to see the city center and its main attractions. This is a perfect alternative to exploring the city by car, if you only have time to do sightseeing during weekday rush hours.

Your English-speaking guide is eager to share every bit of their knowledge about the surrounding landscape, the architecture and historical details.

We conduct Moscow river tour on Radisson Flotilla boats all year around! It’s warm inside during winter months, while there’s air conditioning during hot summer days. You may also treat yourself to drinks, lunch or dinner on board (drinks and food are not included in tour price).

The cost of an excursion with a personal guide for 1 person

Quay at Radisson Collection Hotel

Government Headquarters ("the White House")

Kievsky Railway Central

Novodevichy Convent

Luzhniki Stadium

Academy of Sciences

Monument to Peter I

Cathedral of Christ the Saviour

Moscow Kremlin

St.Basil's Cathedral

Novospassky Monastery

U-turn and back to Quay at Radisson Royal Hotel

Choose your dates

Who's going.

- Excursion River Cruise on Luxurious Radisson Boat

- Date and time:

- Who's going:

See photo of the meeting point

IMAGES

VIDEO

COMMENTS

12 February 2015 • Written by Risa Merl. Brazilian billionaire and superyacht owner Eike Batista has had his yacht Spirit of Brazil VIII seized by police. Five days after Eike Batista had his house in Rio de Janeiro, Brazil, raided by the Brazilian police force, the police have now taken Eike Batista's yacht, three personal watercraft and a ...

Eike Fuhrken Batista da Silva (Portuguese pronunciation: [ˈajk(i) ˈfuʁkẽj baˈtʃistɐ dɐ ˈsiwvɐ]; born 3 November 1956) is a Brazilian-German serial entrepreneur who made and lost a multi-billion dollar fortune in mining and oil and gas industries. He engaged in a quest to promote Brazil's infrastructure with large-scale projects, such as the Porto do Açu.

Police seized 'negative billionaire' Eike Batista's yacht too. Portia Crowe. 2015-02-12T16:26:03Z ... Eike Batista. They froze his assets and took his Lamborghini, as well as six other cars, some ...

Taking risks is part of life for Eike Batista, a 34-year-old Brazilian entrepreneur who a decade ago combed the Amazon jungles in search of gold dust. ... Twenty-six boats have registered to ...

<p>On of seven children, Eike was born in 1956 in Governador Valadares, Minas Gerais, Brazil, to a Brazilian father and German mother, he spent his childhood in the country of his birth, but moved ...

February 11, 2015 at 12:32 PM PST. This article is for subscribers only. Brazilian police seized a yacht and other aquatic toys owned by former billionaire Eike Batista, five days after raiding ...

As he was climbing the ranks of the world's richest people a few years ago, the Brazilian entrepreneur Eike Batista vowed to bring a long-lost pride back to Rio de Janeiro, his adopted hometown ...

Some Brazilians, long since soured on his cocky persona, responded with glee on social networks to the news that Batista's yacht, the Pink Fleet, would soon be sold for scrap. No one wanted, or ...

Batista, a onetime powerboat racer, favored fast cars and yachts. For years, he kept a Lamborghini and a silver Mercedes-Benz SLR McLaren in his living room. Even when giving, Batista went over ...

REUTERS/Fred Prouser Eike BatistaLast week Brazilian police raided the home of once multibillionaire, now negative billionaire, Eike Batista. They froze his

Browse Getty Images' premium collection of high-quality, authentic Views Of Eike Batistas Pink Fleet Yacht As Fortune Dwindles stock photos, royalty-free images, and pictures. Views Of Eike Batistas Pink Fleet Yacht As Fortune Dwindles stock photos are available in a variety of sizes and formats to fit your needs.

Last week Brazilian police raided the home of...

<p>On of seven children, Eike was born in 1956 in Governador Valadares, Minas Gerais, Brazil, to a Brazilian father and German mother, he spent his childhood in the country of his birth, but moved ...

Brazilian mining mogul Eike Batista says he owes the success of his business, ... like a luxury motor yacht with a restaurant that takes paying customers on sightseeing trips along Rio's coast ...

Brazilian authorities have seized Eike Batista's boats and jet skis in an effort to make a dent in the former billionaire's accumulating debt of around $1 billion. × Newsmax TV & Web www.newsmax.com FREE - In Google Play

Police in Brazil on Thursday arrested Eike Batista, the charismatic mining and oil magnate who was once the country's richest man, on suspicion of money laundering and insider trading.

RIO DE JANEIRO (AP) — Brazilian businessman Eike Batista has been found guilty of market manipulation and sentenced to eight years and seven months in prison. The federal court's decision released Monday also includes a fine of 82.8 million reals (nearly $20 million). Batista was once Brazil's richest man. The former oil and mining ...

Brazil federal prosecutors have filed criminal charges against Eike Batista, accusing the fallen tycoon of market manipulation and seeking to freeze up to $1.5 billion reais ($641 million) worth ...

Equipped with ice-breaking technology, these huge fancy yachts are the only river cruisers running all year around. The round trip journey takes two and a half hours and floats past all the big sights like the White House, Novodevichy monastery and the Kremlin. There's a large open air observation deck up top, while the main body of the ship ...

Radisson cruise from Gorky park. 2,5 hours. Yacht of the Radisson Royal flotilla. Best water route in Moscow. Panoramic views of the capital from the water in winter and in summer. Restaurant with signature cuisine. Next tour: 1600 ₽. Learn more.

Buy tickets. River Cruise aboard a River Palace Yacht from City-Expocentre (International Exhibition) HIT SALES. Daily, from April 27, 2024. Departure from the berth City-Expocentre (m. Vystavochnaya), mooring place "A". Cruise duration 3 hours. We invite you on a river cruise aboard a premium class panoramic yacht starting from the main Moscow ...

The unique ice-class luxury yachts of the Radisson Royal Moscow Flotilla navigate the Moscow river 365 days a year, regardless of the season or the weather outside. Gorky Park Pier is the second pier in the city from where the Flotilla yachts depart. Let yourselves be amazed by the stunning views and the elegant mastery of our chef as you pass through the very heart of Moscow surrounded with a ...